|

市场调查报告书

商品编码

1626343

欧洲气体感测器:市场占有率分析、产业趋势、统计、成长预测(2025-2030)Europe Gas Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

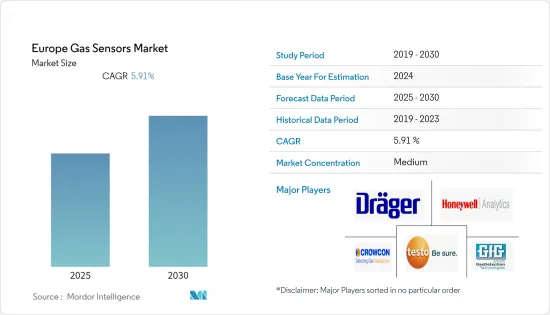

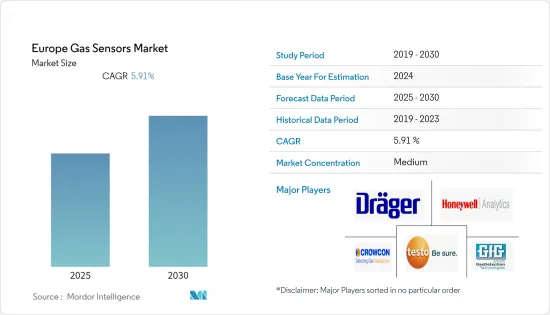

欧洲气体感测器市场预计在预测期内复合年增长率为 5.91%

主要亮点

- 欧洲气体感测器市场预计将继续以汽车和交通应用为主。污染物气体经由通风系统进入乘客室。新鲜空气摄入不足会导致氧气(02)浓度过低,污染物会透过窗户进入,有害气体会因废气方向错误而进入。在欧洲,严格的环境和安全要求要求所有汽车和运输OEM在其产品中包含气体感测器技术。

- 此外,工业物联网也在该地区取得进展。客户对物联网气体探测器越来越感兴趣,产业参与者正在努力建立适合物联网解决方案的产品线。由于需要连续、即时监测和检测排放物,对无线检测器的需求预计将推动近年来和未来几年对气体检测器的需求。

- 二氧化碳感测器主要用于家庭、学校、办公室和医院来监测室内空气品质。同样,这些感测器也用于即时监控农产品的新鲜度、品质和安全性。因此,该地区对二氧化碳感测器的需求正在迅速增加,因为过度接触二氧化碳会导致头痛和烦躁等健康问题。

- 然而,该地区正在经历大规模的 COVID-19 疫情,西班牙、法国、义大利和英国政府下令关闭。因此,某些严重依赖气体感测器市场的最终用户公司预计业务将受到干扰,市场也会受到影响。

欧洲气体感测器市场趋势

政府对气体感测器采用的支持性法规

- 随着政府污染法规变得更加严格,气体感测器在汽车产业变得越来越受欢迎。例如,去年(2020年)12月修订的《通用安全条例》要求在所有车辆上实施行人安全通讯协定,并考虑到速度辅助、感测器、先进紧急煞车系统和资料记录等新技术。商。

- 污染物气体经由通风系统进入、污染物经由窗户开口进入、缺乏新鲜空气摄入而导致氧气(02)浓度降低、因废气改道而导致有毒气体进入等。因此,严格的环境和安全法要求所有汽车和运输OEM提供气体感测器系统。

- 此外,随着复杂的安全功能和ADAS(高级驾驶辅助系统)的兴起,安全性和舒适性正在从豪华车转向中檔车,因此每辆车的气体感测器和检测器零件的使用量也在增加。增加。

- 博世 (Bosch)、电装 (Denso) 和英飞凌科技 (Infineon Technologies) 等主要汽车感测器公司正在投资开发技术更先进、更安全、更可靠的基于气体感测器的产品,以适应各种应用。

气体感测器在关键领域的需求量很大

- 气体感测器用于化学品、采矿、石油和天然气以及电力等关键领域,用于检测和监控可燃性气体和有毒气体的存在。这些关键操作向大气中排放多种气体,包括二氧化碳、一氧化碳、氨、碳氢化合物和硫化氢。这些气体排放排放到大气中会对人类健康产生负面影响。

- 此外,这些关键操作可能会排放一些爆炸性气体,例如丙烷、甲烷和丁烷,并可能引起火灾。许多监管机构已经实施了各种法规来保护生态系统免受危险气体的影响。

- 这需要对这些气体进行检测和监测,并采取补救措施,以确保只有少量的这些气体直接释放到大气中。因此,关键产业对感测器等物联网设备的需求不断增长,大大推动了该地区的市场。

欧洲气体感测器产业概况

欧洲气体感测器市场部分分散。市场的主要企业包括 GFG Europe、Crowcon Inspection Instruments Limited、Testo SE &Co.KGaA、Honeywell Analytics Inc. 和 Draegerwerk AG &Co.KGaA。该领域的最新进展包括:

- 2021年10月,Honeywell宣布即使在雨、雾、雪等恶劣天气条件下也能持续监测有害气体,确保化工、石化、石油天然气等工业工人和场所的安全。蓝牙(R)* 连接气体侦测器。

- 2021 年 1 月,江森自控公司的新产品 GS3000 可监测一氧化碳 (CO) 或二氧化氮 (NO2) 水平,并在室外和室内应用中儘早检测到浓度过高并发出警告。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 气体感测器更多地整合到空气品质监测器和 HVAC 系统中

- 支持性政府法规

- 市场限制因素

- 成本增加和技术问题

第六章 市场细分

- 依气体类型

- 氧

- 二氧化碳

- 一氧化碳

- 氮氧化物

- 烃

- 其他的

- 按连线类型

- 有线

- 无线的

- 依技术

- 电化学

- 顺磁性的

- 氧化锆

- 无损红外线

- 按用途

- 石油和天然气

- 化学/石化

- 用水和污水

- 车

- 卫生保健

- 电力

- 其他的

- 按国家/地区

- 英国

- 德国

- 法国

- 其他欧洲国家

第七章 竞争格局

- 公司简介

- Honeywell Analytics Inc.

- Johnson Controls Corporation

- Testo SE & Co. KGaA

- Comtrol Instruments Corporation

- RAE Systems

- ABB Ltd.

- GFG Europe

- Draegerwerk AG & Co. KGaA

- MSA Safety Incorporated

- Teledyne Technologies Incorporated(3M)

第八章投资分析

第9章市场的未来

简介目录

Product Code: 47975

The Europe Gas Sensors Market is expected to register a CAGR of 5.91% during the forecast period.

Key Highlights

- The European gas sensor market is projected to continue to be dominated by automotive and transportation applications. Pollutant gases enter the car cabin through the ventilation systems. There is a shortage of fresh air intake, which results in low oxygen (02) concentrations, pollutants entering through window apertures, and hazardous gases entering via misdirected exhaust fumes. In Europe, strict environmental and safety requirements require all vehicle and transportation OEMs to include gas sensor technologies in their offers.

- Additionally, the IIoT is also advancing in the region. Customers are becoming more interested in IoT gas detectors, and players in the industry are working on establishing a product range tailored to IoT solutions. The necessity for wireless detectors owing to the requirement of continuous and real-time monitoring and detection of emissions is predicted to drive up demand for gas detectors in recent years and the coming years.

- Carbon dioxide sensors are primarily used in households, schools, offices, and hospitals to monitor indoor air quality. Similarly, these sensors are also utilized for real-time monitoring of agricultural goods' freshness, quality, and safety. Therefore, as excessive carbon dioxide exposure can cause health problems such as headaches and restlessness, the need for carbon dioxide sensors is rapidly increasing in this region.

- However, the region is experiencing a sizeable COVID-19 epidemic, with lockdowns ordered by the individual governments in Spain, France, Italy, and the United Kingdom. As a result, the market is projected to suffer due to disruptions in the operations of particular end-user businesses that rely heavily on the gas sensors market.

Europe Gas Sensors Market Trends

Supportive Government Regulations for Adopting Gas Sensors

- The popularity of gas sensors in the automobile sector is increasing as government pollution rules become more rigorous. For example, starting in December of last year (2020), the revised General Safety Regulation will require automakers to make pedestrian safety protocols mandatory for all vehicles, taking into account new technologies like speed assistance, sensors, advanced emergency braking systems, data recording, and so on.

- The entrance of pollutant gases through ventilation systems, pollutants entering through window apertures, a lack of fresh air intake resulting in low oxygen (02) concentrations, and toxic gases entering via redirected exhaust fumes all have a significant impact on the air quality in the car cabin. As a result, strict environmental and safety laws oblige all vehicle and transportation OEMs to offer gas sensor systems.

- Additionally, the usage of gas sensor and detector components per car is being enhanced by the migration of safety and comfort features from high-end sector vehicles to mid-range vehicles, owing to the rise of complex safety features and advanced driver assistance systems (ADAS).

- Leading automotive sensor companies like Bosch, Denso, and Infineon Technologies are putting their money into more technologically sophisticated, safer, and secure gas sensor-based products for a variety of applications.

Gas sensors are in high demand in Critical Sectors

- Gas sensors are used in critical sectors, including chemical, mining, oil and gas, and electricity, to detect and monitor the presence of flammable and poisonous gases. These vital businesses emit a huge variety of gases into the atmosphere, including carbon dioxide, carbon monoxide, ammonia, hydrocarbons, and hydrogen sulfide. Excessive emissions of these gases into the atmosphere can have a negative impact on human health.

- Furthermore, some explosive gases, such as propane, methane, and butane, may be discharged by these important businesses, potentially resulting in fires. Various restrictions are being implemented by many regulatory agencies to protect the ecology from dangerous gases.

- This necessitates the detection and monitoring of these gases, as well as the implementation of remedial actions to ensure that only a small amount of these gases is released directly into the atmosphere. Therefore, the increasing demand for IoT devices such as sensors in critical industries is significantly driving the market in this region.

Europe Gas Sensors Industry Overview

Europe Gas Sensors Market is partially fragmented. Some of the major players in the market are GFG Europe, Crowcon Detection Instruments Limited, Testo SE & Co. KGaA, Honeywell Analytics Inc., Draegerwerk AG & Co. KGaA, and others. Recent Developments made in this sector are:

- In October 2021, Honeywell has announced the availability of two new Bluetooth(R)*-connected gas detectors that can provide continuous monitoring for harmful gases even in the rain, fog, snow, and other adverse weather, ensuring the safety of chemical, petrochemical, oil, and gas, and other industrial employees and sites.

- In January 2021, the GS3000, a new product from Johnson Controls Corporation, monitors levels of carbon monoxide (CO) or nitrogen dioxide (NO2) to provide early alerts of excessive concentrations in both outdoor and indoor applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Integration of gas sensors into air quality monitors and HVAC systems

- 5.1.2 Supportive Government Regulations

- 5.2 Market Restraints

- 5.2.1 Increasing Cost and Technical Concerns

6 MARKET SEGMENTATION

- 6.1 By Gas Type

- 6.1.1 Oxygen

- 6.1.2 Carbon Dioxide

- 6.1.3 Carbon Monoxide

- 6.1.4 Nitrogen Oxide

- 6.1.5 Hydrocarbon

- 6.1.6 Others

- 6.2 By Connectivity Type

- 6.2.1 Wired

- 6.2.2 Wireless

- 6.3 By Technology

- 6.3.1 Electrochemical

- 6.3.2 Paramagnetic

- 6.3.3 Zirconia

- 6.3.4 Non-disruptive IR

- 6.4 By Application

- 6.4.1 Oil and Gas

- 6.4.2 Chemicals and Petrochemicals

- 6.4.3 Water and Wastewater

- 6.4.4 Automotive

- 6.4.5 Healthcare

- 6.4.6 Power Sector

- 6.4.7 Others

- 6.5 By Country

- 6.5.1 United Kingdom

- 6.5.2 Germany

- 6.5.3 France

- 6.5.4 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell Analytics Inc.

- 7.1.2 Johnson Controls Corporation

- 7.1.3 Testo SE & Co. KGaA

- 7.1.4 Comtrol Instruments Corporation

- 7.1.5 RAE Systems

- 7.1.6 ABB Ltd.

- 7.1.7 GFG Europe

- 7.1.8 Draegerwerk AG & Co. KGaA

- 7.1.9 MSA Safety Incorporated

- 7.1.10 Teledyne Technologies Incorporated (3M)

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219