|

市场调查报告书

商品编码

1550011

半导体耗材:市场占有率分析、产业趋势、成长预测(2024-2029)Semiconductor Consumables - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

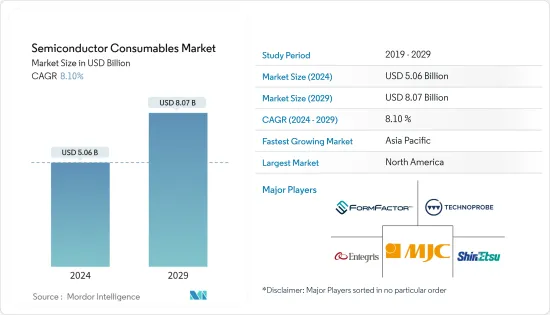

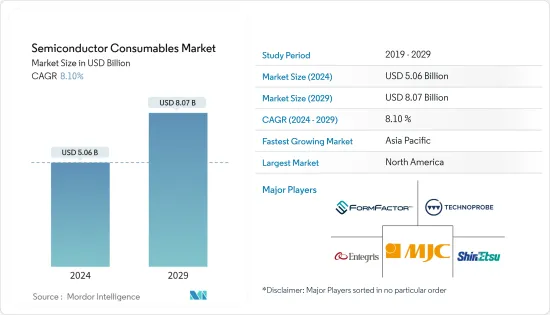

2024年半导体耗材市场规模预估为50.6亿美元,预估2029年将达80.7亿美元,预测期内(2024-2029年)复合年增长率为8.10%。

主要亮点

- 半导体消耗品是用于半导体製造和检查过程的材料和零件。这些消耗品对于半导体製造至关重要,并且通常是製造中使用的一次性或可更换零件。它对于确保半导体製造的品质和效率发挥重要作用。半导体广泛应用于多种产业,包括电脑、行动电话、汽车技术和消费性电子产品。半导体产业对全球经济至关重要,是经济整体健康状况的指标。随着半导体需求的增加,对可靠、高品质消耗品的需求持续成长。

- 半导体消耗品包括製造过程中使用的各种材料和零件。半导体消耗品的例子包括电极、聚焦环、刀片、垫圈和其他需要经常更换的零件。这些消耗品与机械和设备一起使用,以有效生产半导体。

- 技术进步一直是半导体耗材产业的主要驱动力。随着对更快、更紧凑、更有效率的电子设备的需求不断增加,半导体製造商需要先进的耗材来满足这些不断变化的要求。新材料、新製造技术的开拓以及人工智慧和机器学习在半导体製造过程中的整合可能会为所研究市场的成长提供利润丰厚的机会。

- 包括酸、氢氧化物和过氧化物在内的湿化学物质用于清洗和蚀刻半导体产业中的基板表面。这些製程对于半导体製造和湿式剥离至关重要。半导体製造过程需要清洁的环境,而湿化学品在保持这种清洁度方面发挥着重要作用。过氧化氢等化学物质用于蚀刻和清洗积体电路 (IC) 等长期应用。

- 新的半导体製造设施的建设也将刺激对半导体耗材的需求。随着这些设施产能的提高,所研究市场的需求预计将迅速增加。例如,2024年3月,印度联合内阁批准了为三座半导体工厂提供1.26兆印度卢比(150.7亿印度卢比)的资金,其中包括塔塔集团在古吉拉特邦多莱拉建设印度首个大型晶片製造工厂的提案,核准投资额达1000万美元。塔塔电子公司与台湾力晶半导体製造公司 (PSMC) 合作在多拉建造的半导体工厂将采用 28 奈米技术製造高性能计算晶片。

- 半导体耗材产业面临多种市场限制因素,影响其成长和盈利。主要阻碍因素之一是半导体耗材製造所使用的原料高成本。这增加了整体製造成本,并使公司难以保持有竞争力的价格。此外,该产业高度依赖半导体市场,而半导体市场则受週期性需求模式和经济波动的影响。这种波动可能会导致对消耗品的需求不可预测,并影响收益流。

- 此外,俄罗斯和乌克兰之间的衝突可能会对半导体产业产生重大影响。这场争端已经加剧了已经影响半导体产业的半导体供应链问题和晶片短缺问题。这种干扰可能导致镍、钯、铜、钛和铝等关键原料的价格波动,进而导致材料短缺。结果,半导体製造可能会受到影响。

半导体耗材市场趋势

湿化学品领域可望推动市场成长

- 半导体技术在很大程度上依赖半导体材料的精确操纵和製造。半导体製造的重要方面之一是湿化学品用于各种消耗品。这些化学品对于半导体表面的清洗、蚀刻和钝化非常重要,可确保高品质、无缺陷的装置。

- 湿化学品广泛应用于半导体製造的清洗过程。半导体晶圆是晶片製造的主要基板,通常含有先前加工步骤产生的杂质、污染物和残留物。湿式化学清洗可去除这些杂质,并确保后续製造步骤的原始起点。硫酸、过氧化氢和去离子水等各种化学物质用于去除某些类型的污染物。

- 蚀刻是半导体製造的重要步骤,用于选择性地从晶圆表面去除材料层。湿蚀刻使用的化学物质可以选择性地溶解某些材料而不影响其他材料。例如,氢氟酸通常用于蚀刻二氧化硅,而氢氧化钾和硝酸等其他化学物质则用于不同的材料。蚀刻过程的精确控制对于实现所需的装置结构和尺寸至关重要。

- 随着半导体製造中湿化学品的使用增加,适当的化学废弃物管理变得非常重要。使用过的化学品的处置需要遵守严格的环境法规,以尽量减少对生态的影响。采用回收和治疗过程从废弃物中回收有价值的成分,并减少对环境的负面影响和整体生产成本。

- 由于多种因素,包括家用电子电器、计算、5G 和汽车半导体的强劲成长,半导体需求正在上升。半导体需求的成长与製造过程中使用的湿化学品需求的成长直接相关。

- 根据爱立信2023年行动报告,从年终到2029年,全球5G用户数预计将成长330%以上,从16亿成长到53亿。预计到 2023年终, 5G 覆盖率将覆盖全球人口的 45% 以上,到 2029年终85%。预计到年终,北美和波湾合作理事会的5G渗透率将达到92%,是地区最高的。西欧预计将紧随其后,渗透率达到 85%。

- 此外,爱立信预计,2022年全球智慧型手机行动网路用户数量预计将达到约66亿,2028年将超过78亿人。预计这将进一步推动市场研究。

预计亚太地区市场成长率较高

- 台湾在亚太地区的半导体製造中发挥着重要作用。台湾半导体产业的成功很大程度得益于政府的正面作用。台湾政府实施了各种政策和措施来促进半导体产业的成长。

- 其中之一是“产业进步和转型计划”,旨在透过投资研发、人才引进和基础设施发展来增强台湾半导体产业的竞争力。政府也向国内半导体公司提供税收优惠、补贴和财政支持,鼓励它们投资创新和全球企业发展。

- 台湾半导体企业在半导体耗材市场不断创新先进产品与工艺,引领产业技术进步。台湾企业已成功开发实施7奈米、5奈米等先进晶片製造技术,有利于生产更小、更快、更节能的晶片。这些先进的半导体製造能力使台湾在全球市场上具有竞争优势。

- 此外,业界在人工智慧、物联网(IoT)和自动驾驶汽车等新兴技术专用晶片的开发方面取得了重大进展,这将进一步支持台湾半导体耗材供应商的成长。

- 台积电(台积电)、联发科、联电(联华)等台湾企业已成为全球半导体供应链的重要参与者。特别是,台积电已成为全球最大的合约晶片製造商之一,为全球知名科技公司提供产品。

- 领先半导体公司的存在可能会推动台湾调查市场的扩张。此外,台湾半导体产业也利用其强大的供应链来获得竞争优势。台湾已经建立了从设计到製造、测试和封装的垂直整合生态系统。这种整合提高了灵活性和成本效率,使台湾成为对世界各地半导体公司有吸引力的目的地。

- 亚太地区电子设备产量和需求的增加可能会推动研究市场的成长。例如,中国是世界领先的家用电器生产国之一。该国製造业蓬勃发展,并引进了多项製造和通讯技术。

半导体耗材产业概况

半导体耗材市场是一个竞争激烈的市场,有几家主要公司,包括 FormFactor Inc.、Technoprobe SpA、Micronics Japan、Entegris Inc. 和 Shin-Etsu Polymer。市场参与企业正在透过大量的研发投资、合作和合併来创新新产品,以满足消费者不断变化的需求。

- 2023 年11 月领先的自动化测试解决方案供应商泰瑞达(Teradyne) 和领先的探针卡设计商和製造商Techno-Probe 将加速各自发展,为全球带来更高性能的半导体测试接口,我们已宣布达成一系列战略协议。作为合作关係的一部分,泰瑞达将向Technoprobe投资约5.16亿美元,而Technoprobe将以8,500万美元收购泰瑞达的设备介面解决方案业务。两家公司也将致力于联合开发计划。

- 2023年8月Technoprobe完成对Harbor Electronics的收购。 Harbour Electronics 于 1980 年代在加利福尼亚州圣克拉拉成立,是一家为着名半导体製造商生产用于测试系统的先进印刷电路基板的着名製造商。 Techno-Probe表示,此次收购将进一步增强技术力,垂直整合探针卡製造工艺,并引入内部基板製造专业知识。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 技术进步

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 新进入者的威胁

- COVID-19 后遗症和其他宏观经济因素对市场的影响

- 产业供应链分析

第五章市场动态

- 市场驱动因素

- 对特定类别 IC 的需求增加

- 市场限制因素

- 特定细分市场的需求不确定性与供应链不确定性

第六章 市场细分

- 按产品类型

- 湿化学品(包括酸、碱、相关混合物和有机物)

- 晶圆运输货柜

- 晶圆加工(晶圆盒、FOUP、FOSB 盒等)

- 测试耗材

- 探针卡(垂直、MEMS、悬臂、等特殊产品)

- 插座(老化、测试)

- 末端执行器

- 按地区

- 北美洲

- 台湾

- 中国

- 韩国

- 日本

- 欧洲

- 东南亚

第七章 竞争格局

- 公司简介

- FormFactor, Inc.

- Technoprobe SpA

- Micronics Japan Co., Ltd.

- Japan Electronic Materials(JEM)

- MPI Corporation

- Entegris, Inc.

- Shin-Etsu Polymer Co., Ltd.

- Miraial Co Ltd

- 3s Korea Co.,Ltd.

- Dainichi Shoji KK

第八章 厂商排名分析

第9章市场的未来

The Semiconductor Consumables Market size is estimated at USD 5.06 billion in 2024, and is expected to reach USD 8.07 billion by 2029, growing at a CAGR of 8.10% during the forecast period (2024-2029).

Key Highlights

- Semiconductor consumables are materials or components used in semiconductors' manufacturing and testing processes. These consumables are essential for producing semiconductors and are often disposable or replaceable parts used in fabrication. They play a crucial role in ensuring the quality and efficiency of semiconductor production. Semiconductors are widely used in various industries, including computers, mobile phones, automotive technologies, and consumer electronics. The semiconductor industry is an essential part of the global economy and serves as an indicator of the economy's overall health. As the demand for semiconductors increases, the need for reliable and high-quality consumables becomes increasingly essential.

- Semiconductor consumables can include various materials and components employed in the manufacturing process. Some examples of semiconductor consumables are electrodes, focus rings, blades, gaskets, and other parts that need frequent replacement. These consumables are used with machinery and equipment to ensure efficient production of semiconductors.

- Technological advancements serve as a key driver for the semiconductor consumables industry. As the demand for faster, compact, and more efficient electronic devices increases, semiconductor manufacturers require advanced consumables to meet these evolving requirements. The development of new materials, novel fabrication techniques, and the integration of artificial intelligence and machine learning in semiconductor manufacturing processes are likely to offer lucrative opportunities for the growth of the market studied.

- Wet chemicals, including acids, hydroxides, and peroxides, are used for cleaning and etching substrate surfaces in the semiconductor industry. These processes are essential for the fabrication and wet stripping of semiconductors. The manufacturing process of semiconductors requires a clean environment, and wet chemicals play a crucial role in maintaining this cleanliness. Chemicals like hydrogen peroxide are used for long-term applications such as etching and cleaning integrated circuits (ICs).

- The establishment of new semiconductor manufacturing facilities also drives the demand for semiconductor consumables. As these facilities increase their production capacity, the demand for the studied market is expected to increase rapidly. For instance, in March 2024, the Union Cabinet of India approved INR 1.26 trillion (USD 15.07 billion) worth of investments in three semiconductor plants, including a Tata Group proposal to build the country's first major chip fabrication facility at Dholera in Gujarat. The semiconductor fabrication unit in Dholera by Tata Electronics, in partnership with Powerchip Semiconductor Manufacturing Corp (PSMC), Taiwan, would manufacture high-performance computing chips with 28 nm technology.

- The semiconductor consumables industry faces several market restraints that impact its growth and profitability. One major restraint is the high cost of raw materials used in the manufacturing of semiconductor consumables. This increases the overall production cost, making it difficult for companies to maintain competitive pricing. Additionally, the industry is highly dependent on the semiconductor market, which is subject to cyclical demand patterns and economic fluctuations. This volatility can lead to unpredictable demand for consumables, affecting revenue streams.

- Further, the conflict between Russia and Ukraine will significantly impact the semiconductor industry. The conflict has already exacerbated the semiconductor supply chain issues and the chip shortage that have affected the industry for some time. The disruption may result in volatile pricing for critical raw materials such as nickel, palladium, copper, titanium, and aluminum, resulting in material shortages. This, in turn, could impact the manufacturing of semiconductors.

Semiconductor Consumables Market Trends

The Wet Chemicals Segment is Expected to Drive the Market's Growth

- Semiconductor technology relies heavily on the precise manipulation and fabrication of semiconductor materials. One critical aspect of semiconductor manufacturing is the use of wet chemicals in various consumables. These chemicals are important in cleaning, etching, and passivating semiconductor surfaces, ensuring high-quality, defect-free devices.

- Wet chemicals are extensively used in the cleaning processes of semiconductor manufacturing. Semiconductor wafers, the primary substrates for chip production, often have impurities, contaminants, and residue from previous processing steps. Wet chemical cleaning removes these impurities and ensures a pristine starting point for subsequent fabrication steps. Different chemicals, such as sulfuric acid, hydrogen peroxide, and deionized water, are used to remove specific types of contaminants.

- Etching is an essential step in semiconductor manufacturing, used to remove layers of material from the wafer surface selectively. Wet etching involves using chemicals that can selectively dissolve specific materials without affecting others. For instance, hydrofluoric acid is commonly used to etch silicon dioxide, while other chemicals like potassium hydroxide or nitric acid are used for different materials. Precise control of the etching process is essential to achieve desired device structures and dimensions.

- Proper chemical waste management becomes critical with the increasing use of wet chemicals in semiconductor manufacturing. The disposal of spent chemicals requires adherence to strict environmental regulations to minimize ecological impact. Recycling and treatment processes are employed to recover valuable components from the waste, reducing environmental harm and overall production costs.

- The demand for semiconductors has been on the rise, driven by various factors such as robust growth in consumer electronics, computing, 5G, and automotive semiconductors. This increased demand for semiconductors directly translates into a higher demand for wet chemicals used in their manufacturing processes.

- According to Ericsson Mobility Report 2023, between the end of 2023 and 2029, global 5G subscriptions are forecasted to increase by over 330%, from 1.6 billion to 5.3 billion. 5G coverage was forecasted to be available to more than 45% of the global population by the end of 2023 and 85% by the end of 2029. North America and the Gulf Cooperation Council are anticipated to have the highest regional 5G penetration rates by the end of 2029 at 92%. Western Europe is forecasted to follow at 85% penetration.

- Moreover, according to Ericsson, the global number of smartphone mobile network subscriptions reached nearly 6.6 billion in 2022, and it is expected to exceed 7.8 billion by 2028. This is expected to drive the market studied further.

Asia-Pacific is Expected to Witness a High Market Growth Rate

- Taiwan plays a crucial role in semiconductor manufacturing in Asia-Pacific. Taiwan's semiconductor industry owes much of its success to the proactive role played by the government. The Taiwanese government has implemented a diverse range of policies and initiatives to foster the growth of the industry.

- One such initiative is the Industrial Upgrading and Transformation Plan, which aims to enhance the competitiveness of Taiwan's semiconductor industry through investments in research and development, talent acquisition, and infrastructure development. The government has also provided tax incentives, subsidies, and funding support to domestic semiconductor companies, encouraging them to invest in innovation and expand their global reach.

- Taiwanese semiconductor companies have continuously innovated advanced products and processes in the semiconductor consumables market, driving technological advancements in the industry. Advanced chip manufacturing technologies, such as 7 nm and 5 nm processes, have been successfully developed and deployed by Taiwanese firms, facilitating the production of smaller, faster, and more energy-efficient chips. The ability to manufacture these advanced semiconductors has given Taiwan a competitive edge in the global market.

- Additionally, the industry has witnessed substantial progress in the development of specialized chips for emerging technologies like artificial intelligence, the Internet of Things (IoT), and autonomous vehicles, which are further driving the growth of Taiwanese semiconductor consumables vendors.

- Taiwanese companies, such as TSMC (Taiwan Semiconductor Manufacturing Company), MediaTek, and UMC (United Microelectronics Corporation), have become critical players in the global semiconductor supply chain. TSMC, in particular, has emerged as one of the world's largest contract chipmakers, catering to prominent global technology companies.

- The presence of major semiconductor companies is likely to aid the expansion of the market studied in the country. Moreover, Taiwan's semiconductor industry has leveraged its robust supply chain to gain a competitive advantage. The country has developed a vertically integrated ecosystem, encompassing everything from design and manufacturing to testing and packaging. This integration allows for greater flexibility and cost-effectiveness, making Taiwan an attractive destination for semiconductor companies worldwide.

- The increasing electronics production and demand in Asia-Pacific are likely to drive the growth of the market studied. For instance, China is one of the prominent consumer electronics producers worldwide. The manufacturing industry is growing quickly in the country and is witnessing the deployment of several manufacturing and telecommunications technologies, which is likely to aid in the market's growth.

Semiconductor Consumables Industry Overview

The semiconductor consumables market is a competitive market with the presence of several major players like FormFactor Inc., Technoprobe SpA, Micronics Japan Co. Ltd, Entegris Inc., and Shin-Etsu Polymer Co. Ltd. The market players are striving to innovate new products by way of extensive investments in R&D, collaborations, and mergers to cater to the evolving demands of consumers.

- November 2023: Teradyne Inc., a prominent supplier of automated test solutions, and Technoprobe SpA, a significant company in the design and production of probe cards, announced a series of agreements establishing a strategic partnership that is anticipated to accelerate growth for both companies and allow them to deliver higher performance semiconductor test interfaces to their global customers. As part of the partnership, Teradyne will make nearly USD 516 million in equity investment in Technoprobe, and Technoprobe will acquire Teradyne's Device Interface Solutions business for USD 85 million. The companies also claimed to engage in joint development projects.

- August 2023: Technoprobe finalized its acquisition of Harbor Electronics Inc. Harbor Electronics, a company founded in the '80s in Santa Clara, California, is a prominent manufacturer of advanced printed circuit boards for testing systems for prominent semiconductor manufacturers. As per Technoprobe, the acquisition is claimed to allow it further to strengthen its technological skills in the testing field and vertically integrate the probe card production process, bringing PCB production expertise in-house.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technological Advancements

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.3.6 Threat of New Entrants

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

- 4.5 Industry Supply Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Certain Class of ICs

- 5.2 Market Restraints

- 5.2.1 Uncertainties in Demand for Certain Segments and Supply Chain Uncertainties

6 MARKET SEGMENTATION

- 6.1 By Product Category

- 6.1.1 Wet Chemicals (includes acids, basis, associated mixtures, and organics)

- 6.1.2 Wafer Shipping Containers

- 6.1.3 Wafer Processing (Cassettes, FOUP, FOSB Boxes etc.)

- 6.1.4 Test Consumables

- 6.1.4.1 Probe Card (Vertical, MEMS, Cantilever, and Other Speciality)

- 6.1.4.2 Sockets (Burn-in, and Test)

- 6.1.5 End Effectors

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Taiwan

- 6.2.3 China

- 6.2.4 South Korea

- 6.2.5 Japan

- 6.2.6 Europe

- 6.2.7 South East Asia

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 FormFactor, Inc.

- 7.1.2 Technoprobe S.p.A.

- 7.1.3 Micronics Japan Co., Ltd.

- 7.1.4 Japan Electronic Materials (JEM)

- 7.1.5 MPI Corporation

- 7.1.6 Entegris, Inc.

- 7.1.7 Shin-Etsu Polymer Co., Ltd.

- 7.1.8 Miraial Co Ltd

- 7.1.9 3s Korea Co.,Ltd.

- 7.1.10 Dainichi Shoji K.K.