|

市场调查报告书

商品编码

1548610

GaN半导体装置:市场占有率分析、产业趋势/统计、成长预测(2024-2029)GaN Semiconductor Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

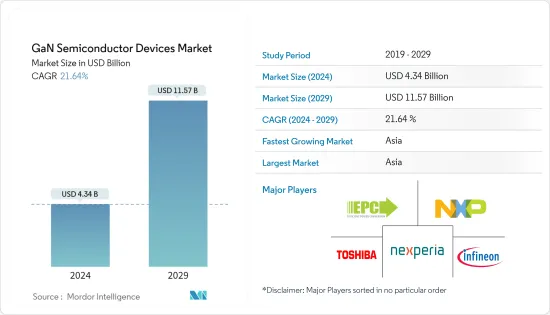

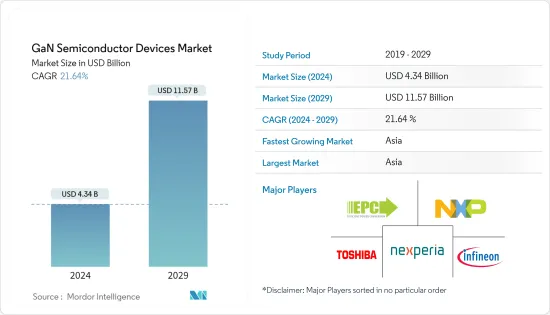

预计2024年全球GaN半导体元件市场规模将达43.4亿美元,2024-2029年预测期间复合年增长率为21.64%,2029年将达到115.7亿美元。

主要亮点

- 对太阳能和风能等可再生能源不断增长的需求正在推动 GaN 半导体元件在电力转换系统中的使用。 GaN 的高功率密度、快速开关速度和改进的热性能可实现高效的能量转换,减少能源浪费并提高整体系统效率。

- 太阳能是绿色能源领域成长最快的领域之一。太阳能电池板由多个分离式半导体组成,透过光伏效应将阳光转化为电能。由于政府激励措施和成本下降等因素,太阳能需求不断增长,导致太阳能板生产和安装激增。因此,对使这些面板高效工作所需的离散半导体的需求不断增加。

- GaN 能够在高频下工作、承受恶劣的环境条件并提供高功率,使其适合雷达系统、电子战和通讯系统等应用。 GaN 装置透过提高性能、可靠性和减小系统尺寸,为航太和国防技术的进步做出贡献。

- 然而,与氮化镓半导体装置相关的高成本是所研究的市场成长的主要限制。这些设备的製造过程需要复杂的製造技术和专用设备,这提高了整体成本。因此,与其他半导体材料相比,氮化镓半导体装置相对昂贵,限制了其在价格敏感市场的采用。

- 在后新冠疫情背景下,远距工作环境将导致超大规模资料中心的成长,从而增加对智慧型手机、穿戴式装置、笔记型电脑和其他 IT 装置的需求。

- 根据印度国家软体和服务公司协会(NASSCOM)预测,到 2025 年,印度资料中心投资预计将达到 46 亿美元。与新兴市场相比,印度资料中心的最大优势在于无论是市场开拓或营运都具有成本效益。目前,印度的资料中心主要位于孟买、班加罗尔、清奈、德里(NCR)、海得拉巴和普纳。加尔各答、喀拉拉邦和艾哈默德巴德将成为未来的资料中心地点。资料中心市场投资的扩大正在推动受访市场的成长。

氮化镓(GaN)半导体装置市场趋势

家电占较大市场占有率

- 氮化镓 (GaN) 半导体正在成为消费性电子产业的重要组件。由于其独特的性能,这些半导体在电力电子领域迅速普及。与传统的硅基元件相比,GaN 半导体具有高击穿电压和低导通电阻。

- 与传统的硅基半导体相比,GaN 半导体由于其高电子迁移率和宽频能隙而表现出较低的功率损耗。在智慧型手机中,基于 GaN 的电源管理晶片可实现更快的充电、更长的电池寿命和更低的发热量。同样,GaN 半导体可以提高笔记型电脑中的功率转换效率,从而延长电池寿命并减轻设备重量。

- 智慧型手机的日益普及也推动了受访市场的成长。根据爱立信预测,到2023年,全球智慧型手机行动网路用户数量将达到近70亿人。预计到2028年将超过77亿。印度、中国和美国的智慧型手机行动网路订阅数量最多。

- 氮化镓半导体在高频应用中表现出优异的性能,使其适合现代电子设备不断增长的需求。在智慧型手机中,基于 GaN 的射频 (RF) 放大器可提高讯号质量,从而提高通话清晰度和资料传输速度。在笔记型电脑中,基于 GaN 的功率放大器可实现高速无线连接并提高整体性能。此外,在消费性穿戴产品中,GaN 半导体可促进稳定的无线通讯并实现先进的感测器整合。

中国正在实现令人瞩目的成长

- 近几十年来,中国已成为半导体及相关产品的主要製造商和使用者。中国半导体晶片需求的快速成长很大程度上得益于数位环境的快速扩张。此外,政府项目也有助于中国更多地采用数位技术。其中之一是“中国製造2025”,旨在鼓励机器人、物联网、自动化、人工智慧、AR/VR和ML等先进ICT解决方案融入工业领域。

- 该国GaN半导体市场的成长也受到智慧型手机、智慧电视、笔记型电脑、平板电脑、消费性电子产品等日益普及的影响。由于材料的成本和效率优势,消费领域一直是OEM采用 GaN 的主要力量,而这一趋势预计将持续有增无减。 GaN 使智慧型手机製造商能够生产体积小且具有良好性价比的充电器。

- 中国也是汽车生产大国,正在加大对汽车产业的投资,以提高其市场地位。因此,中国政府最近取消了对外国投资的各种限制,以鼓励国内汽车製造。

- 此外,由于消费者可支配收入的增加,对豪华汽车的需求不断增加,因为这些汽车中安装的电子和控制单元的数量将会增加,从而推动了对GaN 半导体的需求,创造了良好的市场增长前景。例如,根据中国汽车工业工业(CAAM)的数据,2023年12月中国汽车产量将为每月227.3万辆乘用车和31万辆商用车。

氮化镓(GaN)半导体装置产业概况

GaN半导体装置市场正走向半固体。市场的主要企业包括东芝电子元件及储存装置株式会社、Nexperia Holding BV(闻泰科技)、英飞凌科技股份公司、Efficient Power Conversion Corporation 和 NXP Semiconductors NV。公司正在透过建立多个合作伙伴关係和投资新产品发布来扩大市场占有率,以在预测期内获得竞争优势。

- 2024 年 6 月 - 英飞凌科技股份公司推出 CoolGaNTransistor 700 V G4 产品系列。这些元件在功率转换方面表现出色,尤其是在 700 V 电压范围内。这些电晶体的输入/输出比性能提高了 20%。这种增强可以提高效率、最小化功率损耗并提供更经济的解决方案。这些应用范围从消费性充电器和笔记型电脑适配器到资料中心电源、可再生能源逆变器和电池储存解决方案。

- 2024 年 5 月 - 东芝电子元件及储存装置株式会社在石川县加贺东芝电子株式会社(东芝的主要集团公司)举行了功率半导体 300 毫米晶圆製造工厂和办公大楼的竣工仪式。此次完成标誌着东芝多年投资计画第一阶段的重要里程碑。我们将在2024财年下半年进行设备安装并开始量产。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- COVID-19 和其他宏观经济因素对市场的影响

第五章市场动态

- 市场驱动因素

- 5G实施进展带动通讯基础建设产业需求旺盛

- 高性能和小外形规格等优势特性推动了军事领域的采用

- 市场限制因素

- 成本和营运挑战

第六章 市场细分

- 按类型

- 功率半导体

- 光电半导体

- 射频半导体

- 按设备

- 电晶体

- 二极体

- 整流器

- 电源IC

- 按最终用户产业

- 车

- 家电

- 航太/国防

- 医疗保健

- 资讯通讯/技术

- 其他最终用户产业

- 按地区

- 美国

- 欧洲

- 日本

- 中国

- 韩国

- 台湾

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Toshiba Electronic Devices & Storage Corporation

- Nexperia Holding BV(Wingtech Technology Co. Ltd)

- Infineon Technologies AG

- Efficient Power Conversion Corporation

- NXP Semiconductors NV

- Texas Instruments Incorporated

- MACOM Technologies Solutions Holdings Inc.

- STMicroelectronics NV

- Microchip Technology Inc.

- Soitec

- Qorvo Inc.

- ROHM Co. Ltd

第八章投资分析

第9章市场的未来

The GaN Semiconductor Devices Market size is estimated at USD 4.34 billion in 2024, and is expected to reach USD 11.57 billion by 2029, growing at a CAGR of 21.64% during the forecast period (2024-2029).

Key Highlights

- The escalating demand for renewable energy sources, including solar and wind power, has propelled the use of GaN semiconductor devices in power conversion systems. GaN's high-power density, fast switching speeds, and improved thermal performance enable efficient energy conversion, reducing energy wastage and increasing overall system efficiency.

- Solar power is one of the fastest-growing segments in the green energy sector. Solar panels, which consist of multiple discrete semiconductors, transform sunlight into electricity through the photovoltaic effect. The rising demand for solar energy, driven by factors such as government incentives and falling costs, has led to a surge in the production and installation of solar panels. This, in turn, has fueled the demand for discrete semiconductors required for the efficient functioning of these panels.

- GaN's ability to operate at high frequencies, withstand harsh environmental conditions, and deliver high power outputs makes it suitable for applications such as radar systems, electronic warfare, and communication systems. GaN devices offer improved performance, reliability, and reduced system size, contributing to advancements in aerospace and defense technologies.

- However, the high cost associated with gallium nitride semiconductor devices acts as a significant restraint to the growth of the studied market. The production process of these devices requires complex manufacturing techniques and specialized equipment, which adds to the overall cost. This makes gallium nitride semiconductor devices relatively expensive compared to other semiconductor materials, limiting their adoption in price-sensitive markets.

- The remote working environment, in the post-COVID scenario, is leading to the growth in hyper-scale data centers and increased demand for smartphones, wearables, laptops, and other IT equipment, creating a need for memory chips and resulting in increased demand for the market studied.

- As per the the National Association of Software and Service Companies (NASSCOM), India's data center investment is slated to reach USD 4.6 billion by 2025. India's higher cost efficiency in both development and operation is its most significant advantage compared to more mature markets. Currently, India's data centers are primarily located in Mumbai, Bengaluru, Chennai, Delhi (NCR), Hyderabad, and Pune. Calcutta, Kerala, and Ahmedabad are the upcoming data center hubs. These growing data center market investments drive the growth of the market studied.

Gallium Nitride (GaN) Semiconductor Devices Market Trends

Consumer Electronics to Hold Significant Market Share

- Gallium nitride (GaN) semiconductors have emerged as crucial components in the consumer electronics industry. Due to their unique properties, these semiconductors have rapidly gained popularity in power electronics. Compared to traditional silicon-based devices, GaN semiconductors offer higher breakdown voltage and lower on-resistance.

- Compared to traditional silicon-based semiconductors, GaN semiconductors exhibit lower power losses due to their higher electron mobility and wider bandgap. In smartphones, GaN-based power management chips enable faster charging, longer battery life, and reduced heat generation. Similarly, GaN semiconductors allow for more efficient power conversion in laptops, resulting in extended battery life and reduced device weight.

- The increasing penetration of smartphones is likely to aid the growth of the studied market. According to Ericsson, in 2023, the number of smartphone mobile network subscriptions worldwide reached almost seven billion. It is expected to exceed 7.7 billion by 2028. India, China, and the United States have the highest number of smartphone mobile network subscriptions.

- GaN semiconductors perform well in high-frequency applications, making them suitable for the ever-increasing demands of modern electronic devices. In smartphones, GaN-based radio frequency (RF) amplifiers enhance signal quality, leading to improved call clarity and faster data transfer rates. In laptops, GaN-based power amplifiers enable high-speed wireless connectivity and enhance overall performance. Furthermore, in consumer wearables, GaN semiconductors facilitate stable wireless communication and enable the integration of advanced sensors.

China to Witness Significant Growth

- China has emerged as the leading manufacturer and user of semiconductors and associated goods in recent decades. The surge in demand for semiconductor chips in China is largely due to the rapid expansion of the digital environment. In addition, government programs contribute to the increased adoption of digital technologies in China. One such initiative is "Made in China 2025," which aims to encourage the integration of advanced technologies like robotics, IoT, automation, and advanced ICT solutions such as AI, AR/VR, and ML in the industrial sector.

- The growth of the country's GaN semiconductor market is also influenced by the rising popularity of smartphones, smart TVs, laptops, tablets, home appliances, etc. The consumer sector has been the primary force behind GaN adoption by OEMs due to the material's cost and efficiency advantages, and this trend is anticipated to continue without deceleration. GaN enables smartphone manufacturers to produce chargers with reduced dimensions and a better price-to-power ratio.

- China is also known as a leading producer of motor vehicles and is expanding its investment in the automotive industry to enhance its market position. As a result, the Chinese government has recently lifted various restrictions on foreign investment to promote automotive manufacturing within the nation.

- Moreover, the growing demand for luxury vehicles owing to the rising disposable income of the consumers is creating a favorable outlook for the studied market's growth as more electronic and control units feature in these vehicles, which drives the demand for GaN semiconductors. For instance, according to the China Association of Automobile Manufacturers (CAAM), in December 2023, monthly automobile production in China stood at 2,273 thousand units of passenger vehicles and 310 thousand units of commercial vehicles.

Gallium Nitride (GaN) Semiconductor Devices Industry Overview

The GaN semiconductor devices market is semi-consolidated. Some of the significant players in the market are Toshiba Electronic Devices & Storage Corporation, Nexperia Holding BV (Wingtech Technology Co. Ltd), Infineon Technologies AG, Efficient Power Conversion Corporation, NXP Semiconductors NV, and many more. The companies are increasing their market share by forming multiple partnerships and investing in introducing new products to earn a competitive edge during the forecast period.

- June 2024 - Infineon Technologies AG introduced the CoolGaNTransistor 700 V G4 product family. These devices excel in power conversion, specifically in the 700 V voltage range. These transistors boast a 20% performance boost in input and output figures-of-merit. This enhancement translates to heightened efficiency, minimized power losses, and more economical solutions. These applications span from consumer chargers and notebook adapters to data center power supplies, renewable energy inverters, and battery storage solutions.

- May 2024 - Toshiba Electronic Devices & Storage Corporation held a ceremony to mark the completion of a new 300-millimeter wafer fabrication facility for power semiconductors and an office building at Kaga Toshiba Electronics Corporation in Ishikawa Prefecture, Japan, one of Toshiba's key group companies. Completing construction is a significant milestone for Phase 1 of Toshiba's multi-year investment program. Toshiba will now proceed with equipment installation and start mass production in the second half of the fiscal year 2024.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Strong Demand from Telecom Infrastructure Segment Driven by Advancements in 5G Implementation

- 5.1.2 Favorable Attributes Such As High-performance and Small Form Factor to Drive Adoption in the Military Segment

- 5.2 Market Restraint

- 5.2.1 Cost & Operational Challenges

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Power Semiconductors

- 6.1.2 Opto-Semiconductors

- 6.1.3 RF Semiconductors

- 6.2 By Devices

- 6.2.1 Transistors

- 6.2.2 Diodes

- 6.2.3 Rectifiers

- 6.2.4 Power ICs

- 6.3 By End-user Industry

- 6.3.1 Automotive

- 6.3.2 Consumer Electronics

- 6.3.3 Aerospace and Defense

- 6.3.4 Medical

- 6.3.5 Information Communication and Technology

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 United States

- 6.4.2 Europe

- 6.4.3 Japan

- 6.4.4 China

- 6.4.5 Korea

- 6.4.6 Taiwan

- 6.4.7 Latin America

- 6.4.8 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Toshiba Electronic Devices & Storage Corporation

- 7.1.2 Nexperia Holding BV (Wingtech Technology Co. Ltd)

- 7.1.3 Infineon Technologies AG

- 7.1.4 Efficient Power Conversion Corporation

- 7.1.5 NXP Semiconductors NV

- 7.1.6 Texas Instruments Incorporated

- 7.1.7 MACOM Technologies Solutions Holdings Inc.

- 7.1.8 STMicroelectronics NV

- 7.1.9 Microchip Technology Inc.

- 7.1.10 Soitec

- 7.1.11 Qorvo Inc.

- 7.1.12 ROHM Co. Ltd