|

市场调查报告书

商品编码

1692519

全球半导体设备-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Global Semiconductor Device - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

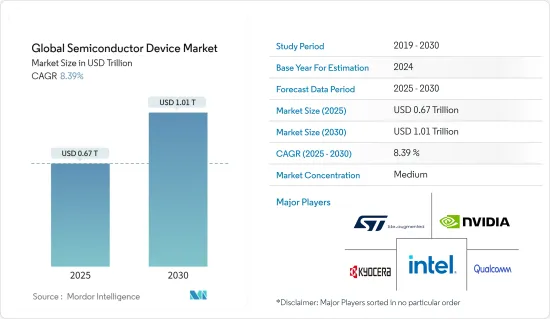

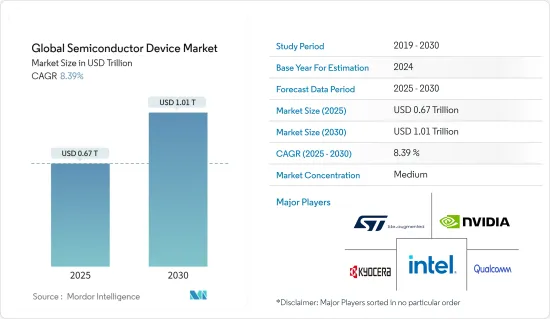

预计2025年全球半导体装置市场规模为6,700亿美元,到2030年将达到1,0100亿美元,预测期内(2025-2030年)的复合年增长率为8.39%。

从出货量来看,预计市场将从 2025 年的 8,800 亿台成长到 2030 年的 1.23 兆台,预测期间(2025-2030 年)的复合年增长率为 7.02%。

半导体装置通常透过称为半导体製造或积体电路 (IC) 製造的复杂製程来製造。该过程涉及精确操纵半导体材料以创建具有特定电气行为的组件。

半导体装置是现代电子产品的支柱,为从智慧型手机和电脑到医疗设备和可再生能源系统等所有产品提供动力。半导体装置的主要优点之一是体积小、结构紧凑。

与需要大型、笨重元件的旧真空管技术不同,半导体装置可以製造成极小的尺寸。这种小型化促进了可携式、可穿戴电子产品的发展,例如重量轻且易于携带的智慧型手机、健身追踪器和智慧型手錶。

近年来,由于人工智慧和物联网等尖端技术的日益普及,半导体装置市场发生了重大转变。这些先进技术为医疗、汽车等产业的革命性变革铺平了道路,并为半导体装置市场开闢了新的途径。

数据消费的爆炸性成长是5G的主要市场驱动力之一。随着连网型设备、智慧型手机和物联网应用的激增,人们每天都会产生大量数据。 5G的高频宽和容量将支援数据消费的激增,并为用户实现无缝连接。

此外,半导体供应链是一个复杂的网络,由设计、製造、测试和分销等相互关联的阶段组成。该过程从晶片设计开始,然后是晶圆製造、组装和测试。最后,这些晶片被供应给目标商标产品製造商(OEM),用于各种电子设备。受远端工作、电子商务和 5G 应用等趋势的推动,电子产品需求激增,超出了半导体製造商的供给能力。需求的增加给整个供应链带来压力,导致供不应求。

COVID-19 疫情爆发的一个显着后遗症是资料使用量的增加。此外,远距工作环境的兴起为增加资料产生带来了新的机会。各种资料中心供应商都在不断投资新的资料中心,以满足对资料永不满足的需求。据印度国家软体和服务公司协会(NASSCOM)称,到2025年,印度资料中心市场的投资预计将达到约46亿美元。

半导体装置市场趋势

通讯业是最大的终端用户

- 半导体在有线通讯中发挥着至关重要的作用,包括乙太网路控制器、适配器和交换器。这些半导体包括乙太网路供电 (PoE) 介面控制器和电力线收发器,对于支援网际网路协定语音 (VoIP) 至关重要。

- 在无线通讯,半导体用于微波、红外线、卫星、广播无线电和行动通讯系统,以及Wi-Fi、蓝牙和Zigbee等技术。系统晶片(SoC) 和现场可程式闸阵列 (FPGA) 设备正在推动无线通讯系统,尤其是 5G 的发展。同时,低功耗微控制器(MCU)对于增强蓝牙功能至关重要。无线感测器网路正在应用于从环境和结构监测到资产追踪等各个领域。

- 随着 5G 的加速推出,无线通讯半导体市场正在经历重大转型。根据GSMA预测,到2025年,5G行动连线预计将分别占韩国和日本总连线数的73%和68%。此外,到2030年,海湾合作委员会国家95%的行动连线将为5G,而亚洲这一比例将达到93%。 5G智慧型手机和网路的日益普及将创造新的市场机会。

- 据 5Gamericas.org 称,预计全球第五代 (5G) 用户数量将在 2023 年达到 19 亿,到 2028 年将跃升至 80 亿。与前代技术相比,5G 技术拥有更快的下载速度和更低的延迟。

中国正在经历快速成长

- 多年来,中国半导体产业迅速扩张,成为全球最大的晶片消费国之一。中国旨在透过发展强大的国内供应链来减少对半导体元件进口的依赖。

- 例如,2024年5月,中国启动了政府支持的投资基金第三期,以扩大国内半导体产业。此举凸显了中国在美国制裁下实现自给自足的决心。

- 该基金註册资本为3,440亿元人民币(475亿美元)。中国积体电路产业投资基金为中国两大晶片代工厂-中芯国际和华虹半导体以及少数几家规模较小的公司提供融资。

- 其他因素包括消费性电子产业的快速成长、政府努力推动国内製造业并减少对外国技术的依赖(这导致对半导体生产能力的投资增加)、人工智慧和物联网等新兴技术的兴起以及对电动车的需求不断增加。

- 中国蓬勃发展的通讯业也是市场的主要动力。例如,根据中国国家统计局的数据,截至2023年3月,中国通讯业累积收入约为人民币1,510亿元(207.9亿美元)。当月与前一年同期比较增长率约为4.8%。

半导体装置产业概况

半导体装置市场处于半静态状态。它随着一体化程度的提高、技术进步和地缘政治情势的变化而波动。除了代工厂和IDM之间的垂直整合不断加强之外,市场竞争也在加剧。参与企业包括英特尔公司、英伟达公司、京瓷公司、高通公司和意法半导体公司。

2024 年 3 月—亚马逊网路服务和 Nvidia 宣布扩大合作,以推动 Gen AI 创新。为了帮助客户释放先进的生成人工智慧的力量,Blackwell 将提供 NVIDIA GB200 Grace Blackwell 超级晶片和 B100 Tensor Core GPU,扩大两家公司长期的策略合作,以提供最安全、最先进的基础设施、软体和服务。

2024 年 2 月-英特尔公司宣布推出英特尔代工厂,这是一个针对 AI 时代的永续系统代工厂。该公司还公布了其扩张进程的蓝图,以巩固其在 21 世纪 20 年代的领导地位。该公司强调了强大的客户倡导和生态系统支持,其主要合作伙伴包括新思科技、Cadence、西门子和 Ansys,旨在透过先进的工具和设计流程加速英特尔代工客户的晶片设计。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 科技趋势

- 产业价值链/供应链分析

- 新冠疫情及其他宏观经济因素对市场的影响

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场动态

- 市场驱动因素

- 物联网和人工智慧等技术的采用日益增多

- 5G的普及和5G智慧型手机需求的成长

- 市场问题

- 供应链中断导致半导体晶片短缺

第六章市场区隔

- 依设备类型

- 离散半导体

- 光电子

- 感应器

- 积体电路

- 模拟

- 逻辑

- 记忆

- 微

- 微处理器(MPU)

- 微控制器(MCU)

- 数位讯号处理器

- 按行业

- 汽车

- 通讯(有线和无线)

- 消费者

- 工业的

- 计算/数据存储

- 政府(航太和国防)

- 按地区

- 美国

- 欧洲

- 日本

- 中国

- 韩国

- 台湾

- 其他的

第七章 半导体代工展望

- 铸造业务销售额及铸件製造商市场占有率

- 半导体收入 – IDM 与 Fabless

- 截至 2021 年 12 月底各晶圆厂产能

- 五大半导体公司晶圆产能及各节点产能趋势

第八章竞争格局

- 公司简介

- Intel Corporation

- Nvidia Corporation

- Kyocera Corporation

- Qualcomm Incorporated

- STMicroelectronics NV

- Micron Technology Inc.

- Advanced Micro Devices Inc.

- NXP Semiconductors NV

- Toshiba Corporation

- Texas Instruments Inc

- Analog Devices Inc.

- SK Hynix Inc.

- Samsung Electronics Co. Ltd

- Fujitsu Semiconductor Ltd

- Rohm Co. Ltd

- Infineon Technologies AG

- Renesas Electronics Corporation

- Wolfspeed Inc.

- Broadcom Inc.

- ON Semiconductor Corporation

第九章:未来市场展望

The Global Semiconductor Device Market size is estimated at USD 0.67 trillion in 2025, and is expected to reach USD 1.01 trillion by 2030, at a CAGR of 8.39% during the forecast period (2025-2030). In terms of shipment volume, the market is expected to grow from 0.88 trillion units in 2025 to 1.23 trillion units by 2030, at a CAGR of 7.02% during the forecast period (2025-2030).

Semiconductor devices are typically manufactured through a complex process called semiconductor fabrication or integrated circuit (IC) manufacturing. This process involves precise manipulation of the semiconductor material to create components with specific electrical behavior.

Semiconductor devices are the backbone of modern electronics, powering everything from smartphones & computers to medical devices and renewable energy systems. One of the primary advantages of semiconductor devices is their small size and compactness.

Unlike older vacuum tube technology, which requires large and bulky components, semiconductor devices can be manufactured in extremely small sizes. This miniaturization has allowed for the development of portable and wearable electronics that are lightweight and easy to carry, such as smartphones, fitness trackers, and smartwatches.

The semiconductor devices market has witnessed a significant transformation in recent years due to the increasing adoption of advanced technologies like AI and IoT. These advanced technologies have paved the way for revolutionary changes in various industries, ranging from healthcare to automotive, and have opened up new avenues for the semiconductor devices market.

The explosive growth of data consumption is one of the primary market drivers of 5G. With the proliferation of connected devices, smartphones, and IoT applications, people generate an enormous amount of data daily. 5G's higher bandwidth and capacity will support this surge in data consumption, enabling seamless connectivity for users.

Moreover, the semiconductor supply chain is a complex network of interconnected stages involving design, manufacturing, testing, and distribution. The process begins with chip design, followed by wafer fabrication, assembly, and testing. Finally, the chips are distributed to original equipment manufacturers (OEMs) who use them in various electronic devices. The surge in demand for electronic devices, driven by trends like remote working, e-commerce, and 5G adoption, has outpaced the supply capacity of semiconductor manufacturers. This increased demand has strained the entire supply chain, leading to shortages.

One of the significant aftereffects of the outbreak of COVID-19 is the increased usage of data. Moreover, it presented new opportunities for growing data generation due to increased remote working environments; various data center vendors consistently invest in new data centers in line with the insatiable need for data. According to the National Association of Software and Service Companies (NASSCOM), India's data center market investment is anticipated to reach approximately USD 4.6 billion in 2025.

Semiconductor Device Market Trends

Communication Industry to be the Largest End User

- Semiconductors play a pivotal role in wired communications, encompassing ethernet controllers, adapters, and switches. They feature Power over Ethernet (PoE) interface controllers, crucial for supporting Voice over Internet Protocol (VoIP), alongside powerline transceivers.

- In wireless communication, semiconductors are used in microwave, infrared, satellite, broadcast radio, mobile communications systems, Wi-Fi, and technologies such as Bluetooth and Zigbee. System-on-chip (SoC) and field-programmable gate array (FPGA) devices drive the evolution of wireless communication systems, notably 5G. Meanwhile, low-energy microcontrollers (MCUs) are pivotal in enhancing Bluetooth functionalities. Wireless sensor networks find applications in diverse fields, from environmental and structural monitoring to asset tracking.

- The market for semiconductors that power wireless communication is undergoing significant change with the increasing implementation of 5G. According to the GSMA, in 2025, the share of 5G mobile connections of total connections in South Korea and Japan are anticipated to account for 73% and 68%, respectively. Further, 95% of mobile connections will be 5G by 2030 in GCC states and 93% in Asia. The increasing adoption of 5G smartphones and networks creates new market opportunities.

- According to 5Gamericas.org, in 2023, the global count of fifth-generation (5G) subscriptions hit an estimated 1.9 billion, projected to soar to 8 billion by 2028. Compared to its predecessors, 5G technology boasts faster download speeds and significantly lower latency.

China to Witness Significant Growth

- Over the years, China's semiconductor industry has rapidly expanded and become one of the largest consumers of chips in the world. China aims to reduce its dependence on imported semiconductor components by developing a robust domestic supply chain.

- For instance, in May 2024, China established the third phase of a government-supported investment fund to expand its domestic semiconductor industry, which is the most significant phase to date. This move highlights China's determination to achieve self-sufficiency in light of US sanctions.

- The fund has a total registered capital of CNY 344 billion (USD 47.5 billion). The China Integrated Circuit Industry Investment Fund offers funding to the country's top two chip foundries, Semiconductor Manufacturing International Corporation and Hua Hong Semiconductor, and a few smaller companies.

- Moreover, the rapid growth of the consumer electronics industry, the government's efforts to promote domestic manufacturing and reduce reliance on foreign technology, which have led to increased investment in semiconductor production facilities, the rise of emerging technologies, such as artificial intelligence and internet of things, and the increasing demand for electric vehicles.

- The robust telecom industry in China is also a significant market driver. For instance, according to the National Bureau of Statistics of China, in March 2023, China generated a cumulative revenue of about CNY 151 billion (20.79 USD Billion) from its telecommunications industry. It had a year-on-year growth rate of approximately 4.8% that month.

Semiconductor Device Industry Overview

The semiconductor device market is semi-consolidated. It fluctuates with growing consolidation, technological advancement, and geopolitical scenarios. In addition to this increasing vertical integration of Foundries and IDMs, intense competition in the market studied is expected to rise, considering their ability to invest, which results from their revenues. Some players include Intel Corporation, Nvidia Corporation, Kyocera Corporation, Qualcomm Incorporated, and STMicroelectronics NV.

March 2024 - Amazon Web Services and Nvidia announced the extension of their collaboration to advance Gen AI innovation. To help customers unlock advanced generative artificial intelligence capabilities, Blackwell will offer the NVIDIA GB200 Grace Blackwell super chip and B100 Tensor core GPUs, which will extend the long-standing strategic collaboration between the two companies to deliver the most secure and advanced infrastructure, software, and services.

February 2024 - Intel Corporation unveiled Intel Foundry, a sustainable systems foundry tailored for the AI era. They also revealed an extended process roadmap to solidify their leadership well into the 2020s. The company emphasized strong customer backing and ecosystem support, with key partners like Synopsys, Cadence, Siemens, and Ansys, all geared to expedite chip design for Intel Foundry's clientele through advanced tools and design flows.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technological Trends

- 4.3 Industry Value Chain/Supply Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Technologies like IoT and AI

- 5.1.2 Increased Deployment of 5G and Rising Demand for 5G Smartphones

- 5.2 Market Challenges

- 5.2.1 Supply Chain Disruptions Resulting in Semiconductor Chip Shortage

6 MARKET SEGMENTATION

- 6.1 By Device Type

- 6.1.1 Discrete Semiconductors

- 6.1.2 Optoelectronics

- 6.1.3 Sensors

- 6.1.4 Integrated Circuits

- 6.1.4.1 Analog

- 6.1.4.2 Logic

- 6.1.4.3 Memory

- 6.1.4.4 Micro

- 6.1.4.4.1 Microprocessors (MPU)

- 6.1.4.4.2 Microcontrollers (MCU)

- 6.1.4.4.3 Digital Signal Processors

- 6.2 By End-user Vertical

- 6.2.1 Automotive

- 6.2.2 Communication (Wired and Wireless)

- 6.2.3 Consumer

- 6.2.4 Industrial

- 6.2.5 Computing/Data Storage

- 6.2.6 Government (Aerospace and Defense)

- 6.3 By Geography

- 6.3.1 United States

- 6.3.2 Europe

- 6.3.3 Japan

- 6.3.4 China

- 6.3.5 Korea

- 6.3.6 Taiwan

- 6.3.7 Rest of the World

7 SEMICONDUCTOR FOUNDRY LANDSCAPE

- 7.1 Foundry Business Revenue and Market Shares by Foundries

- 7.2 Semiconductor Sales - IDM vs Fabless

- 7.3 Wafer Capacity By End of December 2021 Based on Fab Location

- 7.4 Wafer Capacity By Top 5 Semiconductor Companies and an Indication of Wafer Capacity by Node Technology

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Intel Corporation

- 8.1.2 Nvidia Corporation

- 8.1.3 Kyocera Corporation

- 8.1.4 Qualcomm Incorporated

- 8.1.5 STMicroelectronics NV

- 8.1.6 Micron Technology Inc.

- 8.1.7 Advanced Micro Devices Inc.

- 8.1.8 NXP Semiconductors NV

- 8.1.9 Toshiba Corporation

- 8.1.10 Texas Instruments Inc

- 8.1.11 Analog Devices Inc.

- 8.1.12 SK Hynix Inc.

- 8.1.13 Samsung Electronics Co. Ltd

- 8.1.14 Fujitsu Semiconductor Ltd

- 8.1.15 Rohm Co. Ltd

- 8.1.16 Infineon Technologies AG

- 8.1.17 Renesas Electronics Corporation

- 8.1.18 Wolfspeed Inc.

- 8.1.19 Broadcom Inc.

- 8.1.20 ON Semiconductor Corporation