|

市场调查报告书

商品编码

1626335

美国智慧感测器:市场占有率分析、产业趋势、统计和成长预测(2025-2030)United States Smart Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

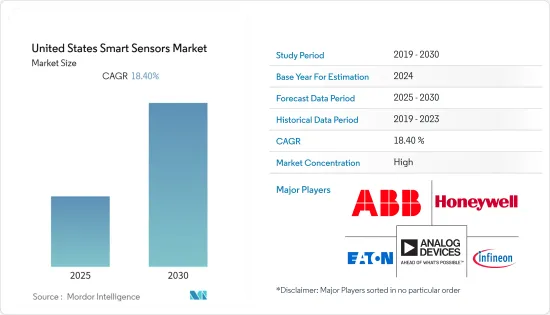

美国智慧感测器市场预计在预测期内复合年增长率为18.4%

主要亮点

- 感测器已成为各种应用中最重要且使用最广泛的组件之一。过去几年,对性能和效率的需求不断增长,导致智慧感测器的采用不断增加。

- 这些感测器是传统感测器的升级版,能够自动收集环境讯息,并显着降低错误率。智慧感测器改进了以下应用:自校准(调整感测器几何形状的 O/P 偏差)、通讯(广播有关其自身状态的资讯)、云端支援(存取巨量资料分析和机器学习 (ML) 演算法)、成本效益(硬体智慧感测器的成本-有效,因为它们需要更少的磨损并减少重复测试),多感测(一个智慧感测器,用于压力、温度、湿度、气流、红外线、化学反应、表面、声学、蒸气等)。

- 物联网(IoT)的使用和渗透不断增加,加上用于车辆自动化和健康监测的智慧穿戴系统的兴起,预计将在预测期内促进智慧感测器市场的成长。一项研究显示,每年有近130万人死于交通事故,平均每天有3,287人死亡。因此,製造商正致力于将 ADAS 系统整合到乘用车中。智慧感测器技术广泛应用于汽车中,用于主动车距控制巡航系统、停车辅助、盲点侦测和防撞。

- 将智慧感测器纳入製造业务的公司透过改进工业机械的资产管理和预测性维护来获得竞争优势。例如,在哈雷戴维森的生产设施中,所有资产都是相互连接的,管理人员可以透过绩效管理系统即时追踪生产的每个步骤并监控关键设备,以主动解决潜在的中断问题。

- 此外,工业 4.0 也影响OEM在业务整体采用物联网。玛丽维尔大学估计,到 2025 年,全球每年将产生超过 180 兆千兆位元组的资料。工业IoT(IIoT) 预计 IIoT 支援的产业将产生大部分资料。工业IoT(IIoT) 巨头微软的一项研究发现,85% 的公司至少拥有一个 IIoT使用案例计划。这一数字预计还会上升,94% 的受访者表示,他们将在 2021 年之前製定 IIoT 策略。

- 此外,COVID-19 大流行迫使世界各地的企业调整策略,以在「新常态」中生存。疫情影响了各个製造业,导致工业活动暂时停止。供应链中断影响了智慧感测器应用突出的领域的生产,例如家用电器、汽车和医疗设备。

美国智慧感测器市场趋势

温度感测器可望推动市场成长

- 智慧温度感测器是由温度感测器、偏压电路和类比数位转换器(ADC)组成的整合系统。温度感测器测量热量,以确保製程处于一定范围内,满足安全应用使用以及处理极端高温、危险或难以接近的测量点时的要求。对可靠、高性能、低成本感测器的需求不断增加,从而催生了微米技术和奈米技术等新技术。在 55 至 150°C 的温度范围内,双极性接面型电晶体几乎可以采用任何标准 IC 技术以及其他电路来製造,这使得它们非常适合作为温度感测器的应用。

- 由于其成本低、尺寸小且易于使用,它们被广泛应用于各种行业,包括汽车、住宅、医疗、环境、食品加工和化学工业。常见的温度感测器类型包括热电偶、红外线感测器和热敏电阻。温度感测器的主要应用是智慧恆温器,即智慧家庭设备。由于强烈的消费者兴趣、逐步的技术创新和不断增加的可及性,智慧家庭的需求预计将快速增长。

- 尽量减少与表面接触的需求推动了智慧家庭生态系统感测器系统的开发。 2022 年 1 月,GE 照明在 CES 2022 上扩展了其智慧型系统产品组合“Cyclc”,在其连网型产品系列中添加了智慧恆温器和温度感测器、一系列户外保全摄影机和照明产品。 CYNC 的室温感测器可与智慧恆温器搭配使用,可监控各个房间或整个家庭并自动优化室温。

- 此外,温度感测器可以在医疗保健领域实现精确的非接触式温度测量。医生使用基于物联网的温度追踪器来测量耳朵、前额或皮肤的温度。 FLIR Systems 宣布推出 FLIR A400/A700热感智慧感测器和热感影像流固定摄影机解决方案,用于监控设备、生产线、关键基础设施以及筛检皮肤温度升高,以应对新冠疫情。

- 这些高度可配置的智慧摄影机系统为各种应用提供精确的非接触式温度监控,包括製造过程控制、产品开发、废弃物管理、设备维护、排放气体监控以及环境、健康和安全 (EHS) 改进。建议用于测量皮肤温升的热感感测器配置结合了边缘运算增强型测量工具和警报,以实现更快的关键决策。

市场区隔预计将由工业自动化主导

- 新兴的工业IoT(IIoT) 技术正成为製造公司最大限度提高智慧工厂计画投资报酬率的关键要素。由于工业4.0 和物联网(IoT) 的接受,製造业发生了巨大转变,正在推动企业开发敏捷、智慧和智慧技术,以利用机器人技术补充和增强人类劳动力,并减少因流程故障而导致的工业事故。

- 智慧工厂采用物联网技术,透过感测器、机器人、软体、无线系统、企业软体、M2M 学习或其他技术来收集、共用和分析资料。透过利用连接和感测器,可以产生有关工厂和整个供应链中物理事物状况的可操作的、近乎即时的资料见解。这与资料分析、新技术和高速网路相结合,使製造商能够更好地维护资产并提高生产效率。

- 此外,人工智慧和机器学习功能的市场渗透可能会提高速度、准确性和资料分析,从而进一步推动市场发展。现场设备市场、感测器和机器人的进步可能会进一步扩大研究市场的范围。

- 采用智慧系统可以减少对人力的需求,特别是在充满挑战的环境中。品管过程历来依赖人为干预。也就是说,更多用户友好的控制将使这些智慧工厂系统更容易访问,并有望在复杂的製造环境中变得更加普遍。

- 工业机器人技术是製造过程中的颠覆性现象,可望彻底改变智慧工厂市场。工业机器人的引入带来了先进的生产过程,有助于提高生产率、减少人为错误并提高产量。

- 透过整合智慧感测器,智慧工厂可以帮助工厂管理者提供优化生产流程、快速测试先进製造设计以及优化所有物流所需的工具。智慧工厂技术和物联网设备对整个製造价值链的效率、产品品质和安全具有深远的影响。物联网技术可以增强智慧製造的要素,例如品质保证、设备维护、业务、库存管理和其他製造业务。

美国智慧感测器产业概况

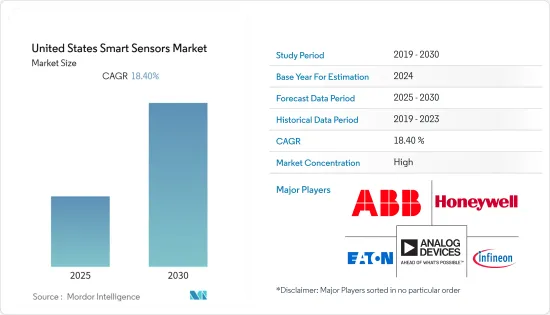

英飞凌科技股份公司、Microchip Technology Inc.、Analog Devices, Inc.、TE Connectivity、意法半导体、伊顿公司、霍尼韦尔国际公司是美国智慧感测器市场的主要竞争对手。由于ABB、西门子、Honeywell等跨国公司的存在,市场集中。感测器技术需要较高的初始投资以及产品的持续研发。

- 2021 年 12 月 -SONY半导体解决方案开发了一种具有两层电晶体像素的堆迭式 CMOS 影像感测器,与传统影像感测器相比,其饱和讯号水平加倍、拓宽了动态范围并降低了杂讯。这些感测器设计的开发经过最佳化,可在任务关键型汽车应用的复杂且苛刻的环境中提供快速、清晰和高品质的影像。

- 2021 年 7 月 - 三星发表 ISOCELL Auto 4AC。这是该公司首款汽车专用影像感测器,旨在用作倒车摄影机或(在更先进的系统中)为环景显示监视器供电。重点是高动态范围 (120dB) 和减少 LED 闪烁等实用方面。它们基于三星称为 CornerPixel 的技术。该技术每个像素结合了两个光电二极管,一个 3.0μm 用于低照度操作,另一个 1.0μm 放置在角落用于明亮环境(因此得名)。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- 技术简介

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 对能源效率和节约的需求不断增长

- 小型化和无线功能的技术进步

- 市场限制因素

- 与传统感测器相比,设计复杂

- 实施成本相对较高

第六章 市场细分

- 按类型

- 流量感测器

- 影像感测器

- 位置感测器

- 压力感测器

- 温度感测器

- 其他类型

- 依技术

- MEMS

- CMOS

- 光谱学

- 其他技术

- 按成分

- 类比数位转换器

- 数位类比转换器

- 扩大机

- 其他组件

- 按用途

- 航太/国防

- 汽车/运输设备

- 卫生保健

- 工业自动化

- 建筑自动化

- 消费性电子产品

- 其他用途

第七章 竞争格局

- 公司简介

- ABB Ltd

- Honeywell International Inc.

- Eaton Corporation

- Analog Devices Inc.

- Infineon Technologies AG

- NXP Semiconductors NV

- ST Microelectronics

- Siemens AG

- TE Connectivity Ltd

- Legrand Inc.

- General Electric

- Vishay Technology Inc.

第八章投资分析

第9章 未来展望

The United States Smart Sensors Market is expected to register a CAGR of 18.4% during the forecast period.

Key Highlights

- Sensors have become one of the most important and widely used components in various applications. The increasing demand for performance and efficiency has helped in the rising adoption of smart sensors over the past few years.

- These sensors represent an upgrade over conventional sensors, enabling the automated collection of environmental information with a significantly lower error rate. Smart sensors improve the following applications, Self-calibration (Adjust deviation of o/p of sensor form), Communication (Broadcast information about its own status), Cloud support (Access Big Data Analytics and machine learning (ML) algorithms), Cost-effectiveness (Less hardware and reduction of repetitive testing make smart sensors cost-effective), Multi-sensing (A single, smart sensor can measure pressure, temperature, humidity, gas flow and infrared, chemical reaction, surface, acoustic, vapor and more).

- The increasing utilization and penetration of the internet of things (IoT), coupled with increasing automation in vehicles and smart wearable systems for health monitoring, is expected to augment the growth of the smart sensors market over the forecast period. According to a study, nearly 1.3 million people die in road crashes each year, on average, 3,287 deaths per day. Hence, manufacturers are focusing on incorporating the ADAS system in passenger vehicles. Smart sensor technology is used vastly in automobiles for adaptive cruise control, park assistance, blind-spot detection, and collision avoidance.

- Companies that have integrated smart sensors in their manufacturing operations have achieved competitive advantage through improved asset management and predictive maintenance of industrial machinery. At Harley-Davidson's production facility, for example, every asset is connected, allowing management to track each step of production in real-time in a performance management system and monitor critical equipment to address potential interruptions proactively.

- Moreover, industry 4.0 influenced OEMs to adopt IoT across their operations. Maryville University estimated that by 2025 over 180 trillion gigabytes of data would be created globally every year. Industrial IoT (IIoT)IIoT-enabled industries are expected to generate a large portion of the data. A survey by industrial IoT (IIoT) giant Microsoft found that 85% of companies have at least one IIoT use case project. This number is expected to rise, as 94% of respondents said they would implement IIoT strategies by 2021.

- Additionally, the COVID-19 outbreak forced companies globally to adjust their strategies to survive in the "new normal." The outbreak affected the various manufacturing industries, resulting in a temporary shutdown of industrial operations. The supply chain's disruption affected the production of consumer electronics, automotive, healthcare devices, and other sectors, which are prominent adopters of smart sensors.

US Smart Sensors Market Trends

Temperature Sensors are Expected to Drive the Market's Growth

- A smart temperature sensor is an integrated system comprising a temperature sensor, bias circuitry, and an analog-to-digital converter (ADC). A temperature sensor measures heat to ensure a process stays within a specific range, providing safe application usage or meeting a necessary condition when dealing with extreme heat, hazards, or inaccessible measuring points. The demand for reliable, high-performance, low-cost sensors is increasing, leading to new technologies like microtechnology and nanotechnology. For the temperature range of -55 to 150°C, bipolar junction transistors are very suited to be applied as temperature sensors because they can be fabricated in almost any standard IC technology, together with other circuitry.

- The low cost, small size, and ease of use led the sensors to widespread use in various industries, such as automobile, residential, medical, environmental, food processing, and chemical. Some of the common temperature sensor types include thermocouples, IR sensors, and thermistors. Temperature sensors find their primary usage in a smart thermostat, a smart home device. The demand for smart homes is forecasted to grow rapidly, owing to robust consumer interest, incremental technological innovations, and greater accessibility.

- The need for minimized contact with surfaces elevated the development of sensor systems for smart home ecosystems. In January 2022, GE Lighting expanded its smart systems portfolio, Cync, by introducing a Smart Thermostat and Temperature Sensor, a line of Outdoor Security Cameras, and additional lighting products to the family of connected products at CES 2022. The cync room temperature sensors work in tandem with their smart thermostat to monitor individual rooms or the entire home and automatically optimize the room temperature.

- Additionally, temperature sensors enable accurate non-contact temperature measurement in healthcare. Physicians use IoT-based temperature trackers to measure ear, forehead, or skin temperature. Responding to the pandemic, FLIR Systems Inc. announced the FLIR A400/A700 Thermal Smart Sensor and Thermal Image Streaming fixed camera solutions for monitoring equipment, production lines, critical infrastructure, and screening for elevated skin temperatures.

- These highly configurable smart camera systems offer accurate and non-contact temperature monitoring across various disciplines: manufacturing process control, product development, waste management, facilities maintenance, emissions monitoring, and Environmental, Health, and Safety (EHS) improvements. The thermal smart sensor configuration, recommended for measuring elevated skin temperatures, incorporates enhanced measurement tools and alarms with edge computing to enable faster critical decisions.

Industrial Automation Segment is Expected to Hold a Major Market Share

- The new industrial IoT (IIoT) technologies are becoming a key component in helping manufacturing companies to maximize the ROI from smart factory initiatives. Massive shifts in manufacturing due to industry 4.0 and the acceptance of IoT require enterprises to adopt agile, smarter, and innovative ways to advance production with technologies that complement and augment human labor with robotics and reduce industrial accidents caused by process failure.

- Smart factories adopt IoT technologies through sensors, robots, software, wireless systems, enterprise software, M2M learning, or other technologies to gather, share, and analyze data. Powered by connectivity and sensors, it generates actionable and near real-time data insights about the condition of physical things in the factory and throughout the supply chain. This, combined with data analytics, new technologies, and a fast network, is helping manufacturers better maintain their assets and boost production efficiency.

- Furthermore, the market penetration of AI and machine learning capabilities may enhance speed, accuracy, and data analysis, significantly driving the market further. The advancement in the field devices market, sensors, and robots may further expand the scope of the studied market.

- The adoption of smart systems can reduce the need for human labor, particularly in challenging environments. Quality control processes have historically relied on human intervention. Nevertheless, with more user-friendly controls, the greater availability of these smart factory systems is expected to gain popularity in complex manufacturing settings.

- Industrial robot technology is a disruptive phenomenon in the manufacturing process and is expected to bring a revolution in the smart factory market. Implementation of industrial robotics has led to advanced production processes that help in improving productivity, reducing human errors, and increasing production volume.

- Through the integration of smart sensors, Smarter factories can help plant managers by providing tools needed to optimize the production process, perform high-speed testing of advanced manufacturing designs, and optimize all logistics. Smart factory technology and IoT devices have far-reaching implications for efficiency, product quality, and safety across the manufacturing value chain. IoT technology can empower elements of smart manufacturing, such as quality assurance, equipment maintenance, warehouse operations, inventory management, and other manufacturing operations.

US Smart Sensors Industry Overview

Infineon Technologies AG, Microchip Technology Inc., Analog Devices, Inc., TE Connectivity, STMicroelectronics, Eaton Corporation plc, Honeywell International Inc., and others are among the leading competitors in the United States Smart Sensors Market. The presence of multi-national corporations such as ABB, Siemens, Honeywell, etc., makes the market concentrated. Sensor technology also requires high initial investment along with high continuous research and development of the product.

- December 2021 - Sony Semiconductor Solutions developed a stacked CMOS image sensor with two-layer transistor pixel, doubling saturation signal level, widening dynamic range, and reducing noise relative to conventional image sensors. Such developments in sensor designs are optimized to provide fast, clear, and high-quality video in mission-critical automotive applications' complex and demanding environments.

- July 2021 - Samsung launched the ISOCELL Auto 4AC, its first image sensor that is tailor-made for cars, intended to be used as a reverse camera or (on more advanced systems) to power surround view monitors. It focuses on practical things like a high dynamic range (120 dB) and LED flicker mitigation. They are based on what Samsung calls CornerPixel. This technology combines two photodiodes per pixel - one 3.0 µm for low-light operation and one 1.0 µm placed in the corner (hence the name) that would be used for bright environments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitutes

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Technology Snapshot

- 4.5 Assessment of the Impact of Covid-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Energy Efficiency and Saving

- 5.1.2 Technology Advancements in Miniaturization and Wireless Capabilities

- 5.2 Market Restraints

- 5.2.1 Complex Design Compared to Traditional Sensors

- 5.2.2 Relatively High Deployment Costs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Flow Sensors

- 6.1.2 Image Sensors

- 6.1.3 Position Sensors

- 6.1.4 Pressure Sensors

- 6.1.5 Temperature Sensors

- 6.1.6 Other Types

- 6.2 By Technology

- 6.2.1 MEMS

- 6.2.2 CMOS

- 6.2.3 Optical Spectroscopy

- 6.2.4 Other Technologies

- 6.3 By Component

- 6.3.1 Analog-to-Digital Converters

- 6.3.2 Digital-to-Analog Converters

- 6.3.3 Amplifiers

- 6.3.4 Other Components

- 6.4 By Application

- 6.4.1 Aerospace and Defense

- 6.4.2 Automotive and Transportation

- 6.4.3 Healthcare

- 6.4.4 Industrial Automation

- 6.4.5 Building Automation

- 6.4.6 Consumer Electronics

- 6.4.7 Other Applications

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Honeywell International Inc.

- 7.1.3 Eaton Corporation

- 7.1.4 Analog Devices Inc.

- 7.1.5 Infineon Technologies AG

- 7.1.6 NXP Semiconductors NV

- 7.1.7 ST Microelectronics

- 7.1.8 Siemens AG

- 7.1.9 TE Connectivity Ltd

- 7.1.10 Legrand Inc.

- 7.1.11 General Electric

- 7.1.12 Vishay Technology Inc.