|

市场调查报告书

商品编码

1549834

全球微显示器市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Microdisplay - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

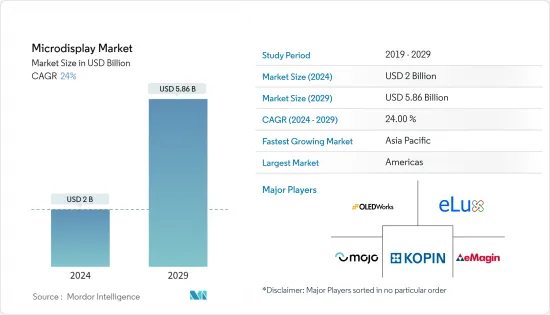

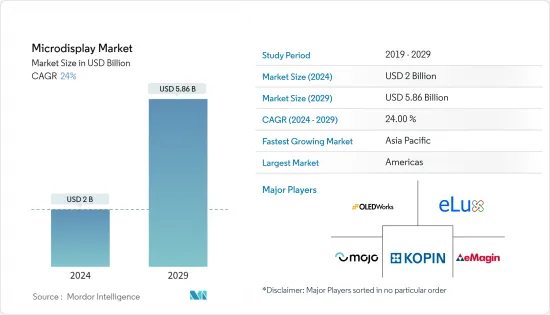

预计 2024 年全球微显示器市场规模将达到 20 亿美元,到 2029 年预计将达到 58.6 亿美元,在预测期内(2024-2029 年)复合年增长率为 24%。

主要亮点

- 现代设备正迅速变得更小、更便携、更方便,并用于显示图形和图像资讯。这些设备必须结构紧凑、易于理解,并具有高解析度显示器。随着越来越多的人考虑在多个领域使用 EVF 和投影仪,微显示器市场正在显着成长。鑑于未来几年对 AR 智慧眼镜的需求将会增加,微显示器具有巨大的成长潜力。

- 微显示器正在被纳入 ADAS(高级驾驶辅助系统)和自动驾驶汽车中,为驾驶员和乘客提供重要信息,从而促进市场成长。我们的研发工作重点是製造灵活的可折迭微型显示器,为各种移动和穿戴式装置提供新的外形规格。

- 大多数 HMD 系统都使用 LCD 微型显示器。准直光学元件可以是放大镜、接目镜或投影透镜。具有高影像性能的小型轻量系统始终是 HMD 系统的首选。科技和沈浸式体验的技术发展急剧增加了对头戴式显示器的需求,尤其是在游戏和娱乐领域。同时,医疗保健、国防和教育领域的健康监测设备越来越多地采用 HMD,推动了微显示器市场的成长。

- 微显示器的製造成本可能很高,尤其是那些具有高解析度和高亮度等先进功能的微显示器。这可能会减少采用率,尤其是在成本敏感的消费性电子应用中。微型显示器需要复杂的半导体製造工艺,并且需要专门的设备和合格的人员。这可能会导致生产延迟和成本增加,从而阻碍市场成长。

- 儘管微显示器多年来取得了长足的进步,但仍存在一些技术挑战和其他宏观经济因素,阻碍了它们在许多具有挑战性的应用中的广泛采用,例如虚拟实境头戴式显示器。微显示器製造商面临的关键挑战预计是开发一个以紧凑的外形规格提供宽视角和高解析度的大型产品系列。

微显示市场趋势

消费性电子和汽车应用显着成长

- 由于消费性电子产品的小型化、穿戴式显示器的普及、ADAS在汽车领域的使用不断增加,特别是HUD整合到汽车中,消费性电子和汽车产业预计将显着成长。

- 据SIAM India预计,2023年,印度汽车产量将比上年度增加约2,593万辆。由于尺寸小、解析度高,微显示器作为扩增实境(AR) 和虚拟实境 (虚拟 Reality) 装置的主要显示器驱动器而受到关注。 AR/ VR头戴装置中也使用了各种微显示器,包括有机发光二极体(OLED)和液晶显示器(LCD)。

- 微显示技术通常被认为适合扩增实境和虚拟实境应用。扩增实境应用程式使用微显示技术为使用者周围环境添加讯息,例如眼镜上的地图显示、锻炼期间的心率或赛道上的左转讯号。另一方面,虚拟实境应用程式由自足式的单元组成,这些单元在观看装置中创建自主的现实。这种娱乐应用程式受到影像和游戏产业的青睐。

- 例如,2024 年 5 月,微固印供应商 Beaureal 宣布推出其先进的 ColourFusion microDisplay,这是一款最先进的扩增实境(AR) 萤幕,为视觉清晰度和色彩准确性设定了新标准。本发明适用于家用电器和汽车领域。

- 此外,三星电子于 2023 年 12 月将所有 OLED 微显示器计划转移给三星显示部门。同时,三星半导体(SSI)和三星化合物半导体解决方案团队将管理所有micro-LED微显示器计划的开发。此领域主要用于需要更先进显示的AR眼镜。

- 此外,主要市场公司正在筹集投资,利用先进的微显示器来开发 AR/VR 领域的创新产品。例如,2023年8月,SONY解决方案半导体公司宣布主要发表ECX344A,这是最大、最高解析度的4K解析度1.3吋OLED微显示器。这款新型有机发光二极体微显示器主要针对使用头戴式显示器的 VR(虚拟实境)和 AR(扩增实境)应用而设计。透过采用 SSS 透过开发相机电子观景器(EVF) 和像素驱动电路而培育的小型化工艺,在 1.3 吋大显示器上实现了 4K 解析度。

预计亚太地区将出现显着成长

- 亚太地区由许多新兴国家和已开发国家组成,预计将为该地区市场的成长做出贡献。在中国,汽车、电子和医疗保健等各行业都呈现强劲成长,推动了对微显示器的需求。中国、日本、韩国和印度的电子和国防工业蓬勃发展,为亚太地区的市场成长做出了贡献。

- 这些国家最大的消费群体对智慧型手机、相机、投影机、智慧型穿戴装置和远端控制解决方案等电子设备更感兴趣。亚太地区微显示器市场受到快速转型的汽车製造业的推动。关于 HUD 技术在汽车中的使用,该领域发生了模式转移。在亚太地区,这些变化预计将导致微型显示器的采用。

- 印度正在透过「印度製造」和「数位印度」等政府措施促进工业和技术的采用。这为微显示器製造商和供应商提供了市场机会。 AR和VR技术在游戏、教育、医疗保健和培训中的采用正变得越来越普遍,而微显示器与这些应用的整合将推动市场成长。

- 此外,2024年4月,高品质微显示器开发商Kopin公司赢得了第三份有机发光二极体(OLED)微显示器生产订单。这些微型显示器旨在用于印度军方的热成像系统。订单包括 1,200 多个单位,预计将在未来六个月内交货。该公司生产的OLED微型显示器以尺寸小、节能而闻名,非常适合电池供电的可携式红外线热感成像设备。

- 此外,LG电子、三星和SONY集团等主要市场参与者在该地区占有重要份额。全球三大显示面板製造商三星显示器公司、LG显示器公司和索尼公司正在加紧努力,以在快速增长的虚拟现实设备小型有机发光二极体屏幕市场中占据主导地位。

微显示行业概况

微显示市场竞争激烈、集中度高,企业规模不一。所有主要企业都占有重要的市场占有率,并致力于扩大其全球消费群。该市场的主要参与者包括 OLEDWorks、eLux Inc.、Mojo Vision Inc.、Kopin Corporation 和 eMagin。为了在预测期内获得竞争优势,多家公司正在透过结盟、合作、收购和推出创新新产品来扩大市场占有率。

- 2024 年 3 月:总部位于罗彻斯特的 OLEDWorks LLC 获得美国政府授予的 OTA(其他交易协议),价值约 860 万美元。美国正在监督民用和国防用途的先进 OLED 微型显示器的开发和增强。这些微型显示器旨在用于扩增实境和虚拟实境领域的头戴式显示器。

- 2024 年 1 月:Kopin Corporation 和 Micledi Microdisplays 共同开发用于下一代视觉解决方案的先进 micro-LED 显示器。此次合作旨在设计、开发和製造适用于高亮度光照条件的 micro-LED 显示器,并提供更身临其境、资讯丰富的 AR 体验。透过结合 MICLEDI 的 Micro-LED 技术和 Kopin 的先进背板设计专业知识,我们的目标是开发 Micro-LED 显示器,以应对新应用的困难挑战,同时解决现有技术的限制。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术简介

- COVID-19 和其他宏观经济因素对市场的影响

第五章市场动态

- 市场驱动因素

- 微显示器在消费性电子产品和 AR/VR 应用的采用增加

- 各行业对头戴式设备的需求增加

- 市场限制因素

- 微显示器的製造成本高

第六章 市场细分

- 依技术类型

- 传统(LCoS、LCD、DLP)

- OLED-on-Si

- 微型LED

- 按用途

- 家电/汽车

- 扩增实境/虚拟实境耳机

- 汽车抬头显示器

- 传统应用(投影/摄影机等)

- 防御

- 其他的

- 家电/汽车

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 中东/非洲

- 拉丁美洲

第七章 竞争格局

- 公司简介

- OLEDWorks

- eLux Inc.

- Mojo Vision Inc.

- Kopin Corporation

- eMagin

- LG Electronics

- JBD(Jade Bird Display)

- Sony Semiconductor Solutions Corporation

- Seiko Epson Corporation

- Himax Technologies Inc.

第八章投资分析

第9章市场的未来

The Microdisplay Market size is estimated at USD 2 billion in 2024, and is expected to reach USD 5.86 billion by 2029, growing at a CAGR of 24% during the forecast period (2024-2029).

Key Highlights

- Modern devices are rapidly becoming compact, portable, and convenient and are used to present graphical and pictorial information. These devices must be compact and straightforward with a high-resolution display. The market for microdisplays is growing significantly as more people consider using EVFs or projectors in several sectors. Given that demand for AR smart glasses is set to increase over the next few years, microdisplays have vital growth potential.

- Microdisplays contribute to market growth for drivers and passengers by providing critical information when integrated into ADAS (advanced driver assistance systems) or autonomous vehicles. Research and development efforts are focused on manufacturing flexible and foldable microdisplays that will allow new form factors for a wide range of mobile devices and wearables.

- Most HMD systems use LCD microdisplays because they have excellent image quality and a small form factor. Magnifiers, eyepieces, or projection lenses may be used for collimating optics. A compact and light system with high image performance is always preferred for HMD systems. Technological developments in technology and immersive experiences have led to a surge in demand for head-mounted displays, especially in the gaming and entertainment sectors. Concurrently, market growth for microdisplays is driven by the increasing adoption of HMDs in health monitoring devices in healthcare, defense, and education.

- The cost of producing microdisplays can be considerable, particularly for those with advanced features such as large resolution and brightness. This may lead to reduced adoption, particularly in cost-sensitive consumer electronics applications. Microdisplays have complex production processes for the manufacture of semiconductors, requiring specialized facilities and qualified personnel. As a result, production delays and higher costs can occur, thus hindering the market's growth.

- While there have been substantial advances in microdisplays over the years, macroeconomic factors, such as several engineering issues, still exist, which prevent them from being broadly adopted for numerous challenging applications, including virtual reality head-mounted displays. The critical challenge for microdisplay manufacturers is expected to be the development of many collections that are compact in form factor and achieve a wide field of view and high resolution.

Microdisplay Market Trends

Consumer and Automotive Application to Witness Significant Growth

- The consumer electronics and automotive industry is anticipated to experience notable growth due to miniaturization in consumer electronics, the rising popularity of wearable displays, and the increasing use of ADAS in the automotive sector, particularly with HUD integration in vehicles.

- According to SIAM India, in the fiscal year 2023, India witnessed a rise in the total vehicle production volume to approximately 25.93 million units compared to the previous year. Microdisplays have attracted much attention because of their tiny size and large resolution as the primary display drivers for Augmented Reality and Virtual Reality devices. Various microdisplays, including the organic light-emitting diode (OLED) and liquid crystal display (LCD), are also used for AR/VR headsets.

- Microdisplay technologies are generally considered appropriate for Augmented Reality and Virtual Reality applications. Augmented Reality applications use microdisplay technology to add information to the user's surroundings, such as a map display in a person's glasses, a heartbeat during exercise, or a left turn signal on a racing course. Virtual Reality applications, on the other hand, consist of self-contained units that create an autonomous reality called reality within a visual apparatus. The video and gaming industries fondly use this entertainment application.

- For instance, in May 2024, VueReal, a provider of MicroSolid Printing, announced the introduction of its advanced ColourFusion microDisplay, the latest augmented reality (AR) screen that establishes a fresh benchmark in visual sharpness and color accuracy. This invention applies to both consumer electronics and automotive sectors.

- Moreover, in December 2023, Samsung Electronics assigned all OLED microdisplay projects to the Samsung Display division. At the same time, Samsung Semiconductor Inc. (SSI) and the Samsung Compound Semiconductor Solutions team will be managing the development of all Micro LED microdisplay projects. This area is mainly used in AR glasses with more advanced display needs.

- Moreover, major market players are raising investments to develop innovative products in the AR/VR segment by utilizing advanced microdisplays. For instance, in August 2023, Sony Solutions Semiconductor Corporation announced a major release of its ECX344A, the largest and highest definition 1.3-inch OLED microdisplay with 4K resolution. The new OLED microdisplays are primarily designed for virtual reality (VR) and augmented reality (AR) applications that use head-mounted displays. They deliver 4K resolution with a 1.3-type large-size display by employing miniaturization processes that SSS has achieved while developing camera electronic viewfinders (EVFs) and pixel drive circuits.

Asia-Pacific is Expected to Grow Significantly

- Asia-Pacific comprises many developing and developed countries, which are expected to contribute to the regional market's growth. In China, different industries have shown strong growth that has given rise to the demand for microdisplays, e.g., automobiles, electronics, and healthcare. In China, Japan, South Korea, and India, the flourishing electronics industry and defense sector have been responsible for market growth in Asia-Pacific.

- The largest consumer segment in these countries is more interested in electronic devices such as smartphones, cameras, projectors, smart wearables, and remotely controlled solutions. The Asia-Pacific market for microdisplays has grown because of its fast-transforming automotive production sector. A paradigm shift has occurred within this sector regarding using HUD technologies in automobiles. In the APAC region, these changes are expected to lead to the adoption of microdisplays.

- India is driving industrial and technological adoption with its government's initiatives, such as Make in India and Digital India. This will provide a market opportunity for microdisplay producers and suppliers. Adopting AR or VR technologies for gaming, education, health care, and training is becoming more common to stimulate market growth where microdisplays are integrated into these applications.

- Furthermore, in April 2024, Kopin Corporation, a company that develops high-quality microdisplays, received its third order for producing organic light-emitting diode (OLED) microdisplays. These microdisplays are intended for use in thermal imaging systems for the Indian Armed Forces. The order includes more than 1,200 units and is expected to be delivered within the next six months. The OLED microdisplays produced by the company are known for being small in size and using energy efficiently, making the microdisplays ideal for portable thermal imaging devices that run on batteries.

- Moreover, key market players like LG Electronics, Samsung, and Sony Group have significant market shares in the region. The three world's largest display panel manufacturers, Samsung Display Company, LG Display Co., and Sony Corp., are accelerating efforts to take a leading position in the rapidly growing small organic light emitting diode screen market for virtual reality devices.

Microdisplay Industry Overview

The microdisplay market is very competitive and highly concentrated due to various large and small players. All the major players account for a significant market share and focus on expanding the global consumer base. Some significant players in the market are OLEDWorks, eLux Inc., Mojo Vision Inc., Kopin Corporation, and eMagin. Several companies are increasing their market share by forming collaborations, partnerships, and acquisitions and introducing new and innovative products to earn a competitive edge during the forecast period.

- March 2024: OLEDWorks LLC, located in Rochester, was granted an OTA (Other Transactional Agreement) worth approximately USD 8.6 million by the US government. The US Army supervises the development and enhancement of advanced OLED microdisplays for consumer and defense uses. These microdisplays are intended for head-mounted display use in the Augmented and Virtual Reality sectors.

- January 2024: Kopin Corporation and Micledi Microdisplays collaborated to create advanced microLED displays for next-generation vision solutions. The collaboration aims to design, develop, and manufacture microLED displays with a more immersive and information-rich AR experience suitable for high-brightness light conditions. MICLEDI's microLED technology, when paired with Kopin's advanced backplane design expertise, seeks to develop microLED displays that cater to the challenging requirements of new applications while addressing the limitations of existing technologies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Microdisplays in Consumer Electronics and AR/VR applications

- 5.1.2 Increasing Demand for Head-Mounted Devices in Different Industries

- 5.2 Market Restraints

- 5.2.1 High Manufacturing Costs of Microdisplays

6 MARKET SEGMENTATION

- 6.1 By Type of Technology

- 6.1.1 Traditional (LCoS, LCD, DLP)

- 6.1.2 OLED-on-Si

- 6.1.3 MicroLEDs

- 6.2 By Application

- 6.2.1 Consumer & Automotive

- 6.2.1.1 Augmented Reality/Virtual Reality Headsets

- 6.2.1.2 Automotive HUDs

- 6.2.1.3 Traditional Applications (Projection/Camera, Others)

- 6.2.2 Defense

- 6.2.3 Others

- 6.2.1 Consumer & Automotive

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Middle East and Africa

- 6.3.6 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 OLEDWorks

- 7.1.2 eLux Inc.

- 7.1.3 Mojo Vision Inc.

- 7.1.4 Kopin Corporation

- 7.1.5 eMagin

- 7.1.6 LG Electronics

- 7.1.7 JBD (Jade Bird Display)

- 7.1.8 Sony Semiconductor Solutions Corporation

- 7.1.9 Seiko Epson Corporation

- 7.1.10 Himax Technologies Inc.