|

市场调查报告书

商品编码

1626292

法国工厂自动化和工业控制设备:市场占有率分析、行业趋势、统计和成长预测(2025-2030)France Factory Automation and Industrial Controls - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

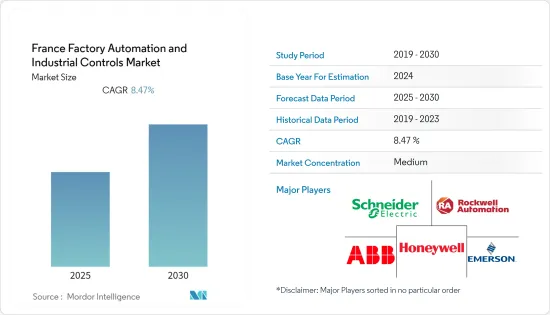

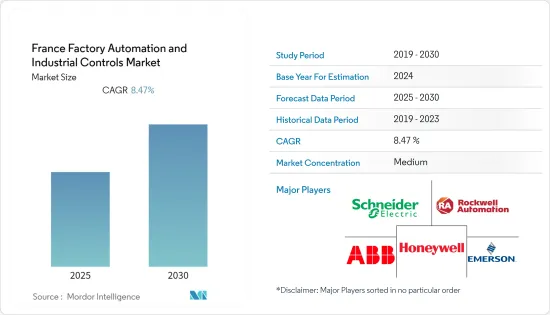

法国工厂自动化和工业控制设备市场预计在预测期内复合年增长率为8.47%

主要亮点

- 法国工业部门占GDP的近17%,其中製造业是最重要的部分之一。法国正在透过物联网和 M2M 向高度工业化的经济迈进,以适应工业 4.0。它透过分析见解和减少浪费来帮助製造部门提高效率、减少系统故障并优化成本。

- 法国目前製造业产值居世界第八位,主要製造业领域包括食品饮料、机械设备、飞机、汽车、金属及金属加工製品、船舶及铁路等。

- 由于用于控制工业设备的软体应用程式的使用增加,这些製造商的市场占有率预计将显着增长。

- 此外,化学、化妆品、製药和汽车行业基础设施对工业机器人的投资也在稳步增加。物料输送在拾放机器人的兴起中发挥关键作用。

- 然而,自动化生产线总是需要较高的初始投资,而法国经济成长疲软是引入自动化的障碍。

法国工厂自动化和工业控制设备市场趋势

可程式逻辑控制器的采用预计将显着成长

- 可程式逻辑控制器是一种工业数位计算机,设计用于在恶劣的工业环境中运作以实现工业自动化。这些电脑主要用于控制工业製造过程,机器人设备、机器和组装可以透过 PLC 轻鬆、自主地控制。

- PLC 使用必要的参数进行预先编程,处理和分析接收到的资料,并在必要时触发输出。 PLC 可轻鬆记录和监控运行时资料,例如机器生产率、温度、自动启动/停止过程以及机器故障时产生的警报。

- 它还具有检查设备和程式状态的能力,因此如果出现问题或错误,它可以比其他控制设备更快修復。输入和输出指示器在系统内很容易辨识。

- 法国的汽车工业正在不断发展,随之而来的是对机器人自主製造和组装的需求。 PLC 因其坚固性、灵活性和易于可程式设计而在控制製造过程中发挥重要作用。

- PLC 的高级功能可让您透过网路浏览器进行资料通讯并将资料与云端连接,让您的工厂轻鬆采用工业物联网和工业 4.0。

工业机器人可望主导市场

- 工业机器人领域包括关节型机器人、直角座标机器人、 SCARA机器人、协同机器人(cobots)、并联机器人、取件机器人等。工业机器人因其更高的精度、灵活性、减少的产品损坏、速度和最终的营运效率而越来越多地被大多数最终用户和应用所采用。

- 协作机器人和协作机器人的使用正在迅速增加,因为它们利用先进的感测器、软体和臂端工具来快速、安全地响应环境变化并帮助提高效率。

- 在工业机器人中配备人工智慧后,汽车产业的组装变得更有效率、更有效率且具有成本效益。该领域的工业机器人,特别是圆柱形机器人,透过製造过程的自动化彻底改变了汽车生产。

- 法国拥有许多着名的製造公司,包括空中巴士、Daher、雷诺集团和海军集团。此外,创新丛集和创新平台包括ID 4 Car、EMC2、Others、Clarte、Proxinnov等。

- 因此,该国工业部门具有巨大的成长潜力。因此,对工厂自动化和现场设备的需求不断增长,以实现此类製造工厂的自动化。工业机器人在製造自动化中扮演重要角色。

法国工厂自动化及工控设备产业概况

法国工厂自动化和工业控制设备市场适度分散,参与者规模各异。市场适度整合,从事工业自动化和工控设备先进技术的企业众多。随着自动化程度的提高,公司正在透过与其他自动化公司合作来投资市场。

- 2021 年 9 月 - Orange Business Services 和西门子透过在资料分析、专用 5G 网路、工业IoT、网路安全、云端和边缘运算领域合作,扩大法国製造业的工业 4.0 范围。

- 2021 年 5 月-Schneider Electric与乐家集团合作加速脱碳。乐家集团是产品设计、生产和商业化领域的全球领导者,定义了脱碳新蓝图,该集团已在整个集团范围内製定了单一的全球策略。

- 2021 年 4 月 - 西门子和 Google Cloud 宣布将合作简化生产运营,以提高生产现场的效率。西门子计画将Google云端的顶级资料云和人工智慧/机器学习(AI/ML)能力整合到其工厂自动化解决方案中,以支援製造业的製造流程。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场概况

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 自动化技术的兴起

- 扩大机器对机器 (M2M) 技术的引进

- 市场挑战

- 安装成本高

- 行业法规政策

- 技术简介

第六章 市场细分

- 按类型

- 工业控制系统

- 集散控制系统(DCS)

- 可程式逻辑控制器(PLC)

- 监控/资料采集 (SCADA)

- 产品生命週期管理 (PLM)

- 製造执行系统(MES)

- 人机介面 (HMI)

- 其他工业控制系统

- 现场设备

- 机器视觉

- 工业机器人

- 马达和驱动器

- 安全系统

- 感测器和发射器

- 其他现场设备

- 工业控制系统

- 按最终用户产业

- 石油和天然气

- 化学/石化

- 电力/公共产业

- 饮食

- 汽车/交通

- 製药

- 其他最终用户产业

第七章 竞争格局

- 公司简介

- Schneider Electric SE

- Rockwell Automation Inc.

- Honeywell International Inc.

- Emerson Electric Company

- ABB Ltd

- Mitsubishi Electric Corporation

- Siemens AG

- Omron Corporation

- Yokogawa Electric Corporation

- Fanuc Corporation

第八章投资分析

第9章 未来展望

简介目录

Product Code: 46907

The France Factory Automation and Industrial Controls Market is expected to register a CAGR of 8.47% during the forecast period.

Key Highlights

- The country's industrial sector contributes nearly 17% to the GDP, in which manufacturing is one of the most important parts. France is adapting to industry 4.0 by moving a highly industrialized economy through IoT and M2M. This is helping the manufacturing sector to increase its efficiency, reduce system failures and optimize the cost through analytical insight and cutting down on wastage.

- France is currently ranked eighth in the world for manufacturing output, the biggest segments in manufacturing sector includes food products and beverages, machinery and equipment goods, aircrafts, automobiles, metals and fabricated metal products, ships and trains.

- The market share of these manufacturing industries is expected to grow to a significant extent due to increase in use of software applications that are used to control industrial devices.

- Alslo, there has been increase in industrial robot investment at steady rate in chemical, cosmetic, pharmaceutical industries and in the infrastructure of automotive industry. Material handling has played the important role to increase pick and place robots.

- However, there is always a high initial investment requirement for automated production line which hinders the automation adoption in France due to the stagnated growth in the economy of the country.

France Factory Automation & Industrial Controls Market Trends

Programable Logic Controller Expected to Witness Signifcant Growth in the Adoption

- Programable Logic Controller is an industrial digital computer which is designed to operate in tough industrial environment for industrial automation. These computers are mainly used to control manufacturing process in industry, robotic devices, machines, assembly lines can be easily and autonomously controlled with PLC.

- PLCs are pre-programmed with required parameters; they process and analyse the received data and trigger outputs as per need. PLC easily records and monitors runtime data like machine productivity, temperature, automatic start and stop processes, generation of alarms when a machine fails and many more.

- It also provides a function that can check the state of facilities and programs so that if there are problems or errors, it is possible to make repairs quickly compared to other control units. Input and output indicators are easily identifiable in a system.

- The automobile industry in France in growing and with it the need of autonomous manufacturing assembly controlled by robots is also increasing. PLC plays an important role in controlling manufacturing processes due to their rugged, flexible and easily programmable features.

- The advanced features of PLC can communicate data through web browser and connect data with clouds, this enables easy adoption of Industrial Internet of Things and Industry 4.0 in a factory.

Industrial Robotics are expected to dominate the market

- The industrial robotics segment consists of articulated robots, cartesian robots, SCARA robots, collaborative industry robots (cobots), parallel robots, piece picking robots, etc. The adoption of industrial robots has been increasing in most end-users and applications as these robots enhance accuracy, flexibility, reduced product damage, speed, and ultimately the efficiency of operations.

- The use of collaborative robots or cobots is increasing rapidly as they are utilizing advanced sensors, software, and end-of-arm tooling that quickly and safely respond to the changes in the environment and assist in improving efficiency.

- With the help of artificial intelligence in industrial robots, the automotive sector's assembly lines have become more productive, efficient, and cost-effective. Industrial robotics on the shop floor, especially cylindrical robots, transformed automobile production by automating the manufacturing process.

- France is home to many reputable manufacturing companies that include Airbus, Daher, Groupe Renault, naval Group, and many others. Furthermore, the presence of innovation cluster and innovation platforms include ID 4 Car, EMC2, and other, Clarte, Proxinnov, and others.

- Thus, there is a huge potential for the growth of the country's industrial sector. This increases the need for factory automation and field devices to automate such manufacturing factories. Industrial Robots play important role in automation in manufacturing industry.

France Factory Automation & Industrial Controls Industry Overview

The France Factory Automation and Industrial Controls Market is a moderately fragmented market, with presence of many small and large players. Many companies are engaged in industrial automation and advanced technologies in industrial control devices, the market is moderately consolidated. Considering the increasing automation, companies are investing in the same, by partnering with other automation companies.

- September 2021 - Orange Business Services and Siemens struck a deal to combine in data analytics, private 5G networks, industrial IoT, cybersecurity, cloud and edge computing to expand the industry 4.0 space in French manufacturing sector.

- May 2021 - Schneider Electric partnered with Roca Group to accelerate decarbonization. Roca Group, a world leader in the design, production, and commercialization of products to define a new roadmap toward decarbonization, has been establishing a single, global strategy across the group.

- April 2021 - Siemens and Google Cloud announced their collaboration to streamline production operations for boosting shop floor efficiency. Siemens plans to integrate Google Cloud's top data cloud and artificial intelligence/machine learning (AI/ML) capabilities with its factory automation solutions to assist manufacturers in the manufacturing process.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGTHS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID -19 impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Gaining Prominence for Automation Technologies

- 5.1.2 Increasing Deployment of Machine-to-Machine (M2M) Technologies

- 5.2 Market Challenges

- 5.2.1 High Installation Costs

- 5.3 Industry Policies and Regulations

- 5.4 Technology Snapshot

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Industrial Control Systems

- 6.1.1.1 Distributed Control System (DCS)

- 6.1.1.2 Programable Logic Controller (PLC)

- 6.1.1.3 Supervisory Control and Data Acquisition (SCADA)

- 6.1.1.4 Product Lifecycle Management (PLM)

- 6.1.1.5 Manufacturing Execution System (MES)

- 6.1.1.6 Human Machine Interface (HMI)

- 6.1.1.7 Other Industrial Control Systems

- 6.1.2 Field Devices

- 6.1.2.1 Machine Vision

- 6.1.2.2 Industrial Robotics

- 6.1.2.3 Motors and Drives

- 6.1.2.4 Safety Systems

- 6.1.2.5 Sensors & Transmitters

- 6.1.2.6 Other Field Devices

- 6.1.1 Industrial Control Systems

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Chemical and Petrochemical

- 6.2.3 Power and Utilities

- 6.2.4 Food and Beverage

- 6.2.5 Automotive and Transportation

- 6.2.6 Pharmaceutical

- 6.2.7 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schneider Electric SE

- 7.1.2 Rockwell Automation Inc.

- 7.1.3 Honeywell International Inc.

- 7.1.4 Emerson Electric Company

- 7.1.5 ABB Ltd

- 7.1.6 Mitsubishi Electric Corporation

- 7.1.7 Siemens AG

- 7.1.8 Omron Corporation

- 7.1.9 Yokogawa Electric Corporation

- 7.1.10 Fanuc Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK

02-2729-4219

+886-2-2729-4219