|

市场调查报告书

商品编码

1687119

铟镓氧化锌:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Indium Gallium Zinc Oxide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

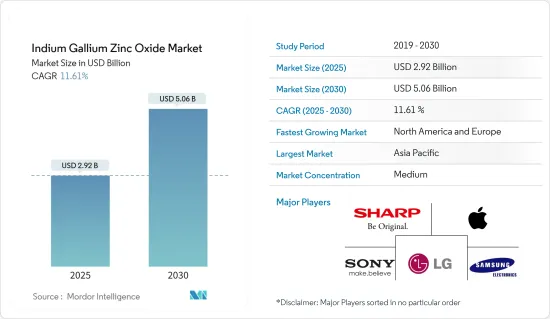

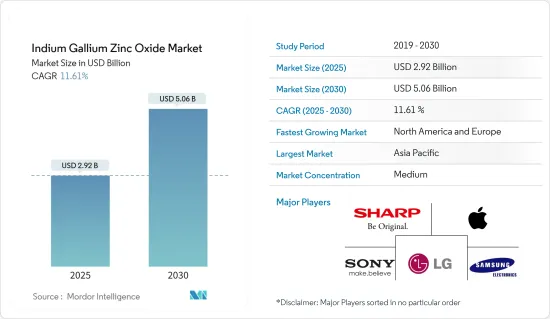

预计 2025 年铟镓氧化锌市场规模为 29.2 亿美元,到 2030 年将达到 50.6 亿美元,预测期间(2025-2030 年)的复合年增长率为 11.61%。

主要亮点

- 由于铟镓锌氧化材料 (IGZO) 比传统硅基材料具有更优异的性能,电子产业越来越多地采用它。 IGZO 主要用于 LCD 和 OLED 显示器的薄膜电晶体 (TFT)。 IGZO 的高电子迁移率可实现更快的切换速度和更高的分辨率,使其成为高清电视、智慧型手机和平板装置的首选材料。对先进显示器的需求不断增长是 IGZO 市场发展的主要驱动力。

- IGZO 的一大独特优势是它能够以低功耗实现高效能,这对于电池寿命至关重要的便携式电子设备来说极为重要。透过降低功耗,IGZO 显着延长了电池寿命,为製造商和消费者提供了引人注目的价值提案。此外,IGZO的透明度和灵活性使其成为折迭式和旋转性萤幕等新型显示类型的理想选择,使其在市场上越来越受欢迎。

- 此外,小型化趋势和对更高效电子元件的需求正在塑造 IGZO 市场。 IGZO的高电子迁移率使得能够製造更小、更有效率的电晶体,从而促进开发更智慧、更轻的电子产品以满足消费者的偏好。此外,随着物联网设备变得越来越普遍并且需要更有效率、更紧凑的组件,对 IGZO 材料的需求预计将会成长。

- IGZO市场面临生产成本高、需要先进製造流程等挑战,但正在进行的研究和开发重点是提高效率和降低成本。此外,来自低温多晶硅(LTPS)和有机半导体等替代品的竞争也是一个问题。然而,IGZO 的独特特性和不断扩大的应用范围使其成为显示器和电子产品发展的关键材料。在技术进步和不断增长的消费者需求的推动下,IGZO 市场预计将持续成长。

铟镓氧化锌市场趋势

穿戴式装置市场占有率将大幅增加

- 铟镓锌氧化 (IGZO) 因其独特的性能满足现代可穿戴技术的严格要求,正在成为穿戴式装置市场的关键组成部分。 IGZO 的高电子迁移率和低功耗对于开发高解析度、节能显示器至关重要,对于智慧型手錶、健身追踪器和 AR 眼镜等设备至关重要。随着这些设备的进步和对性能的要求越来越高,IGZO 在其发展中变得越来越重要。

- IGZO 能够支援高解析度显示,同时保持低功耗,这是穿戴式装置的关键优势。鑑于穿戴式装置的电池容量有限,提高能源效率可显着延长电池寿命。 IGZO 电晶体运转时耗电量极小,可节省电池寿命,同时不影响显示品质。对于希望实现高效能穿戴装置且每次充电可使用较长时间的製造商而言,IGZO 是一个相当吸引人的选择。

- 除了电源效率之外,IGZO 的灵活性和透明度也为穿戴式装置带来了显着的优势。穿戴式装置需要轻巧、耐用且足够灵活,以适应各种形状和尺寸。 IGZO 的灵活性使得可以创建可弯曲和折迭的显示器,从而增强用户体验并为穿戴式技术开闢了新的设计可能性。此外,它的透明度可以用来开发创新的显示解决方案,例如用于 AR 眼镜的透明萤幕,提供无缝且身临其境的使用者体验。

- 消费者对先进穿戴技术的需求不断增长,推动了 IGZO 市场的发展。随着消费者要求穿戴式装置具有更多功能和更好性能,製造商越来越多地采用 IGZO 来满足这些期望。更高解析度的显示器、更灵敏的触控萤幕和更长的电池寿命等功能正在成为穿戴式装置的标准,而 IGZO 的特性对于实现这些增强功能至关重要。此外,将健康监测、健身追踪和连接选项整合到穿戴式装置中将进一步需要使用像 IGZO 这样的高效能、高性能材料。

- 物联网 (IoT) 的普及以及医疗保健、健身和娱乐等各行业中穿戴式装置的日益普及,预计将推动对 IGZO 的需求。根据国际数据公司 (IDC) 的《印度月度穿戴装置追踪报告》,印度穿戴式装置市场预计将在 2023 年成长 34%,达到创纪录的 1.342 亿台。 2023年第四季(10-12月),销量较去年同期成长12.7%至2,840万台。

- 穿戴式装置不仅用于个人健康管理,也用于医疗监测和工业用途等专业应用。 IGZO 支援先进显示技术和低功耗操作的能力使其成为下一代穿戴式装置开发的重要元素。随着这一趋势的持续,穿戴式装置预计将占据 IGZO 市场的巨大份额,从而推动行业创新和成长。

亚太地区将成为成长最快的市场

- 以中国、日本和韩国等国家为主导的亚太地区可能会主导铟镓锌氧化 (IGZO) 市场。这些国家拥有强大的电子製造业,并以快速的技术进步而闻名。尤其是,它是世界上一些最大的消费性电子产品和显示面板生产商的所在地。凭藉强大的工业基础和对研发 (R&D) 的投入,这些国家成为全球 IGZO 领域的重要参与者。Sharp Corporation、LG 和三星等产业巨头正在大力投资 IGZO 技术,以完善产品系列确保竞争优势。

- 中国拥有庞大的电子製造业,成为亚太地区 IGZO 市场的主要企业。中国致力于推动显示技术的发展,并大规模投资于IGZO生产设施。中国製造商越来越多地转向 IGZO,因为他们认识到其在薄膜电晶体 (TFT) 中的卓越性能,而薄膜电晶体 (TFT) 对于高画质电视、智慧型手机和其他消费性电子产品至关重要。如此广泛的采用可能会进一步巩固中国在 IGZO 市场的主导地位。

- 日本以其技术力实力而闻名,是亚太地区 IGZO 市场的主要贡献者。值得注意的是,Sharp Corporation等公司一直处于 IGZO 技术的前沿,为高效能、节能显示器树立了标竿。日本注重研发,加上其生产顶级电子元件的声誉,使其牢牢确立了其作为 IGZO 市场领导者的地位,推动了国内和全球的需求。

- 韩国是三星和 LG 等科技巨头的所在地,也是 IGZO 市场的另一个主要参与者。这些公司处于显示技术的前沿,将IGZO融入其尖端产品中。三星的折迭式和可捲曲显示器的突破,以及 LG 的 OLED 创新,充分利用了 IGZO 的高电子迁移率和能源效率等特性。韩国对技术创新和严格製造标准的承诺进一步巩固了其在 IGZO 市场的关键地位。

- 积极的政府政策巩固了IGZO在亚太地区的主导地位。中国、日本和韩国等国家正透过研发资金、基础建设和技术采用补贴等方式积极支持其电子产业。这些倡议不仅刺激了本地製造商对 IGZO 的投资,也鼓励了其在各种应用中的应用。因此,亚太地区不仅成为IGZO的主要生产地,也成为重要的消费地,巩固了其全球市场占有率。

铟镓氧化锌产业概况

受使用铟镓氧化锌的新技术创新的推动,铟镓氧化锌市场呈现中度分散。随着企业努力开发先进的应用并提高产品性能,这项技术创新正在加剧市场竞争。主要参与者正致力于研究和开发,以提高铟镓氧化锌在显示面板、太阳能电池和感测器等各种应用中的效率和功能。此外,随着企业寻求加强其市场地位和扩大产品系列,策略联盟和合作变得越来越普遍。

- 2024 年 4 月,LTPO(低温多晶氧化物)背板技术领先的苹果进一步创新,采用 IGZO(铟镓锌氧化物)来驱动薄膜电晶体(TFT)。此策略改进旨在提高 LTPO 显示器的效率,LTPO 显示器的特点是节能和可变更新率。

- 2024 年 3 月,优派继推出 XG272-2K-OLED 之后,又推出了最新游戏显示器 VX2781-4K-PRO-6。 XG272-2K-OLED 具有 2.5K 解析度和 240Hz 的有机发光二极体面板。 ViewSonic 声称 VX2781-4K-PRO-6 是世界上第一款采用 IGZO(铟镓锌氧化)和 IPS 面板的 27 吋 4K 显示器的创新产品,可提供 165Hz 的更新率。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

- 研究框架

- 二次调查

- 主要研究方法及主要受访者

- 资料三角测量与洞察生成

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 技术简介

- 市场驱动因素

- 高解析度技术的进步

- 重视节能技术

- 市场限制

- 低温多晶(LTPS) 等竞争对手

- COVID-19 产业影响评估

第五章 市场区隔

- 按应用

- 智慧型手机

- 穿戴式装置

- 壁挂式展示架

- 电视机

- 平板电脑、笔记本、笔记型电脑

- 其他用途

- 按最终用户

- 车

- 家电

- 卫生保健

- 产业

- 其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第六章 竞争格局

- 公司简介

- Sharp Corporation

- Apple Inc.

- Sony Corporation

- ASUSTEK Computer Inc.

- LG Electronics

- AU Optronics

- Samsung Electronics Co. Ltd

- Fujitsu Limited

第七章 投资分析及未来趋势

- 投资分析

- 市场的未来

The Indium Gallium Zinc Oxide Market size is estimated at USD 2.92 billion in 2025, and is expected to reach USD 5.06 billion by 2030, at a CAGR of 11.61% during the forecast period (2025-2030).

Key Highlights

- The electronics industry is increasingly adopting indium gallium zinc oxide (IGZO) over traditional silicon-based materials, driven by its superior performance. IGZO is primarily utilized in thin-film transistors (TFTs) for LCD and OLED displays. With its high electron mobility, IGZO enables faster switching speeds and higher resolutions, making it a preferred choice for HD TVs, smartphones, and tablets. The rising demand for advanced displays is a key driver for the IGZO market.

- One notable advantage of IGZO is its ability to deliver high performance at lower power consumption, which is crucial for portable electronics where battery life is critical. By reducing power usage, IGZO displays a significantly extended battery life, presenting a compelling value proposition for both manufacturers and consumers. Additionally, IGZO's transparency and flexibility are ideal for emerging display types like foldable and rollable screens, which are gaining traction in the market.

- Moreover, the trend toward miniaturization and the need for more efficient electronic components are shaping the IGZO market. Thanks to its high electron mobility, IGZO enables the creation of smaller, more efficient transistors, facilitating the development of sleeker and lighter electronic devices, aligning with consumer preferences. Furthermore, as the adoption of IoT devices increases, demanding efficient and compact components, the demand for IGZO materials is expected to rise.

- While the IGZO market faces challenges such as high production costs and the need for sophisticated manufacturing processes, ongoing R&D efforts are focused on enhancing efficiency and reducing costs. Additionally, competition from alternatives like low-temperature polysilicon (LTPS) and organic semiconductors poses a challenge. However, given its unique properties and expanding applications, IGZO is solidifying its role as a pivotal material in the evolution of displays and electronic devices. With technological advancements and rising consumer demand, the IGZO market is poised for sustained growth.

Indium Gallium Zinc Oxide Market Trends

Wearable Devices to Gain a Significant Market Share

- Indium gallium zinc oxide (IGZO) is emerging as a critical component in the wearable devices market, driven by its unique properties that meet the stringent requirements of contemporary wearable technology. IGZO's high electron mobility and low power consumption make it indispensable for developing high-resolution, energy-efficient displays that are essential for devices such as smartwatches, fitness trackers, and AR glasses. As these devices advance and demand higher performance, IGZO's significance in their development becomes increasingly crucial.

- IGZO's ability to support high-resolution displays while maintaining low power consumption is a key advantage for wearable devices. Given the limited battery capacity of wearables, improvements in energy efficiency can significantly extend battery life. IGZO transistors operate with minimal power, conserving battery life without compromising display quality. This makes IGZO an attractive option for manufacturers aiming to deliver high-performance wearables with longer operational periods between charges.

- In addition to power efficiency, IGZO's flexibility and transparency offer substantial benefits for wearable devices. Wearables need to be lightweight, durable, and often flexible to conform to various shapes and sizes. IGZO's flexibility allows for the creation of bendable and foldable displays, enhancing user experience and opening new design possibilities for wearable technology. Moreover, its transparency can be utilized in developing innovative display solutions, such as transparent screens in AR glasses, providing a seamless and immersive user experience.

- Increasing consumer demand for advanced wearable technology is driving the IGZO market. As consumers seek more functionality and better performance from their wearable devices, manufacturers are increasingly adopting IGZO to meet these expectations. Features such as high-definition displays, responsive touchscreens, and extended battery life are becoming standard in wearables, with IGZO's properties being crucial in achieving these enhancements. Additionally, the integration of health monitoring, fitness tracking, and connectivity options in wearables further necessitates the use of efficient and high-performing materials like IGZO.

- The proliferation of the Internet of Things (IoT) and the growing adoption of wearables across various industries, including healthcare, fitness, and entertainment, are expected to boost demand for IGZOs. International Data Corporation's (IDC) India Monthly Wearable Device Tracker reported that the Indian wearable market experienced a 34% growth in 2023, reaching a record 134.2 million units. In the fourth quarter of 2023 (October-December), the market recorded 28.4 million units, reflecting a 12.7% Y-o-Y increase.

- Wearable devices are not only used for personal health tracking but also for professional applications in medical monitoring and industrial use. IGZO's capability to support advanced display technologies and low-power operations makes it a vital component in developing the next generation of wearables. As this trend continues, wearable devices are set to capture a significant share of the IGZO market, driving innovation and growth in the industry.

Asia-Pacific to Witness the Fastest Market Growth

- The Asia-Pacific regional segment, led by countries such as China, Japan, and South Korea, is poised to dominate the indium gallium zinc oxide (IGZO) market. These nations boast robust electronic manufacturing industries and are renowned for their rapid technological advancements. Notably, they house some of the world's largest producers of consumer electronics and display panels. With strong industrial bases and a keen focus on research and development (R&D), these countries are pivotal players in the global IGZO landscape. Major industry players like Sharp, LG, and Samsung are channeling significant investments into IGZO technology to elevate their product portfolios and secure a competitive advantage.

- With its mammoth electronics manufacturing industry, China stands out as a key player in the Asia-Pacific IGZO market. The nation's commitment to advancing display technology has translated into substantial investments in IGZO production facilities. Chinese manufacturers increasingly turn to IGZO, recognizing its superior performance in thin-film transistors (TFTs) - crucial components in high-definition televisions, smartphones, and other consumer electronics. This widespread adoption is poised to further solidify China's dominance in the IGZO market.

- Japan, renowned for its technological prowess, is a significant contributor to the Asia-Pacific IGZO market. Notably, companies like Sharp have been at the forefront of IGZO technology, setting benchmarks for high-performance, energy-efficient displays. Japan's emphasis on R&D, coupled with its reputation for producing top-tier electronic components, cements its position as an IGZO market leader, driving both local and global demand.

- South Korea, home to tech giants like Samsung and LG, is another linchpin in the IGZO market. These companies are at the vanguard of display technology, integrating IGZO into their cutting-edge products. Samsung's strides in foldable and rollable displays, alongside LG's OLED innovations, heavily leverage IGZO's attributes, such as high electron mobility and energy efficiency. South Korea's commitment to innovation and stringent manufacturing standards further solidify its significant role in the IGZO market.

- The Asia-Pacific's IGZO dominance is bolstered by proactive government policies. Nations like China, Japan, and South Korea are actively supporting the electronics industry through R&D funding, infrastructure development, and technology adoption incentives. These initiatives not only spur local manufacturers to invest in IGZO but also drive its adoption across diverse applications. Consequently, the Asia-Pacific regional segment emerges not just as a major IGZO producer but also as a substantial consumer, underlining its global market share.

Indium Gallium Zinc Oxide Industry Overview

The indium gallium zinc oxide market exhibits moderate fragmentation, driven by players innovating with new technologies using indium gallium zinc oxide. This innovation is intensifying market competition as companies strive to develop advanced applications and improve product performance. Key players are focusing on research and development to enhance the efficiency and functionality of indium gallium zinc oxide in various applications, including display panels, solar cells, and sensors. Additionally, strategic partnerships and collaborations are becoming common as companies aim to strengthen their market position and expand their product portfolios.

- In April 2024, Apple, a leader in LTPO (low-temperature polycrystalline oxide) backplane technology, further innovated by incorporating IGZO (indium gallium zinc oxide) into driving thin-film transistors (TFTs). This strategic enhancement aims to improve the efficiency of LTPO displays, which are distinguished by their energy-saving features and variable refresh rates.

- In March 2024, ViewSonic launched its latest gaming monitor, the VX2781-4K-PRO-6, following the introduction of the XG272-2K-OLED. The XG272-2K-OLED features a 2.5K resolution and a 240 Hz OLED panel. ViewSonic claimed the VX2781-4K-PRO-6 to be a world-first innovation with its 27-inch, 4K display utilizing an IGZO (indium gallium zinc oxide) and IPS panel, offering a 165 Hz refresh rate.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research Approach and Key Respondents

- 2.4 Data Triangulation and Insight Generation

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Market Drivers

- 4.4.1 Advancements in High Resolution Technologies

- 4.4.2 Emphasis on Energy-saving Technology

- 4.5 Market Restraints

- 4.5.1 Competitors, Such as Low-temperature Polycrystalline Silicon (LTPS)

- 4.6 Assessment of the Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Smartphones

- 5.1.2 Wearable Devices

- 5.1.3 Wall-mounted Displays

- 5.1.4 Televisions

- 5.1.5 Tablets, Notebooks, and Laptops

- 5.1.6 Other Appplications

- 5.2 By End User

- 5.2.1 Automotive

- 5.2.2 Consumer Electronics

- 5.2.3 Healthcare

- 5.2.4 Industrial

- 5.2.5 Other End Users

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Sharp Corporation

- 6.1.2 Apple Inc.

- 6.1.3 Sony Corporation

- 6.1.4 ASUSTEK Computer Inc.

- 6.1.5 LG Electronics

- 6.1.6 AU Optronics

- 6.1.7 Samsung Electronics Co. Ltd

- 6.1.8 Fujitsu Limited

7 INVESTMENT ANALYSIS AND FUTURE TRENDS

- 7.1 Investment Analysis

- 7.2 Future of the Market