|

市场调查报告书

商品编码

1637919

中东和非洲危险场所连接器:市场占有率分析、产业趋势和成长预测(2025-2030)MEA Hazardous Location Connectors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

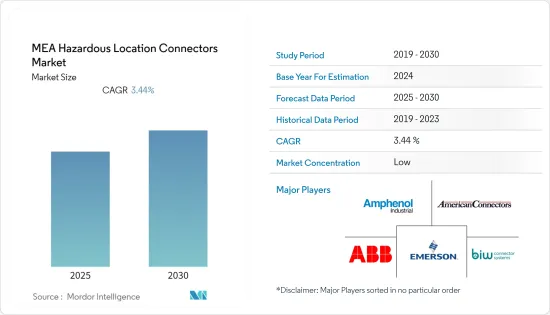

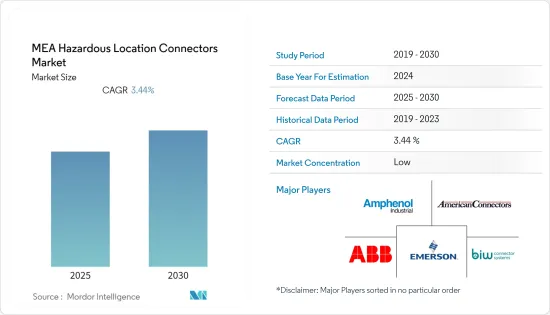

中东和非洲危险场所连接器市场预计在预测期内复合年增长率为 3.44%

主要亮点

- 加强工业安全措施正在推动市场成长。製造过程中使用的工具和设备会产生热量和火焰,增加火灾风险,尤其是在 I 类场所,而连接器在防止此类爆炸方面发挥重要作用。

- 随着光纤通讯的使用变得越来越普遍,以提高安全性和生产力,光纤连接器已成为一种趋势。光纤连接器提供了硬配线方法的替代方案,让使用者可以透过提供宽广的动作温度范围(包括现场零下操作)来安全地建造光缆,同时最大限度地减少危险操作期间的停机时间,从而可以断开电线。

- 由于需要承受振动、极端温度和衝击,每种应用都需要不同的连接器设计。

- 石油领域采用优质软连接器,正确连接所有金属非载流设备,防止触电。同时,橡胶模压防水电连接器用于污水处理设施。

- PCB 安装或电线端接连接器的额外成本导致较高的设定成本,而较高的产品安装和维护成本阻碍了市场成长。

中东和非洲危险场所连接器的市场趋势

精製大幅成长

- 对原油需求的快速成长需要安全设备来防止炼油厂内危险区域发生致命事故。一些炼油厂是危险区域,经常存在爆炸性化学物质和气体。外壳内部可安装连接器等防爆设备,防止火花造成内部爆炸。

- Thomas & Betts 的产品是一种称为机械接地连接器的软连接器,能够非常有效地正确连接石油和天然气设施中的所有金属非载流设备,从而显着降低触电或爆炸的风险。

- 科德宝石油和天然气技术公司的Vector Tech 锁夹连接器是最有效、最经济的管道连接系统,可在压力下承受较大的弯矩而不会洩漏,以防止危险的死亡和螺栓鬆动。它可以承受高轴向力,从而显着降低维护成本和安全性。

0区预计占有较大份额

- 0区是指爆炸性气体环境长期持续存在或可能频繁发生的区域。划分为 0 区的区域具有特定的特征。可燃性气体、蒸气或液体连续存在或此类气体长时间存在的区域被划分为 0 区。

- 例如,罐或桶顶部液体上方的蒸气空间以及地下储气库被归类为 0 区。由于存在天然气等可燃性气体,0 区危险区域主要存在于石油和天然气产业。由于其流程的性质,化学和石油行业也有相对较多的 0 区。

- 据估计,该区域内的爆炸区域每年存在超过 1,000 小时,即超过 10%。这些值有助于确定工业中的不安全和安全区域。

- 石油和天然气产业的发展有望带动新兴市场的开放。此外,对天然气洩漏等事件的安全担忧不断增加,以及越来越多地采用自动化工具来连续监测地下气藏和管道,预计将推动中东和非洲对危险场所连接器的需求。

中东和非洲危险场所连接器产业概述

中东和非洲危险场所连接器市场的集中度较低,只有少数知名公司占据主要份额,例如 American Connectors Inc.、Amphen Industrial Products Group 和 Thomas and Betts(ABB 集团)。该地区的公司已经进行了多次联盟和合併,以扩大市场占有率。

- 2022 年 2 月 - ITT BIW Connector Systems 宣布扩展和重新设计其飞机零件系列,推出五种新阀门和致动器,用于航太和国防市场的燃油、液压、水和环境控制系统。流体控制解决方案。

- 2021 年 11 月 - ITT BIW 连接器系统推出坚固耐用的模组化圆形系列 Veam MOVE-MOD。这项灵活的设计利用具有多种触点布局的卡接式模组,在一个连接器中提供讯号、电源和资料,以满足单独的系统要求。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买方议价能力

- 供应商的议价能力

- 新进入者的威胁

- 竞争程度

- 替代品的威胁

- 产业价值链分析

- COVID-19 影响评估

第五章市场动态

- 市场驱动因素

- 加强工业安全措施

- 扩大工业领域的应用并降低成本

- 提高行业相关人员的意识

- 市场限制因素

- 标准复杂度

- 产品安装及维护费用

第六章 市场细分

- 按班级

- Ⅰ类

- 二级

- 三级

- 按危险区域划分

- 0区

- 1区

- 2区

- 按用途

- 食品和饮料加工

- 石油和天然气生产

- 精製

- 石化精製

- 药品製造

- 污水处理设施

- 其他的

第七章 竞争格局

- 公司简介

- American Connectors, Inc.

- Thomas & Betts(ABB Group)

- ITT BIW Connector Systems

- Emersion Industrial Automation

- Amphenol Industrial Products Group

- Hubbell-Killark

- Crouse-Hinds(Eaton)

- Vantage Technology

第八章投资分析

第9章 市场的未来

简介目录

Product Code: 48587

The MEA Hazardous Location Connectors Market is expected to register a CAGR of 3.44% during the forecast period.

Key Highlights

- Increasing industrial safety measures are driving the market's growth. The tools and equipment used in manufacturing can generate heat and flame, therefore increasing the risk of fire, especially in class I locations, because connectors play an essential role in preventing these types of explosions.

- Fiber optic connectors are in trend, as the use of fiber optic communications is becoming more common in improving safety and productivity. It substitutes hard-wiring methods, allowing users to safely make and break optic cables by providing wide operating temperature ranges, including sub-zero operation in the field with minimum downtime during the hazardous time.

- Increasing applications in the industrial sector are accelerating the market growth, as every application requires different connector designs, owing to the industry's need to withstand vibrations, extreme temperatures, and shocks.

- High-quality flexible connectors are used in the oil sectors by properly connecting all metallic non-current carrying equipment to prevent shock. At the same time, waterproof electrical connectors that are rubber molded are used in the wastewater treatment facility.

- Higher product installation and maintenance costs hinder the market's growth, as the PCB-mounted or wire-terminated connector has an additional cost associated with them that makes the set-up cost high.

MEA Hazardous Location Connectors Market Trends

Oil Refineries to have a significant growth

- As the demand for crude oil is growing rapidly, there is a need for safety equipment to prevent any fatality at hazardous locations in the refineries. Some areas of the refinery are inherently dangerous, with levels of explosive chemicals and gases present at all times. Explosion-proof equipment, such as connectors, can be installed inside an enclosure, preventing an internal explosion caused by the spark.

- Thomas & Betts products named mechanical grounding connectors, which are flexible connectors that are very effective by properly connecting all metallic non-current carrying equipment at the oil and gas facility, which significantly reduce the potential for electric shock and explosions.

- Vector Techlok clamp connectors of Freudenberg Oil & Gas Technologies are the most effective and economical pipe connection systems, which can withstand considerable bending moments and axial forces under pressure without leaking to prevent hazardous fatality or bolts becoming loose, which significantly reduces the maintenance costs and significant fatal incidents.

Zone 0 is expected to hold a significant share

- Zone 0 is an area where an explosive atmosphere has been continuously present for an extended period or may occur frequently. The areas classified as Zone 0 have specific characteristics. The continuous presence of flammable gases, vapors, liquids, or the company of such gases for long periods in a region is the condition for the Zone 0 classification.

- For instance, the vapor space above the liquid on the top of a tank or drum can and underground gas storage be classified as Zone 0. The ANSI/NEC classification method considers this environment a Class 1, Division 1 area. Zone 0 hazardous locations are primarily present in the oil and gas sector, owing to flammable gases like natural gases in the industry. The chemical and petroleum industry also has a relatively high presence of Zone 0, owing to the nature of the processes.

- The explosive area in the zone is estimated to be present for more than 1000 hr/year or greater than 10%. These values aid in the determination of safe areas from unsafe areas in the industry.

- The expansion in the oil and gas industry is expected to develop space for the studied market. Additionally, the growing safety concerns regarding incidents like natural gas leaks and the increasing adoption of automation tools for continuous monitoring of the underground gas storage and pipelines are expected to fuel the demand for hazardous location connectors in the Middle East and Africa Region.

MEA Hazardous Location Connectors Industry Overview

The Middle East and Africa Hazardous Location Connectors Market are less concentrated, with only a few prominent companies like American Connectors Inc., Amphenol Industrial Products Group, Thomas and Betts (ABB Group), etc., holding a significant share of the market. The companies in the region are forming multiple partnerships and mergers to increase their market share.

- February 2022 - ITT BIW Connector Systems announced its expanded and redesigned aircraft component line with five new valves and actuators, providing customers with solutions to control fluid handling valves used in fuel, hydraulic, water, and environmental control systems in the aerospace and defense market.

- November 2021 - ITT BIW Connector Systems introduced its ruggedized, modular circular series Veam MOVE - MOD. The flexible design delivers signal, power, and data in a single connector by utilizing a range of snap-in modules with various contact layouts to match individual system requirements.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Degree of Competition

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment Of Covid-19 Impact

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Industrial Safety Measures

- 5.1.2 Increasing Applications in the Industrial Sector and Reducing Costs

- 5.1.3 Growing Awareness among Industry Personnel

- 5.2 Market Restraints

- 5.2.1 Complexity of Standards

- 5.2.2 Product Installation and Maintenance Costs

6 MARKET SEGMENTATION

- 6.1 By Class

- 6.1.1 Class I

- 6.1.2 Class II

- 6.1.3 Class III

- 6.2 By Hazardous Zones

- 6.2.1 Zone 0

- 6.2.2 Zone 1

- 6.2.3 Zone 2

- 6.3 By Applications

- 6.3.1 Food & Beverage Processing

- 6.3.2 Oil & Gas Production

- 6.3.3 Oil Refineries

- 6.3.4 Petrochemical Refineries

- 6.3.5 Pharmaceutical Manufacturing

- 6.3.6 Wastewater Treatment Facilities

- 6.3.7 Other Applications

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 American Connectors, Inc.

- 7.1.2 Thomas & Betts ( ABB Group)

- 7.1.3 ITT BIW Connector Systems

- 7.1.4 Emersion Industrial Automation

- 7.1.5 Amphenol Industrial Products Group

- 7.1.6 Hubbell-Killark

- 7.1.7 Crouse-Hinds (Eaton)

- 7.1.8 Vantage Technology

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219