|

市场调查报告书

商品编码

1624601

欧洲安全连接设备:市场占有率分析、产业趋势、成长预测(2025-2030)Europe Safety Connection Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

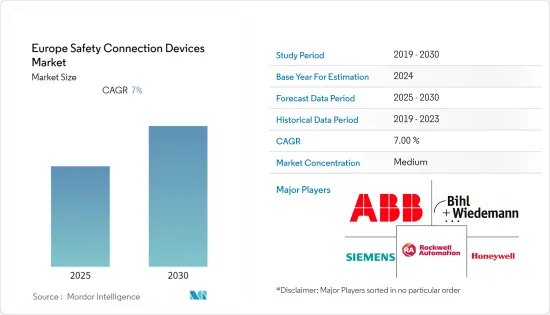

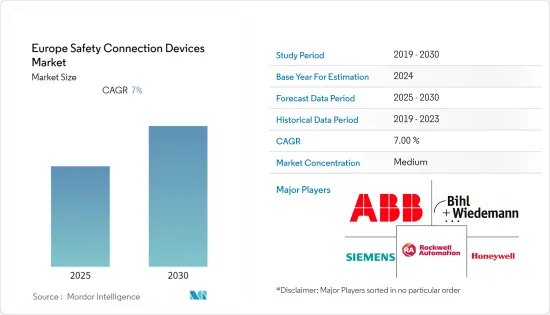

欧洲安全互联设备市场预计在预测期内复合年增长率为 7%

主要亮点

- 安全连接装置可确保可靠的通讯,例如急停开关、安全联锁切换和拉线开关。网路媒体、控制网路、电力媒体和设备网路是安全连接设备的范例。这些设备改善了多台机器之间的连接,同时提高了人身安全。安全连接系统旨在使安全设备的安装尽可能简单。

- 此外,为了满足消费者不断增长的期望以及对便携性和可穿戴性的跨市场趋势,我们还提供高速连接解决方案,支援具有更快的超高频宽、低延迟讯号和不断发展的小型化等新技术的5G网路。

- 此外,自动化生产设备僱用了各种各样的工人,从生产工人到工程师。随着范围如此广泛且自动化程度不断提高,多个最终用户行业都需要安全连接设备。

- 相较之下,新冠肺炎 (COVID-19) 疫情对全球众多製造业和加工业产生了重大影响。机器人、建筑技术、电子和加工设备等产业的供应链受到干扰。然而,这些行业预计将迅速復苏,因为它们服务于广泛的应用。

- 此外,高生产成本,加上缺乏对技术发展和工业进步的认识,可能是市场的限制因素。

欧洲安全连接设备市场趋势

自动化的进步推动市场

- 在欧洲,由于对高可靠性和大规模生产的期望以及对产品品质的要求不断提高,对自动化的需求正在迅速增长。

- 製造流程自动化也带来许多好处,包括平稳准确的监控、减少浪费和稳定的生产速度。该技术以低成本按时向客户提供标准化、优质的产品。

- 英国政府的产业战略主要概述了到 2020 年每年投资 20 亿英镑用于新技术研发的计画。智慧製造和工业物联网 (IoT) 可能会建立在过去几年自动化奠定的基础上。

- 此外,根据国际机器人联合会 (IFS) 的数据,欧盟目前在製造业自动化方面是世界领先者之一:65% 的国家每万名员工拥有的工业机器人数量高于平均水平。

- 随着自动化在欧洲各行业中越来越普遍,对安全连接设备以安全可靠地通讯资料的需求也随之增加。例如,2020年5月,霍尼韦尔透过快速自动化加速了疫苗和医疗疗法的研发和生产。

汽车领域预计将占据较大份额

- 汽车工业对欧洲经济发展至关重要。根据欧盟委员会统计,汽车业直接和间接僱用了1,380万欧洲人,占欧盟总就业人数的6.1%。汽车直接生产僱用了260万人,占欧盟製造业就业人数总数的8.5%。欧盟是世界主要汽车製造国之一。

- 此外,欧盟汽车产业是私人研发投资水准最高的产业之一。欧盟委员会鼓励全球技术协调并资助研发,以提高欧盟汽车工业的竞争力并保持其全球技术领先地位。

- 因此,许多欧洲汽车製造商正在建造新的製造基础设施或将生产流程从手动机器转移到机器人机器。例如,BMW计画在2023年在匈牙利开设一家新工厂,年产能为15万辆汽车。

- 但 COVID-19 大流行从根本上动摇了欧洲汽车业,旅行禁令、工厂关闭和消费者消费能力限制等综合因素损害了新车市场。

- 欧洲汽车工业协会 (ACEA) 预测,2020 年欧盟乘用车註册量将下降 25%,仅 960 万辆。德国联邦汽车运输管理局最新发布的 2020 年数据显示,4 月新车註册量下降了 61%,5 月下降了 50%。

欧洲安全互联设备产业概况

欧洲安全连接设备市场竞争激烈,由几家主要参与者组成,包括 ABB Ltd.、Bihl+Wiedemann GmbH、Mouser Electronics 和 Rockwell Automation Inc.。从市场占有率来看,目前几家大公司占据市场主导地位。这些拥有压倒性市场份额的大公司正致力于扩大海外基本客群。这些公司利用策略合作措施来扩大市场占有率并提高盈利。预计竞争和快速的技术进步将对预测期内每家公司的市场成长构成威胁。

- 2021 年 9 月 - ABB Ltd. 与史陶比尔电气连接器公司签署谅解备忘录,向市场推出减少采矿业重型设备相关温室气体 (GHG)排放的解决方案。连接器解决方案製造商史陶比尔 (Staubli) 和全球科技公司 ABB 正在寻求开发满足工业应用要求的电气化解决方案。这些要求包括高功率要求、自动化和安全操作、适应恶劣的环境条件以及遵守核准的标准。重点将是采矿基础设施。

- 2021 年 10 月 - Bihl+Wiedemann 推出经过 BTL 认证的 ASi BACnet/IP 控制器,其整合式安全单元高达 SIL3 BWU4001。该设备具有两个 ASi 主站和一个整合式安全单元,可用作安全防火防烟阀的自足式微型控制器,通常可达到 SIL2 的安全等级。儘管如此,它也可以连接到更高级别的 BACnet DDC 或 GLT,充当连接控制器和 ASi 安装的网关。透过 BACnet、网路伺服器或网关内建显示器上的简单文字讯息,可以提供用于快速系统分析的诊断功能。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 影响评估

第五章市场动态

- 市场驱动因素

- 严格的安全要求

- 工业自动化的进步

- 小型化和可变设计

- 新技术不断发展

- 市场限制因素

- 安全连接装置高成本

- 业界对安全连接装置的发展缺乏认识

第六章 市场细分

- 按类型

- 电缆和电线

- 连接器

- 闸道

- 适配器

- 继电器

- T型连接器

- 配电箱

- 按最终用户

- 车

- 製造业

- 卫生保健

- 能源/电力

- 其他行业

- 按国家/地区

- 德国

- 英国

- 法国

- 其他欧洲国家

第七章 竞争格局

- 公司简介

- ABB Ltd.

- Bihl+Wiedemann GmbH

- Siemens AG

- Lumberg Automation

- Rockwell Automation Inc.

- Murrelektronik

- Schneider Electric Company

- Parmley Graham

- Mouser Electronics

- Honeywell International, Inc.

第八章投资分析

第9章市场的未来

The Europe Safety Connection Devices Market is expected to register a CAGR of 7% during the forecast period.

Key Highlights

- The safety connection devices ensure that E-stops, safety interlock switches, and cable pull switches, among other things, communicate reliably. Network media, control net, power media, device net are some examples of safety connection devices. These gadgets improve the connection between multiple machines while also boosting personal safety. The safety connection system is intended to make the installation of safety devices as simple as possible.

- Additionally, the increasing consumer expectations and the ever-evolving new technologies like high-speed connectivity solutions to support 5G networks with faster, ultra-high-bandwidth, lower latency signals, miniaturized connectors, and high-density contacts to conserve space and weight to support prevailing cross-market trends towards portability and wearability are propelling the market's growth.

- Moreover, diverse categories of personnel work on automated production equipment, spanning from production workers to engineers. This wide range and increasing automation are necessitating safety connection devices from several end-user industries.

- In contrast, the COVID-19 pandemic has drastically impacted numerous manufacturing and processing industries across the globe. The supply chain of industries like robotics, building technology, electronics, and processing equipment have been disrupted. However, These industries are expected to recover rapidly due to the extensive range of applications they cater to.

- Also, the high production costs coupled with the lack of awareness about technological developments and industrial advances are the possible market constraints.

Europe Safety Connection Devices Market Trends

Increasing Automation to Drive the Market

- The demand for automation is rapidly growing in Europe due to the increased high product quality requirements, coupled with expectations of high reliability and large volume production.

- Additionally, automation of manufacturing processes has contributed to numerous benefits, such as smooth and accurate monitoring, reduction of waste, consistent production speed. This technology offers customers standardized and superior products within time and at a lower cost.

- The Industrial Strategy of the UK government fundamentally outlined a plan to invest GBP 2 billion per year by 2020 for new research and development in the technology sector. Smart manufacturing and the Industrial Internet of Things (IoT) would be built upon the work that automation has already forged over these years.

- Further, according to the International Federation of Robotics (IFS), as for automation in manufacturing, the European Union is currently one of the global frontrunners: 65 percent of countries with an above-average number of industrial robots per 10,000 employees are located in the EU.

- With automation becoming prevalent in every industry in Europe, the demand for safety connection devices to communicate data safely and securely is also increasing. For instance, in May 2020, Honeywell expedited the development and production of vaccines and medical therapies through fast-track automation.

Automotive segment is Expected to Hold a Major Share

- The automotive industry is essential to Europe's economic development. According to the European Commission, the automobile industry employs 13.8 million Europeans directly and indirectly, accounting for 6.1 percent of overall employment in the EU. Direct production of automobiles employs 2.6 million people, accounting for 8.5 percent of all manufacturing jobs in the EU. The European Union is one of the major makers of automobiles globally.

- Additionally, the EU's automotive industry is one of the largest private investors in R&D. (R&D). The European Commission encourages worldwide technology harmonization and provides money for R&D to boost the competitiveness of the EU automobile industry and maintain its global technological leadership.

- Resultantly, many automotive manufacturers in Europe are creating new manufacturing infrastructures or transitioning their manufacturing processes away from manual labor towards robotic machinery. For instance, BMW plans to open a new factory in Hungary by 2023, with a capacity of 150,000 vehicles per year.

- However, the COVID-19 pandemic has shaken Europe's automotive industry to its core, with a combination of travel bans, factory shutdowns, and limited consumer spending power spelling disaster for the new vehicle market.

- The European Automobile Manufacturers' Association (ACEA) estimated a 25% drop in passenger car registrations in the European Union to just 9.6 million units in 2020. Recent figures from Germany's federal motor transport authority in 2020 revealed that new car registrations had fallen 61% in April and 50% in May.

Europe Safety Connection Devices Industry Overview

The Europe Safety Connection Devices Market is moderately competitive and consists of several major players like ABB Ltd., Bihl+Wiedemann GmbH, Mouser Electronics, Rockwell Automation Inc., etc. In terms of market share, few of the major players currently dominate the market. With a prominent share in the market, these major players are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and increase their profitability. The competition and rapid technological advancements are expected to pose a threat to the market's growth of the companies during the forecast period.

- September 2021 - ABB Ltd. signed a Memorandum of Understanding (MoU) with Staubli Electrical Connectors to bring solutions to the market to reduce the greenhouse gas (GHG) emissions associated with heavy machinery in mining. Staubli, a manufacturer of connector solutions, and global technology company ABB would explore the development of electrification solutions to meet the requirements of industrial applications. These involve high power requirements, automated and safe operations, adaptation to harsh environmental conditions, and the meeting approved standards. The focus would be on mine infrastructure.

- October 2021 - Bihl + Wiedemann launched a BTL-certified ASi BACnet / IP controller with an integrated safety unit up to SIL3 BWU4001. The device has two ASi masters and an integrated safety unit, can be used as a self-sufficient miniature controller for safe fire protection and smoke extraction dampers, which typically achieve a safety level of SIL2. Nonetheless, it can also be connected to a higher-level BACnet DDC or GLT and thus act as a gateway connecting the controller and the ASi installation. Diagnostic functions for fast system analysis are then available via BACnet, web server, or simple text messages on the gateway's integrated display.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Stringent Safety Requirements

- 5.1.2 Increasing Automation in Industries

- 5.1.3 Miniaturization and Variable Designs

- 5.1.4 Ever-evolving new technologies

- 5.2 Market Restraints

- 5.2.1 The high cost of safety connection devices

- 5.2.2 Lack of awareness about its developments in the industry

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Cables and Cords

- 6.1.2 Connectors

- 6.1.3 Gateways

- 6.1.4 Adaptors

- 6.1.5 Relays

- 6.1.6 T-Couplers

- 6.1.7 Distribution Box

- 6.2 By End-user

- 6.2.1 Automotive

- 6.2.2 Manufacturing

- 6.2.3 Healthcare

- 6.2.4 Energy and Power

- 6.2.5 Other End-user Verticals

- 6.3 By Country

- 6.3.1 Germany

- 6.3.2 United Kingdom

- 6.3.3 France

- 6.3.4 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd.

- 7.1.2 Bihl+Wiedemann GmbH

- 7.1.3 Siemens AG

- 7.1.4 Lumberg Automation

- 7.1.5 Rockwell Automation Inc.

- 7.1.6 Murrelektronik

- 7.1.7 Schneider Electric Company

- 7.1.8 Parmley Graham

- 7.1.9 Mouser Electronics

- 7.1.10 Honeywell International, Inc.