|

市场调查报告书

商品编码

1550335

工业离散半导体:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Industrial Discrete Semiconductor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

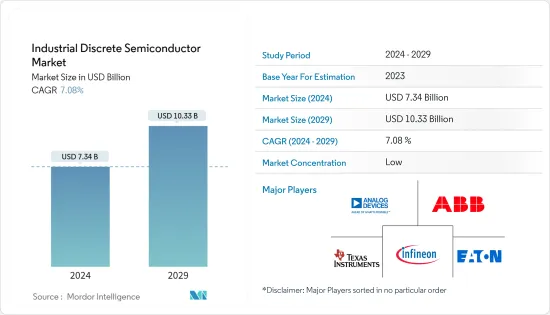

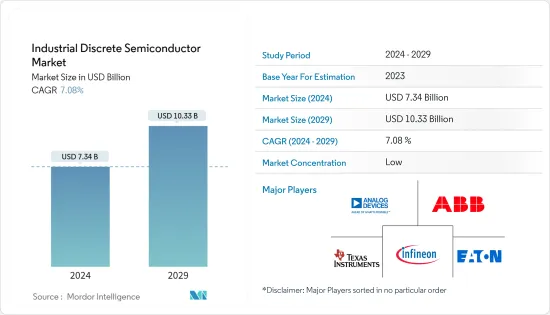

工业离散半导体市场规模预计到2024年为73.4亿美元,预计到2029年将达到103.3亿美元,在预测期内(2024-2029年)复合年增长率为7.08%。

主要亮点

- 工业离散半导体广泛应用于工业设备、製造设备、机械、UPS等。离散半导体在工业领域的主要应用是大型电池供电应用,例如堆高机、不断电系统(UPS)系统、太阳能逆变器,以及小型电力驱动系统(例如电动工具)。它还可以实现工业製程中的精确控制和自动化,例如功率调节、马达控制和感测器介面。

- 单一组件对于最大限度地提高工业系统的效率至关重要。这些特定组件可确保自动化系统各部分的稳定能源供应。此外,它还提高了工业自动化系统的速度和功能。此外,它的适应性允许轻鬆定制以提高整体性能。

- 工业物联网和工业 4.0 对于整个物流流程(也称为智慧工厂自动化)的推进、生产和监督至关重要。这些技术目前在工业领域处于领先地位,因为它们促进了机器和设备通过互联网的连接。

- 智慧工厂是工业领域的另一个显着趋势。智慧工厂可以显着提高生产力,并透过突破性的创新和技术投资帮助产业进入新市场。政府对工厂自动化投资的增加也推动了这一趋势。

- 例如,2023年10月,美国政府宣布将投资2,200万美元支持全国中小型设施的智慧製造。由总统两党基础设施法案资助的政府製造业领导计画将重点关注占美国碳排放六分之一以上的国内製造业的智慧製造技术和高性能运算。

- 工业领域对积体电路(也称为积体电路和微晶片)的需求不断增长可能会进一步阻碍市场成长。积体电路,也称为IC或微晶片,是一种将多个电子电路整合到单一半导体基板上的电子元件。另一方面,离散半导体是设计用来执行特定功能的电子元件,例如调节电流、放大讯号或开关。

- 俄罗斯和乌克兰之间的衝突导致价格大幅上涨,并限制了工业离散半导体生产所需的原材料的供应。此外,美国和中国之间不断升级的紧张局势导致微晶片和原材料短缺。工程供应链的中断会产生深远的影响,影响产品可用性并导致整个产业的成本飙升。

工业离散半导体市场趋势

功率电晶体领域占据主要市场占有率

- 由于其高效率和改进的性能,对工业离散半导体的需求正在增加。离散半导体在需要管理大电流和高电压的情况下发挥重要作用。

- 随着 IGBT 和 MOSFET 等功率电晶体被整合到马达驱动中,马达驱动变得更加高效。特别是,碳化硅 (SiC) MOSFET 越来越多地用于马达驱动功率级。 IGBT 和 SiC MOSFET 具有高额定电流和高电压,因此适用于高功率交流功率级应用。

- 然而,SiC MOSFET 与 IGBT 的不同之处在于开关频率要求。 IGBT 工作在较低的开关频率范围,而 SiC MOSFET 则工作在较高的开关频率范围。较高频率的开关可带来功率密度、效率和散热等系统优势。

- 快速发展的工业 4.0 趋势为市场参与企业创造了许多机会,也是推动马达驱动应用中对 IGBT 需求的因素之一。许多公司不断用先进的马达驱动器取代传统马达,以简化操作并提高产量。

- 例如,2023年7月,Nexperia进入绝缘栅双极电晶体(IGBT)市场,推出了以30A NGW30T60M3DF为首的一系列600V元件。这些元件用于各种应用,包括电源转换、马达驱动、UPS、20kHz 的 5kW 至 20kW伺服马达、机器人、夹具、电梯、电源逆变器、光伏串以及感应加热和焊接等工业应用。 。

- 世界各地的工业部门都见证了自动化程度的提高作为一个突出趋势,这为在该市场运营的供应商带来了新的机会。据工业机器人联合会称,全球对工业机器人的需求正在稳步增长。例如,上年度全球工业机器人市场预计将成长7%,达到全球超过59万台。

- 同样,根据 vdma.org 的数据,去年德国机器人和自动化产业的国内和出口销售额合计约为 175.8 亿美元,预计将比去年有所成长。

预计中国将占较大市场占有率

- 这些年来,中国经济发生了重大变化。中国政府实施的各项政策,以提高经济付加值为目标,对促进各产业发展发挥了重要作用。

- 中国工业部门的快速扩张使中国成为全球製造业的重要参与者。为了继续促进该行业的成长,中国政府近年来实施了各种策略,包括「中国製造2025」倡议。该计划旨在鼓励工业企业采用先进技术,提高生产效率并维持国际品质标准。

- 同样,2024年4月,中国工业和资讯化部等六部门公布了促进工业领域装备更新换代的实施方案。

- 中国製造业的工业装备更新倡议范围广泛,包括更新落后设备,特别是10年以上的工具机,加强航太、太阳能、电池等重点领域的装备建设。融合、促进环境永续性的绿色科技的采用等各个方面。因此,这些新兴市场的开拓有望创造新的机会。

- 2023年世界机器人大会报告显示,中国机器人产业取得了令人瞩目的发展。 2022年,产业销售额突破1,700亿元人民币(折合233亿美元)。此外,2022年中国工业机器人销售将占全球市场占有率一半以上,并连续10年维持全球第一。

- 中国的特点是工业活动活性化和製造业增加。例如,根据中国国家统计局的资料,2023年,中国工业部门对国内生产毛额的贡献率将达到31.7%左右,成为经济成长的主要引擎。必须强调的是,中国作为世界第二大经济体,光是其工业部门创造的价值就比德国整个经济创造的价值还要多。

工业离散半导体产业概况

工业离散半导体市场分散且由多个参与者组成。该市场中的公司不断努力透过推出新产品、扩大业务、策略性收购/合併、联盟和合作来提高其在市场上的影响力。主要供应商包括 ABB Ltd、Infineon Technologies AG、Texas Instruments Inc.、Analog Devices Inc. 和 Eaton Corporation PLC。

- 2024 年 6 月:三菱电机公司宣布推出最新产品,内建肖特基势垒二极体 (SBD) 的 3.3kV/400A 和 3.3kV/200A 碳化硅 (SiC) 金属氧化物半导体场场效电晶体(MOSFET) 模组。这些模组专为铁路车辆和电力系统等重型工业应用而客製化。

- 2024 年 5 月:英飞凌科技将 SiC MOSFET 开发范围扩大到电压低于 650V。今年稍早宣布推出的 CoolSiCMOSFET 400V 系列基于第二代 (G2) 技术,是该公司的最新产品。这款新的 MOSFET 系列专用于 AI 伺服器的 AC/DC 阶段,符合英飞凌最近的 PSU蓝图。除了伺服器应用之外,这些装置还用于逆变器马达控制、能源储存系统和 SMPS。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- COVID-19副作用和其他宏观经济因素对市场的影响

第五章市场动态

- 市场驱动因素

- 工业自动化对高能源效率设备的需求不断增长

- 工业领域更多采用自动化和机器人技术

- 市场挑战

- 积体电路需求增加

第六章 市场细分

- 按类型

- 二极体

- 小讯号电晶体

- 功率电晶体

- MOSFET功率晶体管

- IGBT功率电晶体

- 其他功率电晶体

- 整流器

- 闸流体

- 按地区

- 美国

- 欧洲

- 日本

- 中国

- 韩国

- 台湾

第七章 竞争格局

- 公司简介

- ABB Ltd

- On Semiconductor Corporation

- Infineon Technologies AG

- STMicroelectronics NV

- Toshiba Electronic Devices and Storage Corporation

- NXP Semiconductors NV

- Diodes Incorporated

- Nexperia BV

- Semikron Danfoss Holding A/S(Danfoss A/S)

- Eaton Corporation PLC

- Hitachi Energy Ltd(Hitachi Ltd)

- Texas Instrument Inc.

- Wolfspeed Inc.

- Microchip Technology

- Renesas Electronics Corporation

- Mitsubishi Electric Corporation

- Analog Devices Inc.

- Vishay Intertechnology Inc.

- Rohm Co. Ltd

- Littelfuse Inc.

第八章投资分析

第九章 市场机会及未来趋势

The Industrial Discrete Semiconductor Market size is estimated at USD 7.34 billion in 2024, and is expected to reach USD 10.33 billion by 2029, growing at a CAGR of 7.08% during the forecast period (2024-2029).

Key Highlights

- Industrial discrete semiconductors are widely used in industrial equipment, manufacturing equipment and machines, UPS, etc. The primary use of discrete semiconductors in the industrial sector is in large battery-driven applications, such as forklifts, uninterruptible power supply (UPS) systems, solar inverters, and smaller power-driven systems, like power tools. They also enable precise control and automation in industrial processes, such as power regulation, motor control, and sensor interfacing.

- It is essential to have individual components to maximize the effectiveness of industrial systems. These particular components guarantee a consistent energy supply to various parts of automated systems. Moreover, they boost the speed and functionality of industrial automation systems. In addition, their adaptability allows for simple customization to enhance overall performance.

- The industrial Internet of Things and Industry 4.0 is pivotal in advancing, manufacturing, and supervising the complete logistics process, also called smart factory automation. These technologies are currently leading the way in the industrial sector, as they facilitate the connection of machinery and devices through the internet.

- Smart factories are another prominent trend in the industrial sector. Smart factories help generate significant productivity gains and help industries make new markets accessible through breakthrough innovations and technological investments. The rising government investment in factory automation also supports the trend.

- For instance, in October 2023, the government of the United States announced that it would invest USD 22 million to support smart manufacturing at small and medium-sized facilities across the nation. The administration's Manufacturing Leadership Program, funded by the President's Bipartisan Infrastructure Act, aims to make smart manufacturing technologies and high-performance computing more available in the domestic manufacturing sector, accounting for more than one-sixth of the US carbon emissions.

- Rising demand for integrated circuits, also known as ICs or microchips, in the industrial sector will further hamper the market's growth. Integrated circuits, also known as ICs or microchips, are electronic components that integrate multiple electronic circuits onto a single semiconductor substrate. In contrast, discrete semiconductors are electronic components designed to carry out specific functions like regulating current flow, amplifying signals, and switching.

- The conflict between Russia and Ukraine has caused a notable price surge, constraining the availability of raw materials essential for manufacturing industrial discrete semiconductors. Additionally, escalating tensions between the United States and China have resulted in shortages of microchips and raw materials. The disturbance in the supply chain for engineering has had widespread implications, impacting product availability and causing a sharp increase in costs throughout the industry.

Industrial Discrete Semiconductor Market Trends

Power Transistor Segment Holds the Significant Market Share

- The demand for discrete semiconductors in the industrial sector is increasing as they offer high efficiency and performance improvements. They hold a crucial position in circumstances that require the management of high currents or voltages.

- The efficiency of motor drives is increasing as power transistors like IGBTs and MOSFETs are incorporated into them. Particularly, silicon carbide (SiC) MOSFETs are increasingly used in the power stage for motor drives. Due to their high current and high voltage ratings, IGBTs and SiC MOSFETs fit well in high-power AC power stage applications.

- SiC MOSFETs, however, differ from IGBTs in the switching frequency requirement. While IGBTs operate in a lower switching frequency range, SiC MOSFETs operate in a much higher switching frequency range. Switching at higher frequencies allows system benefits such as higher power density, efficiency, and heat dissipation.

- The rapidly advancing trend of Industry 4.0 has created a stream of opportunities for market participants, which is one of the factors driving the need for IGBTs in motor drive applications. Many businesses continue replacing conventional motors with advanced motor drives to simplify operations and improve output.

- For instance, in July 2023, Nexperia entered the insulated gate bipolar transistor (IGBT) market by introducing a series of 600 V devices led by the 30 A NGW30T60M3DF. These devices are designed to enhance power density in various applications, including power conversion, motor drives, and industrial uses such as UPS, servo motors ranging from 5kW to 20 kW at 20 kHz, robotics, grippers, elevators, power inverters, photovoltaic strings, and induction heating and welding.

- The industrial sector across the globe is witnessing a rise in automation as a prominent trend, thus creating new opportunities for the vendors operating in the market. According to the Industrial Federation of Robotics, the demand for industrial robots is witnessing stable growth globally. For instance, in the previous year, the global market for industrial robots was expected to grow by 7% to more than 590,000 units worldwide.

- Similarly, according to vdma.org, last year, the German robotics and automation industries were forecast to record a combined domestic and export turnover of around USD 17.58 billion, an increase from the year before that.

China is Expected to Hold the Significant Market Share

- China's economy has experienced substantial changes throughout the years. The policies implemented by the Chinese government have played a crucial role in fostering growth across different industries, with the goal of advancing the economy to higher-value-added activities.

- The rapid expansion of the industrial sector in China has positioned the country as a key player in global manufacturing. To continue fostering growth in this sector, the Chinese government has implemented various strategies in recent years, such as the 'Made in China 2025' initiative. This program aims to promote industrial companies' adoption of advanced technologies to improve production efficiency and uphold international quality standards.

- Similarly, in April 2024, China's Ministry of Industry and Information Technology (MIIT) and six other departments released a notice unveiling the Implementation Plan for Advancing Equipment Renewal in the industrial sector.

- The scope of China's initiative to upgrade industrial equipment in manufacturing is extensive, covering various aspects such as substitution of outdated equipment, particularly machine tools that have been in use for over a decade; enhancement of equipment in critical sectors like aerospace, solar energy, and battery manufacturing; integration of industrial robots and the industrial internet; and adoption of green technology to promote environmental sustainability. As a result, these developments are expected to create new opportunities within the market.

- According to the 2023 World Robot Conference report, China's robotics sector has made remarkable advancements. In 2022, the industry generated a revenue of over 170 billion yuan (equivalent to USD 23.3 billion). Moreover, China's sales of industrial robots accounted for more than half of the global market share in 2022, maintaining its position as the top global leader for ten consecutive years.

- China is characterized by a rise in industrial operations and an increase in manufacturing. For instance, data from the National Bureau of Statistics of China revealed that in 2023, China's industrial sector contributed around 31.7% to the nation's GDP, serving as the main engine of economic growth. It is essential to highlight that China, as the world's second-largest economy, produced more value from its industrial sector alone than the entire economy of Germany.

Industrial Discrete Semiconductor Industry Overview

The industrial discrete semiconductor market is fragmented and consists of several players. Companies in the market continuously try to increase their market presence by introducing new products, expanding their operations, or entering into strategic acquisitions and mergers, partnerships, and collaborations. Some of the major vendors include ABB Ltd, Infineon Technologies AG, Texas Instruments Inc., Analog Devices Inc., Eaton Corporation PLC, and many more.

- June 2024: Mitsubishi Electric Corporation started shipping its newest products: a 3.3kV/400A and a 3.3kV/200A model of a Schottky barrier diode (SBD) integrated silicon carbide (SiC) metal-oxide-semiconductor field-effect transistor (MOSFET) module. These modules are tailored for heavy-duty industrial applications, such as rolling stock and electric power systems.

- May 2024: Infineon Technologies broadened its SiC MOSFET development to cover voltages lower than 650 V. The introduction of the CoolSiCMOSFET 400 V family, based on the second-generation (G2) technology released earlier this year, marks the company's latest offering. This new lineup of MOSFETs is tailored explicitly for the AC/DC stage of AI servers, which is in line with Infineon's recent PSU roadmap. Apart from server applications, these devices also serve a purpose in inverter motor control, solar and energy storage systems and SMPS.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for High-energy and Power-efficient Devices in the Industrial Automation

- 5.1.2 Increasing Adoption of Automation and Robotics in the Industrial Sector

- 5.2 Market Challenges

- 5.2.1 Rising Demand for Integrated Circuits

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Diode

- 6.1.2 Small Signal Transistors

- 6.1.3 Power Transistors

- 6.1.3.1 MOSFET Power Transistors

- 6.1.3.2 IGBT Power Transistors

- 6.1.3.3 Other Power Transistors

- 6.1.4 Rectifier

- 6.1.5 Thyristor

- 6.2 By Geography

- 6.2.1 United States

- 6.2.2 Europe

- 6.2.3 Japan

- 6.2.4 China

- 6.2.5 South Korea

- 6.2.6 Taiwan

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 On Semiconductor Corporation

- 7.1.3 Infineon Technologies AG

- 7.1.4 STMicroelectronics NV

- 7.1.5 Toshiba Electronic Devices and Storage Corporation

- 7.1.6 NXP Semiconductors NV

- 7.1.7 Diodes Incorporated

- 7.1.8 Nexperia BV

- 7.1.9 Semikron Danfoss Holding A/S (Danfoss A/S)

- 7.1.10 Eaton Corporation PLC

- 7.1.11 Hitachi Energy Ltd (Hitachi Ltd)

- 7.1.12 Texas Instrument Inc.

- 7.1.13 Wolfspeed Inc.

- 7.1.14 Microchip Technology

- 7.1.15 Renesas Electronics Corporation

- 7.1.16 Mitsubishi Electric Corporation

- 7.1.17 Analog Devices Inc.

- 7.1.18 Vishay Intertechnology Inc.

- 7.1.19 Rohm Co. Ltd

- 7.1.20 Littelfuse Inc.