|

市场调查报告书

商品编码

1548884

密码管理:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Password Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

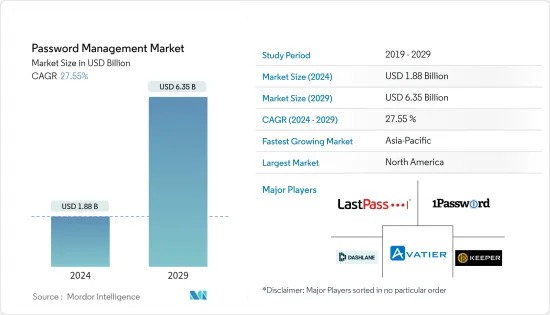

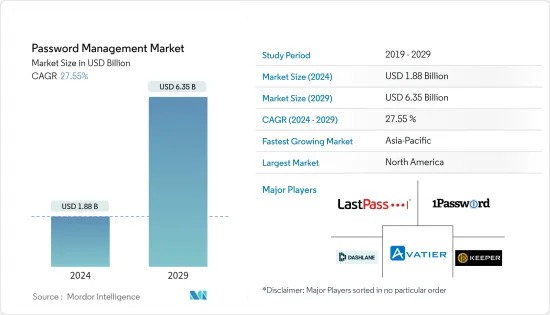

密码管理市场规模预计到 2024 年为 18.8 亿美元,预计到 2029 年将达到 63.5 亿美元,在预测期内(2024-2029 年)复合年增长率为 27.55%。

密码管理 (PM) 技术可让使用者在帐户锁定后或个人忘记其凭证时重设客户的密码。此外,PM工具可以跨多个平台同步使用者密码,允许使用者使用一个密码登入多个应用程式。随着越来越多的财务和个人资讯在线上管理,对复杂密码和安全储存密码的需求导致了密码管理的发展。

主要亮点

- 随着云端应用程式、行动应用程式和新技术被引入职场,许多密码被引入,员工们很难管理它们。小型企业在管理密码方面遇到的困难最大,但由于资源和法规的原因,较大的公司可能会实施单一登入解决方案,让员工以更少的密码存取更多的应用程式。因此,需要一种密码管理解决方案来有效地利用密码。

- 随着技术使用的增加,在关键场景中采用技术的风险也随之增加。例如,财务或个人资讯等敏感资讯的洩露,或由于使用者或密码洩露而导致核心系统伺服器拒绝服务,都推动了对密码管理的需求。

- 多因素身份验证等先进技术的引入将支援密码管理的采用。一些密码管理器支援多重身份验证 (MFA),以更好地保护使用者及其密码。要启用多重身份验证并存取您的凭证,攻击者必须知道您的主密码并有权存取您的第二个因素。所有 CloudSync 密码管理器以及使用密码管理器储存密码以保护对特权帐户和其他敏感帐户的存取的其他位置都必须启用多重验证。

- 密码管理应用程式的缺陷正在挑战此类解决方案的市场成长和采用。应用程式管理多个ID和密码,使得资料更加敏感。

- 自 COVID-19 爆发以来,网路攻击显着增加,对个人、企业和组织产生了负面影响。远距工作实践、对病毒传播缺乏了解以及社会动盪加剧导致骇客使用多种网路攻击技术来赚钱。一些受影响的公司正在花钱升级过时的资料和密码管理系统。网路攻击的威胁预计将持续存在。

密码管理市场趋势

桌面技术类型细分市场预计将占据主要市场占有率

- 随着安全威胁、资料外洩和诈骗的增加,BFSI 组织受到了监管和公众越来越严格的审查。因此,密码管理解决方案在BFSI领域中变得至关重要。

- 这些解决方案使金融机构能够以结构化、集中的方式管理和衡量安全性,并识别与使用者存取关键系统和应用程式相关的风险。联邦存款保险公司(FDIC)和联邦金融机构检查委员会(FFIEC)等机构制定统一的核心标准和报告,以促进金融机构监督的统一。

- 此外,金融领域网路犯罪的增加迫使银行和金融机构加强密码安全。此外,银行正在与通讯业者合作,打击银行业日益增长的网路犯罪。据IBM称,2023年,製造业在全球主要产业中遭受网路攻击的比例最高。近四分之一的网路攻击发生在製造业。金融和保险紧随其后,约占 18%。专业、商业和消费者服务排名第三,占报告的网路攻击的 15.4%。

- 此外,金融服务组织正在投资网路安全解决方案并提高员工网路安全意识,以提高密码安全性。

- BFSI 部门与高度敏感的资料密切合作,包括个人识别资讯和财务记录。网路犯罪分子可能会洩露这些资料,并将其用于金融诈骗、收益或其他邪恶活动,以谋取自身利益。这些因素有力地推动了银行和金融领域密码管理解决方案的成长。

预计北美将占据较大市场占有率

- 由于美国和加拿大国家先进技术的采用率很高,预计北美将在密码管理市场中占据重要的市场占有率。美国社群媒体的高度普及以及政府对资料外洩的严格监管增加了该地区对密码管理软体的需求。行动付款、社交媒体帐户和多个其他生产帐户的亲和性,催生了对易于管理的多个密码的需求。此外,密码管理解决方案始终受到网路攻击的威胁,并且往往提供高级加密。

- 该地区网路攻击数量的增加进一步促进了市场的成长。此外,COVID-19 大流行使远距工作成为常态,为市场成长做出了巨大贡献。远端工作带来的最大挑战与存取安全有关。由于使用者经常安装核准的/盗版软体或开启未知/恶意附件,因此保护端点免受恶意软体传播已成为首要问题。

- 随着诈骗利用糟糕的存取管理流程带来的机会,面对这些障碍已成为必要。儘管攻击者不分地域,但针对美国公司的网路攻击数量创历史新高。 IT 管理员正在寻找特权存取管理 (PAM) 解决方案来解决这些问题,同时不会影响工作效率或增加额外的复杂性。

- 美国的密码安全漏洞数量正在增加,因此需要在全部区域实施密码管理平台。此外,该地区的联盟和扩张等策略开拓也促进了市场成长率。

- 产品更新数量的不断增加也增加了对密码管理软体的需求。例如,随着机器秘密管理市场的成长,一家总部位于多伦多的企业密码管理公司宣布推出新的解决方案和收购。

密码管理产业概述

密码管理市场高度分散,主要参与者包括 LastPass US LP (Goto Group Inc.)、1Password (AgileBits Inc.)、Dashlane Inc.、Keeper Security Inc. 和 Avatier Corporation。市场上的公司正在采取合作、併购、创新、投资和收购等策略来增强其产品供应并获得永续的竞争优势。

- 2024 年 2 月:身分安全领域的领导企业之一 1Password 宣布推出新的全球合作伙伴计画。作为这项多年倡议的第一阶段,合作伙伴将获得 1Password 不断增长的安全解决方案套件、简化的合作伙伴体验以及推动共同成长的销售、行销和支援资源套件。

- 2024 年 2 月 Keeper Security 是云端基础的零信任和零知识网路安全软体供应商,可保护密码、金钥、秘密、连线和特权访问,与Amazon Web Services (AWS) 合作伙伴网路(APN) 合作。作为 APN 成员,Keeper 加入了由 200 多个国家/地区 130,000 名合作伙伴组成的全球网络,这些合作伙伴与 AWS 合作提供创新解决方案、解决技术挑战、赢得业务并为客户创造价值。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 对密码管理市场的影响

第五章市场动态

- 市场驱动因素

- 近年来网路安全风险增加

- 市场限制因素

- 与密码管理员骇客攻击相关的安全漏洞

第六章 市场细分

- 按解决方案类型

- 自助密码管理

- 特权使用者密码管理

- 依技术类型

- 桌面

- 行动装置

- 语音密码重设

- 按行业分类

- BFSI

- 卫生保健

- 资讯科技/通讯

- 其他行业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Lastpass US LP(Goto Group Inc.)

- 1Password(AgileBits Inc.)

- Dashlane Inc.

- Keeper Security Inc.

- Avatier Corporation

- Core Security Technologies(Helpsystems LLC)

- Fastpasscorp A/S

- Hitachi ID Systems Inc.

- Microsoft Corporation

- IBM Corporation

- Cyberark Software Ltd

- Trend Micro Inc.

- EmpowerID Inc.

- Ivanti

- Intuitive Security Systems Pty Ltd

- Steganos Software GmbH

- AceBIT GmbH

- Siber Systems Inc.(Roboform)

- Delinea Inc(Centrify Corp)

- Zoho Corporation Pvt. Ltd

第八章投资分析

第九章 市场机会及未来趋势

The Password Management Market size is estimated at USD 1.88 billion in 2024, and is expected to reach USD 6.35 billion by 2029, growing at a CAGR of 27.55% during the forecast period (2024-2029).

Password management (PM) technologies enable users to reset clients' passwords following an account lockout or when individuals forget their credentials. Additionally, PM tools can synchronize passwords for users across many platforms, enabling users to log into numerous applications using a single password. As more financial and personal information is kept online, the demand for complex passwords and safe means to store them has led to the development of password managers.

Key Highlights

- As cloud apps, mobile apps, and new technologies are being increasingly integrated into the workplace, many passwords are also being introduced, which employees struggle to keep track of. Small businesses struggle the most with passwords, while due to resources and regulations, larger companies may be more likely to have single sign-on solutions, enabling employees to access more apps with fewer passwords. This calls for password management solutions, which help efficiently utilize passwords.

- As technology use is increasing, the risks involved in adopting technology in critical scenarios are also on the rise. For instance, sensitive information, such as financial and personal details, breaches, or denial of services by servers on mission-critical systems by the breach of user and password are driving the demand for password management.

- Deploying advanced technologies such as multi-factor authentication boosts the adoption of password management. Several password managers support multi-factor authentication (MFA) to safeguard users and their passwords better. An attacker would need to know the master password and have access to the second factor to gain access to credentials with multi-factor enabled. Every cloud-sync password manager and any other place where password managers are being used to store passwords, protecting access to privileged or other sensitive accounts, should enable multi-factor authentication.

- The flaws in password management applications are challenging the market's growth and the adoption of such solutions. A security breach from the perspective of the password manager is expected to be catastrophic compared to a single entity breach, owing to the presence of multiple IDs and passwords managed by applications, which make the data even more sensitive.

- Since the COVID-19 outbreak, there has been a significant increase in cyberattacks that have had a negative impact on people, companies, and organizations. Due to remote working practices, a lack of knowledge about the outbreak's spread, and increased public anxiety, hackers used numerous cyberattack techniques to make money. Some impacted businesses are spending money to upgrade their outdated data and password management systems. The threat of cyberattacks is anticipated to continue in the coming years.

Password Manager Market Trends

Desktop Technology Type Segment is Expected to Hold Significant Market Share

- With the increasing number of security threats, data breaches, and frauds, BFSI organizations are under increasing regulatory and public scrutiny. Hence, password management solutions are becoming essential in the BFSI sector.

- These solutions allow the institutions to manage and measure security and identify the risks associated with the users' access to crucial systems and applications in a structured and centralized way. Agencies, such as the Federal Deposit Insurance Corporation (FDIC) and Federal Financial Institutions Examination Council (FFIEC), have established uniform principal standards and reports for promoting uniformity in the supervision of financial institutions.

- Further, the increased cybercrimes in financial sectors force banks and financial institutes to enhance their password security. In addition, banks are partnering with telcos to fight growing cybercrimes in the banking sector. According to IBM, in 2023, manufacturing saw the highest share of cyberattacks among the leading industries worldwide. The manufacturing companies encountered nearly a quarter of the total cyberattacks. Finance and insurance organizations followed, with around 18%. Professional, business, and consumer services ranked third, with 15.4% of reported cyberattacks.

- Further, financial services organizations have been increasing investments in cybersecurity solutions and cybersecurity awareness among employees, owing to the increasing password security it provides.

- The BFSI sector works closely with highly sensitive data such as personally identifiable information and financial records. Cybercriminals can compromise this data, use it for financial fraud, monetize it, and do other malicious activities for their benefit. Such factors have strongly augmented the growth of password management solutions in the banking and finance sectors.

North America is Expected to Hold Significant Market Share

- Owing to the high adoption rate of advanced technologies in countries across the United States and Canada, North America is expected to account for a significant market share of the password management market. The high social media penetration and the strict government regulations regarding data breaches in the United States have increased the demand for password management software in this region. The growing affinity toward mobile payments, social media accounts, and several other productional accounts has resulted in the need for multiple passwords, which can be managed easily. Moreover, password management solutions are always under the threat of cyber-attacks, which tend to offer a high level of encryption.

- The growing number of cyber attacks in the region further contributes to the market growth. Further, the COVID-19 pandemic has made remote working a norm, significantly contributing to the market growth. The most significant difficulties brought on by remote work are those connected to access security. Protecting endpoints against malware propagation has become the primary concern since users frequently install unauthorized/pirated software and open unknown/malicious attachments.

- Rising to these obstacles becomes necessary as fraudsters utilize the opportunity supplied by the inadequate access management processes. Even though attackers are not geographically limited, the number of cyberattacks against US-based firms is at an all-time high. Privileged access management (PAM) solutions that handle these issues without affecting productivity or adding extra complexity are sought after by IT managers.

- The growing number of password security breaches in the country has necessitated the deployment of password management platforms across the region. Further, strategic developments such as collaborations and expansions in the region contribute to the market's growth rate.

- The growing number of product updates is also bolstering the demand for password managers. For instance, a Toronto-based enterprise password management company announced the debut of a new solution and an acquisition, along with growth in the machine secrets management market.

Password Manager Industry Overview

The password management market is highly fragmented, with the presence of major players like LastPass US LP (Goto Group Inc.), 1Password (AgileBits Inc.), Dashlane Inc., Keeper Security Inc., and Avatier Corporation. Players in the market are adopting strategies such as partnerships, mergers, innovations, investments, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- February 2024: 1Password, one of the leaders in identity security, announced the launch of its new global partner program. This multi-year initiative's first phase provides partners access to 1Password's growing security solutions suite, a simplified partner experience, and a toolkit of sales, marketing, and enablement resources to drive mutual growth.

- February 2024: Keeper Security, a provider of cloud-based zero-trust and zero-knowledge cybersecurity software protecting passwords, passkeys, secrets, connections, and privileged access, partnered with the Amazon Web Services (AWS) Partner Network (APN). As an APN member, Keeper joined a global network of 130,000 partners from more than 200 countries working with AWS to provide innovative solutions, solve technical challenges, win deals, and deliver value to customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Password Management Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Cybersecurity Risk in the Recent Times

- 5.2 Market Restraints

- 5.2.1 Security Flaw Related to Hacking of Password Managers

6 MARKET SEGMENTATION

- 6.1 By Solution Type

- 6.1.1 Self-service Password Management

- 6.1.2 Privileged User Password Management

- 6.2 By Technology Type

- 6.2.1 Desktop

- 6.2.2 Mobile Devices

- 6.2.3 Voice-enabled Password Reset

- 6.3 By End-user Vertical

- 6.3.1 BFSI

- 6.3.2 Healthcare

- 6.3.3 IT and Telecommunication

- 6.3.4 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Lastpass US LP (Goto Group Inc.)

- 7.1.2 1Password (AgileBits Inc.)

- 7.1.3 Dashlane Inc.

- 7.1.4 Keeper Security Inc.

- 7.1.5 Avatier Corporation

- 7.1.6 Core Security Technologies (Helpsystems LLC)

- 7.1.7 Fastpasscorp A/S

- 7.1.8 Hitachi ID Systems Inc.

- 7.1.9 Microsoft Corporation

- 7.1.10 IBM Corporation

- 7.1.11 Cyberark Software Ltd

- 7.1.12 Trend Micro Inc.

- 7.1.13 EmpowerID Inc.

- 7.1.14 Ivanti

- 7.1.15 Intuitive Security Systems Pty Ltd

- 7.1.16 Steganos Software GmbH

- 7.1.17 AceBIT GmbH

- 7.1.18 Siber Systems Inc. (Roboform)

- 7.1.19 Delinea Inc (Centrify Corp)

- 7.1.20 Zoho Corporation Pvt. Ltd