|

市场调查报告书

商品编码

1686564

欧洲玻璃包装:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Europe Glass Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

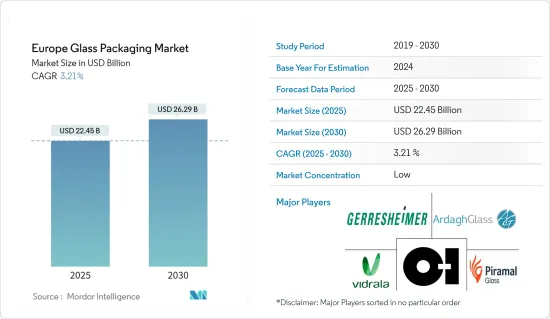

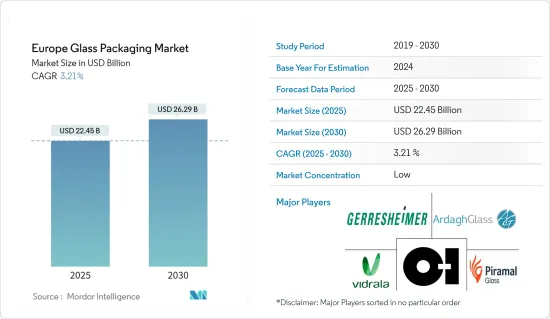

预计2025年欧洲玻璃包装市场规模为224.5亿美元,到2030年预计将达到262.9亿美元,预测期内(2025-2030年)的复合年增长率为3.21%。

主要亮点

- 欧洲玻璃工业为食品饮料、化妆品、药品和香水产业提供玻璃包装产品。玻璃作为包装材料的适用性是推动市场成长的关键因素。使用环保包装材料的趋势日益增长也推动了玻璃包装市场的发展。

- 消费者对安全健康包装的需求不断增长,推动了各类玻璃包装的成长。对玻璃进行压花、塑形和添加艺术饰面的创新技术使玻璃包装在终端用户中越来越受欢迎。此外,对环保产品的需求不断增加以及食品和饮料行业的需求不断增长等因素也在推动市场成长。

- 该地区关于永续性和可回收性的新法规也是推动玻璃包装成长的重要因素。欧盟提案的《包装和包装废弃物条例》(PPWR)要求各欧盟成员国到2030年将人均包装废弃物减少5%,到2035年减少10%,到2040年减少15%,这将进一步推动对再生玻璃的需求。

- 玻璃仍然是主要酒精饮料(包括葡萄酒、烈酒和啤酒)的标准包装材料。玻璃在食品、水和乳製品行业中占有重要份额。这是由以下因素推动的:消费者越来越倾向于选择本地、有机和天然食品,玻璃包装的正面形象,以及消费者从环境、健康和口味保存的角度对玻璃作为首选包装材料的强烈信任。

- 该地区玻璃包装产业面临的主要挑战之一是能源价格上涨,阻碍了市场成长。玻璃生产的能源密集特性使製造商难以吸收这些上升的成本。此外,俄罗斯和乌克兰之间的持续衝突加剧了英国玻璃包装製造商的处境,并导致能源成本上升。因此,能源价格上涨推高了生产成本,导致玻璃价格上涨。

- 此外,由于供应链中断和熔炉停运,一些葡萄酒製造商正在转向使用塑胶作为替代品。例如在英国,酒精饮料製造商正在加速从玻璃包装转向纸瓶包装。最近,大型零售商Aldi推出了一款由 94% 再生纸板製成的葡萄酒,配有食品级包装袋。

欧洲玻璃包装市场趋势

饮料业占市场占有率大

- 预计欧洲饮料市场将经历强劲成长并确保相当大的市场占有率。产业专家预测,随着对永续和便利饮料包装的需求不断增长,欧洲饮料市场将会扩大。欧洲包装生产和製造流程的不断进步正在提高该行业的环境相容性。包装公司越来越注重永续实践,利用再生材料生产产品,从而减少能源和水的消耗并减少碳排放。

- 以较低的生产成本製造具有吸引力的设计、吸引人的配色的创新、轻量化产品仍然是推动成长的关键因素。知名饮料製造商也越来越多地采用玻璃包装,这增加了他们在欧洲饮料领域的份额。例如,2023年9月,可口可乐HBC在奥地利埃德尔斯塔尔工厂开设了一条新的高速回收玻璃瓶装生产线(RGB)。可口可乐 HBC 的 1,200 万欧元(1,299 万美元)投资得到了奥地利政府 400 万欧元(433 万美元)的津贴,该基金是为饮料公司和零售商提供资金的一部分,旨在实现真正的包装循环经济。

- 葡萄酒等酒精饮料产量的增加以及出口的增加进一步推动了对玻璃包装的需求。例如,根据欧盟委员会的数据,欧盟的葡萄酒产量将从2022年的1.529亿百公升增加到2023年的1.59亿百升。根据联合国贸易委员会(UN Comtrade)的数据,2023年欧洲最大的葡萄酒出口国是法国和义大利,出口额分别为127.894亿美元和84.032亿美元。

- 为了应对日益严重的塑胶污染问题,随着饮料产品需求的快速增长,该地区的饮料製造商正在转向可再填充的玻璃瓶。例如,2023年8月,可口可乐启用新系统,直接向客户配送、收集和重复使用零度可乐玻璃瓶,以履行减少塑胶污染的承诺。该饮料将与宅配服务Milk & More 合作配送到英国各地的家庭。该试验原定于 2023 年 6 月 5 日开始,并将持续整个夏季在伦敦南部和英格兰中南部进行。

波兰:市场可望大幅成长

- 预计预测期内波兰将经历东欧最显着的包装成长。预计瓶装水、果汁、能量饮料和高檔饮料将推动玻璃瓶的发展。

- 波兰玻璃包装市场的併购趋势显示企业之间存在合併的趋势,以增强竞争力和市场占有率。这种整合将提高效率、技术创新和潜在的定价动态,进而塑造波兰玻璃包装市场的格局。例如,2024年4月,Canpac Group和BA Glass宣布将Canpac的波兰玻璃业务出售给BA Glass。结果,Orzeze 玻璃厂被转让给 BA Glass,并成为其波兰业务的一部分。

- 波兰玻璃产业正在实现製造能力多元化。波兰玻璃工业在生产容器玻璃时使用大量的玻璃砂。为了开始向这个体系过渡,波兰政府已开始准备在 2022 年引入玻璃瓶和宝特瓶强制性押金制度。该押金计划还包括容量不超过 1.5 公升的可重复使用玻璃瓶。预计波兰在饮料业将保持强劲表现,其中玻璃瓶是主要的包装材料,其他类型的包装仅占一小部分。

- 从事该行业的公司正专注于透过在国内扩张来创新新的解决方案。例如,2023 年 1 月,Ardagh Glass Packaging 在波兰设计了一个永续玻璃炉。新炉实现并维持了低排放水平,同时以多种永续的方式最大限度地减少了天然气、电力和水的使用。据该公司介绍,透过热回收、涡轮压缩机、水回收和封闭式冷却程序,将最大限度地减少天然气、电力和水的使用。这家玻璃製造商表示,减少排放和改善环境影响是玻璃产业的重要目标。预计领先公司的此类技术创新将在预测期内推动市场成长。

- 此外,日本使用玻璃包装的饮料和其他产品的出口也强劲成长。例如,根据联合国商品贸易统计资料库的数据显示,2023年波兰的饮料、烈酒和醋出口额将维持大致稳定在16亿欧元左右。预计这一出口成长将进一步提振波兰对玻璃包装产品的需求。

欧洲玻璃包装产业概况

欧洲玻璃包装市场竞争激烈,多家本土企业占据市场主导地位。这些公司正在利用战略倡议来增加市场占有率和盈利。

- 2024年7月,知名食品饮料玻璃包装製造商Veraria收购义大利Vidrara的玻璃业务。该交易的企业价值为 2.3 亿欧元(2.489 亿美元),其中包括位于科西科的工厂。该工厂拥有两座最近维修的熔炉,现代化生产能力为每年 225 千吨。该公司活跃于食品、啤酒和烈酒市场。

- 2024 年 5 月,Gerresheimer AG 的间接子公司 Gerresheimer Glas 签署协议,收购 Bormioli Pharma 集团的控股公司 Blitz Luxco Sarl。透过此次收购,Gerresheimer 增加了其在欧洲(主要是南欧)的生产基地,并加强了其在欧洲的业务基础。这也将加强该公司作为製药和生物技术行业领先的全方位服务供应商和全球合作伙伴的市场地位。

- 2023 年 9 月,Oi 开始提供先进的压花和客製化包装。凭藉 OI:Expressions Signature,OI 成为第一家使用可变资料列印生产装饰玻璃瓶的玻璃製造商。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 买家的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 评估微观经济因素对市场的影响

第五章 市场动态

- 市场驱动因素

- 严格的法规推动向永续包装快速转变

- 饮料和化妆品等终端用户行业越来越多地采用优质玻璃包装

- 市场挑战

- 替代包装形式对市场成长构成挑战

第六章 市场细分

- 依产品类型

- 瓶子

- 安瓿

- 管瓶

- 注射器

- 罐

- 按最终用户产业

- 饮料

- 酒精

- 啤酒

- 软性饮料

- 其他饮料

- 食物

- 化妆品

- 药品

- 饮料

- 按国家

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 波兰

- 荷兰

- 其他欧洲国家

第七章 竞争格局

- 公司简介

- Owens-Illinois Inc.

- Origin Pharma Packaging

- Verallia

- Vidrala SA

- Vetropack Holding Ltd

- Vitro SAB de CV

- APG Europe

- Saverglass Group

- Wiegand-Glass GmBH

- Crestani SRL

- Verescene France SASU

- Stolzle Glass Group

- Ardagh Packaging Group PLC

- SGD Pharma SA

- Beatson Clark PLC

- Stevanato Group

- Gerresheimer AG

- BA Vidro SA(BA Glass BV)

- Glassworks International Limited

- Gaasch Packaging(UK)Ltd

第八章投资分析

第九章:市场的未来

简介目录

Product Code: 52667

The Europe Glass Packaging Market size is estimated at USD 22.45 billion in 2025, and is expected to reach USD 26.29 billion by 2030, at a CAGR of 3.21% during the forecast period (2025-2030).

Key Highlights

- The European glass industry offers glass packaging products for the food and beverage, cosmetics, pharmacy, and perfumery industries. The compatibility of glass as a packaging material is a significant factor propelling the market's growth. The growing inclination toward using environment-friendly packaging material is another driver for the glass packaging market.

- Increasing consumer demand for safe and healthier packaging is helping glass packaging grow in different categories. Innovative technologies for embossing, shaping, and adding artistic finishes to glass make glass packaging more desirable among end users. Furthermore, factors such as the increasing demand for eco-friendly products and the rising demand from the food and beverage industry are stimulating the market's growth.

- The new rules for sustainability and recyclability in the region are also prominent factors pushing the growth of glass packaging. The European Union's Packaging and Packaging Waste Regulation (PPWR) proposals outline that each EU Member State could be required to reduce its packaging waste per capita by as much as 5% by 2030, 10% by 2035, and 15% by 2040, which is further driving the demand for recycled glass.

- Glass continues to be the reference packaging material for leading alcoholic beverages such as wines, spirits, and beer. It is gaining a prominent share in the food, water, and dairy industries. This is due to new consumption trends for local, organic, and natural food, the positive image of glass packaging, and strong consumer trust in glass as the preferred packaging for environmental, health, and taste preservation reasons.

- One of the primary challenges facing the glass packaging industry in the region is the surge in energy prices, which is hindering market growth. The energy-intensive nature of glass production makes it difficult for manufacturers to absorb these rising costs. Additionally, the ongoing conflict between Russia and Ukraine has intensified the situation for glass packaging producers in the United Kingdom, leading to soaring energy expenses. As a result, these escalating energy prices have driven up production costs, thereby increasing the price of glass.

- Furthermore, several wine manufacturers have switched to plastic as an alternative due to disrupted supply chains and inactive furnaces. For instance, the trend of alcoholic beverage companies in the United Kingdom replacing glass packaging with bottles made of paper has picked up pace. Recently, Aldi, a leading retailer, recently introduced wine in bottles made from 94% recycled paperboard, featuring a food-grade pouch.

Europe Glass Packaging Market Trends

Beverages Segment to Hold a Significant Market Share

- The European beverages market is poised for robust growth and is expected to secure a significant market share. As demand for sustainable and convenient beverage packaging increases, industry experts anticipate an expansion in the European beverages market. Continuous advancements in Europe's packaging production and manufacturing processes are enhancing the industry's environmental friendliness. Packaging companies are increasingly focusing on sustainable practices by producing products from recycled materials, which consume less energy and water while reducing carbon emissions.

- Creating innovative, lightweight products with appealing designs and appealing color schemes at lower production costs has continued to be a key growth facilitator. Prominent beverage companies are also raising the adoption of glass packaging, which adds to the beverage segment's share in Europe. For instance, in September 2023, Coca-Cola HBC established a new, high-speed returnable glass bottling line (RGB) at the Edelstal plant in Austria. An investment of EUR 12 million (USD 12.99 million) from Coca-Cola HBC was supported by a grant of EUR 4 million (USD 4.33 million) from the Austrian government as part of its fund for beverage companies and retailers to enable an actual circular economy for packaging.

- The growth in the production of alcoholic beverages, such as wine, along with a rise in exports, is further boosting demand for glass packaging. For instance, according to the European Commission, wine production in the European Union reached 159 million hectoliters in 2023 from 152.9 million hectoliters in 2022. As per the UN Comtrade, France and Italy were the largest exporters of wine in Europe in 2023, with values of USD 12,789.4 million and USD 8,403.2 million, respectively.

- In response to the escalating plastic pollution, beverage manufacturers in the region are increasingly transitioning to refillable glass bottles due to the rapidly growing demand for beverage products. For instance, in August 2023, to fulfill its commitment to reducing plastic pollution, Coca-Cola launched a new system for delivering, collecting, and reusing glass bottles of Coke Zero directly with customers. The beverage is being distributed to homes in the United Kingdom in partnership with delivery service Milk & More. The trial began on June 5, 2023, and was to continue throughout the summer in south London and central southern England.

Poland Expected to Witness Significant Market Growth

- Poland is anticipated to experience the most significant growth in packaging in Eastern Europe during the forecast period. The development of glass bottles is expected to be fueled by bottled water, juice, energy drinks, and premium beverages.

- The rising mergers and acquisitions in the Polish glass packaging market indicate a consolidation trend among companies to enhance competitiveness and market share. This consolidation is likely to lead to increased efficiency, innovation, and potential pricing dynamics, shaping the landscape of the Polish glass packaging market. For instance, in April 2024, CANPACK Group and BA Glass announced the finalization of the sale of CANPACK's Glass operations in Poland to BA Glass. Consequently, the glass plant in Orzesze was transferred to BA Glass and became part of its operations in Poland.

- The Polish glass industry has diversified its manufacturing capabilities. In the Polish glass industry, significant amounts of glass sand are used to produce container glass. To initiate the country's transition to such a system, the Polish government began preparing the introduction of a mandatory deposit for glass and plastic bottles in 2022. The deposit system included reusable glass bottles of up to 1.5 liters. Poland is expected to remain a strong performer in the beverages industry, where glass bottles may be the primary packaging material, with a small share held by other packaging types.

- Companies operating in the industry are focused on innovating new solutions through expansions in the country. For instance, in January 2023, Ardagh Glass Packaging designed a sustainable glass furnace in Poland. The new furnace can gain and maintain lower emission levels while gas, electricity, and water usage will be minimized via multiple sustainable methods. According to the firm, gas, electricity, and water usage will be minimized via heat recovery, turbo compressors, water recovery, and a closed-loop cooling procedure. The glass manufacturer stated that reducing emissions and enhancing the effect on the environment is a crucial goal for the glass industry. Such technological innovations by major companies are expected to fuel market growth during the forecast period.

- Moreover, the country has witnessed significant growth in the export of beverages and other products that use glass packaging. For instance, according to UN Comtrade, in 2023, the value generated from the export of beverages, spirits, and vinegar in Poland remained nearly unchanged at around EUR 1.6 billion. This growth in exports is anticipated to further create demand for glass packaging products in Poland.

Europe Glass Packaging Industry Overview

The European glass packaging market is highly competitive, with many regional players holding significant shares in the market. These companies are leveraging strategic initiatives to increase market share and profitability.

- In July 2024, Verallia, a prominent producer of glass packaging for food and beverage products, acquired Vidrala's glass business in Italy. The transaction, valued at an enterprise value of EUR 230 million (USD 248.9 million), included a Corsico-based plant. This facility, equipped with two recently renovated furnaces, features modern production capabilities with an annual capacity of 225 kilotons. It actively operates in the food, beer, and spirits markets.

- In May 2024, Gerresheimer Glas, an indirect subsidiary of Gerresheimer AG, signed an agreement to acquire Blitz LuxCo Sarl, the holding company of Bormioli Pharma Group. This acquisition enhances Gerresheimer's European footprint with additional production sites, particularly in Southern Europe. It also strengthens its market position as a leading full-service provider and global partner for the pharmaceutical and biotech industries.

- In September 2023, O-I launched an advanced, embossed, customized packaging offering. With its O-I: Expressions Signature, O-I became the first glass manufacturer to produce decorated glass bottles using variable data printing.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of Microeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Shift Toward Sustainable Packaging Due to Stringent Regulations

- 5.1.2 Growing Adoption of Premium Glass Packaging in End-user Industries, such as Beverages and Cosmetics

- 5.2 Market Challenge

- 5.2.1 Alternative Forms of Packaging Challenging the Market's Growth

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Bottles

- 6.1.2 Ampoules

- 6.1.3 Vials

- 6.1.4 Syringes

- 6.1.5 Jars

- 6.2 By End-user Industry

- 6.2.1 Beverage

- 6.2.1.1 Liquor

- 6.2.1.2 Beer

- 6.2.1.3 Soft Drinks

- 6.2.1.4 Other Beverages

- 6.2.2 Food

- 6.2.3 Cosmetics

- 6.2.4 Pharmaceuticals

- 6.2.1 Beverage

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Spain

- 6.3.6 Poland

- 6.3.7 Netherlands

- 6.3.8 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Owens-Illinois Inc.

- 7.1.2 Origin Pharma Packaging

- 7.1.3 Verallia

- 7.1.4 Vidrala SA

- 7.1.5 Vetropack Holding Ltd

- 7.1.6 Vitro SAB de CV

- 7.1.7 APG Europe

- 7.1.8 Saverglass Group

- 7.1.9 Wiegand-Glass GmBH

- 7.1.10 Crestani SRL

- 7.1.11 Verescene France SASU

- 7.1.12 Stolzle Glass Group

- 7.1.13 Ardagh Packaging Group PLC

- 7.1.14 SGD Pharma SA

- 7.1.15 Beatson Clark PLC

- 7.1.16 Stevanato Group

- 7.1.17 Gerresheimer AG

- 7.1.18 BA Vidro SA (BA Glass BV)

- 7.1.19 Glassworks International Limited

- 7.1.20 Gaasch Packaging (UK) Ltd

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219