|

市场调查报告书

商品编码

1624594

拉丁美洲的药品包装:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Latin America Pharmaceutical Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

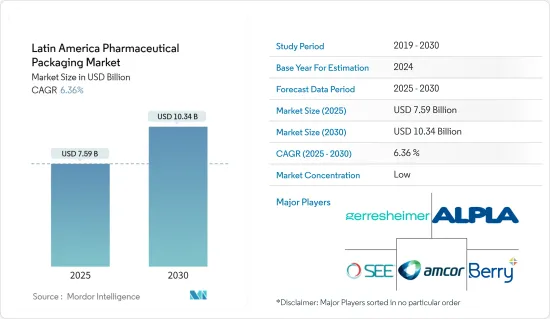

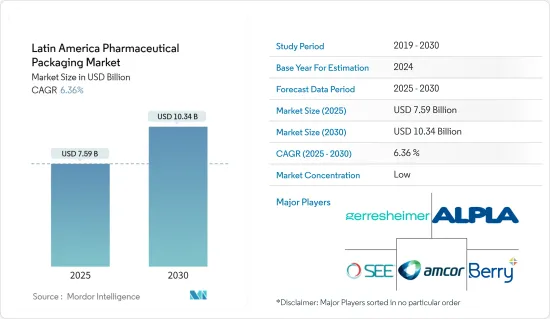

拉丁美洲药品包装市场规模预计到2025年为75.9亿美元,预计到2030年将达到103.4亿美元,预测期内(2025-2030年)复合年增长率为6.36%。

主要亮点

- 药品包装对于药品整个生命週期的展示、保护、识别和遏制至关重要。轻鬆储存、运输和展示产品,同时确保在消费前符合监管标准。正确的包装可以保护药品免受各种环境因素的影响,包括气候、生物、物理和化学条件。为了达到最佳效果,药品包装必须具有成本效益,并在产品的整个保质期内提供足够的稳定性。包装材料和产品类型的选择是基于药品的特定特性,确保所选包装提供足够的保护、清晰的标誌并保持封装药品的完整性。

- 由于该地区的经济成长和都市化,对拉丁美洲药品包装行业的需求正在增加。需要持续医疗照护的老年人数量不断增加也推动了这一趋势。随着药品製造业的发展势头,该地区的包装供应商将能够挖掘市场的巨大潜力。外国投资、本地生产增加和新产品开发正在促进该地区包装产业的成长。因此,预计拉丁美洲很快将继续成为药品包装的主要市场。

- 拉丁美洲的製药业是该地区规模最大、资本最密集的产业之一。研究与开发 (R&D) 在创新药物的开发中发挥关键作用,并在过去二十年中为提高拉丁美洲的预期寿命做出了贡献。这种对研究和开发的关注导致了治疗方法和治疗方法的重大进步,以解决该地区特有的各种健康挑战。

- 传统上,拉美医药市场一直由西欧和美国的大型跨国公司主导。这些老字型大小企业利用其广泛的资源、全球研究网络和先进的製造能力,在该地区保持强大的影响力。然而,近年来,该行业的新进业者开始改变这一格局。

- 这些新参与企业包括来自中国、印度和韩国的跨国公司,带来了不同的药物开发和製造方法。此外,拉丁美洲开发中国家正在兴起专门从事学名药和利基治疗领域的本土公司。市场参与企业的多元化可以增加竞争、促进创新并改善拉丁美洲人民获得药物的机会。拉丁美洲不断变化的製药业格局为老牌公司和新兴企业带来了机会和挑战。随着市场的不断发展,法规环境、智慧财产权、医疗政策等因素将在很大程度上决定该地区产业的未来。

- 拉丁美洲製药工业协会 (ALIFAR) 是一个独立于政府和政府间组织运作的非营利国际组织。它代表整个拉丁美洲的国家製药公司。 ALIFAR 拥有来自 12 个拉丁美洲国家的 400 多名会员,占该地区医药市场 90% 以上。 ALIFAR在维护会员企业利益、促进拉美医药产业发展方面发挥重要作用。 ALIFAR 促进其成员之间的合作,共用最佳实践,并解决该地区製药业面临的通用挑战。

- 人口成长、预期寿命延长和慢性病增加推动了拉丁美洲药品需求的成长。製药业的这些需求和技术进步与对瓶子、安瓿和其他容器等包装解决方案不断增长的需求直接相关。因此,拉丁美洲药品包装市场经历了显着成长。包装材料和包装解决方案製造商必须适应行业不断变化的要求,包括药品稳定性、安全性和遵守监管标准。

- 与药品包装原料相关的环境问题可能会限制市场,但也为该地区製药业的包装创新带来了机会。人们对永续性的日益关注使得传统包装材料受到越来越严格的审查,促使製造商寻求环保的替代品。虽然这种转变带来了成本和法规遵循挑战,但它也为开发新的环保包装解决方案开闢了道路。

- 公司正在投资研发,以开发生物分解性材料、减少塑胶使用并提高药品包装的可回收性。这些努力是为了应对环境问题,并符合不断变化的消费者偏好和监管要求。因此,该行业见证了创新包装设计的激增,这些设计既保持了产品的完整性,又最大限度地减少了对环境的影响,为具有前瞻性的公司创造了新的细分市场和竞争优势。

拉丁美洲药品包装市场趋势

塑胶瓶占较大市场占有率

- 塑胶因其多功能性、耐用性、灵活性和永续性而广泛应用于药品包装。由多种材料製成的塑胶瓶用于药品包装,包括聚氯乙烯、聚乙烯、聚丙烯和聚苯乙烯。该行业依靠透明、耐用且轻质的塑料来储存和分配。这些塑胶材质具有难以破碎、易于模製成各种形状和尺寸、且与多种医药产品相容的优点。

- 此外,塑胶包装有助于保护药品免受湿气、光线和污染物的影响,确保产品完整性并延长保质期。在药品包装中使用塑胶也有助于提高製造和运输的成本效益,因为它通常比玻璃或金属等替代材料更轻、更经济。

- 塑胶瓶广泛用于包装各种液体和固态药物,如糖浆、胶囊、锭剂和眼用製剂等。製药业青睐塑胶包装,因为它强度大、重量轻且灵活,可以适应各种形状和尺寸。由于技术进步以及口服固态和液体药品越来越多地采用塑胶容器,医药塑胶瓶市场正在扩大。

- 用于製药应用的塑胶必须无毒、非致癌性、生物相容且对生物环境无害。这些严格的要求确保了药品的安全性和有效性。在药物开发过程中,进行了严格的测试,以确保PET包装材料不会浸出或提取到药物中。此测试对于防止包装和药物内容物之间的污染和交互作用非常重要。 宝特瓶提供有效的防油层,防止运送过程中化学物质溢出。这种阻隔性能对于维持液体药物的完整性和防止外部污染非常重要。此外,PET 包装耐用且不易破损,这是可能暴露于各种处理和运输条件下的药品容器的基本品质。

- 药用塑胶瓶的需求不断增加,影响了拉丁美洲塑胶瓶市场的估值。 2023年,拉丁美洲和加勒比海地区药品出口总合达到约93亿美元,创下分析期间该地区药品出口额的最高水准。 2022年,墨西哥将在药品出口方面领先拉丁美洲国家。此外,据预测,越来越多地采用含营养药物可能会促进固态包装的成长。公众对营养强化以维持人体营养平衡的认识的提高预计将推动该地区营养食品的消费并推动对塑胶瓶的需求。

- 有眼疾的人通常会使用滴管瓶。这些专用容器可以精确计量眼科药物和溶液。 Gerresheimer 等公司为各种应用提供医药塑胶包装,包括固态、液体和眼科产品。该公司的产品范围包括用于液体製剂和眼药水的 宝特瓶。这些瓶子旨在满足储存和分配眼科药物的特定要求,确保正确剂量并保持产品完整性。随着该地区眼睛相关疾病的盛行率持续上升,滴管瓶在眼科应用中的使用变得越来越重要。

墨西哥预计将经历显着成长

- 墨西哥是拉丁美洲医药市场占有率的主要贡献者。作为该地区製药业的成熟市场,墨西哥正在经历许多产品创新,特别是在药品包装方面。这项创新由遍布墨西哥的大型供应商提供支援。在强大的医疗保健系统以及对学名药和品牌药品不断增长的需求的支持下,墨西哥的药品市场正在稳步增长。

- 该国的战略定位和北美自由贸易组织(NAFTA)贸易协定(现为 USMCA)等贸易协定进一步使其成为该地区製药领域的重要参与者。最近的趋势包括墨西哥的药物研发活动增加,国内外公司投资当地设施。这增加了高品质、具有成本效益的药品的产量,并进一步巩固了墨西哥在拉丁美洲药品市场的地位。

- 墨西哥製药业的包装产业尤其充满活力。该领域的创新重点是提高药物安全性、延长保质期和提高患者依从性。这些先进的包装包括智慧包装解决方案、环保材料以及满足不同病患小组需求的设计。儘管面临监管复杂性和来自其他新兴市场的竞争等挑战,墨西哥製药业仍在不断发展和适应。凭藉对创新的承诺和成熟的製造能力,墨西哥在拉丁美洲製药市场的持续成长和影响力方面处于有利地位。

- 墨西哥的医疗保健产业主要是价格主导的,国内产品在政府销售上具有价格优势。公司必须遵守所有卫生註册标准以确保品质。外国公司应考虑削减成本的措施,并在行销和促销材料中强调新技术的好处。 2023年,墨西哥药品销售额将达到约108.3亿美元,高于2022年的101.2亿美元。该地区药品生产的扩大、非处方药供应量的增加以及当地公司的大量投资正在促进巴西製药业的显着增长。这些趋势加上出口的增加,预计将导致全国对药品包装的需求增加。

- 医疗保健成本的上升以及医院和製药製造商等最终用户日益增长的偏好预计将在预测期内推动墨西哥的产品使用。与其他玻璃容器一样,管瓶易于回收,并被认为是环保的。随着最终用户从传统容器转向管瓶,该国的医疗和保健产业对这些产品的需求旺盛。

拉丁美洲药品包装产业概况

由于现有公司专注于创新和收购,拉丁美洲药品包装市场变得支离破碎。 Amcor Group GmbH、Berry Global Inc. 和 Schott AG 等公司投入大量资源和资金来研发新产品、解决环境问题并确保政府合规。

- 2024 年 5 月 - 德国製药和保健品包装专家 Gerresheimer 计划扩建其在墨西哥克雷塔罗的工厂。此扩建旨在提高RTF(即用型)注射器的产能,并满足北美市场对优质注射器的需求。这些预充式玻璃注射器专为注射生物製药而设计,包括用于肥胖管理的Glucagon-Like Peptide-1製剂。扩建工程将于 2023 年 11 月举行奠基仪式,Gerresheimer 将在该计划中投资约 1 亿欧元(1.06 亿美元)。

- 2023 年 11 月 - Amkor 推出单 PE 层压板来製造可在聚乙烯流中回收的全薄膜医疗包装。据报道,这项创新减少了包装的碳排放,同时确保患者安全。该薄膜预计将为 3D 热成型包装提供可回收的盖子,其中包括手术单、保护器、导管、注射和管道系统等。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场动态

- 市场驱动因素

- 国内药品产量增加

- 增加对该地区製药和包装行业的直接投资

- 市场限制因素

- 与药品包装原料相关的环境问题

- 原物料价格波动

第六章 市场细分

- 按包装材料分

- 塑胶

- 玻璃

- 金属

- 纸

- 依产品类型

- 泡壳包装

- 塑胶瓶

- 预充式註射器

- 管瓶和安瓿

- 密闭容器

- 容器

- 其他产品类型

- 按国家/地区

- 巴西

- 墨西哥

- 哥伦比亚

- 阿根廷

第七章 竞争格局

- 公司简介

- Amcor Group GmbH

- Sealed Air Corporation

- Berry Global Inc.

- Schott AG

- Gerresheimer AG

- Aptar Group Inc.

- ALPLA Werke Alwin Lehner GmbH & Co KG

- Pretium Packaging

- Silgan Holdings Inc.

- Greiner Packaging International GmbH

第八章投资分析

第9章市场的未来

The Latin America Pharmaceutical Packaging Market size is estimated at USD 7.59 billion in 2025, and is expected to reach USD 10.34 billion by 2030, at a CAGR of 6.36% during the forecast period (2025-2030).

Key Highlights

- Pharmaceutical packaging is crucial in drug product presentation, protection, identification, and containment throughout their lifecycle. It facilitates storage, transport, and display while ensuring compliance with regulatory standards until the product is consumed. Adequate packaging shields the drug from various environmental factors, including climatic, biological, physical, and chemical conditions. To be optimal, pharmaceutical packaging must be cost-effective and provide adequate stability throughout the product's shelf life. The selection of packaging materials and types is based on the specific nature of the drug, ensuring that the chosen packaging offers appropriate protection and clear identification and maintains the integrity of the enclosed pharmaceutical product.

- The pharmaceutical packaging industry in Latin America is experiencing increased demand driven by the region's expanding economies and urbanising population. The growing elderly demographic requiring continuous medical care further fuels this trend. As the pharmaceutical manufacturing sector gains momentum, packaging vendors in the region can capitalise on the market's significant potential. Foreign investments, rising local production, and new product development contribute to the growth of the regional packaging industry. Consequently, Latin America is expected to remain a key market for pharmaceutical packaging shortly.

- The pharmaceutical industry in Latin America stands as one of the region's largest and most capital-intensive sectors. Research and development (R&D) plays a crucial role in developing innovative drugs, contributing to increased life expectancy in Latin America over the past two decades, albeit at a high cost. This focus on R&D has led to significant advancements in medical treatments and therapies, addressing various health challenges specific to the region.

- Traditionally, large multinational companies from Western Europe and the United States have dominated the pharmaceutical market in Latin America. These established firms have leveraged their extensive resources, global research networks, and advanced manufacturing capabilities to maintain a strong regional presence. However, in recent years, the landscape has begun to shift with the entry of new players into the industry.

- These new entrants include multinational companies from China, India, and South Korea, bringing different drug development and manufacturing approaches. Additionally, local firms from several developing countries within Latin America have emerged, often focusing on generic drugs or niche therapeutic areas. This diversification of market participants has led to increased competition, potentially driving innovation and improving access to medicines for Latin American populations.The evolving pharmaceutical landscape in Latin America presents opportunities and challenges for established and emerging companies. As the market continues to develop, factors such as regulatory environments, intellectual property rights, and healthcare policies will significantly shape the industry's future in the region.

- ALIFAR, the Latin American Association of Pharmaceutical Industries, is a non-profit international organisation operating independently from governmental and intergovernmental bodies. It represents nationally owned pharmaceutical companies across Latin America. ALIFAR's membership encompasses over 400 companies from 12 Latin American countries, accounting for over 90% of the region's pharmaceutical market. The organization plays a crucial role in advocating for the interests of its member companies and promoting the development of the pharmaceutical industry in Latin America. ALIFAR works to foster collaboration among its members, share best practices, and address common challenges faced by the industry in the region.

- The growing demand for pharmaceutical drugs and medicines in Latin America has been driven by population growth, increasing life expectancy, and a rising prevalence of chronic diseases. This demand and technological advancements in the pharmaceutical industry have directly led to an increased need for packaging solutions such as bottles, ampules, and other containers. The pharmaceutical packaging market in Latin America has consequently experienced significant growth. Manufacturers of packaging materials and solutions have had to adapt to meet the industry's evolving requirements, including considerations for drug stability, safety, and compliance with regulatory standards.

- Environmental concerns related to pharmaceutical packaging raw materials may limit the market but also provide opportunities for innovation in packaging within the pharmaceutical industry in the region. The increasing focus on sustainability has heightened scrutiny of traditional packaging materials, prompting manufacturers to explore eco-friendly alternatives. This shift presents cost and regulatory compliance challenges but also opens avenues for developing novel, environmentally responsible packaging solutions.

- Companies are investing in research and development to create biodegradable materials, reduce plastic usage, and improve the recyclability of pharmaceutical packaging. These efforts address environmental concerns and align with changing consumer preferences and regulatory requirements. As a result, the industry is witnessing a surge in innovative packaging designs that maintain product integrity while minimising environmental impact, potentially creating new market segments and competitive advantages for forward-thinking companies.

Latin America Pharmaceutical Packaging Market Trends

Plastic Bottles to Hold Significant Market Share

- Plastic is widely used in pharmaceutical packaging due to its versatility, durability, flexibility, and sustainability. Pharmaceutical packaging employs plastic bottles made from various materials, including polyvinyl chloride, polyethene, polypropylene, and polystyrene. The industry utilises transparent, durable, lightweight plastic for storage and distribution. These plastic materials offer several advantages, such as resistance to breakage, ease of moulding into various shapes and sizes, and compatibility with a wide range of pharmaceutical products.

- Additionally, plastic packaging helps protect medications from moisture, light, and contaminants, ensuring product integrity and extending shelf life. The use of plastic in pharmaceutical packaging also contributes to cost-effectiveness in manufacturing and transportation, as it is generally lighter and more economical than alternative materials like glass or metal.

- Plastic bottles are extensively utilised for packaging various liquid and solid medicines, including syrups, capsules, tablets, and ophthalmic preparations. The pharmaceutical industry favours plastic packaging due to its strength, lightweight nature, and flexibility, allowing for diverse forms and sizes. The market for pharmaceutical plastic bottles has expanded, driven by technological advancements and the increased adoption of plastic containers for oral solid and liquid medications.

- Plastics in pharmaceutical applications must be non-toxic, non-carcinogenic, biocompatible, and harmless to the biological environment. These stringent requirements ensure the safety and efficacy of pharmaceutical products. The drug development process includes rigorous testing of PET packaging for leaching and extractability in conjunction with the drug. This testing is crucial to prevent contamination or interaction between the packaging and the pharmaceutical contents. PET bottles provide an effective oil barrier, helping to resist chemical spills during transport. This barrier property is significant for maintaining the integrity of liquid medications and preventing contamination from external sources. Additionally, PET packaging offers durability and resistance to breakage, essential qualities for pharmaceutical containers that may be subject to various handling and transportation conditions.

- The demand for pharmaceutical plastic bottles has increased, impacting the market valuation of plastic bottles in Latin America. In 2023, the combined value of pharmaceutical exports from Latin America and the Caribbean reached approximately USD 9.3 billion, marking the region's highest level of pharmaceutical exports during the analyzed period. In 2022, Mexico led Latin American countries in pharmaceutical export value.Further, it is anticipated that the growth of solid containers may be aided due to the increased adoption of medicines containing nutrients. The increasing awareness of nutritional enrichment among working professionals for maintaining balanced nutrition in the human body is anticipated to promote the consumption of dietary supplements and drive demand for plastic bottles in the region.

- Individuals with eye conditions commonly use dropper bottles. These specialised containers allow for the precise administration of eye medications and solutions. Companies like Gerresheimer provide pharmaceutical plastic packaging for various applications, including solid, liquid, and ophthalmic products. Their product range includes PET bottles for liquid dosage forms and ophthalmic solutions. These bottles are engineered to meet specific requirements for preserving and dispensing eye medications, ensuring proper dosage and maintaining product integrity. The use of dropper bottles in ophthalmic applications has become increasingly important as the prevalence of eye-related disorders continues to rise in the region.

Mwxico is Expected to Witness Significant Growth

- Mexico is a significant contributor to the pharmaceutical market share in Latin America. As a mature market in the region's pharmaceutical industry, Mexico has experienced numerous product innovations, particularly in pharmaceutical packaging. This innovation is driven by the presence of significant vendors throughout the country. The Mexican pharmaceutical market has grown steadily, supported by a robust healthcare system and increasing demand for generic and branded medications.

- The country's strategic location and trade agreements, such as NAFTA (now USMCA), have further enhanced its position as a critical player in the regional pharmaceutical landscape. In recent years, Mexico has seen a rise in pharmaceutical research and development activities, with domestic and international companies investing in local facilities. This has increased the production of high-quality, cost-effective medications, further solidifying Mexico's position in the Latin American pharmaceutical market.

- The packaging sector within Mexico's pharmaceutical industry has been particularly dynamic. Innovations in this area have focused on improving drug safety, extending shelf life, and enhancing patient compliance. These advancements include intelligent packaging solutions, eco-friendly materials, and designs catering to different patient groups' needs. Despite challenges such as regulatory complexities and competition from other emerging markets, Mexico's pharmaceutical industry continues to evolve and adapt. The country's commitment to innovation and established manufacturing capabilities position it well for continued growth and influence in the Latin American pharmaceutical market.

- The Mexican healthcare industry is primarily price-driven, with domestically produced goods having a pricing advantage in government sales. Businesses must comply with all sanitary registration standards to ensure quality. Foreign companies should consider cost-cutting measures and highlight the benefits of new technology in their marketing and promotional materials. In 2023, Mexico's pharmaceutical product sales reached approximately USD 10.83 billion, an increase from USD 10.12 billion in 2022. The region's expanding pharmaceutical production, increased availability of over-the-counter medicines, and significant investments by local businesses contribute to the substantial growth of the Brazilian pharmaceutical sector. These trends are expected to lead to an increase in pharmaceutical packaging demand nationwide, along with growing exports.

- The increasing cost of healthcare and the growing preference among end-users such as hospitals and pharmaceutical manufacturers are expected to drive product usage in Mexico during the forecast period. Vials, like other glass containers, are easily recyclable and considered environmentally friendly. The medical and healthcare sectors in the country are experiencing a lucrative demand for these products due to end-users' shift from conventional containers to vials.

Latin America Pharmaceutical Packaging Industry Overview

The pharmaceutical packaging market in Latin America is fragmented, as established companies focus on innovation and acquisition. Companies like Amcor Group GmbH, Berry Global Inc., Schott AG. invest a lot of their resources and money in Research and development to innovate new products, meet with the environment, and ensure government compliance.

- May 2024 - Gerresheimer, a Germany-based company specialising in pharmaceutical and healthcare packaging, is set to expand its facility in Queretaro, Mexico. This expansion aims to boost production capacities for ready-to-fill (RTF) syringes, addressing the North American market's demand for premium syringes. These prefillable glass syringes are designed for injectable biopharmaceuticals, including glucagon-like peptide-1 drugs for obesity management. The expansion started with a ground-breaking ceremony in November 2023, and Gerresheimer is channelling an investment of around EUR 100 million (USD 106 million) into the project.

- November 2023 - Amcor has introduced a mono-PE laminate to create all-film medical packaging recyclable in the polyethylene stream. This innovation reportedly reduces the package's carbon footprint while ensuring patient safety. The film is expected to enable recycle-ready lidding for 3D thermoformed packages, which house items like drapes, protective materials, catheters, and injection and tubing systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Domestic Pharmaceuticals Production

- 5.1.2 Growing FDI In regional pharmaceutical and packaging sector

- 5.2 Market Restraints

- 5.2.1 Environmental Concerns related to Pharmaceutical Packaging Raw Materials

- 5.2.2 Fluctuations In Raw Material Prices

6 MARKET SEGMENTATION

- 6.1 By Packaging Material

- 6.1.1 Plastic

- 6.1.2 Glass

- 6.1.3 Metal

- 6.1.4 Paper

- 6.2 By Product Type

- 6.2.1 Blister Packs

- 6.2.2 Plastic Bottles

- 6.2.3 Prefillable Syringes

- 6.2.4 Vials and Ampuls

- 6.2.5 Closures

- 6.2.6 Containers

- 6.2.7 Other Product Types

- 6.3 By Country

- 6.3.1 Brazil

- 6.3.2 Mexico

- 6.3.3 Columbia

- 6.3.4 Argentina

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Group GmbH

- 7.1.2 Sealed Air Corporation

- 7.1.3 Berry Global Inc.

- 7.1.4 Schott AG

- 7.1.5 Gerresheimer AG

- 7.1.6 Aptar Group Inc.

- 7.1.7 ALPLA Werke Alwin Lehner GmbH & Co KG

- 7.1.8 Pretium Packaging

- 7.1.9 Silgan Holdings Inc.

- 7.1.10 Greiner Packaging International GmbH