|

市场调查报告书

商品编码

1851854

肉类包装:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Meat Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

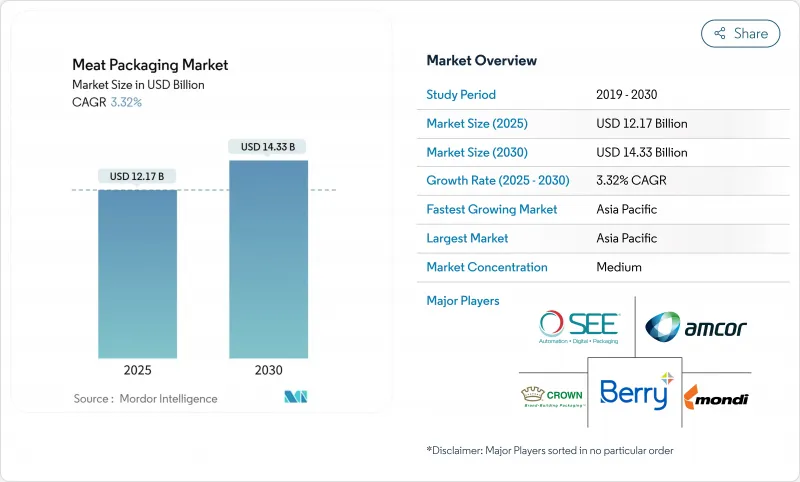

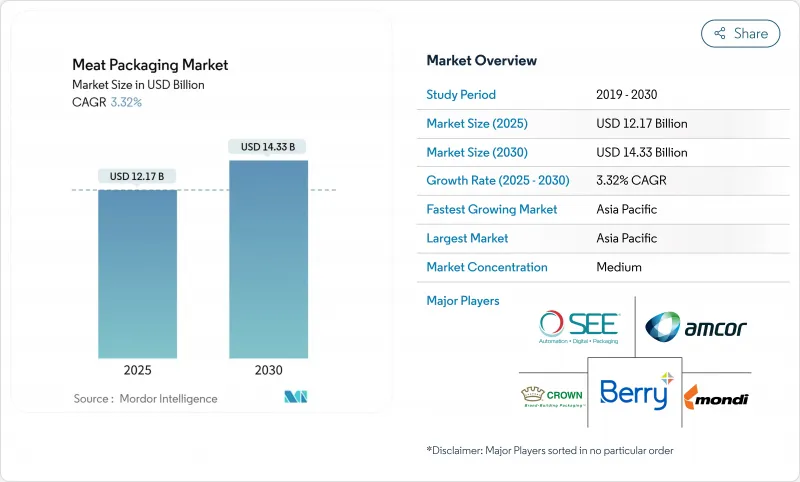

预计到 2025 年,肉类包装市场规模将达到 121.7 亿美元,到 2030 年将成长至 143.3 亿美元,复合年增长率为 3.32%。

这一增长反映了市场对方便肉类产品的稳定需求、低温运输物流的日益普及以及全球食品安全和永续性法规的不断加强。由于零售商追求更长的保质期和更佳的视觉吸引力,柔性塑胶、气调包装和高阻隔单一物流成为主要规格。亚太地区销售量最大,其中线上杂货和食材自煮包通路的成长速度最快。塑胶废弃物法规、原材料价格波动以及替代蛋白的兴起正在削弱净利率前景,促使生产商寻求可回收薄膜、自动化和智慧包装方面的创新。

全球肉类包装市场趋势与洞察

对方便即食肉类的需求

2016年至2022年间,消费者对增值肉类的接受度将从37%增长至67%,这将推动加工商转向采用即食包装,以保持肉的色泽和质地,并最大程度地减少商店处理。泰森鲜肉推出了通用即食包装项目,旨在利用先进的阻隔薄膜简化分销流程并延长保质期。时间紧迫的都市区消费者愿意为方便快速烹饪的包装支付更高的价格。新鲜已调理食品的成长将推动对高压加工和气调包装系统的需求,以保持肉的风味和营养。这些动态将推动成熟城市和新兴城市肉类包装市场持续成长。

有组织的零售和低温运输物流的扩张

预计2023年,中国便利商店销售额将年增10.8%,达到4,248亿元人民币,其中生鲜食品将引领成长。像悦仕机器人这样的新兴企业正在部署可在-30℃低温下运作的自主堆高机,从而提升冷藏配送中心的效率。预计到2035年,更广泛的商用冷藏投资将达到562亿美元,这需要能够承受低温压力并最大限度地减少氧气渗入的包装。零售商也要求采用标准化包装形式以加快货架补货速度,因此加工商正在转向与大规模生产线相容的软包装袋和热成型托盘。这些趋势确保了有组织的零售业将在长期内成为肉类包装市场发展的催化剂。

抗菌奈米复合膜的应用

抗菌奈米复合材料可直接抑制肉类表面的微生物生长,延长保存期限并减少对防腐剂的依赖。注入天然萃取物的水凝胶载体已证实能够在降低细菌数量的同时确保食品安全。北美和欧洲的试点生产线正在扩大生产规模,以期实现商业性应用。将这些薄膜与透明的气调包装盖配合使用,可产生协同效应,既能提供有效的保护,又能保证产品的可视性,这两点对于冷藏柜而言都至关重要。

细分市场分析

到2024年,柔性塑胶将占据肉类包装市场42%的份额,这主要得益于其对不规则切割的适应性和优异的印刷性能。可生物降解薄膜虽然目前仍处于小众市场,但随着监管机构倾向于可堆肥或可回收的解决方案,其复合年增长率将达到7.2%。金属罐和金属箔仍然是高檔腻子和需要灭菌的长保质期产品的重要包装材料。抗菌奈米复合材料层正被应用于柔性薄膜中,在提供有效阻隔性能的同时,也能抑制细菌滋生。树脂和涂层技术的不断创新使加工商能够在保持抗穿刺性的同时降低薄膜厚度,从而保持柔性包装的成本竞争力。

硬质托盘通常由PET或PP製成,用于包装切片产品,因为这类产品对堆迭性要求较高。但由于其材料重量较大,其永续性备受关注。透明的单层PET托盘正在取代发泡托盘,因为后者更容易回收分拣。金属托盘因其优异的气密性而常用于出口的咸牛肉和午餐肉,但重量和成本问题限制了其市场成长。总体而言,随着品牌在永续性和商品行销需求之间寻求平衡,柔性包装解决方案将继续引领肉类包装市场。

到2024年,新鲜和冷冻食品将占肉类包装市场规模的54%,这主要得益于超级市场对美观、防漏且保质期可达数天的托盘和外包装的需求。随着新兴经济体低温运输覆盖范围的扩大,这个市场将持续维持健康成长。从家常小菜切片到常温肉干,已调理食品系列将以5.5%的复合年增长率成长,因为人们的生活方式更注重便利性。这些产品需要高阻氧和防潮性能、微波炉适用密封以及方便消费者使用的开口,从而推动了易撕盖和份量控制方面的创新。

加工肉品市场占有率稳定,但健康趋势正促使消费者转向瘦肉和植物肉替代品。密着包装的升级重点在于可重复密封的拉炼和真空贴体包装,这些措施既能改善肉质,又能最大限度地减少气泡。各品类的需求都集中在能够智慧识别变质风险的指示器上,这有助于在琳琅满目的商品中脱颖而出,并提升消费者对肉类包装市场的信心。

区域分析

到2024年,亚太地区将占肉类包装市场规模的34%,这主要得益于中国近1亿吨的肉类消费量和积极的零售现代化。到2030年,该地区的复合年增长率将达到4.8%,这反映了从北京到班加罗尔的都市化以及对低温运输枢纽的投资。中国线上牛肉购买比例将超过44%,显示专为小包裹网路设计的电商友善包装正在迅速普及。印度超级市场正在扩大冷冻库区,从而扩大气调包装(MAP)和真空包装(VSP)解决方案的应用。东南亚的便利连锁店也纷纷效仿,采用能适应潮湿气候的标准化包装袋。

北美地区人均肉类消费量高,零售基础建设成熟。区块链溯源、抗菌薄膜和自动化装袋机等技术的应用推动了该地区的成长。监管改革正在促进单一材料阻隔薄膜的试验,尤其是在加拿大的大型连锁超市。欧洲在循环经济方面处于领先地位,推动加工商采用可回收的PE/PP结构和纸纤维混合材料。能够同时满足氧气阻隔性和可回收性目标的包装公司正在获得欧盟食品杂货商的优先供应商地位。

在南美洲,巴西等出口导向加工商的需求稳定,他们需要坚固耐用的包装以进行跨洋运输。高阻隔包装袋、压花真空袋和耐用纸板外包装已成为标准配备。中东和非洲的普及程度不一,海湾地区的零售商指定销售优质气调包装牛排,许多非洲市场仍依赖肉品。儘管低温运输差异限制了气调包装的普及,但基础设施投资和快速商业试点计画正在逐步推动其应用。这些地理动态驱动着全球肉类包装市场呈现多速成长的态势。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 对肉类即食肉类产品的需求

- 有组织的零售和低温运输物流的扩张

- 保存期限延长及食品安全法规

- 永续发展主导的向高阻隔单一材料的转变

- 抗菌/奈米复合薄膜的应用

- 基于区块链的可追溯性和防篡改格式

- 市场限制

- 塑胶废弃物法规和可回收性挑战

- 聚合物和金属投入价格波动

- 一次性包装税和生产者责任延伸费

- 替代蛋白的兴起降低了对红肉的需求。

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 疫情影响与恢復分析

第五章 市场规模与成长预测

- 依材料类型

- 塑胶

- 软包装袋

- 包包

- 薄膜和包装

- 其他灵活

- 硬质托盘和容器

- 其他硬质材料

- 金属

- 铝

- 钢

- 其他金属

- 塑胶

- 按肉类类型

- 新鲜/冷冻

- 加工

- 已调理食品

- 透过包装技术

- 调气包装(MAP)

- 真空紧缩包装(VSP)

- 主动式智慧包装

- 可食用和可生物降解的薄膜

- 透过最终用户管道

- 零售(超级市场/大卖场)

- 食品服务/饭店餐饮

- 线上杂货和食材自煮包

- 肉类加工/包装

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲国家

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略倡议与发展

- 市占率分析

- 公司简介

- Amcor plc

- Sealed Air Corporation

- Berry Global Group Inc.

- Mondi plc

- Crown Holdings Inc.

- Coveris Management GmbH

- Winpak Ltd.

- Smurfit Kappa Group plc

- Viscofan SA

- Sonoco Products Company

- Huhtamaki Oyj

- DS Smith plc

- WestRock Company

- Graphic Packaging Holding Company

- Tetra Pak International SA

- Klockner Pentaplast GmbH

- Constantia Flexibles GmbH

- Cascades Inc.

- Innovia Films Ltd.

- LINPAC Packaging Ltd.

第七章 市场机会与未来展望

The meat packaging market size reached USD 12.17 billion in 2025 and is forecast to grow to USD 14.33 billion by 2030 at a 3.32% CAGR.

Growth reflects steady demand for convenience meat formats, widening adoption of cold-chain logistics, and tightening global food-safety and sustainability rules. Flexible plastics, modified-atmosphere formats, and high-barrier mono-materials dominate specifications as retailers push longer shelf life and stronger visual appeal. Asia-Pacific drives the largest volumes, while online grocery and meal-kit channels record the fastest incremental gains. Plastic-waste regulation, raw-material volatility, and the rise of alternative proteins temper margin outlooks, encouraging producers to pursue recyclable films, automation, and smart-packaging innovations.

Global Meat Packaging Market Trends and Insights

Demand for Convenience and Ready-to-Eat Meat Products

Consumer adoption of value-added meat rose from 37% to 67% between 2016 and 2022, pushing processors toward case-ready formats that minimise in-store handling while preserving colour and texture. Tyson Fresh Meats launched its Universal Case Ready Program to streamline distribution and extend shelf life via advanced barrier films. Urban shoppers, pressed for time, accept premium price points for packs enabling rapid meal preparation. Growth in fresh-prepared foods accelerates demand for high-pressure processing and modified-atmosphere systems that safeguard taste and nutrients. These dynamics reinforce sustained volume gains for the meat packaging market in both mature and emerging cities.

Expansion of Organized Retail and Cold-Chain Logistics

Convenience-store sales in China climbed to CNY 424.8 billion in 2023, up 10.8% year on year, with fresh foods steering the rise. Start-ups such as Yueshi Robot are deploying autonomous forklifts operating at -30 °C, lifting efficiency in frozen distribution nodes. Broader commercial-refrigeration investment, projected to reach USD 56.2 billion by 2035, requires packaging that resists low-temperature stress while keeping oxygen ingress minimal. Retailers also demand standardised shapes to speed shelf replenishment, steering converters toward flexible pouches and thermoformed trays adapted for high-volume lines. These trends cement organised retail as a long-run catalyst for the meat packaging market.

Adoption of Antimicrobial/Nanocomposite Films

Antimicrobial nanocomposites inhibit microbial growth directly on the meat surface, extending shelf life and lowering reliance on preservatives. Hydrogel carriers infused with natural extracts show efficacy in lowering bacterial counts while remaining food-safe. Pilot lines in North America and Europe are scaling production for commercial launch. Synergies arise when such films are paired with transparent MAP lids, offering both active protection and product visibility critical for refrigerated cases.

Other drivers and restraints analyzed in the detailed report include:

- Shelf-Life Extension and Food-Safety Regulations

- Sustainability-Led Shift to High-Barrier Mono-Materials

- Blockchain-Enabled Traceability and Tamper-Evident Formats

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Flexible plastics held 42% of the meat packaging market in 2024, propelled by conformance to irregular cuts and excellent printability. Biodegradable films, though still niche, record a 7.2% CAGR as regulators favour compostable or recyclable solutions. Metal cans and foil remain vital for premium pate and long-life products requiring sterilisation. Antimicrobial nanocomposite layers are entering flexible webs, offering active bacterial suppression alongside barrier performance. Continuous resin and coating innovation allows converters to downgrade gauge while maintaining puncture resistance, keeping flexible packs cost-competitive.

Rigid trays, often PET or PP, serve sliced products where stackability matters, but face sustainability scrutiny for their higher material mass. Foam trays are losing ground to clear mono-PET variants that ease recyclability sorting. Metal options endure in export-grade corned beef and luncheon meat thanks to superior hermetic integrity, yet their growth is limited by weight and cost. Overall, flexible solutions will keep leading the meat packaging market as brands balance sustainability with merchandising demands.

Fresh and frozen products generated 54% of the meat packaging market size in 2024, backed by supermarket demand for visually appealing, leak-proof trays and overwraps that endure multi-day shelf life. Growth remains healthy as cold-chain coverage widens in emerging economies. Ready-to-eat lines, from deli slices to shelf-stable jerky, grow at 5.5% CAGR as lifestyles favour convenience. These formats need high-oxygen and moisture barriers, microwave-safe seals, and consumer-friendly openings, spurring innovation in peelable lidding and portion control.

Processed meats enjoy steady share, though health trends shift some volume toward leaner cuts and plant alternatives. Packaging upgrades focus on resealable zippers and vacuum skin formats that highlight texture while minimising air pockets. Across categories, demand converges toward smart indicators that display spoilage risk, reinforcing differentiation in crowded cases and boosting shopper confidence in the meat packaging market.

The Meat Packaging Market Report is Segmented by Material Type (Plastic, Metal), Meat Type (Fresh and Frozen, Processed, Ready-To-Eat), Packaging Technology (Modified Atmosphere Packaging (MAP), Vacuum Skin Packaging, and More ), End-User Channel (Retail, Foodservice, Online Grocery, Meat Processors), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 34% of the meat packaging market size in 2024, underpinned by China's near-100 million-ton meat consumption and vigorous retail modernisation. Regional CAGR of 4.8% through 2030 reflects urbanisation and investment in cold-chain nodes from Beijing to Bangalore. China's online beef purchases surpassed 44% share, signalling rapid uptake of e-commerce friendly packs designed for parcel networks. Indian supermarkets multiply freezer aisles, widening the addressable base for MAP and VSP solutions. Southeast Asian convenience chains follow suit, embracing standardised pouch formats that withstand humid climates.

North America combines high per-capita meat intake with mature retail infrastructure. Growth stems from technology adoption: blockchain tracing, antimicrobial films, and automation-ready baggers. Regulatory reviews spur trials of monomaterial barrier films, especially in Canada's major chains. Europe leads in circular-economy compliance, pushing converters toward recyclable PE/PP structures and paper-fibre hybrids. Packaging firms that meet both oxygen-barrier and recyclability targets unlock preferred supplier status with EU grocers.

South America sees steady demand from Brazil's export-oriented processors that need robust packs for transoceanic shipping. High-barrier pouches, embossed vacuum bags, and strong corrugated outers are standard. Middle East & Africa exhibit uneven penetration; Gulf retailers specify premium MAP steaks, while many African markets still rely on butcher paper. Cold-chain gaps limit adoption but infrastructure investments and quick-commerce pilots point to gradual uptake. Together, these geographic dynamics foster multi-speed growth paths that expand the global meat packaging market.

- Amcor plc

- Sealed Air Corporation

- Berry Global Group Inc.

- Mondi plc

- Crown Holdings Inc.

- Coveris Management GmbH

- Winpak Ltd.

- Smurfit Kappa Group plc

- Viscofan S.A.

- Sonoco Products Company

- Huhtamaki Oyj

- DS Smith plc

- WestRock Company

- Graphic Packaging Holding Company

- Tetra Pak International S.A.

- Klockner Pentaplast GmbH

- Constantia Flexibles GmbH

- Cascades Inc.

- Innovia Films Ltd.

- LINPAC Packaging Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand for convenience and RTE meat products

- 4.2.2 Expansion of organized retail and cold-chain logistics

- 4.2.3 Shelf-life extension and food?safety regulations

- 4.2.4 Sustainability-led shift to high-barrier mono-materials

- 4.2.5 Adoption of antimicrobial / nanocomposite films (under-radar)

- 4.2.6 Blockchain-enabled traceability and tamper-evident formats (under-radar)

- 4.3 Market Restraints

- 4.3.1 Plastic-waste regulations and recyclability challenges

- 4.3.2 Volatile polymer and metal input prices

- 4.3.3 Single-use-packaging taxes and EPR fees

- 4.3.4 Growth of alternative proteins reducing red-meat demand (under-radar)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Pandemic Impact and Recovery Analysis

5 MARKET SIZE and GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Plastic

- 5.1.1.1 Flexible Pouches

- 5.1.1.1.1 Bags

- 5.1.1.1.2 Films and Wraps

- 5.1.1.1.3 Other Flexible

- 5.1.1.2 Rigid Trays and Containers

- 5.1.1.2.1 Other Rigid

- 5.1.2 Metal

- 5.1.2.1 Aluminium

- 5.1.2.2 Steel

- 5.1.2.3 Other Metals

- 5.1.1 Plastic

- 5.2 By Meat Type

- 5.2.1 Fresh and Frozen

- 5.2.2 Processed

- 5.2.3 Ready-to-Eat

- 5.3 By Packaging Technology

- 5.3.1 Modified Atmosphere Packaging (MAP)

- 5.3.2 Vacuum Skin Packaging (VSP)

- 5.3.3 Active and Intelligent Packaging

- 5.3.4 Edible and Biodegradable Films

- 5.4 By End-user Channel

- 5.4.1 Retail (Supermarkets / Hypermarkets)

- 5.4.2 Food-service / HORECA

- 5.4.3 Online Grocery and Meal-kit

- 5.4.4 Meat Processors / Packers

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Developments

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Sealed Air Corporation

- 6.4.3 Berry Global Group Inc.

- 6.4.4 Mondi plc

- 6.4.5 Crown Holdings Inc.

- 6.4.6 Coveris Management GmbH

- 6.4.7 Winpak Ltd.

- 6.4.8 Smurfit Kappa Group plc

- 6.4.9 Viscofan S.A.

- 6.4.10 Sonoco Products Company

- 6.4.11 Huhtamaki Oyj

- 6.4.12 DS Smith plc

- 6.4.13 WestRock Company

- 6.4.14 Graphic Packaging Holding Company

- 6.4.15 Tetra Pak International S.A.

- 6.4.16 Klockner Pentaplast GmbH

- 6.4.17 Constantia Flexibles GmbH

- 6.4.18 Cascades Inc.

- 6.4.19 Innovia Films Ltd.

- 6.4.20 LINPAC Packaging Ltd.

7 MARKET OPPORTUNITIES and FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment