|

市场调查报告书

商品编码

1626326

美国光学感测器:市场占有率分析、产业趋势、成长预测(2025-2030)US Optical Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

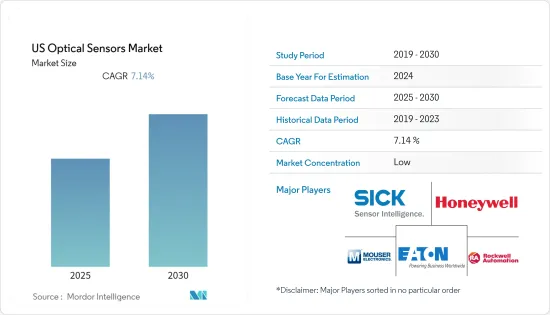

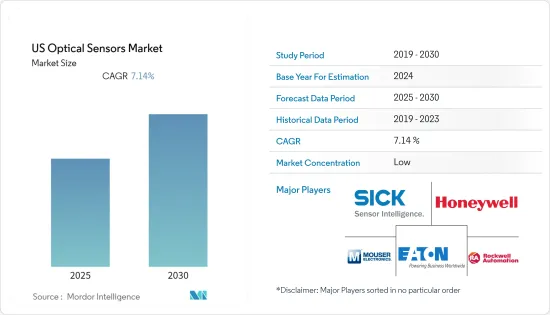

预计美国光学感测器市场在预测期内的复合年增长率为 7.14%。

根据消费者科技协会(CTA)2021年销售额预测,美国家用电子电器零售额达4,420亿美元。智慧型手机是家用电子电器领域零售额最大的产品,2020年销售额将达790亿美元。

美国智慧型手机家庭普及率已达74%,显示该国家庭普及潜力巨大。美国市场主要由市场上最新产品创新所驱动。

光学感测器通常整合到智慧型手机、智慧型穿戴装置和智慧型手錶中,用于环境光等目的。物联网 (IoT)、穿戴式技术以及健康和健身技术正在改变美国市场,是光学感测器需求成长的关键驱动力。

此外,由于智慧型电视的多功能性,预计其在美国将出现高速成长。根据comscore的数据,2020年,美国家庭最受欢迎的智慧型电视品牌是三星,份额稳定在32%,其次是阿尔卡特/TCL(14%)和Vizio(13%)。在美国,智慧型电视预计将普及到每个家庭,并且未来数量预计将进一步增加,从而刺激市场成长。

在美国,使用光学感测器的自动驾驶汽车正在兴起。 Waymo 等公司正在该国扩大业务,以促进无人驾驶汽车的使用。随着包括加州在内的全国各州扩大检查规则以支持无人驾驶汽车的发展,光学感测器的销售量预计将增加。

美国光学感测器市场趋势

光电感测器预计将录得显着增长

光电感测器因其检测物体的精度较高而广泛应用于工业自动化市场。这些感测器正在整合到各种自动化机械中,主要用于非接触式检测和测量,例如计数、监控、输送机机构、运输系统、工具机和组装。

根据《Control Global》杂誌报道,该地区主要自动化供应商包括艾默生、罗克韦尔、ABB、Fortive、施耐德电机和西门子。艾默生 2020 年销售额为 52.7 亿美元,罗克韦尔自动化紧随其后,2020 年销售额为 37.2 亿美元。

随着工业 4.0 的机器人和自动化趋势日益增强,操作精度已成为迫切需求。因此,对光电感测器的需求不断增加。包装、物料输送和汽车行业强调了对光电感测器的需求,因为它们与工业物联网和巨量资料整合以及对智慧感测器资料的依赖。

从包装(增加自动化仓储)到製造、药品到食品和饮料,此类趋势的兴起预计将在预测期内促进市场成长。

根据劳工统计局的数据,美国的仓库数量每年都在增加,2020 年将达到 19,190 个。此外,根据《富比士》对 48 名受访者的调查,三分之一的受访者计划在明年内投资输送机或自动分类设备。

光学感测器在工业和汽车应用中的使用预计将推动市场成长

光学感测器越来越多地应用于驾驶辅助系统,例如车道维持辅助系统、停车辅助系统和紧急煞车辅助系统。基于LED和红外线雷射的传感器是ADAS(高级驾驶辅助系统)的关键技术之一,可逐渐减轻驾驶员的负担。

根据美国经济分析局 (BEA) 的数据,2020 年美国汽车产量约为 220 万辆,由于 COVID-19 大流行而大幅减少。然而,这一数字预计在预测期内将会增加,这可能会推动市场成长。根据 OICA(国际汽车製造商组织)的数据,2020 年北美将生产近 1,340 万辆汽车。

基于红外线雷射的感测器也越来越多地整合到各种自动化机械中,主要用于非接触式检测,例如输送机系统、运输系统和组装监控。光学感测器在汽车行业的应用正在大幅增长,尤其是由于技术进步而使用影像感测器。由于汽车领域广泛的成像应用,预计汽车行业图像感测器的成长将迅速增长。

2020 年 1 月,全球感测器解决方案供应商艾迈斯半导体 (ams AG) 发布了 CMOS 全域百叶窗感测器 (CGSS) 近红外线(NIR) 影像感测器 CGSS130。 CGSS130 感测器在近红外线波长处具有高量子效率,在 940nm 处为 40%,在 850nm 处为 50%。用于製造感测器的层压 BSI 製程列出了 3.8mm*4.2mm 的小占地面积。

此感光元件可产生有效像素阵列为 1080H x 1280V、最大影格速率率为 120 帧/秒的单色影像。此外,我们还列出了超过 100dB 的高动态范围 (HDR) 模式。 CGSS130 对 NIR 波长的敏感度提高了四倍,能够可靠地侦测 3D 感测系统中低功率红外线发送器的反射。此感测器用于主动立体视觉、飞行时间和结构光等 3D 感测技术。

美国光学感测器产业概况

美国光学感测器市场细分为少数主要企业,包括老牌国际品牌、国内品牌和新参与企业,形成了竞争格局。一些主要参与企业越来越希望透过各种策略併购、技术创新和增加研发投资来扩大市场。

- 2021 年 2 月 Mouser Electronics 库存了医疗和汽车行业感测器供应商 Sensirion 的各种环境感测器。 SPS30颗粒物感测器是一款将雷射散射与Sensirion抗污染技术结合的光学感测器。此感测器能够准确测量 HVAC 设备、空调和物联网 (IoT) 设备。

- 2021 年 1 月:Honeywell宣布采用光学卡尺测量感测器,旨在优化锂离子电池 (LIB) 生产。此感测器描述了一种有效的解决方案,用于测量涂层过程中电极材料的真实厚度以及LIB製造过程中的压力站。光学卡尺测量感测器可侦测 0.5 毫米 x 0.5 毫米(0.019685 英吋 x 0.019685 英吋)区域内 1 微米(0.0393701 千分之一英吋)的涂层变化。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 价值链分析

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 智慧型手机普及率扩大

- 工业节电设备的需求增加

- 自动化技术在各行业的市场渗透率不断提高

- 市场限制因素

- 影像品质和价格之间的不平衡

第六章 市场细分

- 技术部分

- 高光谱影像

- 近红外线光谱

- 光声断层扫描

- 光学相干断层扫描

- 感测器类型

- 光纤感测器

- 影像感测器

- 位置感测器

- 环境光和接近感测器

- 硫化镉

- 硅

- 砷化镓感测器

- 扩展InGaAs感测器

- 红外线感测器

- 其他感测器

- 目的

- 商业的

- 家用电子电器

- 医疗用途

- 车

- 工业的

- 航太/国防

- 光耦合器

- 4针光耦

- 6针光耦

- 高速光耦合器

- 用于 IGBT 闸极驱动器的光耦合器

- 绝缘放大器用光耦

- 其他的

第七章 竞争格局

- 公司简介

- Mouser Electronics Inc.

- Sick AG

- Rockwell Automation

- Honeywell Inc.

- Eaton Corporation

- Turck inc.

- Robert Bosch GmbH

- Atmel Corporation

- ST Microelecronics inc

- Hitachi Ltd

- Omnivision Inc.

第八章投资分析

第9章市场的未来

The US Optical Sensors Market is expected to register a CAGR of 7.14% during the forecast period.

According to the Consumer Technology Association (CTA), based on the projected retail sales for 2021, consumer electronics retail sales in the United States reached USD 442 billion. Smartphones were the products accounting for the largest retail revenue within the consumer electronics sector, comprising USD 79 billion in revenue in 2020.

The smartphone household penetration stands at 74% in the United States, which indicates a high potential for household penetration in the country. The United States market is primarily driven by the latest product innovations in the market.

Optical sensors are typically embedded in smartphones, smart wearable, and smartwatches for ambient light and other purposes. Internet of Things (IoT), wearable technology, and health and fitness technology have transformed the United States market and have been primary drivers for increasing the demand for optical sensors.

Smart TVs are also expected to witness high growth in the United States, owing to high multi-functionality. According to comscore, In 2020, Samsung remained the most popular smart TV brand among US households, with a steady share of 32%, followed by Alcatel/TCL and Vizio with 14% and 13% market share, respectively. It is expected that smart TVs will be a part of all households in the United States, which is expected to further increase further, thereby fueling the growth of the market.

Autonomous vehicles, which use optical sensors, have been on the rise in the United States. Companies, such as Waymo, are stationed in the country and have been expanding operations to drive the use of driverless cars. Various states in the country, such as California, have been expanding testing rules to aid the development of driverless cars, which is expected to increase the sales of optical sensors.

US Optical Sensors Market Trends

Photoelectric Sensor is Expected to Register a Significant Growth

These sensors have been recognized for their robust use in the industrial automation marketplace, owing to their high precision in detecting objects. These sensors have found a rising integration into a wide range of automated machinery, mainly for non-contact detections and measurements, including counting, monitoring, conveyor mechanisms, transport systems, machine tools, and across assembly lines.

According to Control Global Magazine, some of the leading automation vendors in the region include Emerson, Rockwell, ABB, Fortive, Schneider Electric, Siemens, etc. Emerson had a sales revenue of USD 5.27 Billion in the year 2020, followed by Rockwell Automation with a sales revenue of USD 3.72 Billion in 2020.

With a greater inclination toward employing robotics and automation through Industry 4.0, there is a pressing need for precision in operations. Thus, driving the need for photoelectric sensors. The packaging, material handling, and automotive industries have emphasized the need for photoelectric sensors, owing to their collaboration of IIoT with Big Data and the reliance on data from smart sensors.

This rising trend in sectors, ranging from packaging (the growth of automated warehouses) to manufacturing, and pharmaceuticals to food and beverages, is set to augment the growth of the market over the forecast period.

According to the Bureau of Labor Statistics, the number of warehouses in the United States has been growing at an increasing rate every year, reaching 19,190 in 2020. Forbes survey with 48 respondents also showed that one-third of respondents plan to invest in conveyors or automatic sortation facilities in the next 12 months.

Usage of optical sensors in Industrial and Automotive applications are expected to drive the growth of the market

Optical sensors are increasingly used in driver assistance systems for lane-keeping assistants, parking assistants, and emergency brake assistant systems. The sensors, based on LEDs and infrared lasers, are one of the primary technologies for advanced driver assistance systems to reduce the burden on the driver gradually.

According to the U.S. Bureau of Economic Analysis (BEA), In 2020, approximately 2.2 million automobiles were produced in the United States, which has decreased a lot due to the covid-19 pandemic. However, this number is expected to increase in the forecasted period, which can fuel the growth of the market. Organisation Internationale des Constructeurs d'Automobiles (OICA), almost 13.4 million motor vehicles were produced in North America in 2020.

Sensors based on infrared lasers are also witnessing a rising integration into a wide range of automated machinery primarily for non-contact detection, such as monitoring conveyor systems, transport systems, and assembly lines. The application of optical sensors in the automotive industry is considerably growing, especially with the usage of image sensors due to the advancement of technology. The image sensors growth in the automotive industry is estimated to grow rapidly due to its extensive image applications in the automotive sector.

In January 2020, ams AG, a worldwide supplier of sensor solutions, launched the CMOS Global Shutter Sensor (CGSS) Near Infrared (NIR) image sensor, CGSS130, that enables 3D optical sensing applications such as face recognition, payment authentication, among others. The CGSS130 sensor has high quantum efficiency at NIR wavelength up to 40% at 940nm and 50% at 850nm. The stacked BSI process used to fabricate the sensors offer a small footprint of 3.8mm*4.2mm.

The sensor produces monochrome images with an effective pixel array of 1080H X 1280V at a maximum frame rate of 120 frames/s. In addition, it offers a high dynamic range (HDR) mode of more than 100dB. The CGSS130 is 4times more sensitive to NIR wavelengths and reliably detects reflections from very low-power IR emitters in 3D sensing systems. The sensor is used for 3D sensing technologies such as Active Stereo Vision, Time-of-flight, and Structured Ligh.

US Optical Sensors Industry Overview

The United States Optical Sensors Market is fragmented with few major players, which are various established international brands, domestic brands, as well as new entrants that form a competitive landscape. Some of the major players are increasingly seeking market expansion through various strategic mergers and acquisitions, innovation, increasing investments in research and development.

- February 2021: Mouser Electronics stocked a broad selection of environmental sensors from Sensirion, a supplier of sensors for the medical and automotive industries. The selection included the SPS30 particulate matter sensor, which is an optical sensor that combines laser scattering with Sensirion's contamination-resistant technology. The sensor enables accurate measurements for HVAC equipment, air conditioners, and Internet of Things (IoT) devices.

- January 2021: Honeywell announced the introduction of an Optical Caliper Measurement Sensor designed to optimize Lithium-Ion Battery (LIB) production. The sensor provides an effective solution for measuring the true thickness of electrode material during coating as well as at the pressing station during LIB manufacturing. The Optical Caliper Measurement Sensor can detect variations in coatings as small as 1 micron (0.0393701 thousandths of an inch) in areas as small as 0.5 mm x 0.5 mm (0.019685 inches x 0.019685 in).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Covid-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Market Penetration of Smartphones

- 5.1.2 Increasing Demand for Power-saving Devices Across Industries

- 5.1.3 Increasing Market Penetration of Automation Techniques Across Various Industries

- 5.2 Market Restraints

- 5.2.1 Imbalance Between the Image Quality and Price

6 MARKET SEGMENTATION

- 6.1 Technology

- 6.1.1 Hyperspectral imaging

- 6.1.2 Near IR Spectroscopy

- 6.1.3 Photo-Acoustic Tomography

- 6.1.4 Optical Coherence Tomography

- 6.2 Sensor Type

- 6.2.1 Fiber Optic Sensors

- 6.2.2 Image Sensors

- 6.2.3 Position Sensors

- 6.2.4 Ambient light and proximity sensors

- 6.2.4.1 Cadmium Sulfide

- 6.2.4.2 Silicon

- 6.2.4.3 InGaAs Sensors

- 6.2.4.4 Extended InGaAs Sensors

- 6.2.5 Infrared Sensors

- 6.2.6 Other Sensors

- 6.3 Applications

- 6.3.1 Commercial

- 6.3.2 Consumer Electronics

- 6.3.3 Medical

- 6.3.4 Automotive

- 6.3.5 Industrial

- 6.3.6 Aerospace & Defence

- 6.3.7 Optocouplers

- 6.3.7.1 4-pin Optocouplers

- 6.3.7.2 6-pin Optocouplers

- 6.3.7.3 High speed optocouplers

- 6.3.7.4 IGBT gate driver optocouplers

- 6.3.7.5 Isolation Amplifier Optocouplers

- 6.3.8 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Mouser Electronics Inc.

- 7.1.2 Sick AG

- 7.1.3 Rockwell Automation

- 7.1.4 Honeywell Inc.

- 7.1.5 Eaton Corporation

- 7.1.6 Turck inc.

- 7.1.7 Robert Bosch GmbH

- 7.1.8 Atmel Corporation

- 7.1.9 ST Microelecronics inc

- 7.1.10 Hitachi Ltd

- 7.1.11 Omnivision Inc.