|

市场调查报告书

商品编码

1626325

欧洲危险区域马达:市场占有率分析、产业趋势、统计、成长预测(2025-2030)Europe Hazardous Location Motors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

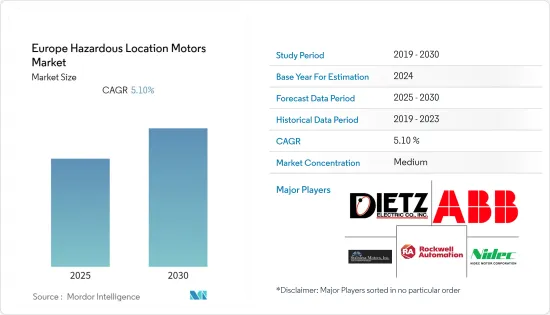

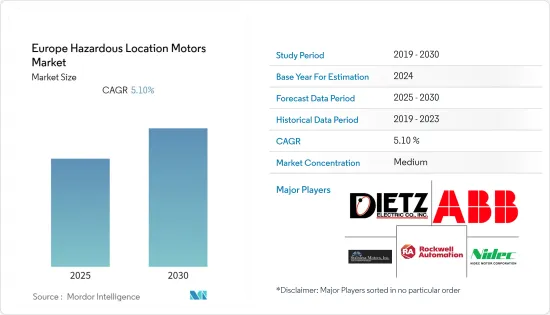

欧洲危险场所马达市场预计在预测期内复合年增长率为 5.1%

主要亮点

- 加工业事故数量的增加凸显了先进危险区域马达的重要性。与危险场所电气设备的设计和使用相关的安全问题导致当局实施了严格的规定。此外,安全设计意识正在增强。

- 可可粉广泛用于巧克力工业,包括糖果、烘焙和麵粉加工。这些食品工业容易发生粉尘爆炸。可可研磨过程在欧洲受到严格监管,这就是防爆马达深受食品製造商欢迎的原因。欧洲可可产量的增加正在推动所研究市场的成长。

- 例如,德国糖果零食协会(BDSI)报告称,2021年第二季德国可可粉销量为108,615吨,较去年同期成长16.35%。 2019年第一季销量成长5.1%。

- 然而,危险场所马达市场面临的挑战是,设计和製造能够完全吞噬内部爆炸而不会破裂的马达,或者排放热气体从机壳中排出并通过称为火焰道的细长开口排出。

- 此外,COVID-19 大流行也为所研究的市场带来了一些挑战,例如供应链中断和原材料价格上涨。

欧洲危险场所马达市场趋势

煤炭生产中的防爆马达可望占据主要市场占有率

- 在欧洲地区,煤炭产量的增加以及钢铁製造和发电等各种用途对煤炭的依赖日益增加正在推动市场成长。

- 例如,根据国际能源总署(IEA)的数据,德国2020年煤炭产量为101吨,2021年为103吨。波兰2020年煤炭产量为96吨,2021年为98吨。

- 在这些地区,带有温度代码(T 代码)的马达和防火马达的使用正在增加。

- 防爆马达,属于防爆马达的一部分,适用于煤矿井下有甲烷或煤尘爆炸危险的地方,有可燃性气体或液蒸气与空气的爆炸性混合物发生的区域(1区、2区)这也越来越流行。

石油和天然气需求的增加推动市场成长

- 由于石油和天然气行业的高需求,欧洲成为危险场所马达的重要市场。根据贝克休斯统计,截至2021年10月,欧洲共有104个石油和天然气钻井平台,其中32个为海上钻机。

- 根据汤森路透报道,跨国石油与燃气公司荷兰皇家壳牌公司(英国)2021年收益为1,761.9亿美元,其次是英国石油公司,为1,362亿美元。

- 此外,据英国石油公司称,2020年欧洲和独联体国家的石油消费量为每天1693万桶。

- I 类危险场所马达设计用于在含有易燃或可燃气体、蒸气和灰尘的环境中运行,并且越来越受欢迎。为了避免灾难性的外部爆炸,为了使马达在这些环境中安全运行,点火或爆炸必须控制在设备外壳内,而不会点燃周围的空气。选择适合运转环境的马达,可以避免此类事故的发生。

欧洲危险场所马达产业概述

欧洲危险场所马达市场 作者:Brook Crompton,Stainless Motors, Inc. 市场中的公司应专注于技术创新和策略联盟,以扩大市场占有率。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术简介

- COVID-19 影响评估

第五章市场动态

- 市场驱动因素

- 增加安全措施

- 对节能马达的需求不断增长

- 市场限制因素

- 监理与合规

- 与非防爆马达相比,材料和人事费用安装成本较高

第六章 市场细分

- 按类型

- 防爆通用马达

- 马达

- 防爆泵马达

- 防爆变频负载马达

- 防爆重载马达

- 按班级

- Ⅰ类

- 二级

- 三级

- 按部门划分

- 1级

- 2区

- 按区域

- 0区

- 1区

- 21区

- 22区

- 按用途

- 喷漆和精加工区域

- 精製

- 干洗设施

- 天然气厂

- 谷物提昇机和谷物加工设施

- 麵粉厂

- 铝材生产及仓储区

- 火力发电厂和储存设施

- 糖果厂

- 其他用途

- 按国家/地区

- 英国

- 德国

- 俄罗斯

- 法国

- 其他欧洲国家

第七章 竞争格局

- 公司简介

- Brook Crompton

- Stainless Motors, Inc.

- Dietz Electric Co., Inc.

- Emerson Electric Co.

- WEG Industries

- Rockwell Automation, Inc.

- Nidec Motor Corporation

- Kollmorgen Corporation

- ABB Ltd

- Heatrex Inc.

第八章投资分析

第9章 市场的未来

简介目录

Product Code: 47560

The Europe Hazardous Location Motors Market is expected to register a CAGR of 5.1% during the forecast period.

Key Highlights

- Increasing numbers of accidents in processing industries highlight the importance of advanced hazardous location motors. Safety problems associated with the design and use of electrical equipment in hazardous areas have led authorities to impose strict rules. It has also elicited awareness of safe-equipment design.

- Cocoa powder is widely used in the chocolate industry by confectionaries and bakeries, and flour mills. These sectors are more prone to dust explosion in the food processing industry. The grinding process of the cocoa comes under strict regulations in the European region, due to which the penetration of the explosion-proof motor is high among the food manufacturers. The increasing cocoa production in Europe is aiding the growth of the studied market.

- For instance, the German Confectionery Association Members (BDSI) reported cocoa grindings of 1,08,615 tonnes in Germany in the second quarter of 2021, representing a 16.35% increase over the same quarter the previous year. Grindings increased by 5.1% in the first quarter of 2019.

- However, designing and manufacturing motors that completely engulf an internal explosion without rupturing or passing out any hot gases from the enclosure so that they are forced to exit through a long, narrow opening known as flame paths are the two major challenges faced by hazardous location motors market.

- Further, the Covid-19 pandemic has also posed several challenges to the studied market, like disruption in the supply chain and increased prices of raw materials.

Europe Hazardous Location Motors Market Trends

Explosion Proof Motor in Coal Production is Expected to Hold a Major Market Share

- The increasing production of coal and the growing dependency on it for several purposes in the European region, like steel making, power production, etc., is triggering the growth of the market.

- For instance, according to International Energy Agency (IEA), Germany produced 101 metric tonnes of coal in 2020 and 103 metric tonnes of coal in 2021. Poland produced 96 metric tonnes and 98 metric tonnes of coal in 2020 and 2021, respectively.

- Spark-proof motors or explosion-proof motors, which are assigned a temperature code (T code), are increasingly being used in these areas.

- Flameproof motors, which are a part of explosion-proof motors, are intended for use in coal mines that are at risk of methane and coal dust explosions in areas (zones one and two) where explosive mixtures of combustible gases and liquid steam with air occurs, are also gaining traction.

The Increasing demand for Oil and Gas to Drive the Market Growth

- Europe has been an important market for hazardous location motors as the region has a massive demand from its oil and gas industry. According to Baker Hughes, Europe had 104 oil and gas rigs as of October 2021, of which 32 were offshore rigs.

- According to Thomson Reuters, The Royal Dutch Shell plc (United Kingdom), a multinational oil and gas company, generated a revenue of USD 176.19 billion in 2021, followed by BP plc, which generated USD 136.2 billion in 2021.

- Further, according to BP, the oil consumption in Europe and CIS in 2020 was 16.93 million barrels per day.

- The class I hazardous location motors, which are designed to operate in environments containing combustible or ignitable gases, vapors, or dust, are gaining popularity. To avoid catastrophic external explosions, ignitions and explosions must be contained within the equipment's housing without igniting the surrounding air for motors to work safely in these environments. This sort of accident can be avoided by selecting the appropriate motor for the operating environment.

Europe Hazardous Location Motors Industry Overview

The Europe Hazardous Location Motors market is moderately competitive with significant players like Brook Crompton, Stainless Motors, Inc., Dietz Electric Co., Inc., Emerson Electric Co., WEG Industries, etc. The players in the market must focus on technological innovations and strategic collaborations to expand their market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Assessment of the Impact of COVID-19

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Safety Measures

- 5.1.2 Increasing Demand for Energy Efficient Motors

- 5.2 Market Restraints

- 5.2.1 Regulations and Compliance

- 5.2.2 High Installation Cost for Material and Labor in Comparison to Non-Explosion Proof Motors

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Explosion-Proof General Purpose Motors

- 6.1.2 Drill Rig Duty Motors

- 6.1.3 Explosion-Proof Pump Motors

- 6.1.4 Explosion-Proof Inverter Duty Motors

- 6.1.5 Explosion-Proof Severe Duty Motors

- 6.2 By Class

- 6.2.1 Class I

- 6.2.2 Class II

- 6.2.3 Class III

- 6.3 By Division

- 6.3.1 Division 1

- 6.3.2 Division 2

- 6.4 By Zone

- 6.4.1 Zone 0

- 6.4.2 Zone 1

- 6.4.3 Zone 21

- 6.4.4 Zone 21

- 6.4.5 Zone 22

- 6.5 By Applications

- 6.5.1 Spray Painting and Finishing Areas

- 6.5.2 Petroleum Refining Plants

- 6.5.3 Dry Cleaning Facilities

- 6.5.4 Utility Gas Plants

- 6.5.5 Grain Elevators and Grain Handling Facilities

- 6.5.6 Flour Mills

- 6.5.7 Aluminum Manufacturing and Storage Areas

- 6.5.8 Fire Work Plants and Storage Areas

- 6.5.9 Confectionary Plants

- 6.5.10 Other Applications

- 6.6 By Country

- 6.6.1 United Kingdom

- 6.6.2 Germany

- 6.6.3 Russia

- 6.6.4 France

- 6.6.5 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Brook Crompton

- 7.1.2 Stainless Motors, Inc.

- 7.1.3 Dietz Electric Co., Inc.

- 7.1.4 Emerson Electric Co.

- 7.1.5 WEG Industries

- 7.1.6 Rockwell Automation, Inc.

- 7.1.7 Nidec Motor Corporation

- 7.1.8 Kollmorgen Corporation

- 7.1.9 ABB Ltd

- 7.1.10 Heatrex Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219