|

市场调查报告书

商品编码

1626313

拉丁美洲玻璃包装:市场占有率分析、行业趋势、统计和成长预测(2025-2030)Latin America Glass Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

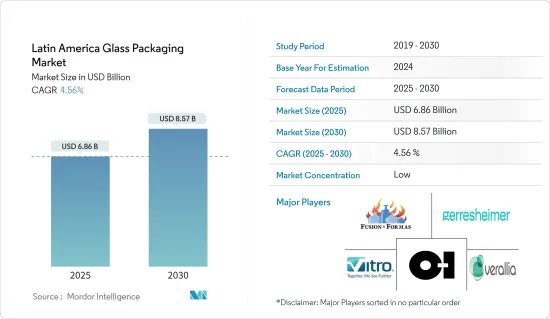

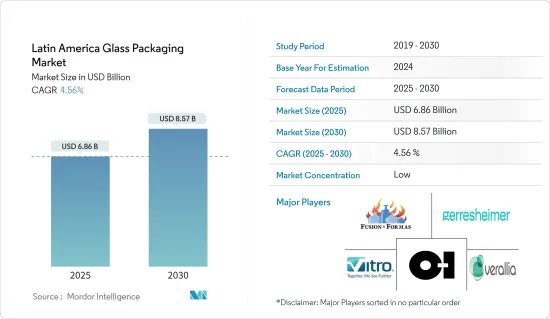

拉丁美洲玻璃包装市场规模预计到2025年为68.6亿美元,预计到2030年将达到85.7亿美元,预测期内(2025-2030年)复合年增长率为4.56%。

对于注重健康、口味和环境安全的消费者来说,玻璃包装是可靠的选择。玻璃包装因其奢华的感觉、保持产品新鲜度并确保保护而受到重视。此外,对环保产品的需求不断增长以及食品和饮料市场的蓬勃发展正在推动玻璃包装市场的成长。

主要亮点

- 随着消费者关注安全和健康的包装,玻璃包装在多个类别中都在成长。此外,压花、成型和艺术饰面等技术创新正在增加玻璃包装对最终用户的吸引力。

- 在都市化、消费者偏好变化以及对饮料和酒精饮料的需求不断增长的推动下,越来越多的製造商开始采用玻璃包装。据联合国称,拉丁美洲和加勒比地区是都市化最高的地区,80%的人口居住在都市区。鑑于这些动态,未来几年市场可能会经历适度成长。

- 儘管玻璃作为各种产品的包装材料仍然受到青睐,但越来越多地采用塑胶作为替代品,这对市场成长构成了挑战。此外,塑胶在更安全应用方面的进步进一步限制了玻璃作为包装材料的范围。

- 近年来,人们的环保意识有所增强。企业和消费者都越来越意识到他们的选择如何影响地球。同时,政策制定者正在创建框架并做出决策,以加强永续性工作。因此,永续性已牢牢地列入全球议程,影响社会、经济和政策辩论,并推动对玻璃包装的需求。

- 市场也面临挑战。一些拉丁美洲国家的回收基础设施不发达,导致玻璃废弃物的收集和处理变得复杂。因此,玻璃废弃物经常被送往掩埋或焚化厂。玻璃与塑胶等包装材料竞争,塑胶具有成本优势,应用范围广泛。

拉丁美洲玻璃包装市场趋势

饮料领域需求的增加预计将推动市场

- 近年来,拉丁美洲饮料的推出和销售有所增加。对酒精和非酒精饮料玻璃包装的需求不断增长,促使公司在巴西建立製造地。

- 巴西成年人和年轻人每週饮用软性饮料五天或以上的比例不断增加,这表明巴西对软性饮料的需求增加。这种消费量的成长可能会对软性饮料产业对玻璃瓶的需求产生正面影响。

- 根据巴西地区统计研究所的数据,2019年烈酒和其他饮料生产收益为902.11美元,2023年将达到9.4932亿美元。因此,随着软性饮料消费量的增加,对玻璃瓶作为满足消费者偏好和市场需求的包装选择的需求也会随之增加。

- 据哥兰比亚营养公司称,拉丁美洲对天然能量饮料的需求不断增长。 69% 的墨西哥消费者对能为他们提供全天能量的产品感兴趣,使他们更有可能更长时间地保持精力充沛。

- 此外,越来越多地转向更健康、洁净标示的选择正在塑造拉丁美洲的机能饮料模式。未来主要的成长领域包括「蛋白质+」饮料,其中包括富含蛋白质的能量饮料,可以添加多种健康成分,而不添加糖或卡路里。对于希望进入拉丁美洲市场的製造商来说,与熟悉饮料创新和区域细微差别的饮料配料供应商合作至关重要。

预计墨西哥市场将稳定扩张

- 预计该国包装设备的快速技术发展和生活方式的快速变化将推动预测期内的市场成长。墨西哥因其丰富的自然资源、低成本劳动力和不断增长的消费者支出而吸引外国玻璃包装製造商和其他公司。

- 根据国家统计和地理研究所(INEGI)的报告,墨西哥可乐饮料的产量正在增加,推动了对玻璃包装的需求。 2023年4月,可乐饮料销售量达到近11.1亿公升,较上季增加。销量的激增凸显了玻璃包装的需求,以适应饮料产业产量的增加。

- 此外,将小型生产商合併到 LaLa 和 Alpura 等大型合作社和公司中可以提高效率和规模经济。液态奶产量的增加预计将支持乳製品行业对玻璃包装的需求。随着产量的增加,对包括玻璃瓶在内的包装材料的需求预计也会增加,以适应流质食品产量的增加。据粮农组织和美国农业部称,随着酪农生产效率的提高,酪农行业对玻璃瓶等包装解决方案的需求预计将会增加。

- 根据龙舌兰酒监管委员会的数据,2019 年龙舌兰酒产量为 351.7 公升。在墨西哥,人均纯酒精消费量为4.9公升,男性消费量多于女性。值得注意的是,18-29岁年龄层的人均消费量为7.6公升,位居榜首。

- 此外,2023年10月,可口可乐将投资1.33亿美元扩大其位于墨西哥哈利斯科州Jugos del Valle-Santa Clara工厂的乳製品和果汁生产,预计将增加对玻璃包装的需求。随着产量的增加,对包括玻璃瓶在内的包装材料的需求可能会增加,以适应乳製品和果汁产品产量的增加。这项投资标誌着饮料产业(尤其是墨西哥)的成长,并可能刺激对玻璃包装的需求。

拉丁美洲玻璃包装产业概况

拉丁美洲玻璃包装市场较为分散,国内和国际公司很少,包括: Vitro SAB de CV、Fusion y Formas SA de CV、Gerresheimer AG、Owens-Illinois Inc. 和 Verallia Group 为了维持市场份额,公司不断创新并建立策略合作伙伴关係。

- 2024年7月,Vitro Glass Containers在墨西哥托卢卡工厂完成了一座新熔炉,将香水和酒精饮料产业的产能提高了50%以上。这座新熔炉投资 7,000 万美元,日产量可达 230 吨。此次升级将使 Vitro 的托卢卡工厂跻身全球最大的玻璃容器製造商行列,专门生产化妆品、优质酒精饮料和特色产品。该熔炉采用尖端技术製造,旨在优化能源消耗并显着减少二氧化碳排放。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业生态系统分析

第五章市场动态

- 市场驱动因素

- 对环保产品的需求不断增加

- 食品和饮料市场需求增加

- 市场限制因素

- 营运成本增加

- 扩大替代产品(塑胶)的使用

第六章 市场细分

- 依产品类型

- 瓶子

- 管瓶

- 安瓿

- 罐

- 其他产品类型

- 按最终用户产业

- 饮料

- 酒精饮料

- 啤酒/苹果酒

- 葡萄酒和烈酒

- 其他酒精饮料

- 非酒精性

- 碳酸饮料

- 牛奶

- 水

- 其他非酒精饮料

- 食品

- 个人护理和化妆品

- 医疗保健和製药

- 其他最终用户产业

- 饮料

- 按国家/地区

- 巴西

- 墨西哥

- 阿根廷

第七章 竞争格局

- 公司简介

- Corning Incorporated

- Heinz-Glas Gmbh & Co. KgaA

- Verallia Group

- Owens-Illinois Inc.

- Gerresheimer AG

- Fusion and Forms SA de CV

- Vitro SAB de CV

- Saverglass SAS

第八章投资分析

第9章 市场的未来

The Latin America Glass Packaging Market size is estimated at USD 6.86 billion in 2025, and is expected to reach USD 8.57 billion by 2030, at a CAGR of 4.56% during the forecast period (2025-2030).

Glass packaging is a trusted choice for consumers prioritizing health, taste, and environmental safety. Glass packaging, valued for its premium nature, preserves product freshness and ensures protection. Additionally, the surging demand for eco-friendly products, coupled with a booming food and beverage market, propels the growth of the glass packaging market.

Key Highlights

- As consumers place a premium on safe and health-conscious packaging, glass packaging is experiencing growth across multiple categories. Furthermore, technological innovations, such as embossing, shaping, and artistic finishes, amplify the appeal of glass packaging for end users.

- Driven by urbanization, shifting consumer preferences, and rising demand for beverages and alcoholic drinks, manufacturers are increasingly turning to glass packaging solutions. The United Nations reports that with 80% of its population residing in cities, Latin America and the Caribbean stand out as the most urbanized regions. Given these dynamics, the market is set for moderate growth in the coming years.

- While glass continues to be the favored packaging material for a range of products, the rising adoption of plastics as a substitute poses a challenge to the market's growth. Moreover, plastic advancements for safer applications further limit the scope of glass as a packaging material.

- In recent years, environmental awareness has surged. Companies and consumers are increasingly mindful of how their choices impact the planet. Concurrently, policymakers are crafting frameworks and making decisions to bolster sustainability efforts. As a result, sustainability has firmly established itself on the global agenda, influencing societal, economic, and policy discussions and subsequently driving the demand for glass packaging.

- The market also faces challenges. Several Latin American nations need help with underdeveloped recycling infrastructures, which complicate the collection and processing of glass waste. Consequently, this often results in glass waste being diverted to landfills or incineration. Glass contends with packaging rivals like plastic, which frequently offer cost advantages and enjoy broader usage.

Latin America Glass Packaging Market Trends

Increasing Demand from the Beverages Segment is Expected to Drive the Market

- In Latin America, beverage launches and sales have risen over the past few years. The increasing demand for glass packaging from alcoholic and non-alcoholic beverages has drawn players to establish their manufacturing units in Brazil.

- The increase in the percentage of adults and young adults in Brazil consuming soft drinks five or more days per week, as reported by Ministerio daSaude, indicates an increasing demand for soft drinks in the country. This rise in consumption is likely to positively impact the demand for glass bottles in the soft drink industry.

- According to the Brazilian Institute of Geography and Statistics, the revenue from the manufacturing of spirits and other beverages in 2019 was USD 902.11 and reached USD 949.32 million in 2023. Therefore, as the consumption of soft drinks increases, there will likely be a corresponding increase in the demand for glass bottles as packaging options to meet consumer preferences and market demand.

- According to Glanbia Nutritionals, in Latin America, there is a rising demand for beverages that boost natural energy. A significant 69% of Mexican consumers express interest in products that sustain their energy throughout the day, underscoring the demand for prolonged vitality.

- Moreover, the ongoing shift toward healthier, clean-label choices is set to shape the functional beverage landscape in Latin America. Key growth areas on the horizon include "protein +" beverages, which encompass protein-infused energy drinks that can integrate a variety of healthy ingredients without sugar or calories. Partnering with a beverage ingredient supplier that is well-versed in beverage innovation and regional nuances is paramount for manufacturers eyeing the Latin American market.

Mexico is Expected to Witness Robust Expansion in the Market

- Rapid technological growth in packaging equipment and changing busy lifestyles in the country are anticipated to drive the market's growth during the forecast period. Mexico attracted foreign glass packaging makers and other companies owing to abundant natural resources, low-cost labor, and increasing consumer expenditure.

- The growing production of cola drinks in Mexico, as reported by the National Institute of Statistics and Geography (INEGI), is driving the demand for glass packaging. In April 2023, the sales volume of cola drinks totaled nearly 1.11 billion liters, marking an increase from the previous month. This surge in sales highlights the need for glass packaging to accommodate the rising production levels in the beverage industry.

- Additionally, integrating small-scale producers into larger cooperatives or companies, like LaLa and Alpura, enhances efficiency and economies of scale. This growth in fluid milk production is expected to support the demand for glass packaging in the dairy segment. With increased production levels, there will be a greater need for packaging materials, including glass bottles, to accommodate the expanded output of fluid milk. According to the FAO and the US Department of Agriculture, as dairy operations become more efficient, the demand for packaging solutions like glass bottles is expected to rise in the dairy industry.

- According to Consejo Regulador del Tequila, the production volume of tequila in 2019 was 351.7 liters. In Mexico, the average per capita consumption of pure alcohol stands at 4.9 liters, with men outpacing women in consumption. Notably, the 18-29 age group leads with a per capita consumption of 7.6 liters.

- Further, in October 2023, Coca-Cola's investment of USD 133 million to expand dairy and juice production at Jugosdel Valle-Santa Clara's plant in Jalisco, Mexico, is expected to support the demand for glass packaging. As production increases, there will likely be a corresponding need for packaging materials, including glass bottles, to accommodate the expanded output of dairy and juice products. This investment signals growth in the beverage sector, particularly in Mexico, which can stimulate demand for glass packaging.

Latin America Glass Packaging Industry Overview

The Latin American glass Packaging Market is fragmented, with few domestic and international players such as Vitro SAB de CV, Fusion y Formas SA de CV, Gerresheimer AG, Owens-Illinois Inc., and Verallia Group. To retain their market share, companies keep on innovating and entering into strategic partnerships.

- July 2024: Vitro Glass Containers completed the anniversary of a new furnace at its Toluca plant in Mexico, boosting its capacity to cater to the perfumery and liquor segments by over 50%. This USD 70 million investment in the new furnace is set to produce 230 tons daily. With this upgrade, Vitro's Toluca facility positions itself among the world's largest producers of glass containers, specifically targeting cosmetic products, premium liquors, and specialty items. The furnace, crafted with cutting-edge technology, aims to optimize energy consumption and significantly reduce CO2 emissions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Ecosystem Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Eco-friendly Products

- 5.1.2 Rising Demand from the Food and Beverage Market

- 5.2 Market Restraints

- 5.2.1 Rising Operational Costs

- 5.2.2 Growing Usage of Substitute Products (Plastic)

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Bottles

- 6.1.2 Vials

- 6.1.3 Ampoules

- 6.1.4 Jars

- 6.1.5 Other Product Type

- 6.2 By End-user Industry

- 6.2.1 Beverages

- 6.2.1.1 Alcoholic**

- 6.2.1.1.1 Beer and Cider

- 6.2.1.1.2 Wine and Spirit

- 6.2.1.1.3 Other Alcoholic Beverages

- 6.2.1.2 Non-Alcoholic**

- 6.2.1.2.1 Carbonated Soft Drinks

- 6.2.1.2.2 Milk

- 6.2.1.2.3 Water

- 6.2.1.2.4 Other Non-Alcoholic Beverages

- 6.2.2 Food

- 6.2.3 Personal Care and Cosmetics

- 6.2.4 Healthcare and Pharmaceutical

- 6.2.5 Other End-user Industries

- 6.2.1 Beverages

- 6.3 By Country

- 6.3.1 Brazil

- 6.3.2 Mexico

- 6.3.3 Argentina

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Corning Incorporated

- 7.1.2 Heinz-Glas Gmbh & Co. KgaA

- 7.1.3 Verallia Group

- 7.1.4 Owens-Illinois Inc.

- 7.1.5 Gerresheimer AG

- 7.1.6 Fusion and Forms SA de CV

- 7.1.7 Vitro SAB de CV

- 7.1.8 Saverglass SAS