|

市场调查报告书

商品编码

1548613

零售虚拟桌面:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Retail Desktop Virtualization - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

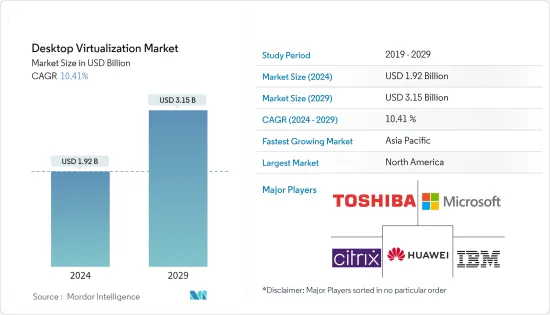

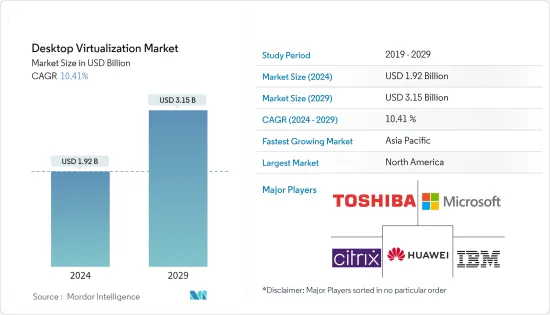

全球虚拟桌面市场规模预计在2024年达到19.2亿美元,并在2024-2029年预测期内以10.41%的复合年增长率增长,到2029年将达到31.5亿美元。

虚拟桌面市场是由云端运算的快速采用和各领域的自动化程度不断提高所推动的。虚拟桌面,即在集中管理的伺服器上託管的虚拟机器 (VM) 内运行桌面作业系统,已成为寻求提高灵活性、安全性和成本效率的企业的关键解决方案。该技术通常透过虚拟桌面基础架构 (VDI) 和桌面即服务 (DaaS) 等平台提供,支援远端桌面解决方案和应用程式虚拟,从而促进无缝虚拟工作空间。

根据产业分析,虚拟桌面对于现代IT基础设施变得越来越重要,特别是随着多重云端环境的兴起以及对最终用户运算 (EUC) 解决方案的需求不断增加。虚拟机器 (VM) 和软体定义资料中心 (SDDC) 也在这一领域发挥着至关重要的作用,使企业能够有效率地部署虚拟桌面。竞争非常激烈,超融合融合式基础架构(HCI) 和精简型用户端领域出现了重大创新,Citrix Systems Inc.、VMware Inc. 和 Microsoft Corporation 等主要企业在市场上处于领先地位。

随着企业继续优先考虑灵活性和远端工作功能,对虚拟桌面部署的需求预计将会成长。市场前景显示云端桌面的采用率稳定成长,尤其是在资料安全性和可存取性至关重要的行业。这种变化也体现在市场区隔上,特别是在北美和欧洲等地区,云端部署模式取代本地解决方案的趋势明显。

云端运算在推动虚拟桌面方面的作用

主要亮点

- 变革IT基础设施:云端运算改变了传统IT基础设施,使虚拟桌面成为各种规模企业的可行解决方案。透过利用云端基础的服务,企业可以更有效地部署虚拟桌面并减少对大规模实体基础架构的需求。这种转变是实现虚拟桌面基础架构 (VDI) 和 DaaS(桌面即服务)解决方案可扩展性的主要力量。云端桌面提供的灵活性允许企业动态管理资源,这在工作负载分配和灾害復原非常重要的多重云端环境中尤其有利。

- 提高可访问性和成本效率:云端运算有助于提高可访问性和成本效率,使企业能够支援远端桌面解决方案和应用程式虚拟,而无需大量的前期投资。虚拟机器 (VM) 的激增使企业能够为员工提供安全、一致的虚拟工作空间访问,无论他们身在何处。在当今的「随时随地工作」文化中,行动性和资料安全性是重中之重,这种功能至关重要。此外,云端桌面可以更轻鬆地管理和更新,与传统桌面设定相比,可以降低总拥有成本 (TCO)。

零售业的自动化推动了虚拟的需求

主要亮点

- 简化零售业务:零售业自动化程度的提高极大地满足了虚拟桌面的需求。零售商越来越多地采用自动化技术来简化业务、改善客户体验并简化供应链。虚拟桌面可以透过提供一个跨多个位置集中管理应用程式、库存系统和客户资料的平台来帮助完成这些工作。透过实施远端桌面解决方案,零售企业可以确保业务同步并提供即时资料存取和处理能力,这在快节奏的环境中至关重要。

- 支援全通路策略:随着零售商继续制定全通路策略,无缝整合实体和数位平台的需求变得显而易见。虚拟桌面允许零售公司创建一个统一的工作空间,支援从 POS(销售点)系统到 CRM(客户关係管理)工具等多种功能。这种整合对于跨通路提供一致的客户体验至关重要。此外,越来越多地采用虚拟桌面使零售商能够维持强大的安全通讯协定和资料保护措施,这在处理敏感的客户资讯时至关重要。

零售虚拟桌面市场趋势

虚拟桌面云端采用的兴起

- 云端采用趋势:由于对经济高效、扩充性且易于管理的解决方案的需求,云端采用已成为虚拟桌面市场的关键趋势。在虚拟桌面基础架构 (VDI) 和 DaaS(桌面即服务)的引领下,从传统本机系统转变为云端系统的转变正在取得进展。这种迁移使企业能够快速部署虚拟桌面、降低初始成本并提高灵活性。多重云端环境的采用进一步加速了这个趋势。企业越来越多地在各种云端平台上采用虚拟机器 (VM),因为他们希望避免供应商锁定并提高营运弹性。

- 推动云端采用的关键因素:云端处理的兴起彻底改变了虚拟桌面的格局,使企业能够更有效地管理其资源。超融合融合式基础架构(HCI) 提供的运算、储存和网路资源的无缝整合正在推动人们对云端部署的偏好。此外,软体定义资料中心 (SDDC) 的兴起使企业能够更轻鬆地管理虚拟工作负载并显着提高营运效率。因此,越来越多的中小企业开始采用云端桌面解决方案来优化其IT资源,进一步推动市场成长。

北美预计将占据很大份额

- 北美引领全球市场:由于其先进的技术基础设施和数位转型策略的高采用率,预计北美将主导虚拟桌面市场。该地区注重创新和新技术的快速整合,使其成为市场成长的关键枢纽。由于远距在家工作的兴起,对远端桌面解决方案的需求不断增长,这是支持这一优势的关键因素。随着该地区企业采用 VDI、DaaS 和云端桌面解决方案,北美市场占有率预计将大幅成长。

- 美国作为主要企业:作为北美最大的虚拟桌面消费国,美国作为该地区的市场领导发挥关键作用。美国主要云端服务供应商的存在以及託管伺服器数量的不断增加正在推动云端基础的虚拟桌面的成长。此外,靠近加拿大以及新工作空间对环保实践的重视进一步支持了该地区的市场扩张。这种区域互连性支持虚拟桌面解决方案的广泛采用,并巩固了北美的领导地位。

零售虚拟桌面产业概述

市场分散:虚拟桌面市场高度分散,没有一家公司占据主导市场占有率。这种细分代表了大型跨国公司和小型专业公司营运的竞争环境。我们提供广泛的解决方案,从基本的虚拟到复杂的客製化部署。

采用多样化方法的市场领导公司:虚拟桌面市场的主要参与者包括 Citrix Systems Inc.、东芝公司、Red Hat Inc.(IBM 公司)、华为科技公司和微软公司。这些公司以其强大的全球影响力、广泛的产品系列和持续创新而闻名。 Citrix 和微软以其全面的虚拟平台而闻名,而红帽公司(IBM 公司)和华为则专注于整合开放原始码和云端基础的解决方案。东芝的存在更加利基,迎合特定产业的需求。

未来的成功策略将专注于创新和整合虚拟桌面市场的主要趋势包括对基于云端基础的解决方案的需求不断增长、安全性的提高以及与现有IT基础设施的无缝整合。为了取得成功,市场参与企业必须专注于这些领域,并提供灵活、安全的解决方案来满足不断变化的业务需求。持续创新、策略合作伙伴关係和扩大服务范围可能是在这个分散的市场中保持竞争力的关键策略。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概览(包括 COVID-19 的影响)

- 产业吸引力-波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场动态

- 市场驱动因素

- 扩大云端运算的采用

- 零售业自动化的发展

- 市场限制因素

- 基础设施实施限制

第六章 市场细分

- 透过桌面交付平台

- 託管虚拟桌面 (HVD)

- 託管共用桌面 (HSD)

- 依实施类型

- 本地

- 云

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Citrix Systems Inc.

- Toshiba Corporation

- Red Hat Inc.(IBM Corporation)

- Huawei Technologies Co. Ltd.

- Microsoft Corporation

- Parallels International GmbH

- Dell Inc.

- Ncomputing, Inc.

- Ericom Software Inc.

- Tems, Inc

- Vmware Inc.

第八章投资分析

第9章市场的未来

The Desktop Virtualization Market size is estimated at USD 1.92 billion in 2024, and is expected to reach USD 3.15 billion by 2029, growing at a CAGR of 10.41% during the forecast period (2024-2029).

The desktop virtualization market has gained significant traction, driven by the rapid adoption of cloud computing and increasing automation across various sectors. Desktop virtualization, which involves running a desktop operating system within a virtual machine (VM) hosted on a centralized server, has become a crucial solution for businesses aiming to enhance flexibility, security, and cost efficiency. This technology, often delivered through platforms like Virtual Desktop Infrastructure (VDI) or Desktop as a Service (DaaS), enables remote desktop solutions and application virtualization, fostering a seamless virtual workspace.

Industry analysis reveals that desktop virtualization is becoming increasingly integral to modern IT infrastructures, especially with the rise of multi-cloud environments and the growing demand for end-user computing (EUC) solutions. Virtual machines (VMs) and software-defined data centers (SDDCs) are also playing a pivotal role in this landscape, enabling organizations to deploy virtual desktops efficiently. With companies like Citrix Systems Inc., VMware Inc., and Microsoft Corporation leading the market, the competition is intense, with significant innovation occurring in hyper-converged infrastructure (HCI) and thin clients.

As businesses continue to prioritize flexibility and remote work capabilities, the demand for virtual desktop deployment is expected to grow. The market outlook suggests a steady rise in the adoption of cloud desktops, particularly in industries where data security and accessibility are paramount. This shift is reflected in the market's segmentation, with a noticeable trend towards cloud deployment modes over on-premise solutions, particularly in regions like North America and Europe.

Cloud Computing's Role in Driving Desktop Virtualization

Key Highlights

- Transformation of IT Infrastructure: Cloud computing has transformed traditional IT infrastructures, making desktop virtualization a feasible solution for businesses of all sizes. By leveraging cloud-based services, companies can deploy virtual desktops more efficiently, reducing the need for extensive physical infrastructure. This shift has been instrumental in enabling the scalability of virtual desktop infrastructure (VDI) and Desktop as a Service (DaaS) solutions. The flexibility offered by cloud desktops allows organizations to manage resources dynamically, which is particularly advantageous in multi-cloud environments where workload distribution and disaster recovery are critical.

- Enhanced Accessibility and Cost Efficiency: Cloud computing facilitates greater accessibility and cost efficiency, enabling organizations to support remote desktop solutions and application virtualization without significant upfront investment. With the proliferation of virtual machines (VMs), businesses can provide employees with secure and consistent access to virtual workspaces, regardless of location. This capability is essential in today's work-from-anywhere culture, where mobility and data security are top priorities. Moreover, cloud desktops allow for more straightforward management and updates, which reduces the total cost of ownership (TCO) compared to traditional desktop setups.

Automation in Retail Boosting Virtualization Demand

Key Highlights

- Streamlining Retail Operations: The growth in automation within the retail sector is significantly contributing to the demand for desktop virtualization. Retailers are increasingly adopting automation technologies to streamline operations, enhance customer experience, and improve supply chain efficiency. Desktop virtualization supports these efforts by providing a centralized platform for managing applications, inventory systems, and customer data across multiple locations. By implementing remote desktop solutions, retailers can ensure that their operations are synchronized, with real-time data access and processing capabilities that are critical in a fast-paced environment.

- Supporting Omnichannel Strategies: As retailers continue to develop omnichannel strategies, the need for seamless integration across physical and digital platforms becomes more pronounced. Desktop virtualization enables retailers to create a unified workspace that supports various functions, from point-of-sale (POS) systems to customer relationship management (CRM) tools. This integration is vital for delivering a consistent customer experience across channels. Additionally, with the rise of virtual desktop deployment, retailers can maintain robust security protocols and data protection measures, which are essential in handling sensitive customer information.

Retail Desktop Virtualization Market Trends

The Rise of Cloud Deployment in Desktop Virtualization

- Cloud Deployment Trends: Cloud deployment has become a pivotal trend in the desktop virtualization market, driven by the need for cost-effective, scalable, and easily managed solutions. Businesses are increasingly transitioning from traditional on-premise setups to cloud-based models, with Virtual Desktop Infrastructure (VDI) and Desktop as a Service (DaaS) leading the way. This shift allows companies to deploy virtual desktops swiftly while reducing upfront costs and enhancing flexibility. The adoption of multi-cloud environments is further accelerating this trend, as businesses seek to avoid vendor lock-in and enhance operational resilience, driving the proliferation of virtual machines (VMs) across various cloud platforms.

- Key Factors Boosting Cloud Deployment: The widespread adoption of cloud computing is transforming the desktop virtualization landscape, offering organizations the ability to manage resources more efficiently. The growing preference for cloud deployment is due to the seamless integration of computing, storage, and networking resources provided by hyper-converged infrastructure (HCI). Additionally, the rise of Software-Defined Data Centers (SDDCs) is making it easier for enterprises to manage virtualized workloads, significantly improving operational efficiency. As a result, small to medium-sized enterprises (SMEs) are increasingly embracing cloud desktop solutions to optimize their IT resources, further driving market growth.

North America is Expected to Hold Major Share

- North America Leading the Global Market: North America is set to dominate the desktop virtualization market, driven by its advanced technological infrastructure and high adoption rates of digital transformation strategies. The region's strong focus on innovation and its ability to rapidly integrate new technologies have positioned it as a critical hub for market growth. The increasing demand for remote desktop solutions, fueled by the rise in remote work and telecommuting, is a key factor supporting this dominance. As businesses across the region adopt VDI, DaaS, and cloud desktop solutions, North America's market share is expected to grow significantly.

- United States as a Key Player: The United States, as the largest consumer of desktop virtualization in North America, plays a crucial role in the region's market leadership. The presence of major cloud service providers and an increasing number of hosted servers in the U.S. are driving the growth of cloud-based desktop virtualization. Additionally, the proximity to Canada and the emphasis on eco-friendly practices in new workspaces are further bolstering the market's expansion across the region. This regional interconnectivity supports the broader adoption of desktop virtualization solutions, reinforcing North America's leadership position.

Retail Desktop Virtualization Industry Overview

Highly Fragmented Market: The desktop virtualization market is highly fragmented, with no single company holding a dominant market share. This fragmentation indicates a competitive environment where both large global corporations and smaller specialized companies operate. The market's nature reflects the diversity of end-user needs, with players offering a wide range of solutions from basic virtualization to complex, customized deployments.

Market Leaders with Diverse Approaches: The leading players in the desktop virtualization market include Citrix Systems Inc., Toshiba Corporation, Red Hat Inc. (IBM Corporation), Huawei Technologies Co. Ltd., and Microsoft Corporation. These companies are distinguished by their strong global presence, extensive product portfolios, and continuous innovation. Citrix and Microsoft are particularly noted for their comprehensive virtualization platforms, while Red Hat (under IBM) and Huawei focus on integrating open-source and cloud-based solutions. Toshiba's presence is more niche, catering to specific industry needs.

Future Success Strategies Revolve Around Innovation and Integration: Key trends in the desktop virtualization market include the growing demand for cloud-based solutions, security enhancements, and seamless integration with existing IT infrastructures. For market players to succeed, they must focus on these areas, providing flexible and secure solutions that can adapt to the changing needs of businesses. Continuous innovation, strategic partnerships, and expanding service offerings will be crucial strategies for staying competitive in this fragmented market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview ( Includes the Impact due to COVID-19)

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Cloud Computing

- 5.1.2 Growth in Automation in Retail

- 5.2 Market Restraints

- 5.2.1 Infrastructure Deployment Constraints

6 MARKET SEGMENTATION

- 6.1 By Desktop delivery platform

- 6.1.1 Hosted Virtual Desktop (HVD)

- 6.1.2 Hosted Shared Desktop (HSD)

- 6.2 By Deployment Mode

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Citrix Systems Inc.

- 7.1.2 Toshiba Corporation

- 7.1.3 Red Hat Inc. (IBM Corporation )

- 7.1.4 Huawei Technologies Co. Ltd.

- 7.1.5 Microsoft Corporation

- 7.1.6 Parallels International GmbH

- 7.1.7 Dell Inc.

- 7.1.8 Ncomputing, Inc.

- 7.1.9 Ericom Software Inc.

- 7.1.10 Tems, Inc

- 7.1.11 Vmware Inc.