|

市场调查报告书

商品编码

1550030

汽车显示面板:市场占有率分析、产业趋势、成长预测(2024-2029)Automotive Display Panel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

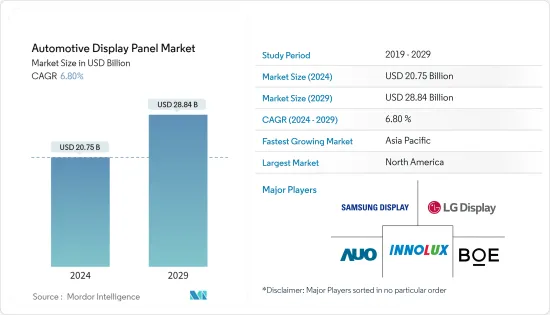

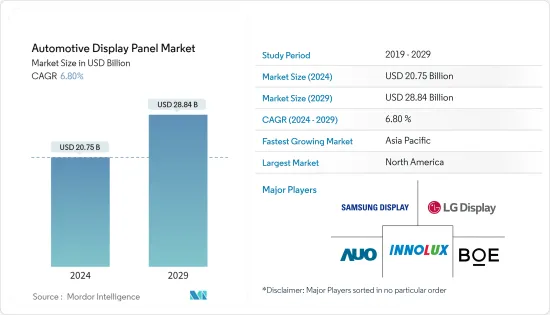

预计2024年汽车显示面板市场规模为207.5亿美元,预计到2029年将达到288.4亿美元,在预测期内(2024-2029年)增长6.80%,复合年增长率为

主要亮点

- 由于对半自动驾驶和自动驾驶汽车的需求不断增加、汽车消费者体验的改善以及豪华和高端汽车细分市场(尤其是在新兴市场)的强劲增长,汽车显示面板市场正在经历强劲增长。消费者越来越期待先进的汽车资讯娱乐系统,包括触控萤幕、导航系统和连接功能。

- 车辆显示面板为您的车辆提供多种功能,提供速度、燃油油位、导航说明和娱乐选项等资讯。它还可以透过显示轮胎气压低或引擎故障等问题的警告和警报来提高安全性。此外,还可配置空调、音讯等多种功能。

- 在microLED技术成熟商用之前,miniLED背光液晶面板将与OLED面板竞争高阶汽车显示器应用。市场上的供应商也在创新他们的产品,为不同的车辆类型提供解决方案。例如,LD Display 宣布计划为低成本汽车开发混合OLED 面板。

- 混合OLED面板结合了OLED(有机发光二极体)和LCD(液晶显示)技术的优点。 OLED 显示器提供令人印象深刻的视觉质量,包括深邃的黑色、鲜艳的色彩和出色的对比度。然而,OLED面板的製造成本传统上高于LCD面板。透过将 LCD 元件整合到混合OLED 面板中,LG Display 旨在实现卓越的视觉性能,同时降低製造成本。

- 日益严格的安全法规促使汽车製造商为其汽车配备更先进的 ADAS(高级驾驶员辅助系统),通常需要显示面板向驾驶员传达重要讯息。 2024年2月,UNECE自动驾驶/自动驾驶和连网型汽车工作组明确了配备驾驶控制辅助系统的车辆的核准规定,并对配备车道维持系统等高级驾驶辅助系统的车辆制定了最低安全要求通过了一项新的法规草案

- 同样,印度政府多年来一直强调加强车辆安全。继定于 2024 年 10 月生效的强制性六个安全气囊规则之后,政府计划在印度汽车中强製配备某些 ADAS 功能。根据 PTI 最近发布的一份报告,道路运输和公路部 (MoRTH) 起草了新提案,以减少印度的道路事故。预计这些趋势将在预测期内推动市场成长。

- 实施先进的显示技术成本高昂,并且会增加车辆的整体成本。因此,对价格敏感的消费者和寻求降低生产成本的製造商可能会避开它们。将显示面板整合到车辆中也会使製造过程复杂化,并且可能需要对维护和维修技术人员进行额外的培训。

- 此外,正在进行的俄罗斯-乌克兰战争对包括汽车产业在内的各个产业产生了重大影响。战争造成的破坏对汽车显示面板市场的成长产生了多种影响。战争也造成汽车业原料短缺。乌克兰和俄罗斯是铝和稀有气体的主要生产国,这对汽车製造至关重要。随着这些原材料供应中断,汽车显示面板的生产进一步受到影响。

汽车显示面板的发展趋势

抬头显示器领域预计将占据主要市场占有率

- 抬头显示器,也称为 HUD,是一种透明显示器,使用者无需将目光从正常观点移开即可显示资料。抬头显示器自 20 世纪中叶以来一直很流行,主要用于飞机上。然而,在 20 世纪 50 年代,人们尝试测试这项技术的汽车应用。

- 抬头显示器以前安装在豪华车上,但OEM现在也将其作为经济型汽车的标准配备。日本製造商丰田推出了与其他汽车相比配备最大挡风玻璃 HUD 的Camry。丰田也为普锐斯标配了挡风玻璃HUD。

- 透过在驾驶员视野内提供即时讯息,HUD 改善了驾驶体验,使驾驶员能够更方便、直观地存取重要资料,而无需将视线离开道路。根据世界卫生组织统计,每年约有 135 万人死于道路交通事故。 HUD 是一种驾驶辅助系统,可为驾驶和行人及时通报潜在危险事件。

- 2023 年 5 月,凯迪拉克 Lyriq 推出了一项显着功能:与新兴企业Envisics 合作的扩增实境(AR)抬头显示器。这项创新性的补充体现了 Lyriq 将新技术融入其设计的承诺。

北美占最大市场占有率

- 预计北美及其主要生产地点将占据很大的市场占有率。由于国内市场的规模和大规模生产技术的使用,该地区的汽车工业是世界上最重要的汽车工业之一。在过去的十年中,该地区的汽车行业从製造到分销都取得了巨大的发展,消费者偏好的变化和新技术的引入推动该行业进入历史性转型。

- 该地区是本田、丰田、福特、雪佛兰和特斯拉等多家公司的所在地。它是汽车行业的先驱,特别是在自动化方面,为该地区的供应商创造了新的机会。根据 CAR 汽车研究中心的数据,到 2025 年,美国汽车产量将达到 1,170 万辆。

- 此外,该地区各国政府正在采取倡议实施 ADAS 功能,从而刺激市场需求。例如,加拿大运输部发布了一份线上通知,征求有关 ADAS 监管更新的意见。具体来说,加拿大运输部正在考虑是否应透过法规强制执行高级驾驶员辅助功能,或不受监管并要求在车辆上安装时满足最低要求。

- 根据通知,ADAS的新安全要求将采取新的加拿大机动车辆安全标准的形式。这可能适用于校车、商用卡车和其他车辆,例如摩托车、汽车、卡车和客车。要求可能因车辆类型而异。

- BEA数据显示,2023年5月轻卡销量不到107万辆,低于4月份的逾107万辆,但较去年同月增长约23.06%,继续主导美国汽车市场它成为最大的部分。预计此类趋势将在预测期内推动北美汽车显示面板市场的发展。

汽车显示面板产业概况

汽车显示面板市场的竞争格局较为分散,现有和新兴厂商众多。汽车产业的技术发展预计将刺激投资和产品创新的增加。竞争对手正在透过制定对市场发展产生最佳整体效果的策略来积极应对挑战。在预测期内,市场成长机会有充足的开拓空间。

2024 年 1 月 - LG Display 在 CES 2024 上展示了一系列超大型汽车显示解决方案,其中包括全球最大的汽车显示器,以加速未来汽车的创新。该公司还展示了三款配备车载显示解决方案的概念车,该解决方案针对软体定义的车辆开发的每个阶段进行了最佳化。

2024年1月-在2024年消费性电子展上,大陆集团首次展示了其水晶中控显示器。全球首款高级车载显示器完全整合到时尚的水晶机壳中,具有无框架、透明的外观,为将简约奢华融入汽车内饰开闢了新的可能性。 10 吋显示器采用最新的 micro-LED 技术,可实现前所未有的亮度和对比度。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 科技趋势

- 产业供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 和其他宏观经济因素对市场的影响

第五章市场动态

- 市场驱动因素

- 对联网汽车的需求增加

- 严格的政府法规减少车祸

- 越来越关注提供 AR 体验

- 市场限制因素

- 高成本和复杂性

第六章 市场细分

- 显示面板

- 依技术

- a-Si LCD

- Oxide LCD

- LTPS LCD

- AMOLED

- 依技术

- 显示主机/集群

- 按用途

- 仪錶群

- 中控台

- 抬头显示器

- 其他用途

- 按用途

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 中东/非洲

- 拉丁美洲

第七章 竞争格局

- 公司简介-显示面板

- LG Display

- Samsung Display

- BOE

- Tianma

- Japan Display

- Innolux Corporation

- AUO

- Sharp Corporation

- Century

- IVO

- 公司简介 - 显示主机/集群

- Continental

- Nippon Seiki

- Denso

- Visteon

- Marelli

- Bosch

- Yazaki

- Faurecia

- Desay SV

- Foryou General Electronics

第八章 厂商排名分析

第九章 市场未来展望

The Automotive Display Panel Market size is estimated at USD 20.75 billion in 2024, and is expected to reach USD 28.84 billion by 2029, growing at a CAGR of 6.80% during the forecast period (2024-2029).

Key Highlights

- The automotive display panel market is witnessing robust growth due to increased demand for semi-autonomous and autonomous vehicles, improved consumer experience in vehicles, and high growth in luxury and high-end car segments, mainly in emerging markets. Consumers increasingly expect sophisticated vehicle infotainment systems, including touchscreens, navigation systems, and connectivity features.

- Automotive display panels serve multiple vehicle functions, providing information such as speed, fuel levels, navigation directions, and entertainment options. They also contribute to safety by displaying warnings and alerts for issues like low tire pressure or engine malfunctions. Additionally, they offer settings for various features like climate control and audio systems.

- Before microLED technology becomes mature for commercial use, miniLED-backlit LCD panels compete with OLED panels for application to high-end automotive displays. Market vendors are also innovating their offerings to provide solutions across various vehicles. For instance, LD Display announced plans to develop hybrid OLED panels for lower-cost cars.

- Hybrid OLED panels combine the strengths of OLED (organic light-emitting diode) and LCD (liquid crystal display) technology. OLED displays offer impressive visual quality with deep blacks, vivid colors, and excellent contrast. However, the manufacturing costs of OLED panels are traditionally higher than those of LCD panels. By integrating LCD elements into their hybrid OLED panels, LG Display aims to deliver superior visual performance while reducing production costs.

- Stricter safety regulations push automakers to include more advanced driver assistance systems (ADAS) in vehicles, often requiring display panels to convey critical information to drivers. In February 2024, UNECE's Working Party on Automated/Autonomous and Connected Vehicles adopted the draft of a new regulation that states provisions for the approval of vehicles with driver control assistance systems and provides minimum safety requirements for vehicles equipped with the advanced driver assistance system, such as lane keep assist.

- Similarly, the Indian government has been stressing enhanced car safety for years. After the mandatory six airbags rule, slated to be implemented in October 2024, the government contemplates making certain ADAS features mandatory on Indian cars. As per a recent report published in PTI, the Ministry of Road Transport and Highways (MoRTH) has drafted a new proposal to reduce road accidents in India. Such trends are expected to drive the market growth during the forecast period.

- Advanced display technologies can be expensive to implement, which may increase the overall cost of vehicles. This could deter price-sensitive consumers or manufacturers looking to keep production costs low. Also, integrating display panels into vehicles adds complexity to the manufacturing process and may require additional training for maintenance and repair technicians.

- Also, the ongoing Russia-Ukraine war has significantly impacted various industries, including the automotive sector. The disruption caused by the war has affected the growth of the automotive display panel market in several ways. The war has also caused shortages of raw materials in the automotive industry. Ukraine and Russia are major producers of commodities like aluminum and rare gases, essential for automotive manufacturing. The disruption in the supply of these raw materials has further affected the production of automotive display panels.

Automotive Display Panel Market Trends

The Heads-up Display Segment is Anticipated to Hold a Significant Market Share

- The head-up display or heads-up display, also known as a HUD, is a transparent display that displays data without requiring users to look away from their usual viewpoints. Head-up displays have been popular since the mid-20th century and were primarily used in aircraft. However, during the 1950s, attempts were made to test this technology for cars.

- Head-up displays were available in luxury cars earlier, but OEMs have made them standard even in economy cars. Japanese manufacturer Toyota launched a Camry with the largest windshield HUD compared to other cars. Toyota has also made windshield HUD as a standard for its Prius model.

- By providing real-time information in the driver's field of view, HUDs enhance the driving experience, making it more convenient and intuitive for drivers to access important data without taking their eyes off the road. According to WHO, around 1.35 million people die every year as a result of road traffic crashes. The HUD is a driver assistance system that reports timely events that conceal a potential risk to drivers and pedestrians.

- In May 2023, Cadillac Lyriq introduced an augmented reality heads-up display through a collaboration with Envisics, a startup, to incorporate a remarkable feature: an augmented reality (AR) head-up display. This innovative addition exemplifies Lyriq's commitment to integrating new technologies into its design.

North America Holds the Largest Market Share

- North America is expected to cater to a significant market share with its major production sites. The region's automotive industry is one of the most important in the world due to the size of the domestic market and the use of mass production techniques. Over the past decade, the region's auto industry has grown dramatically from manufacturing to distribution, changing consumer preferences and new technology, pushing the industry into a historical change.

- The region is home to various companies like Honda, Toyota, Ford, Chevrolet, and Tesla. It has been a pioneer in the automotive industry, especially in terms of automation, thus creating new opportunities for the vendors operating in the region. According to CAR - Center for Automotive Research, US motor vehicle production will reach 11.7 million units by 2025.

- Further, the government in the region is taking initiatives to implement ADAS features, boosting the market demand. For instance, Transport Canada posted an online notice seeking feedback on updating its regulations to include advanced driver assistance systems (ADAS). Specifically, Transport Canada is looking at whether advanced driver assistance features should be required by rules or left unregulated and meet a minimum set of requirements if they're on a vehicle.

- According to the notice, new safety requirements for ADAS would take the form of new Canada Motor Vehicle Safety Standards. That could apply to school buses, commercial trucks, and other vehicles such as motorcycles, cars, trucks, and passenger buses. Requirements could vary by vehicle type.

- According to BEA, at under 1.07 million unit sales, light trucks remained the most significant US auto market segment in May 2023, down from over 1.07 unit sales in April 2023 and up by approximately 23.06% Y-o-Y. Such trends are expected to boost the market for North American automotive display panels during the forecast period.

Automotive Display Panel Industry Overview

The competitive landscape of the automotive display panel market is fragmented due to many existing and emerging players. The technological developments in the automotive industry are expected to fuel the rise in investments and product innovations. The competitors proactively address the challenges by crafting strategies that can have the best overall effect on the market's progress. The market growth opportunities have ample scope for development in the forecast period.

January 2024 - LG Display showcased a series of ultra-large automotive display solutions, including the world's largest automotive display, to accelerate innovations for future cars at CES 2024. In addition, the company introduced three concept cars with automotive display solutions optimized for each phase of software-defined vehicle development.

January 2024 - At the Consumer Electronics Show in 2024, Continental AG displayed its Crystal Center Display for the first time. In the world's first, the premium automotive display is fully integrated into a sleek crystal housing, opening up new possibilities for integrating minimalist luxury into the vehicle's interior with its frameless and transparent appearance. The 10-inch display is equipped with the latest microLED technology, allowing unprecedented brightness and contrast.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technological Trends

- 4.3 Industry Supply Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Connected Cars

- 5.1.2 Stringent Government Regulations to Reduce Car Accidents

- 5.1.3 Increasing Focus to Provide AR Experience

- 5.2 Market Restraints

- 5.2.1 High Cost and Complexity

6 MARKET SEGMENTATION

- 6.1 Display Panel

- 6.1.1 By Technology

- 6.1.1.1 a-Si LCD

- 6.1.1.2 Oxide LCD

- 6.1.1.3 LTPS LCD

- 6.1.1.4 AMOLED

- 6.1.1 By Technology

- 6.2 Display Console/Cluster

- 6.2.1 By Application

- 6.2.1.1 Instrument Cluster

- 6.2.1.2 Center Stack

- 6.2.1.3 Heads-up Display

- 6.2.1.4 Other Applications

- 6.2.1 By Application

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Middle East and Africa

- 6.3.6 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles - Display Panel

- 7.1.1 LG Display

- 7.1.2 Samsung Display

- 7.1.3 BOE

- 7.1.4 Tianma

- 7.1.5 Japan Display

- 7.1.6 Innolux Corporation

- 7.1.7 AUO

- 7.1.8 Sharp Corporation

- 7.1.9 Century

- 7.1.10 IVO

- 7.2 Company Profiles - Display Console/Cluster

- 7.2.1 Continental

- 7.2.2 Nippon Seiki

- 7.2.3 Denso

- 7.2.4 Visteon

- 7.2.5 Marelli

- 7.2.6 Bosch

- 7.2.7 Yazaki

- 7.2.8 Faurecia

- 7.2.9 Desay SV

- 7.2.10 Foryou General Electronics