|

市场调查报告书

商品编码

1628780

中东和非洲的玻璃包装:市场占有率分析、行业趋势和成长预测(2025-2030)MEA Glass Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

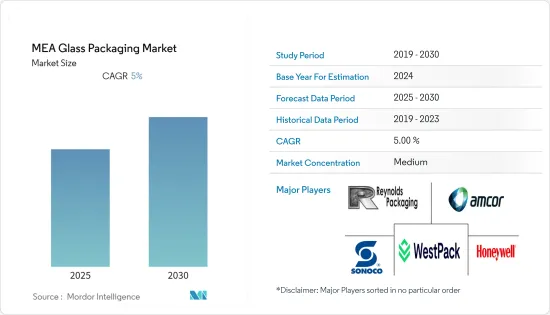

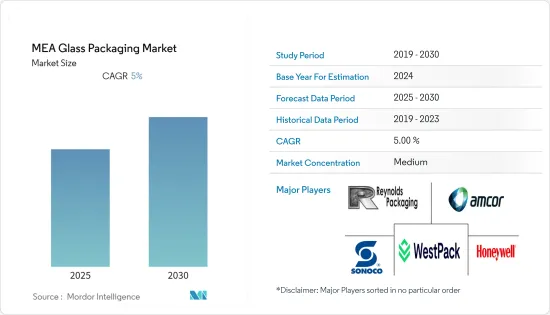

中东和非洲玻璃包装市场预计在预测期内复合年增长率为 5%

主要亮点

- 近年来,食品包装的透明化趋势日益明显。因此,低不透明度玻璃越来越受到青睐作为包装材料。水是一个新兴领域,对带有最少标籤的透明玻璃容器的需求不断增加。中东的几个品牌已宣布计划将水包装转向玻璃包装。例如,Earth Water 于 2021 年 4 月在阿联酋推出了一系列玻璃瓶装天然矿泉水。在 2020 年杜拜世博会上,百事公司推出了 Aquafina,这是一款完全可回收的玻璃瓶联合品牌,旨在推广永续包装。

- 2021 年 3 月,国药控股与阿布达比科技公司 Group 42 (G42) 组成的合资企业计划在阿布达比设立一座新工厂,生产中国製药巨头国药控股的 COVID-19 疫苗。该工厂建于阿布达比哈利工业区 (KIZAD),将拥有 3 条填充线和 5 条自动化包装线,计划每年生产 2 亿剂疫苗。类似的扩张趋势和投资预计将显着增加区域製药业对玻璃包装解决方案的需求。

- 包装塑胶政策也为玻璃瓶和容器市场创造了新的机会。 2021年2月,肯亚签署了“清洁海洋倡议”,成为东非首批限制一次性塑胶的国家之一。此外,从2020年6月起,游览肯亚国家公园、海滩、森林和保护区的游客不再允许携带宝特瓶、杯子、一次性盘子、刀叉餐具和吸管进入保护区。

- 据国际金融公司(IFC)称,衣索比亚政府正在考虑促进生产学名药的私人製药公司和生产原料药(药品製造的主要成分)的公司进行本地生产。衣索比亚《国家药品製造发展策略与行动计画(2015-2025)》也促进了国家层面的药品生产。

中东和非洲玻璃包装市场趋势

饮料占据主要市场占有率

- 酒精饮料行业的玻璃包装市场面临来自罐形金属包装行业的激烈竞争。然而,由于其在高级产品中的采用,预计在预测期内将保持其份额。预计各种饮料产品将成长,包括果汁、咖啡、茶、汤、非乳製品和饮料。

- 精酿啤酒商采取的几项促进投资的措施预计将进一步刺激对玻璃瓶包装的需求。例如,2021年10月,喜力接洽Nambian Breweries购买25%的股份,组成喜力南非合资企业。该合资企业预计将帮助 NBL 减少过去五年中产生的亏损投资(损失 3.39 亿荷兰盾)。预计这将增加该地区的啤酒出口和啤酒产量。

- 由于纽西兰各地酒庄收成不佳且葡萄酒储存紧张,国际零售商正在增加南非葡萄酒的选择。因此,各零售商已将重点转向增加南非葡萄酒的选择。

- 例如,2021年10月,英国线上葡萄酒零售商Majestic向买家提供了新葡萄酒,例如来自开普敦的Lone Creek Sauvignon Blanc 2021和Boekenhoutskloof Vintager Sauvignon Blanc,以及来自西开普省的Pringle Bay Sauvignon Blanc 2021 。它的价格分布也较低(每瓶 10-11 英镑),零售商希望增加南非葡萄酒的销售量。

阿联酋市场预计将大幅成长

- 许多大型製药企业已透过契约製造和当地销售管道进入阿联酋多年,为容器玻璃製造商创造了市场机会。辉瑞、诺华、葛兰素史克(GSK)、默克、艾伯维、礼来、拜耳、阿斯特捷利康、赛诺菲、百时美施贵宝、安进等主要跨国公司已进入国内市场。

- 根据IQVIA预测,到2024年国内药品销售额预计将达到510亿美元。此外,人们越来越认识到在药品和医疗保健设施中使用玻璃包装的既定好处,正在推动药用玻璃领域的发展。

- 2021 年 5 月,百事公司为阿拉伯联合大公国 (UAE)居住者推出了 Aquafina 铝罐和玻璃瓶。这项创新将使 2020 年迪拜世博会的官方饮料和零食合作伙伴百事可乐公司在为期六个月的全球聚会期间收集和回收 2020 年迪拜世博会场馆产生的百事可乐废弃物,以履行我们减少、回收和再造更好、永续产品的承诺。

- 2021 年 1 月,阿联酋调香师 Salva 推出了一款专为海员打造的新香水:Hope。透过这项倡议,该品牌旨在提高人们对世界各地海员困境的认识并为其提供支持。这些倡议预计将提振该国的玻璃瓶市场。

- 2021 年 8 月,阿拉伯联合大公国 (UAE) 领先的香水製造商 LOOTAH Perfume 与中东奢华权威指南 Ounass 合作。 LOOTAH 和 Ounass 合作,在我们的网站上展示了超过 50 种 LOOTAH 香味、卓越的香精油和最丰富的香味。

中东和非洲玻璃包装产业概况

中东和非洲玻璃包装市场适度分散,有少数几家主导企业和一些新参与企业。公司不断创新并结成策略伙伴关係以维持市场占有率。

- 2021 年 4 月 - 尼日利亚啤酒品牌 Star Lager 扩大其优质冷过滤拉格啤酒在美国的销售能力。随着非洲啤酒出口数量和需求的增加,玻璃瓶包装的需求也预计会增加。

- 2021 年 4 月 - SOURCE Global 是一家斯科茨代尔技术和可再生水公司,推出完全由阳光和空气製成的可再生瓶装水。瓶子图形是网版印刷的。瓶子的背面凸显了产品的独特之处。这些瓶装水将提供给红海开发计划(TRSDP)的住宿,红海开发案是沙乌地阿拉伯西海岸一个正在进行的豪华可再生旅游目的地。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 中东和非洲玻璃瓶/容器的巨大市场机会

- 市场限制因素

- 减少消费量

- 产业价值链分析

- 产业吸引力-波特五力分析

- 竞争公司之间的敌对关係

- 新进入者的威胁

- 供应商的议价能力

- 客户议价能力

- 替代品的威胁

- 产业政策与 COVID-19 影响评估

- 技术简介

第五章市场区隔

- 副产品

- 瓶子

- 罐

- 管瓶

- 其他产品

- 按最终用户产业

- 药品

- 医疗的

- 个人护理

- 家居用品

- 农业

- 按国家名称

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲

第六章供应商市场占有率分析

第七章 竞争格局

- 公司简介

- Amcor Ltd

- WestPack

- Sonoco Products Company

- Honeywell International Inc.

- MTS Medication Technologies

- Reynolds Packaging

- The DOW Chemical Company

- Uhlmann Group

- Rohrer Corporation

- Pharma Packaging Solutions

- Tekni-Plex Inc.

第八章投资分析

第9章市场的未来

简介目录

Product Code: 54097

The MEA Glass Packaging Market is expected to register a CAGR of 5% during the forecast period.

Key Highlights

- An increasing trend of transparency in food packaging over the past few years has been observed. This puts growing preference for glass as a material for packaging, being least opaque. Water is an emerging segment aligned with an increasing need for transparent glass containers with minimalist labeling. Multiple brands across the Middle Eastern region have depicted transitioning to glass to package water. For instance, in April 2021, Earth Water launched its natural mineral water lineup in glass bottles across the UAE. PepsiCo launched Aquafina water in Expo 2020 Dubai-cobranded as fully recyclable glass bottles to promote sustainable packaging.

- In March 2021, a new factory in Abu Dhabi planned to manufacture a COVID-19 vaccine from Chinese pharmaceutical giant Sinopharm under a joint venture between Sinopharm and Abu Dhabi-based technology company Group 42 (G42). The plant, built in the Khalifa Industrial Zone of Abu Dhabi (KIZAD), was planned to produce 200 million doses a year with three filling lines and five automated packaging lines. Similar expansion trends and investments are expected to demand glass packaging solutions in the regional pharmaceutical industry significantly.

- The policies against plastic for packaging are also creating new opportunities for the glass bottles and containers market. In February 2021, Kenya signed the Clean Seas Initiative and became one of the first countries in East Africa to limit single-use plastics. Also, as of June 2020, visitors to Kenya's national parks, beaches, forests, and conservation areas can no longer carry plastic water bottles, cups, disposable plates, cutlery, or straws into protected areas.

- According to International Finance Corporation (IFC), officials are considering promoting more local production from private pharma companies that produce generic medications and companies that manufacture active pharmaceutical ingredients or APIs (the primary components in manufacturing drugs). Ethiopia's National Strategy and Plan of Action for Pharmaceutical Manufacturing Development (2015-2025) also catalyzes pharmaceutical production at the country level.

MEA Glass Packaging Market Trends

Beverages to Hold Major Market Share

- The market for glass packaging in the alcoholic beverage industry faces intense competition from the metal packaging segment in the form of cans. However, it is expected to maintain its share during the forecast period due to its usage of premium products. The growth is expected across different beverage products, including juices, coffee, tea, soups, non-dairy, and beverages.

- Multiple initiatives that drove investments from local beer manufacturers are expected to drive the demand for glass bottle packaging further. For instance, in October 2021, Heineken approached Nambian Breweries to purchase a 25% stake to establish a joint venture for Heineken South Africa. The venture is expected to help NBL reduce loss-making investments (attributed to losses of NAD 339 million) attributable from the past five years. This is expected to increase beer exports and beer production volume in the region.

- International retailers have increased options for South African wines due to poor harvest in wineries across New Zealand and challenging storage of wines. This has shifted the focus of various retailers to increase options for wines from South Africa.

- For instance, in October 2021, Majestic, a UK online retailer for wine, added a new set of wine options for buyers, including Lone Creek Sauvignon Blanc 2021 and Boekenhoutskloof Vintager Sauvignon Blanc from Cape Town and Pringle Bay Sauvignon Blanc 2021 from Western Cape. Also, with the price range being low (GBP 10-11 per bottle), the retailers expect greater sales of South African wines.

The UAE Market is Expected to Grow Significantly

- Most major research-based pharma firms have a long-standing presence in the country through contract manufacturing or local distribution channels, creating a market opportunity for container glass manufacturers. Leading multinationals, such as Pfizer, Novartis, GlaxoSmithKline (GSK), Merck, Abbvie, Eli Lily, Bayer, AstraZeneca, Sanofi, BMS, and Amgen, have a presence in the domestic market.

- The IQVIA projected that pharmaceutical sales in the country are likely to reach USD 51 billion by 2024. Moreover, the increased awareness of the established benefits of using glass packaging for pharmaceutical products and healthcare facilities is driving the segment of the pharmaceutical glass.

- In May 2021, PepsiCo launched Aquafina aluminum cans and glass bottles, the company's infinitely recyclable characteristic offering for UAE residents. The innovation is in line with the commitment of PepsiCo, Expo 2020 Dubai's Official Beverage and Snack Partner, to collect and recycle PepsiCo waste generated on Expo 2020 Dubai's site during the six-month global gathering, accelerating efforts to reduce, recycle, and reinvent better and more sustainable packaging.

- In January 2021, the UAE-based perfumer, Salva, revealed its new fragrance, Hope, devoted to seafarers. Through this initiative, the brand aims to increase awareness about seafarers' plight worldwide and offer support. Such initiatives are anticipated to boost the country's glass bottle market.

- In August 2021, the UAE's leading perfumery, LOOTAH perfumes, teamed up with Ounass, the Middle East's Definitive Home of Luxury. LOOTAH and Ounass's collaboration showcases over 50 of LOOTAH's scents, transcendent fragrance oils, and the richest incenses on the website.

MEA Glass Packaging Industry Overview

The Middle-East and African glass packaging market is moderately fragmented, with a few dominant and few new firms. The companies keep innovating and entering into strategic partnerships to retain their market share.

- April 2021- Nigerian Beer Brand Star Lager expanded its distribution capacity in the United States for a premium cold-filtered lager. This is expected to drive the demand for glass bottle packaging as the number of exports and demand for African beer increases.

- April 2021- SOURCE Global, a Scottsdale tech and renewable water company, introduced renewable bottled water made entirely from sunlight and air. The bottle's graphics are applied using screen printing. The back of the bottle highlights the product's unique attributes. The glass-bottled water will eventually be available to guests at The Red Sea Development Project (TRSDP), a regenerative luxury tourism destination along Saudi Arabia's west coast that is underway.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Opportunity for Middle-East and Africa Glass Bottles/Containers

- 4.3 Market Restraints

- 4.3.1 Decreased Alcohol Consumption

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Competitive Rivalry

- 4.5.2 Threat of New Entrants

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Bargaining Power of Customers

- 4.5.5 Threat of Substitute Products

- 4.6 Industry Policies and Assessment of COVID-19 Impact

- 4.7 Technology Snapshot

5 MARKET SEGMENTATION

- 5.1 Products

- 5.1.1 Bottles

- 5.1.2 Jars

- 5.1.3 Vials

- 5.1.4 Other Products

- 5.2 End-user Industry

- 5.2.1 Pharmaceuticals

- 5.2.2 Medical

- 5.2.3 Personal Care

- 5.2.4 Household Care

- 5.2.5 Agricultural

- 5.3 Country

- 5.3.1 Saudi Arabia

- 5.3.2 United Arab Emirates

- 5.3.3 South Africa

- 5.3.4 Rest of Middle-East and Africa

6 VENDOR MARKET SHARE ANALYSIS

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Ltd

- 7.1.2 WestPack

- 7.1.3 Sonoco Products Company

- 7.1.4 Honeywell International Inc.

- 7.1.5 MTS Medication Technologies

- 7.1.6 Reynolds Packaging

- 7.1.7 The DOW Chemical Company

- 7.1.8 Uhlmann Group

- 7.1.9 Rohrer Corporation

- 7.1.10 Pharma Packaging Solutions

- 7.1.11 Tekni-Plex Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219