|

市场调查报告书

商品编码

1694041

外包服务-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Outsourcing Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

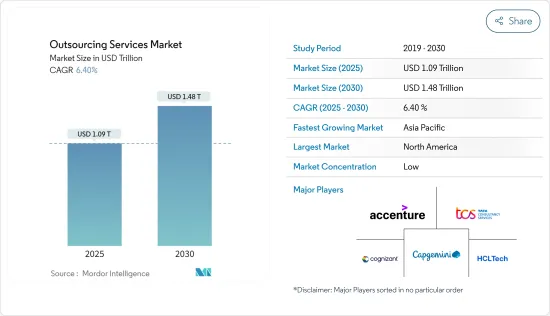

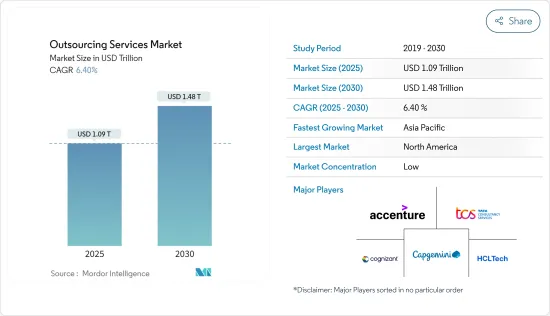

外包服务市场规模预计在 2025 年达到 1.09 兆美元,预计到 2030 年将达到 1.48 兆美元,预测期内(2025-2030 年)的复合年增长率为 6.4%。

越来越注重降低营运成本、熟练劳动力短缺以及外包服务采用先进技术等因素正在推动公司开发新服务以占领市场占有率。预计预测期内市场将大幅成长。

关键亮点

- 由于各种因素,越来越多的公司开始转向外包服务。主要原因之一是,透过外包给人事费用较低的国家可以实现潜在的成本节约,从而大幅节省与工资、社会福利和管理费用相关的开支。此外,公司将资源和管理精力集中在核心业务活动上,以增强竞争力并促进成长。

- 市场参与企业正在收购欧洲的各种外包公司,以扩大基本客群。例如,参与企业客户经验服务公司 Konecta 于 2024 年 2 月收购了英国业务流程外包公司 Bespoke,增强了其在英语市场的地位。 Bespoke 的主要生产设施位于南非德班。

- 此外,Konecta 还在美国德克萨斯州圣安东尼奥开设了一个营运中心,以扩展其英语服务。这些策略性措施符合 Konecta 更广泛的地理扩大策略,旨在更好地服务英语客户,特别是在境外外包服务领域。这些扩张使 Konecta 成为业界的重要参与企业。

- 此外,云端运算在业务流程外包中的日益普及对 BPO 服务的采用产生了重大影响。云端运算正在帮助 BPO 供应商加快产品上市时间、降低成本并加强品管流程。

- 此外,市场上的云端运算可确保即时运算支援和系统金钥、通用存取以及根据所需的业务目的随时调整的配置。预计这些好处将在预测期内对业务流程外包领域云端运算的整体采用产生正面影响。

- 然而,对于资料安全、客製化、资料迁移、IT 结构中的动态需求以及对最终用户定製成本的影响的担忧预计将在预测期内阻碍市场成长。

外包服务市场趋势

资讯科技外包领域将经历显着成长

- 市场越来越注重透过外包非核心业务来发挥核心竞争力,透过依赖外包供应商实现差异化,持续转向云端服务,以及采用虚拟基础设施,这些都推动着组织对 IT 的关注。此外,随着对数位转型的日益重视,企业越来越依赖创造性应用程式的效能和 IT 服务所能提供的扩充功能。

- 因此,企业和组织正在进行策略转变,优先考虑其核心优势和关键功能,同时将非关键 IT业务外包给外部服务供应商。这一趋势认识到将内部资源和专业知识集中在直接有助于公司竞争优势和整体业务成长的活动上的重要性。

- 这种转变背后的关键驱动因素之一是认识到关注核心竞争力的重要性。公司对资源和专业知识的投资越来越具体,并将其分配给直接有助于提高竞争优势的活动。外包非核心 IT业务可使公司将注意力和资源重新转向创新、产品开发和以客户为中心的计划,从而提高其市场定位和敏捷性。

- 此外,由于中小企业采用先进技术的投资增加,中小企业领域的市场也正在扩大。预计这些因素将在未来几年为 IT 外包供应商提供巨大的成长机会。

- 例如,2023 年 5 月,英国三所大学根据哈特里国家数位创新中心 (HNCDI) 计画获得总计 450 万英镑的资助,用于建立中小企业 (SME) 参与中心。纽卡斯尔大学、阿尔斯特大学和卡迪夫大学预计将提供有针对性的、易于获取的帮助,帮助中小企业透过采用超级运算、数据分析、视觉计算和人工智慧 (AI) 等先进的数位技术来更好地竞争和发展。

- 此外,云端运算的不断普及透过提供可扩展、经济高效且灵活的解决方案,显着促进了 IT 外包市场的成长。据Flexera Software称,到2024年,73%接受调查的公司将采用混合云端。企业正在转向云端服务以降低基础设施成本并提高灵活性。这种转变使得 IT 外包供应商能够提供云端管理、整合和安全方面的专业服务。

- 因此,企业可以专注于其核心业务,同时外包复杂的 IT业务。对云端运算专业知识的需求正在推动 IT 外包的成长。这是因为企业寻求利用云端技术的优势,而无需大量的内部资源。这一趋势正在加速各行各业的创新和业务效率。

北美占据主要市场占有率

- 美国在北美外包服务市场占有重要地位。随着该地区科技巨头对业务流程外包服务的需求不断增长,该地区的主导地位预计将持续下去。此外,云端运算需求的快速成长以及为满足个人需求而不断提升的服务个人化程度也有望推动该地区的扩张。

- 许多加拿大公司正在转型,不再只依赖公共云端服务。相反,他们采用融合公共、私有和传统基础架构的混合 IT 方法。推动这一转变的是那些看到了透过混合云端策略来增强业务和客户服务的好处的企业。加拿大政府依照「云端优先」的方针,优先考虑云端服务作为IT投资、技术和计划的优先选择。透过利用私营部门的创新,政府的目标是使其IT基础设施更加灵活。预计政府针对 IT 发展采取的此类措施将推动市场成长。

- 此外,在北美营运的公司越来越多地将人工智慧和自动化技术纳入其外包流程中。这一趋势旨在提高效率并最大限度地减少人工干预。外包领域对人工智慧和自动化的采用正在稳步增加。该公司正在使用人工智慧、RPA(机器人流程自动化)和机器学习来简化业务、提高效率并降低成本。作为回应,外包服务供应商正在转向以人工智慧为中心的解决方案,以更智慧的数据主导洞察力来丰富他们的服务。

- 在该地区,许多公司都在其 BPO 服务中使用人工智慧。例如,Expivia 透过优先考虑技术和人工智慧重塑了 BPO 服务格局。该公司不再仅依赖传统基准,而是优先考虑技术主导策略,以确保其客户获得策略价值。

- 此外,大型企业越来越多地采用 IT 外包策略,以获得更好的后端 IT 支援和IT基础设施更新,这可能会推动美国市场的成长。例如,2023年7月,塔塔咨询服务公司(TCS)扩大了与美国医疗技术公司GE医疗科技的合作关係,帮助该公司转变IT营运模式,以管理应用程式并推动创新。透过此次合作,TCS将为GE医疗提供IT应用开发、维护、合理化和标准化等外包服务,以支持该国大型企业市场的成长。

外包服务业概况

外包服务市场是半固定的,由各种供应商提供的服务。主要供应商包括埃森哲、塔塔顾问服务有限公司、Capgemini SA、Cognizant、HCL Technologies Limited 等。市场参与企业正在加强其投资组合,并透过策略伙伴关係和创新产品寻求长期竞争优势。

2024年3月,Celegence Holdings LLC对Sotelius进行了策略性投资,Sotelius是药品安全和医疗事务领域主要企业。这项投资是 Soterius A 轮资金筹措的一部分,旨在建立伙伴关係。透过利用两个团队的专业知识,此次合作旨在扩大两家公司的业务范围并推动共同成长。

2024 年 1 月,数位科技公司 Varanium Cloud Limited 将在马哈拉斯特拉邦Sawantwadi 建立其第二个办公室和业务流程外包 (BPO) 中心。该BPO中心将专门提供资料核算、身份验证和债务催收等服务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 外包服务市场的监管现状

第五章市场动态

- 市场驱动因素

- 越来越多的云端迁移和虚拟基础架构的采用

- 对效率和可扩展性的需求不断增加

- 透过物联网提升BPO服务效率

- 市场限制

- 资料安全、客製化、资料迁移

- IT架构的动态需求影响最终用户的客製化成本

- 外包服务市场的关键技术趋势

第六章市场区隔

- 按服务类型

- 业务流程外包

- 资讯科技外包

- 人力资源外包

- 知识流程外包

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 爱尔兰

- 瑞典

- 亚洲

- 中国

- 印度

- 日本

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 北美洲

第七章竞争格局

- 公司简介

- Accenture PLC

- Tata Consultancy Services Limited

- Capgemini SE

- Cognizant Technology Solutions Corporation

- HCL Technologies Ltd

- Teleperformance SE

- Evelyn Partners Group Limited

- Thomson Reuters Corporation

- TTEC Holdings Inc.

- Trinitar Solutions LLP

- Amdocs Limited

- Infosys Bpm(Infosys Limited)

- Automatic Data Processing Inc.

- General Outsourcing Public Company Limited

- Concentrix Corporation

第八章投资分析

第九章 市场机会与未来展望

The Outsourcing Services Market size is estimated at USD 1.09 trillion in 2025, and is expected to reach USD 1.48 trillion by 2030, at a CAGR of 6.4% during the forecast period (2025-2030).

Factors such as the rising emphasis on minimizing operational expenses, the unavailability of a skilled workforce, and the incorporation of advanced technology in outsourcing services are propelling players to develop new services to capture market share. The market is expected to witness significant growth during the forecast period.

Key Highlights

- Organizations are increasingly turning to outsourcing services, driven by various factors. One major factor is the cost-saving potential when outsourcing to countries with lower labor costs, which can lead to substantial reductions in expenses related to salaries, benefits, and overheads. Additionally, companies are focusing their resources and management efforts on core business activities, enhancing their competitive edge and fostering growth.

- The market players are acquiring various outsourcing firms in the European region to expand their customer base. For instance, in February 2024, Konecta, a global player in Customer Experience services, bolstered its presence in English-speaking markets by acquiring Bespoke, a United Kingdom-based business process outsourcing firm. Bespoke's primary production facilities are in Durban, South Africa.

- Additionally, Konecta expanded its English services by launching its inaugural operations center in San Antonio, Texas (USA). These strategic moves align with Konecta's broader geographic expansion strategy, enriching its offerings for English-speaking clients, notably in offshoring services. With these expansions, Konecta is solidifying its standing as a critical player in the industry.

- Moreover, the growing popularity of cloud computing in business process outsourcing is a significant factor affecting the adoption of BPO services. Cloud computing aids BPO operators in improving the time to market, reducing costs, and enhancing the quality control process.

- Furthermore, cloud computing in the market ensures instant computing support and system keys, universal access, and adjustable provisioning whenever needed for required business purposes. These advantages are expected to positively impact the overall adoption of cloud computing in the business process outsourcing sector during the forecast period.

- However, concerns related to data security, customization, and data migration, coupled with the dynamic needs of the IT structure, impacting the cost of customization for end users, are poised to hamper market growth during the forecast period.

Outsourcing Services Market Trends

The Information Technology Outsourcing Segment to Witness Significant Growth

- The market is witnessing a rising emphasis on leveraging the core competencies by outsourcing non-core operations, increasing organizations' focus on IT to gain differentiation by relying on outsourced vendors, continuing the shift to cloud services, and embracing virtualized infrastructure. Moreover, due to the growing emphasis on digital transformation, organizations depend on the performance of creative applications and extensions that IT services can provide.

- Hence, there is a strategic shift among businesses and organizations to prioritize their core strengths and critical functions while outsourcing non-essential IT operations to external service providers. This trend recognizes the importance of focusing internal resources and expertise on activities directly contributing to a company's competitive advantage and overall business growth.

- One of the primary drivers behind this shift is recognizing the critical importance of focusing on core competencies. Businesses are increasingly specific about investments in their resources and expertise, allocating them to activities directly contributing to their competitive advantage. Outsourcing non-core IT operations allows organizations to divert their attention and resources toward innovation, product development, and customer-centric efforts, enhancing their market positioning and agility.

- Further, the market is witnessing an expansion in the SME sector due to the rising investments in SMEs to adopt advanced technologies. These factors are further expected to create substantial growth opportunities for IT outsourcing vendors in the coming years.

- For instance, in May 2023, three UK universities collectively received GBP 4.5 million to establish small and medium-sized enterprise (SME) engagement hubs under the HNCDI (Hartree National Centre for Digital Innovation) program. Newcastle University, Ulster University, and Cardiff University are expected to provide targeted and accessible help for SMEs to boost their competitiveness and growth by adopting advanced digital technologies such as supercomputing, data analytics, visual computing, and artificial intelligence (AI).

- Furthermore, rising cloud deployment is significantly augmenting the growth of the IT outsourcing market by offering scalable, cost-effective, and flexible solutions. According to Flexera Software, as of 2024, 73% of enterprises surveyed implement a hybrid cloud in their organizations. Businesses increasingly leverage cloud services to reduce infrastructure costs and improve agility. This shift enables IT outsourcing providers to offer specialized cloud management, integration, and security services.

- Consequently, organizations can focus on core activities while outsourcing complex IT tasks. The demand for cloud expertise drives IT outsourcing growth as companies seek to harness cloud technology's benefits without the need for extensive in-house resources. This trend accelerates innovation and operational efficiency across industries.

North America to Hold a Significant Market Share

- The United States holds a significant position in the North American outsourcing services market. Due to the growing demand for business process outsourcing services from the region's tech giants, the region is expected to maintain its dominance. The surge in the overall demand for cloud computing and the personalization of service offerings to better meet individual needs are also expected to drive regional expansion.

- Many Canadian companies are transitioning from solely relying on public cloud services. Instead, they are embracing a hybrid IT approach, blending public, private, and traditional infrastructure. This shift is driven by the benefits these organizations see in enhancing their operations and customer service through a hybrid cloud strategy. In line with its "cloud-first" approach, the Canadian government prioritizes cloud services for IT investments, techniques, and projects. By leveraging private-sector innovations, the government aims to enhance the agility of its IT infrastructure. Such government initiatives toward IT development are expected to drive market growth.

- Moreover, businesses operating within North America are increasingly integrating AI (artificial intelligence) and automation technologies into their outsourcing processes. This trend aims to boost efficiency and minimize manual intervention. The adoption of AI and automation in outsourcing is on a steady rise. Companies are turning to AI, RPA (Robotic Process Automation), and machine learning to streamline operations, enhance efficiency, and reduce expenses. In response, outsourcing service providers are pivoting toward AI-centric solutions, enriching their services with smarter, data-driven insights for clients.

- Various players in the region are using AI in BPO services. For instance, Expiviahas reshaped the landscape of BPO services by prioritizing technology and AI. Rather than relying solely on conventional benchmarks, the company prioritizes technology-driven strategies, ensuring its clients derive strategic value.

- Also, large enterprises are increasingly adopting IT outsourcing strategies for better backend IT support and IT infrastructure updates, which would drive market growth in the United States. For instance, in July 2023, Tata Consultancy Services (TCS) expanded its relationship with GE HealthCare Technologies Inc., a medical technology company based in the United States, to help transform its IT operating model for managing its applications and driving innovation. After this collaboration, TCS would provide outsourcing services for IT application development, maintenance, rationalization, and standardization of GE Healthcare, supporting the growth of the market in the country's large enterprise sector.

Outsourcing Services Industry Overview

The outsourcing services market is semi-consolidated with an array of services from various vendors. Major vendors include Accenture, TATA Consultancy Services Limited, Capgemini, Cognizant, and HCL Technologies Limited. Market players are enhancing their portfolios and seeking long-term competitive advantages through strategic partnerships and innovative product offerings.

In March 2024, Celegence Holdings LLC strategically invested in Soterius Inc., a key player in outsourced services, collaboration technologies, and data assets within the drug safety and medical affairs domain. This investment, a part of Soterius' Series A financing, has forged a partnership that capitalizes on the strengths of both Celegence and Soterius. By leveraging the expertise of their teams, this collaboration aims to broaden their reach and fuel mutual growth.

In January 2024, Varanium Cloud Limited, a digital technology company, is establishing its second office and business process outsourcing (BPO) center in Sawantwadi, Maharashtra. The BPO center would specialize in services such as data accounting, background verification, and debt recovery.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Regulatory Landscape of Outsourcing Services Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Ongoing Migration Toward the Cloud and Adoption of Virtualized Infrastructure

- 5.1.2 Growing Demand for Efficiency and Scalable IT Infrastructure

- 5.1.3 Internet of Things for Efficient Delivery of BPO Services

- 5.2 Market Restraints

- 5.2.1 Data Security, Customization, and Data Migration

- 5.2.2 Dynamic Needs of IT Structure Impacts the Cost of Customization for End Users

- 5.3 Key Technological Trends in Outsourcing Services Market

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 Business Process Outsourcing

- 6.1.2 Information Technology Outsourcing

- 6.1.3 Human Resource Outsourcing

- 6.1.4 Knowledge Process Outsourcing

- 6.1.5 Other Service Types

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Ireland

- 6.2.2.5 Sweden

- 6.2.3 Asia

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 Japan

- 6.2.4 Latin America

- 6.2.4.1 Brazil

- 6.2.4.2 Mexico

- 6.2.5 Middle East and Africa

- 6.2.5.1 United Arab Emirates

- 6.2.5.2 Saudi Arabia

- 6.2.5.3 South Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Accenture PLC

- 7.1.2 Tata Consultancy Services Limited

- 7.1.3 Capgemini SE

- 7.1.4 Cognizant Technology Solutions Corporation

- 7.1.5 HCL Technologies Ltd

- 7.1.6 Teleperformance SE

- 7.1.7 Evelyn Partners Group Limited

- 7.1.8 Thomson Reuters Corporation

- 7.1.9 TTEC Holdings Inc.

- 7.1.10 Trinitar Solutions LLP

- 7.1.11 Amdocs Limited

- 7.1.12 Infosys Bpm (Infosys Limited)

- 7.1.13 Automatic Data Processing Inc.

- 7.1.14 General Outsourcing Public Company Limited

- 7.1.15 Concentrix Corporation