|

市场调查报告书

商品编码

1550027

半导体测试设备:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Semiconductor Test Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

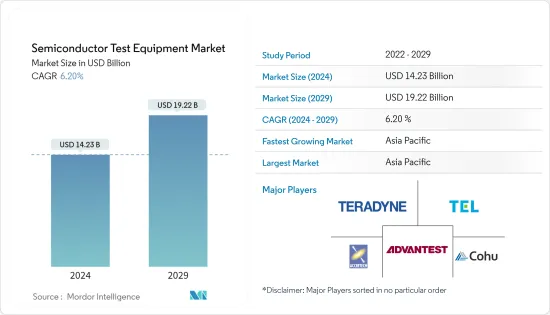

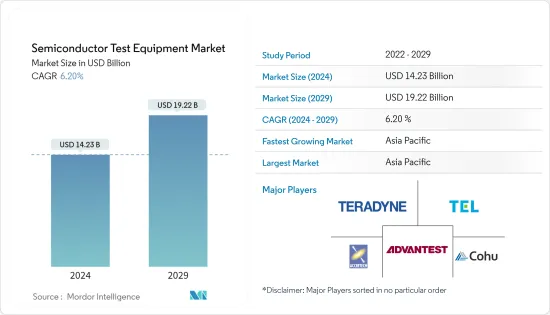

2024年半导体测试设备市场规模预计为142.3亿美元,预计2029年将达到192.2亿美元,在预测期内(2024-2029年)复合年增长率为6.20%。

主要亮点

- 由于人工智慧、高效能运算、5G 和自动驾驶汽车等技术进步,半导体测试设备市场预计将成长。此外,晶片技术的进步以及 3nm 和 5nm 半导体晶片产量的增加,对用于测试精细製程几何形状的高效测试设备产生了巨大的需求。

- 下一代设备采用更小的晶片设计,苹果宣布 iPhone 15 Pro/Ultra 将采用 3nm 技术。在 5 奈米或更小的製程节点上测试半导体是一项挑战。製造商专注于开发新的先进测试解决方案,以确保最高的产量比率和品质并控製成本。

- 政府促进主要半导体工厂内部製造和投资的措施可能会增加半导体产量并推动测试设备市场。例如,2024年2月,印度政府核准了三个半导体单位,用于在印度发展半导体和显示器製造生态系统。

- 电子元件在汽车导航、安全系统和资讯娱乐领域的使用不断增加,也在推动半导体测试设备的成长方面发挥关键作用。此外,智慧型手机、平板电脑和笔记型电脑/个人电脑等消费性电子产品对半导体的需求不断增长预计将成为该市场的主要驱动因素。此外,半导体测试设备市场预计将受益于各工业领域越来越多地采用物联网(IoT)。

- 先进测试设备的高成本限制了市场的成长。随着先进晶片技术的引入,测试设备也不断升级以包含最新技术,增加了设备成本。此外,与半导体设备相关的严格政府法规正在推动市场成长。

- 此外,乌克兰危机是最近的障碍,可能会对高科技、汽车、家用电器和电器产品等多个製造业领域造成重大干扰。这可能会对整个行业产生深远的影响。俄罗斯和乌克兰在全球半导体供应链中发挥重要作用,供应钯和氖等基本材料,这些材料对于生产用于最新装置和设备的硅晶圆至关重要。半导体生产的暂停将对检查设备的销售产生重大影响。由于中国是世界领先的消费电子市场,美国之间持续的争端预计将对市场成长产生重大影响。然而,我们严重依赖其他国家的先进半导体设备。

半导体测试设备市场趋势

半导体自动测试设备(ATE)占据主要市场占有率

- 物联网应用的扩展导致智慧型装置和小型半导体的激增,对先进半导体自动测试设备的需求不断增加。

- 据爱立信称,2022 年至 2028 年间,全球连网型设备数量将几乎翻倍。这一成长将由近距离联网设备的增加所推动,预计到 2028 年将达到 287.2 亿个。连网型设备包括穿戴式装置、联网汽车、智慧感测器等。

- 自动测试设备可降低製造成本和时间并提高生产力。为了更好的应用,复杂设备的不断发展增加了对高通量测试设备的需求。 ATE 可以透过自动化易受人为错误影响的流程来消除错误的测试报告结果。自动测试时,测试结果统一且不失真,确保产品品质的一致性。 ATE 透过减少所需的时间和材料来帮助降低测试成本。这可以使用 ATE 中自动化测试序列的可程式设计功能来实现。

- 当今的车辆越来越多地采用智慧电子元件和先进技术,例如 ADAS、资讯娱乐系统和人工智慧助手,创造了巨大的成长机会。 ATE 系统可以对 ECU、感测器和资讯娱乐系统等组件进行详细测试,以确保可靠性、功能性并符合汽车行业规范。

- IEA 表示,预计 2023 年电动车销量将持续激增。光是第一季就销售了约230万辆电动车,与去年同期相比成长了25%。这一增长主要归功于政府政策和奖励,以及原油价格上涨,这增加了购买慾望。对电动车和联网汽车的需求不断增长预计将推动 ATE 市场的成长。

亚太地区占主要市场占有率

- 中国在测试设备市场占有很大份额。该国正在投资 1500 亿美元来实现雄心勃勃的半导体议程。该国的目标是加强国内积体电路产业并增加晶片产量。

- 美国之间持续的贸易战加剧了这一尖端製程技术关键领域的紧张局势,导致许多中国公司投资半导体代工厂。中国宣布了多项加强半导体产业的倡议,包括在代工、氮化镓 (GaN) 和碳化硅 (SiC) 市场的重大扩张宣传活动。该地区半导体业务的成长和晶片产能的增加预计将推动测试设备的需求。中国高科技产业的目标是利用其在通讯、可再生能源和电动车(EV)领域的强大影响力,提升全球技术价值链的地位。除了这些领域外,该行业目前还专注于先进半导体。这一转变主要是由先进节点製造的进步、记忆体市场的扩张、积极参与碳化硅(SiC)竞争以及对先进封装和製造设备的策略性投资所推动的。中国各地代工业务和晶圆厂投资的扩张预计将刺激市场成长。

- 此外,美国在半导体智慧财产权和製造方面的竞争正在加剧。美国在提高自己的晶片产量的同时,也实施了製裁,阻碍了中国在这一重要产业实现自力更生的努力。因此,该地区正在对半导体製造和测试业务进行重大投资,以提高自力更生能力。一个例子是中国于 2023 年 9 月宣布设立新的国有投资基金,旨在为半导体产业资金筹措约 400 亿美元。该基金将主要致力于收购晶片製造设备,以赶上美国和其他竞争对手。

- 晶圆代工厂的扩张直接影响测试设备市场的成长。透过这项激励措施,北京打算增加对中国晶片公司建设、扩建和升级国内製造、组装、封装和研发设施的支援。

- 此外,根据IEA的数据,到2023年,中国将占全球新註册电动车的近60%。该地区在电动车生产方面投入巨资,主要由比亚迪等公司投资。该地区电动汽车行业的成长预计将推动市场潜力。

半导体测试设备产业概况

半导体测试设备市场处于半巩固状态,由 Advantest Corporation、Teradyne, Inc.、Cohu Inc.、Tokyo Electron Limited、HCT 和 Tokyo Seimitsu Company 等主要企业主导。

- 2024 年 2 月 - Cohu Inc. 宣布,Cohu 最新的 MEMS 测试解决方案组合产品 Sense+ 系统已被选用于测试美国无晶圆厂半导体製造商 Tuo Sense 的下一代高保真麦克风。

- 2023 年 12 月 - Advantest Inc. 宣布推出 ACS 即时资料基础架构 (RTDI),在单一整合平台中为人工智慧、机器学习和资料分析决策提供支援。这项新的基础设施可以安全地收集、处理、分析和监控试验资料,使客户能够自动执行步骤,将见解转化为可行的试验决策。这使得消费者和合作伙伴能够优化品质、减少测试时间并为智慧包装提供支援。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 设备类别技术概述

- COVID-19 和其他宏观经济因素对市场的影响

第五章市场动态

- 市场驱动因素

- 人工智慧、物联网和连网型设备按产业激增

- 扩大半导体在汽车中的使用

- 市场挑战

- 供应链中断导致半导体短缺

- 由于该技术的动态特性,需要对设备进行多次更改

第六章 市场细分

- 依产品类型

- 半导体自动测试设备(ATE)

- 老化系统

- 处理装置

- 探针装置

- 光学检测设备

- 其他产品类型

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 中东/非洲

- 拉丁美洲

第七章 竞争格局

- 公司简介

- Advantest Corporation

- Tokyo Electron Limited

- Teradyne Inc.

- Cohu Inc.

- HCT Co. Ltd

- Tokyo Seimitsu Co. Ltd

- National Instruments

- Astronics Corporation

- TESEC Inc.

- Chroma ATE Inc.

第八章厂商市场占有率分析

第九章市场展望

The Semiconductor Test Equipment Market size is estimated at USD 14.23 billion in 2024, and is expected to reach USD 19.22 billion by 2029, growing at a CAGR of 6.20% during the forecast period (2024-2029).

Key Highlights

- The semiconductor test equipment market is expected to grow due to technological advancements such as AI, HPC, 5G, and automated vehicles. Further, the technological advancement in chip technology and growing production of 3nm and 5nm semiconductor chips create a huge demand for efficient test equipment to test small process geometrics.

- As next-generation devices are designed with smaller chips, Apple announced it would use 3nm technology in iPhone 15 Pro/Ultra; such developments drive market growth. Testing semiconductors with 5nm or smaller process nodes is challenging. Manufacturers focus on developing new and advanced test solutions that ensure the best yield, quality, and control costs.

- The government's efforts to increase in-house production and investment by leading semiconductor fabs will increase semiconductor production, which will likely foster the market for testing equipment. For instance, in February 2024, the Government of India approved three semiconductor units for the development of semiconductor and display manufacturing ecosystems in India.

- The rising utilization of electronic components in automobile navigation, safety systems, and infotainment also plays a significant role in propelling the growth of semiconductor testing equipment. Moreover, the increasing demand for semiconductors in consumer electronics like smartphones, tablets, and laptops/PCs is anticipated to be a key driver in this market. Moreover, the semiconductor test equipment market is expected to benefit from the increasing adoption of internet-of-things (IoT) in different industrial sectors.

- The high cost of advanced testing equipment restricts market growth. With the introduction of advanced chip technology, testing equipment was upgraded to include the latest technology, increasing the equipment cost. Further, stringent government regulations related to semiconductor equipment facilitate market growth.

- Also, the crisis in Ukraine is the latest obstacle to arise, and it can cause significant disruptions in various manufacturing sectors such as high-tech, automotive, consumer electronics, and household appliances. This could have far-reaching consequences for the industry as a whole. Russia and Ukraine play crucial roles in the global semiconductor supply chain, supplying essential materials such as palladium and neon, vital for producing silicon wafers used in modern devices and equipment. The suspended semiconductor production significantly impacts the sales of testing equipment. The ongoing dispute between the US and China will significantly impact the market growth as China is the major consumer electronics market in the world. However, it largely depends on other countries for advanced semiconductor equipment.

Semiconductor Test Equipment Market Trends

Semiconductor Automated Test Equipment (ATE) to Hold Significant Market Share

- Owing to the expansion of IoT applications, smart devices, and small semiconductors are becoming more prevalent, driving demand for advanced semiconductor automated testing equipment.

- According to Ericsson, the number of connected devices worldwide will almost double between 2022 and 2028. This growth is expected to be driven by a rise in short-range IoT devices, with a forecast of 28.72 billion such devices by 2028. Connected devices include wearables, connected cars, and smart sensors.

- Automated testing equipment reduces manufacturing costs and time and increases productivity. The ongoing development of complex devices for better applications drives demand for high-throughput test equipment. An ATE can eliminate false test report results by automating processes susceptible to human mistakes. When testing is done automatically, test results are uniform and cannot be distorted, guaranteeing consistency in product quality. An ATE can help reduce testing costs by reducing the time and materials required. This can be achieved by using programmable functions on ATEs that automate test sequences.

- The growing adoption of smart electronics components and advanced technologies such as ADAS, infotainment systems, and AI assistants in today's vehicles creates significant growth opportunities. ATE systems allow for detailed testing of components such as ECUs, sensors, and infotainment systems, guaranteeing reliability, functionality, and compliance with automotive industry norms.

- According to the IEA, EV sales were expected to continue to surge in 2023. Approximately 2.3 million electric cars were sold in the first quarter alone, representing a 25% increase from the same period last year. This growth is largely attributed to national policies and incentives, as well as high oil prices, which are motivating prospective buyers. The increased demand for electric and connected vehicles will drive the ATE market growth.

Asia-Pacific to Hold Significant Market Share

- China holds a significant share of the testing equipment market. The country is pursuing an ambitious semiconductor agenda with USD 150 billion in funding. The country aims to enhance its domestic IC industry and increase its chip production.

- The ongoing US-China trade war has intensified tensions in this crucial sector, where the most advanced process technology is concentrated, leading many Chinese companies to invest in semiconductor foundries. China has unveiled various initiatives to strengthen its semiconductor sector, such as a substantial expansion campaign in the foundry, gallium-nitride (GaN), and silicon carbide (SiC) markets. The growing semiconductor business and increasing chip production capabilities in the region are expected to drive the demand for testing equipment. China's tech industry aims to ascend the global technology value chain by capitalizing on its strong presence in telecommunications, renewables, and electric vehicles (EVs). In addition to these sectors, the industry is now focusing on advanced semiconductors. This transition is primarily driven by advancements in advanced node manufacturing, the expansion of the memory market, active involvement in the silicon carbide (SiC) race, and strategic investments in advanced packaging and manufacturing equipment. The growing foundry business and investments in fabs throughout China are anticipated to stimulate market growth.

- Moreover, China and the United States are growing competition over semiconductor intellectual property and manufacturing. The United States is taking steps to boost its chip production while imposing sanctions to hinder China's efforts to achieve self-reliance in this crucial industry. As a result, the region is making significant investments in the semiconductor manufacturing and testing business to enhance its self-reliance capabilities. An example is the recent announcement in September 2023 of China's new state-backed investment fund, which aims to raise approximately USD 40 billion for the semiconductor sector. This fund will primarily focus on acquiring chip manufacturing equipment to catch up to the United States and other competitors.

- The expansion of foundries directly impacts the growth of the testing equipment market. Through the incentive package, Beijing intends to enhance its assistance to Chinese chip companies in constructing, expanding, or upgrading domestic facilities for fabrication, assembly, packaging, and research and development.

- Further, according to IEA, China accounted for nearly 60% of all new electric car registrations worldwide in 2023. This region is primarily dominated by companies like BYD and others, which are making significant investments in the production of electric vehicles. The growth of the EV sector in the region is expected to drive the market's potential.

Semiconductor Test Equipment Industry Overview

The semiconductor test equipment market is semi-consolidated and dominated by leading vendors such as Advantest Corporation, Teradyne, Inc., Cohu Inc., Tokyo Electron Limited, HCT Co. Ltd, and Tokyo Seimitsu Co. Ltd. Companies continuously focus on enhancing their market presence by launching new products, expanding their operations, or entering strategic mergers and acquisitions, partnerships, and collaborations.

- February 2024 - Cohu Inc. announced that the Sense+ system, Cohu's recent MEMS test solution portfolio product, was selected by the United States fabless semiconductor manufacturer with µ-sense to test their next-generation high-fidelity microphones.

- December 2023 - Advantest Corporation launched ACS Real-time Data Infrastructure (RTDI) to enhance AI, ML, and data analytics decision-making in a single, integrated platform. The new infrastructure securely gathers, processes, analyzes, and monitors test data to enable customers to automate the procedure of converting insights into actionable test decisions. This helps consumers and partners optimize quality, reduce test time, and enhance smart packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technological Overview of Equipment Categories

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Proliferation of Artificial Intelligence, IoT, and Connected Devices across Industry Verticals

- 5.1.2 Increased Applications of Semiconductors in Automotive

- 5.2 Market Challenges

- 5.2.1 Supply Chain Disruptions Resulting in Semiconductor Shortage

- 5.2.2 Dynamic Nature of Technologies Requires Several Changes in Equipment

6 MARKET SEGMENTATION

- 6.1 By Type of Product

- 6.1.1 Semiconductor Automated Test Equipment (ATE)

- 6.1.2 Burn-in Systems

- 6.1.3 Handler Equipment

- 6.1.4 Probe Equipment

- 6.1.5 Optical Inspection Systems

- 6.1.6 Other Equipment Categories

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Middle East and Africa

- 6.2.6 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Advantest Corporation

- 7.1.2 Tokyo Electron Limited

- 7.1.3 Teradyne Inc.

- 7.1.4 Cohu Inc.

- 7.1.5 HCT Co. Ltd

- 7.1.6 Tokyo Seimitsu Co. Ltd

- 7.1.7 National Instruments

- 7.1.8 Astronics Corporation

- 7.1.9 TESEC Inc.

- 7.1.10 Chroma ATE Inc.