|

市场调查报告书

商品编码

1626338

欧洲药品包装:市场占有率分析、产业趋势、统计与成长预测(2025-2030)Europe Pharmaceutical Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

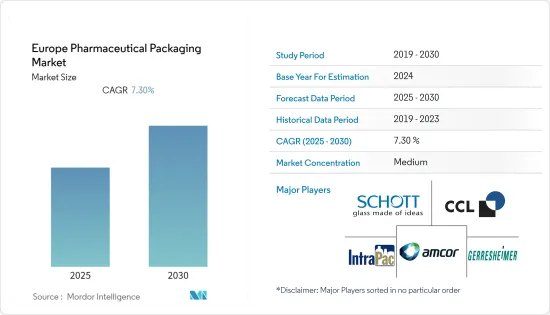

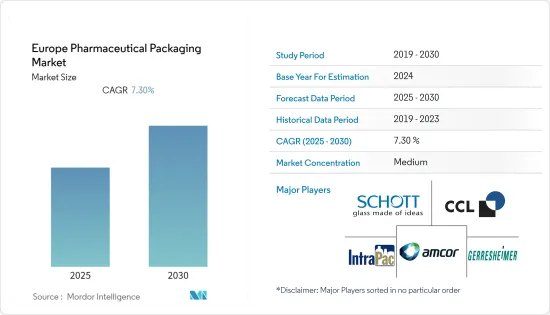

欧洲药品包装市场预计在预测期内复合年增长率为 7.3%

预计 2021 年至 2026 年预测期内,欧洲药品包装市场的复合年增长率约为 7.3%。由于生活方式的改变、越来越多的人被诊断出患有各种疾病以及政府医疗保健支出的增加,欧洲製药业正在经历快速增长和持续颠覆。然而,他们仍面临药品供应全球化、慢性生活方式增加以及假药威胁不断演变等挑战。

该地区的药品包装行业正在应对不断发展的製药行业在整个市场中感受到的挑战所带来的影响,这些挑战来自物理损坏、劣化和生物污染造成的各种性质的变化,它们在其中发挥着关键作用。

近年来,透过物联网、基因组学和其他连网型医疗设备等平台的发展,随着中小型企业进入市场的增加,定製药品的本地生产以及大麻等,该地区的包装行业出现了个性化方法的热潮。

此外,吹灌封技术等创新技术的引入以及对防伪技术日益增长的需求正在显着改变市场。全球化程度的提高导致製造工厂在世界各地建立,改善了原材料的使用并延长了供应链。

此外,最近要求药品序列化的欧盟 (EU) 法规已被添加到美国药品供应链安全法案中,将合规性延长至2023 年,使序列化和追踪倡议成为可能,以促进药品的可追溯性和真实性。同样,欧盟的其他法规目前要求医疗包装上有二维码,以验证产品标识及其真实性,并且透过利用智慧型手机技术,数位化

根据联合国进行的一项研究,抗体释放到环境中会加速抗药性菌株的出现并影响抗生素污染。针对这些案例,药品包装製造商更加重视永续性,考虑可回收和生物分解的包装材料、减少碳足迹和生命週期分析。

欧洲占全球市场的三分之一以上,仅次于北美,但包括中国在内的亚太国家的崛起正在构成威胁,对更快生产和提高保质期的需求正在增加,我们正在引领市场。该市场的担忧包括欧洲政府对药品包装的严格规定、与塑胶使用相关的环境问题以及所用原材料成本的上升。

在 COVID-19 大流行之前,成长是由电子商务行业的成长、对永续材料的兴趣增加以及智慧技术的整合所推动的。儘管如此,疫情后对泵浦、柔性泡壳铝箔等医疗保健包装的需求仍然激增。此外,由于对生技药品和疫苗的需求,公司现在正在投资无菌形式并扩大生产能力。

欧洲药品包装市场趋势

永续包装材料推动市场成长

- 众所周知,製药业是全球的重要污染物,因为它排放的温室气体比汽车排放多 55%。

- 此外,欧洲药品包装公司在分配系统方面的大部分研发工作都集中在永续性、提高合规性和儿童安全考量等因素。

- 例如,Ramaco Siebler 和 Huhtamaki 等领先公司已宣布计划推出可靠、可回收的单位剂量包装,用于由可回收材料(如聚烯层压板)製成的药品。包装零件90%由聚丙烯或聚乙烯製成,70%以上的产品将回收。多年来,企业也大幅减少了排放。

- 此外,2020年2月,总部位于欧洲的Natupharma A/S开发了一种新的完全生物分解性塑胶包装解决方案,由塑胶添加剂和甘蔗组成。

- 显然,药品包装预计将转向更永续的材料,远离该行业传统上严重依赖设计和製造的塑胶。该行业也将继续应用聚对苯二甲酸乙二醇酯(PET),因为它可以在分子水平上分解并转化回 PET。

德国占有很大的市场占有率

- 德国是欧洲製药和包装行业的主要贡献者,也是Gerresheimer AG和Schott AG等知名供应商的所在地,也是该地区最大的化学品和塑胶生产国之一,预计将占很大市场占有率。归因于以下因素:

- 例如,根据CPhI Worldwide进行的一项研究,德国在欧洲製药业中名列前茅,资料来自CPhl的年度报告以及全球350多家製药公司的意见。这一结果也巩固了德国作为精英製药市场的地位。

- 针对此类案例,该地区的知名供应商已开始在该地区进行投资,以维持其在市场中的战略地位。例如,2020 年2 月,Schott AG 在其位于德国米尔海姆的现有工厂建造了一座新生产工厂,并宣布了扩建计划,以满足对静脉治疗和高粘度药物所用的预充式无菌聚合物注射器不断增加的需求。施工预计 2021年终完成。

- 该工厂将满足对高端聚合物製成的药品包装不断增长的需求,预计将在不久的将来提高肖特股份公司在药品市场的地位。此外,2020年4月,该公司宣布计划在2025年投资10亿美元扩大其药品包装业务。

- 此外,製药和医疗设备业受到严格监管,重点关注製造和包装过程的安全性和永续性方面。更好、更先进的医疗保健基础设施的发展以及製药公司透过联盟和伙伴关係的发展预计将推动包装市场的成长。

欧洲药品包装产业概况

欧洲药品包装市场由 Amcor、CCL Industries、Intrapac、Rexam Plc 和 Schott AG 等公司主导,这些公司正在推动欧洲包装行业的永续性数位化,并透过大量研发投资扩大市场。

- 2020 年 2 月 - Amcor 宣布与医疗塑胶回收委员会建立合作伙伴关係,以提高塑胶产品的可回收性。

- 2020 年 6 月 - Amcor 和 Espoma Organic 合作创新永续塑胶包装并推出新型生物基聚合物包装。 PE(聚乙烯)薄膜含有 25% 来自甘蔗的生物基材料。

- 2021 年 11 月 - Gerreshmeir 和 Midas Pharma 宣布在创新自动注射器方面开展合作。随着公司越来越注重专有智慧财产权产品,药筒自动注射器增强了公司广泛的设备和初级药物包装产品组合。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 新兴国家製药业的成长

- 药物输送装置和泡壳包装市场的需求不断成长

- 奈米技术对欧洲药品包装发展的贡献

- 非处方药市场的成长

- 对永续包装材料和智慧技术整合产生兴趣

- 市场限制因素

- 包装成本增加

- 更严格的健康监管合规标准、环境问题

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 依材料类型

- 塑胶

- 玻璃

- 其他材料(纸/纸板、金属)

- 依产品类型

- 瓶子

- 管瓶/安瓿

- 小袋

- 注射器

- 药物管

- 盖子和塞子

- 标籤

- 其他产品类型

- 按国家/地区

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 其他欧洲国家

第六章 竞争状况

- 公司简介

- Gerresheimer AG

- CCL Industries Inc.

- 亚太集团

- Schott AG

- Nipro Corporation

- Vetter Pharma Packaging

- Ardagh Group SA

- Origin Pharma Packaging

- Gaplast GmbH

- Aptargroup Inc.

- Nolato AB

- APG Europe

- SGD Pharma

- Piramal Glass Ltd

- Amcor Ltd.

第七章 投资分析

第八章市场的未来

The Europe Pharmaceutical Packaging Market is expected to register a CAGR of 7.3% during the forecast period.

The Europe Pharmaceutical Packaging Market is estimated to grow at a CAGR of about 7.3% over the forecast period 2021 to 2026. The pharmaceutical Industry industry in Europe is experiencing constant disruption as it experiences exponential growth with the changing lifestyle and more and more people being diagnosed with various diseases and increased spending on healthcare by the government bodies. However, it continues to face challenges such as globalization of drug supply, rise in chronic lifestyle, and evolving threat concerning counterfeit medicine, among others.

The pharmaceutical packaging industry in the region plays a vital role in helping the evolving pharma industry to address the impact associated with challenges being felt across the market, ensuring the protection of drugs against all sorts of alteration in the properties caused as a result of physical damage, degradation, biological contamination while driving boost in profits.

Over the period last few years, the packaging sector in the region has been experiencing a great deal of transformation with the industry-changing focus towards personalized approaches with development of platforms such as IoMT, genomics, and other connected medical devices, localized production of customized medicines added with the increase in the number of SMEs entering the market, increasing demand for cannabis-based medicinal products and diversification of the innovators.

Also, the introduction of innovative techniques like Blow-Fill-Seal technology and the increasing need for anti-counterfeiting technologies are changing the market drastically. The increasing globalization has resulted in the setting up of manufacturing plants all across the world, thereby improving the raw materials used and lengthening the supply chains.

Additionally, with the recent European Union (EU) regulations mandating pharmaceutical serialization is added with the US Drug Supply Chain Security Act, compliance extended to 2023 is driving the serialization and track-and-trace efforts, thereby are promoting pharmaceutical traceability and authenticity in the region. Similarly, other EU regulation now requires dimensional codes on the medical packaging to help identify the product and verify their authenticity; leveraging smartphone technology drives the digitalization of the packaging industry.

According to a study conducted by the UN, the release of antibodies into the environment will accelerate the emergence of resistant strains and will impact antibiotic pollution, which continues to be the topic of global discussion in 2020. Owing to such instances, the manufacturers of pharmaceutical packaging are showcasing greater emphasis on sustainability by considering recyclable and biodegradable packaging materials, reduction in their carbon footprint, and lifecycle analyses.

However, Europe has been the second, just behind North America with more than a third of the global market, but with the emergence of China and other Asia-Pacific nations remains a threat, the increasing need for faster production and enhanced shelf appeal are driving the market ahead. Some concerns to this market are the stringent regulations to pharmaceutical packaging by the governments across Europe, environmental concerns regarding the use of plastics, and the rising costs of raw materials used.

Before the global pandemic COVID-19, the industry was driving growth concerning the growth of the e-commerce industry, increased interest in sustainable materials, and integration of smart technologies. Still, later the pandemic, there has been a surge in demand for healthcare packaging such as pumps, flexible blister foils, among others. Also, with the need for biologics and vaccines, the companies are now investing in the sterile format and are expanding their production capacity.

Europe Pharmaceutical Packaging Market Trends

Sustainable packaging materials to drive the market growth

- The pharmaceuticals industry is known to be a significant global polluter as it is responsible for generating the greenhouse gas emissions, i.e., 55% greater than that of the gas emitted by the automotive industry owing to the growing number of regulations and compliance such as the Paris agreement added with raising concern of people against the non-recyclable packaging materials is enabling the manufacturers to switch to sustainable materials.

- Also, Most of the R&D efforts by Europe's pharma packaging companies concerning drug dispensing systems are focused on factors such as sustainability, increasing compliance, and child safety considerations, among others.

- For instance, major players such as Ramaco Siebler, Huhtamaki announced their plans to launch a range of recyclable unit dose packaging for reliable pharmaceutical products to be made from recyclable material such as polyolefin laminate. The packaging component is expected to be made from 90% of either polypropylene or polyethylene, with more than 70% of the product would be recycled. Also, the companies have significantly reduced their emissions over the years.

- Furthermore, In February 2020, Natupharma A/S, based in Europe, developed a novel completely recyclable, biodegradable plastic packaging solution made of plastic additive and sugarcane, which is aimed to be used in the pharmaceutical industry owing to its biodegradability nature that does not alter the product' shelf life.

- Evidently, It is expected that pharma packaging will shift towards more sustainable materials by moving away from plastic, which the industry traditionally has been heavily dependent on for design and manufacturing. Also, the industry would continue the application of polyethylene terephthalate (PET) owing to its capability of breaking down its molecular level back into PET.

Germany to hold major market share

- Germany is expected to hold a significant market share in the region owing to factors such as its significant contribution in the European pharmaceutical & packaging industry, the presence of a few prominent vendors in the region, including Gerresheimer AG and Schott AG, among others, and also being one of the largest producers of chemicals and plastics in the region.

- For instance, According to the research conducted by CPhI Worldwide, Germany ranks as Europe's preeminent pharma industry as per the data drawn from CPhl Annual report and opinions from over 350 global pharma companies. Also, the results consolidate Germany as an elite pharmaceutical market.

- Owing to such instances, the Prominent vendors in the region have started to invest in the region to maintain their strategic position in the market. For instance, In February 2020, Schott AG announced its plan for expansion by building a new production plant at its existing site in Mullheim, Germany, to meet the increasing demand for pre-fillable sterile polymer syringes are used in intravenous therapies and highly viscous medications. The construction is expected to be completed by the end of 2021.

- The plant will help the company leverage the rising demand for pharmaceutical packaging made out of high-end polymer and is expected to enhance Schott AG's position in the pharmaceutical market in the near future. Also, In April 2020, the company further announced its plan to expand its pharmaceutical packaging business by investing USD 1 billion until the year 2025.

- Moreover, the pharmaceutical and medical device industries are highly regulated and have been emphasizing the safety and sustainability aspects of manufacturing and packaging processes. The development of better and more advanced healthcare infrastructure, coupled with the growth of pharmaceutical companies through alliances and partnerships, is set to boost the growth of the packaging market.

Europe Pharmaceutical Packaging Industry Overview

The European Pharmaceutical Packaging Market is moderately fragmented due to the presence of players like Amcor, CCL Industries, Intrapac, Rexam Plc, and Schott AG upscaling the market with substantial R&D investments, driving towards the sustainability and digitization of the packaging industry in Europe.

- February 2020 - Amcor announced the partnership with the Healthcare Plastics Recycling Council to improve the recyclability of plastic products.

- June 2020- Amcor and Espoma Organic partnered together and innovated sustainable plastic packaging and even launched a new bio-based polymer packaging. The PE (Polyethylene) film contains 25% bio-based material that is derived from sugarcane.

- November 2021 - Gerreshmeir and Midas Pharma announced a partnership for an innovative autoinjector is an important milestone to be a solution provider offering leading and innovative medical devices. With an increasing focus on its own-IP products, the company enhances the broad portfolio of devices and primary pharmaceutical packaging with this cartridge-based autoinjector.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in Pharmaceutical industries in Emerging economies

- 4.2.2 Growing demand for drug delivery devices & Blister packaging market

- 4.2.3 Contribution of Nano-technology in the growth of Europe Pharmaceutical packaging

- 4.2.4 Growth in over-the-counter market

- 4.2.5 Developing interest in sustainable packaging materials, and integration of smart technologies

- 4.3 Market Restraints

- 4.3.1 Increaing Packaging costs

- 4.3.2 Stricter health regulatory compliance standards, Environmental concerns

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Material Type

- 5.1.1 Plastic

- 5.1.2 Glass

- 5.1.3 Others Materials (Paper and Paperboard And Metal)

- 5.2 By Product Type

- 5.2.1 Bottles

- 5.2.2 Vials and Ampoules

- 5.2.3 Pouches

- 5.2.4 Syringes

- 5.2.5 Medication Tubes

- 5.2.6 Caps and Closures

- 5.2.7 Labels

- 5.2.8 Others Product Types

- 5.3 By Country

- 5.3.1 United Kingdom

- 5.3.2 Germany

- 5.3.3 France

- 5.3.4 Spain

- 5.3.5 Italy

- 5.3.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Gerresheimer AG

- 6.1.2 CCL Industries Inc.

- 6.1.3 Intrapac Group

- 6.1.4 Schott AG

- 6.1.5 Nipro Corporation

- 6.1.6 Vetter Pharma Packaging

- 6.1.7 Ardagh Group SA

- 6.1.8 Origin Pharma Packaging

- 6.1.9 Gaplast GmbH

- 6.1.10 Aptargroup Inc.

- 6.1.11 Nolato AB

- 6.1.12 APG Europe

- 6.1.13 SGD Pharma

- 6.1.14 Piramal Glass Ltd

- 6.1.15 Amcor Ltd.