|

市场调查报告书

商品编码

1537692

二次包装:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Secondary Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

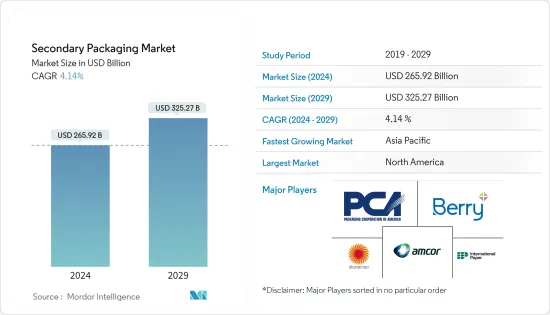

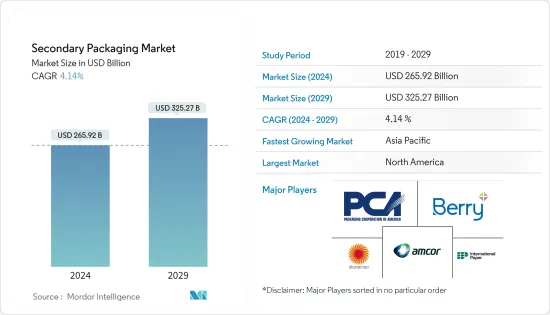

二次包装市场规模预计到2024年为2659.2亿美元,预计到2029年将达到3252.7亿美元,在预测期内(2024-2029年)复合年增长率为4.14%。

主要亮点

- 二次包装透过将产品捆绑在一起并优化运输,在保护产品方面发挥着至关重要的作用。纸箱、托盘和薄膜束是二次包装的一些例子,有多种形状和尺寸。二次包装对于品牌行销和产品展示也很重要。

- 二次包装越来越多地部署到食品和饮料、药品、化妆品、个人护理和家居产品等多个最终用户行业,正在推动市场成长。

- 提供二次包装的公司致力于将循环性和永续性作为成长策略,以提高二次包装应用回收解决方案的可用性。 2023 年 6 月,利安德巴塞尔和 AFA Nord 建立合作关係,回收上市后的软质二次包装废弃物。在这家合资企业中,LMF Nord GmbH 计划建造一座回收工厂,将 LDPE废弃物转化为可用于包装的高品质再生塑胶材料。

- 医疗保健领域的二次包装用于进一步保护和整理初级包装,例如瓶子、管瓶和泡壳。二次包装还可以增加对产品的需求,因为它提供了有关产品的重要信息,例如剂量说明、有效期和监管信息,并有助于防止伪造和篡改。

- 各个二次包装製造商都受到严格的监管,这使得新产品的创新变得困难。消费者对二次包装的偏好不断变化也可能使製造商更难在市场上竞争。

二次包装市场趋势

折迭式纸盒领域预计将占据主要市场占有率

- 随着重点转向环保和永续实践,许多行业对折迭式纸盒的需求不断增加,包括食品和饮料、医疗保健、个人护理、家庭护理和零售。消费者对永续包装偏好、原材料可用性、纸张重量轻、生物分解性、可回收性、森林砍伐等的认识推动了对折迭式纸盒的需求。

- 各国旅游业的快速成长导致加工食品、碳酸饮料和已调理食品的消费量增加。餐饮业的二次包装要求正在发生变化,推动了对 FDA 批准的食品药物管理局纸盒的需求。多功能且引人注目的食品纸盒的出现正在推动产品需求。

- 许多公司正在投资併购作为扩大市场占有率的扩大策略。 2023年9月,美国包装公司Graphic Packaging宣布收购美国折迭纸盒公司贝尔公司。此次收购还包括 Bell Inc. 在美国的三个加工工厂,可能会增加 Graphic 在食品服务包装市场的影响力。

- 各公司正在製造个人化和创新的折迭式纸盒,用于包装化妆品、护肤、护髮品等各种美容产品,拉动了需求。该公司也致力于透过使用环保材料来製造纸盒来实现永续包装。

- 根据美国林业和农业协会统计,2023年全球纸和纸板产能约为258,631,000吨。过去十年,随着各终端用户产业需求的不断增长,纸张和纸板产量保持稳定。这些因素预计将为市场参与者创造机会开发新产品以获得市场占有率。

预计北美将占据较大市场占有率

- 北美二次包装市场是由二次包装中越来越多地使用环保材料推动的。食品和饮料、製药和化妆品行业等最终用户越来越意识到需要利用环保包装材料来满足日益增长的永续性需求。由纸板等可回收和生物分解性材料製成的纸箱可促进永续性并推动市场成长。

- 客户支出的增加和网路购物销售额的增加正在影响电子商务的扩张。美国人口普查局预计,2024年第一季电子商务销售额将占美国零售额的15.6%,高于2023年第一季并推动市场成长。

- 北美的製药业正在迅速蓬勃发展,开发新药的进步正在推动对二次包装的需求。 2024年5月,美国合约包装公司Sharp Corporation服务公司宣布将扩大製造地,以提高无菌注射二级包装的产能。

- 二次饮料包装有多种用途。二次包装用于防止重型瓶子破裂,并透过将多个物品一起运输来降低成本。它也可以用作抵御阳光照射和其他外部挑战的屏障或保护。饮料二次包装有助于产品行销并提高产品的知名度,从而促进市场成长。

二次包装行业概况

二次包装市场较为分散,领导企业正在采取各种成长策略,例如併购、新产品发布、业务扩张、合资和合作伙伴关係,以巩固其市场地位。该市场的主要企业包括 Amcor、国际纸业公司、雷诺兹包装、斯道拉恩索、WestRock、Ball Corporation 和 Berry Global。

- 2024年5月,Mondi推出了TrayWrap,这是一种新型纸质二次包装解决方案,用于取代食品和饮料产品中使用的塑胶收缩膜。 TrayWrap 由 100% 牛皮纸製成,完全可回收。

- 2023 年 9 月,总部位于美国的WestRock 与总部位于爱尔兰的 Smurfit Kappa 合併,创建 Smurfit WestRock,生产永续包装解决方案。该合资企业是两家公司的策略性倡议,旨在扩大 Smurfit 瓦楞纸板和箱板纸的产品系列,并扩大各个最终用户市场的地理范围。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买方议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 地缘政治情势对市场的影响

第五章市场动态

- 市场驱动因素

- 全球工业和消费活动的扩展

- 安全交通的需求日益增加

- 市场限制因素

- 不断变化的消费者需求和对永续环境的认识

第六章 市场细分

- 依产品类型

- 折迭式纸盒

- 瓦楞纸箱

- 塑胶盒

- 包装和薄膜

- 按最终用户产业

- 食品

- 饮料

- 卫生保健

- 家电

- 个人护理/家居用品

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Amcor PLC

- Berry Global Inc.

- Packaging Corporation of America

- Stora Enso Oyj

- WestRock Company

- Ball Corporation

- International Paper Company

- Sealed Air Corporation

- Reynolds Group Holdings

- Mondi Group

- Multi-Pack Solutions LLC

第八章投资分析

第9章市场的未来

The Secondary Packaging Market size is estimated at USD 265.92 billion in 2024, and is expected to reach USD 325.27 billion by 2029, growing at a CAGR of 4.14% during the forecast period (2024-2029).

Key Highlights

- Secondary packaging plays a pivotal role in product protection by holding them together and optimizing the product for transportation. Cartons, trays, and film bundles are a few examples of secondary packaging available in several shapes and sizes. Secondary packaging is also important for brand marketing and product display.

- The increasing deployment of secondary packaging for multiple end-user industries, including food and beverage, pharmaceuticals, cosmetics, personal care, and household care, is boosting market growth.

- Companies providing secondary packaging aim for circularity and sustainability as a growth strategy to increase the availability of recycled solutions for secondary packaging applications. In June 2023, LyondellBasell and AFA Nord entered a partnership to recycle post-commercial flexible secondary packaging waste. In the joint venture, LMF Nord GmbH planned to build a recycling plant to turn LDPE waste into quality recycled plastic material that can be used in packaging.

- Secondary packaging in healthcare is used to provide an additional level of protection and organization for primary packaging, including bottles, vials, and blisters. Secondary packaging can also provide important information about the product, such as dosage instructions, expiration dates, and regulatory information, and help prevent counterfeiting and tampering, thus boosting product demand.

- Various manufacturers of secondary packaging are subject to stringent regulations, which can make it challenging for them to innovate new products. Also, evolving consumer preferences for secondary packaging can make it difficult for manufacturers to compete in the market.

Secondary Packaging Market Trends

The Folding Cartons Segment is Expected to Hold a Significant Market Share

- Folding carton demand has been increasing across many industries, including food and beverage, healthcare, personal care, homecare, retail, and others, as the focus shifts to eco-friendly and sustainable practices. The need for folding cartons is driven by consumer awareness of sustainable packaging preferences, availability of raw materials, the lightweight, biodegradable, and recyclable nature of paper, and deforestation.

- Rapidly growing tourism in different countries has led to the high consumption of processed food, carbonated beverages, and ready-to-eat foods. The food service industry's requirement for secondary packaging has been reshaped, fueling the demand for folding cartons that are approved by the FDA (Food and Drug Administration). The availability of versatile and eye-catching food folding cartons boosts product demand.

- Various companies are investing in mergers and acquisitions as an expansion strategy to boost their market share. In September 2023, Graphic Packaging, a US packaging company, announced the acquisition of Bell Inc., a US folding carton company. The acquisition included Bell's three converting facilities in the United States, which is likely to grow Graphic's presence in the food service packaging market.

- Various companies are manufacturing personalized and innovative folding cartons to package different beauty products, including cosmetics, skincare, and haircare, boosting the demand. Companies are also aiming toward sustainable packaging by using eco-friendly materials to make folding cartons.

- According to the Forest and Agriculture Association of the United States, in 2023, the production capacity of paper and paperboard was approximately 258,631 thousand tons globally. The production of paper and paperboard has been stable over the past decade with respect to the growing demand in various end-user industries. Such factors are expected to create an opportunity for the players in the market to develop new products to capture market share.

North America is Expected to Hold a Significant Market Share

- The North American market for secondary packaging is being driven by the increasing usage of environment-friendly materials in secondary packaging. End users, such as the food and beverage, pharmaceutical, and cosmetic industries, are becoming increasingly aware of the need to utilize environment-friendly packaging materials to cater to growing sustainability demand. Folding cartons made from recyclable and biodegradable materials like paperboard promote sustainability, propelling market growth.

- Increasing customer spending and growing online shopping sales influence the expansion of e-commerce. According to the US Census Bureau, e-commerce sales accounted for 15.6% of all US retail sales in the first quarter of 2024, higher than the first quarter of 2023, propelling the market growth.

- The rapidly booming pharmaceutical industry in North America and the growing advancements in developing a variety of new drugs are driving the demand for secondary packaging. In May 2024, Sharp Services, a United States-based contract packaging company, announced the expansion of its Pennsylvania manufacturing site to increase its production capacity for sterile injectables secondary packaging.

- The secondary packaging for beverages serves different purposes. The secondary packaging is used to protect heavy bottles from breaking, and it reduces costs by shipping multiple items together. It may sometimes be used as a barrier or protection against sunlight exposure or other external challenges. The secondary packaging for beverages helps in product marketing and enhances product visibility, thus driving market growth.

Secondary Packaging Industry Overview

The secondary packaging market is fragmented, with major players adopting various growth strategies, such as mergers and acquisitions, new product launches, expansions, joint ventures, partnerships, and others, to strengthen their position in the market. Some of the major players in the market are Amcor, International Paper Company, Reynolds Packaging, Stora Enso, WestRock, Ball Corporation, and Berry Global.

- May 2024: Mondi unveiled a new secondary paper packaging solution, "TrayWrap," to replace plastic shrink film used for food and beverage products. TrayWrap is made from 100% krafted paper, which is fully recyclable.

- September 2023: WestRock, a United States-based company, merged with Smurfit Kappa, an Ireland-based company, to create Smurfit WestRock to manufacture sustainable packaging solutions. The joint venture was a strategic move by the companies to expand Smurfit's product portfolio in corrugated and containerboard, along with regional expansion for various end-user markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products and Services

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of the Geo-Political Scenarios on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Industrial and Consumer Activities across the World

- 5.1.2 Increased Need for Safe Transportation

- 5.2 Market Restraints

- 5.2.1 Changing Consumer Needs and Awareness Towards a Sustainable Environment

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Folding Cartons

- 6.1.2 Corrugated Boxes

- 6.1.3 Plastic Crates

- 6.1.4 Wraps and Films

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Healthcare

- 6.2.4 Consumer Electronics

- 6.2.5 Personal Care and Household Care

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Berry Global Inc.

- 7.1.3 Packaging Corporation of America

- 7.1.4 Stora Enso Oyj

- 7.1.5 WestRock Company

- 7.1.6 Ball Corporation

- 7.1.7 International Paper Company

- 7.1.8 Sealed Air Corporation

- 7.1.9 Reynolds Group Holdings

- 7.1.10 Mondi Group

- 7.1.11 Multi-Pack Solutions LLC