|

市场调查报告书

商品编码

1626348

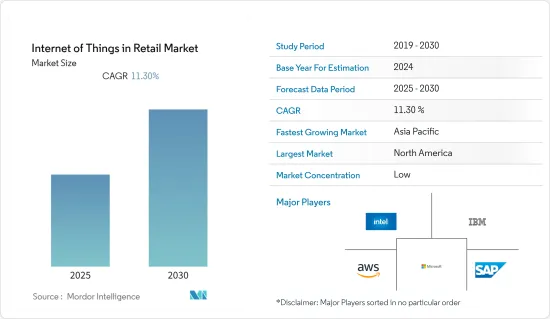

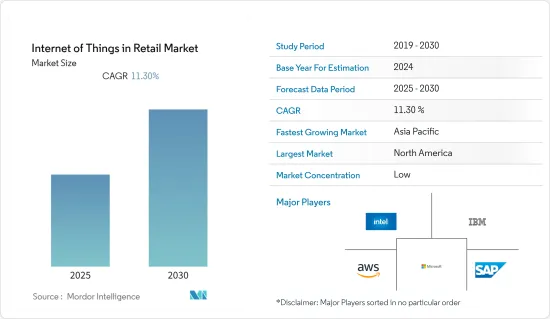

零售业物联网 -市场占有率分析、产业趋势与统计、成长预测(2025-2030)Internet of Things in Retail - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

零售业物联网市场预计在预测期内复合年增长率为 11.3%

主要亮点

- 物联网使零售商能够与企业和人员建立联繫。物联网使零售商能够深入了解产品性能以及与客户参与的新方法。克罗格、Zara、沃尔玛和乐购等多家公司正在推出智慧设备来改善客户体验。

- 此外,由于购物的便利性和智慧型手机的广泛采用,电子商务平台的使用量正在迅速增加,预计这将推动市场的发展。对资料分析和分析整合的需求不断增长预计将在预测期内推动物联网市场的利用。例如,亚马逊位于美国西雅图的第一家商店就内建了自助结帐服务以及可在Android和iOS系统上使用的行动付款方式。该商店配备了摄影机、感测器和RFID读取器,利用电脑视觉、深度学习演算法和「感测器融合」来识别消费者和产品。

- 此外,零售商店人工智慧 (AI) 和扩增实境(AR) 的进步极大地改变了零售环境。零售商正在使用人工智慧来识别目标市场,了解消费者过去的购买习惯,并向客户提供个人化的产品广告。例如,今年1月,Google云端宣布了四项针对零售商的新人工智慧技术。这些新技术主要旨在帮助零售商转变商店货架检查流程,扩大电子商务业务,并提供更流畅、更自然的网路购物体验。它还包括一个主要基于 Vertex AI 构建的新的“自我检查人工智能”,它利用谷歌广泛的资料库来帮助零售商识别“数十亿种产品”并确保商店货架上有足够的库存。

- 然而,随着各种安全相关问题和互通性问题的增加,整个预测期内的整体市场成长率可能会受到抑制。

- 这场大流行对全球物联网支出产生了重大影响,特别是在零售领域。在经济危机期间,零售商推迟了一些新倡议,因为维持生计是首要任务。因此,物联网零售市场在疫情期间收益下降。然而,在 COVID-19 之后,物联网在零售业的使用预计将逐渐增加。零售商已经在整合人工智慧技术、云端服务、行动付款系统、自主清洁机器人等,以消除人类的参与并阻止冠状病毒的传播。

零售物联网市场趋势

软体组件预计将占据很大份额

- 网路购物的显着成长归因于交易额和订单频率的增加。物联网可以优化供应链管理、减少库存错误并降低人事费用。物联网可以显着改善客户体验并削减不必要的开支,从而帮助传统实体店在当今线上优先的购物世界中竞争。

- 各种软体解决方案供应商正在提供物联网以改善零售业。其中包括 Qliktag、Evrythng、ThinFilm NC 解决方案、Gimble、Kaa Projects、Wise Shelf、Swirl、Memomi、Authentic or Not、Queuehop 等。

- 此外,支援 NFC 的技术为零售商告知和说服消费者创造了巨大的成长机会。例如,全国连锁超级市场克罗格公司试行了智慧货架标籤来显示产品资讯。此外,NFC 还解决了无电源物件无法存取网路的难题,提供了最简单、最直观的方式来展示用户采取行动的兴趣,并透过轻鬆直观地连接设备来实现物联网的重要功能。因此,NFC 解决方案的使用越来越多,已经渗透到零售市场,并正在显着推动市场发展。

- Paytm 等公司去年宣布计划进行 22 亿美元的 IPO,成为头条新闻。这家总部位于诺伊达的金融科技公司最初被称为 One97 Communications,最初是一家重要的数位电话付款提供商。儘管如此,它已经发展到涵盖保险销售、机票预订和其他数位金融服务。在印度的网路购物中,PhonePe 和 Paytm 比信用卡和签帐金融卡更常用。

- 据该网站(Boku)称,到 2025年终, Google Pay、PhonePe 和 Paytm 预计将在印度拥有数亿用户。因此,随着行动钱包用户数量的增加,零售业物联网市场预计在整个预测期内将出现显着的成长机会。

北美占最大份额

- 电子商务技术的出现和最佳店内体验的结合一直是美国零售业模式转移的关键驱动力。零售商正在优先考虑全通路零售支出,从纯粹的网路商店商店转向实体店,反之亦然。

- 此外,美国越来越多的消费者正在采用智慧家庭环境,而物联网正在整个全部区域扩展。因此,零售公司正在寻求围绕家庭助理开发解决方案。 Alexa 和 Google Home 的成功清楚地表明了这一趋势。此外,部署 IoT 使用感测器和 RFID 标籤追踪库存可以实现即时管理和简化整个流程。美国的亚马逊仓库配备了智慧货架,可以帮助零售商监控和追踪库存,减少重新订购产品时的人为错误,并消除仓库中积压的产品。

- 网上购物的显着增长是由于交易价值的增加以及由于便利性而增加的订单频率。美国零售业分为实体零售商,这些零售商在线上策略取得了成功,并在亚马逊的竞争中倖存下来。此外,零售商广泛使用物联网为客户提供个人化体验。例如,沃尔玛在美国仓库中使用物联网来深入了解社群媒体上流行的产品。

- 此外,沃尔玛、塔吉特和百思买等公司已成功地找到了正确的产品和服务组合(例如杂货销售),以留住消费者。虽然亚马逊仍然是电子商务领域的领导者,但这些公司正在利用实体店来履行线上订单,同时增加数位促销活动。

- 去年 12 月,亚马逊计划为其应用程式带来类似 TikTok 的购物体验。该公司宣布推出 Inspire,这是一种新的短影片和照片来源,可让消费者从品牌、影响者和其他客户创建的内容中发现创意、产品和购物。该功能的主要目的是吸引消费者远离 TikTok 等应用程序,品牌可以在这些应用程式中直接向消费者进行行销,从而显着提高亚马逊网站上的销售额。

零售业物联网产业概述

零售业的物联网市场需要变得更具凝聚力。越来越多的消费者接受智慧家庭环境、仓库温度感测器的引入以及电子商务技术的出现,为零售业的物联网市场提供了利润丰厚的机会。整体而言,现有竞争对手之间的竞争非常激烈。产品创新及拓展有效渗透产业成长。

- 2023 年 1 月 - 安永宣布开始采用由 Microsoft Cloud 支援的零售解决方案,以协助为消费者提供无缝的购物体验。安永宣布推出新的安永零售智慧解决方案,该解决方案主要使用微软云端和零售云端为消费者提供直接、无缝的购物体验。

- 2022 年 12 月 - 全球物联网 (IoT) 解决方案和全球物联网 CaaS(物联网连接即服务)领域的领导者 KORE 与 Google Cloud 和 Go 合作,为全球企业提供物联网功能 - 宣布成立。 。这项多年合作伙伴关係将使该公司能够利用 Google Cloud 的基础架构和功能以及 KORE 的物联网解决方案来建立强大的物联网解决方案。此外,这种合作伙伴关係还将透过为车队/物流、工业IoT、连线健诊和零售/通讯服务供应商等产业拓展新的市场途径来改变物联网产业。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- 技术简介

第五章市场动态

- 市场驱动因素

- 物联网在零售业的应用不断增加,包括预测性设备维护、联网消费者和智慧商店

- 越来越需要有竞争力的经营模式来维持竞争

- 竞赛

- 市场问题

- 安全性问题和互通性问题

第六章 市场细分

- 按成分

- 硬体

- 软体

- 服务

- 管理的

- 专业的

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Amazon Web Services Inc.

- AT&T Inc.

- Ayla Networks Inc.

- Bosch Software Innovations GmbH

- Cisco Systems Inc.

- Fujitsu Ltd

- General Electric

- Google Inc.

- Hewlett Packard Enterprise

- Hitachi Ltd

- Huawei Technologies Co. Ltd

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Siemens AG

第八章投资分析

第9章市场的未来

简介目录

Product Code: 48120

The Internet of Things in Retail Market is expected to register a CAGR of 11.3% during the forecast period.

Key Highlights

- IoT enables retailers to connect with both businesses and people. It allows retailers to gain insights into product performance and new ways of customer engagement with both new and existing customers. Several companies, like Kroger, Zara, Walmart, Tesco, etc., have launched smart devices to improve customer experience.

- Additionally, the e-commerce platform's use is rapidly increasing owing to the ease of shopping and smartphone penetration, which will likely boost the market. The increasing need for data analysis and analytics integration is expected to propel the utilization of the Internet of Things market over the forecast period. For instance, Amazon's first store in Seattle, the United States, is incorporated with a self-checkout service and mobile payment methods available on Android and iOS systems. The store is equipped with cameras, sensors, and RFID readers to identify shoppers and products and uses computer vision, deep learning algorithms, and the 'sensor fusion.'

- Also, with the advancement of artificial intelligence (AI) and augmented reality (AR) in retail establishments, the retail environment underwent a seismic shift. Retailers employ AI to identify the target market, comprehend the purchasing habits of past consumers, and provide customers with personalized product advertisements. For instance, in January this year, Google Cloud said it would launch four new artificial intelligence technologies aimed at retailers. The new technologies are mainly designed to aid retailers in transforming in-store shelf-checking processes and augment e-commerce operations, delivering more fluid and natural online shopping experiences. They also include a new "self-checking AI solution" that is primarily built on Vertex AI and leverages Google's extensive databases to provide retailers recognize "billions of products" and ensure that in-store shelves are well-stocked.

- However, with the rise in various security-related concerns and interoperability issues, the market's overall growth rate might get restrained throughout the forecast period.

- The pandemic significantly impacted IoT spending globally, especially in the retail sector. The merchants have postponed several new initiatives as their main priority during the economic crisis was maintaining corporate operations. As a result, IoT's retail market saw a revenue fall during the pandemic. However, it is anticipated that IoT use in retail will progressively rise after COVID-19. To eliminate human involvement and stop the coronavirus from spreading, retailers are already integrating AI technologies, cloud services, mobile payment systems, autonomous cleaning robots, and many others.

IoT in Retail Market Trends

Software Component Expected to Hold Significant Share

- The significant growth of internet shopping can be attributed to higher transaction values and increased order frequency. IoT can optimize supply chain management, reduce inventory error, and decrease labor costs. Ultimately, IoT can help the traditional brick-and-mortar shop compete with today's online-first shopping world by exponentially improving customer experience and reducing unnecessary expenses.

- Different software solutions providers provide IoT for the retail sector's betterment. Some of them are Qliktag, Evrythng, ThinFilm NC solutions, Gimble, Kaa Projects, Wise Shelf, Swirl, Memomi, Authentic or Not, Queuehop, and many others.

- Moreover, NFC-enabled technology creates immense growth opportunities for retailers to inform and persuade shoppers. For instance, national supermarket chain Kroger Co. piloted smart shelf tags to display product information. Moreover, the NFC provides significant functionalities to IoT by solving the challenges of unpowered objects lacking network access, providing the simplest, most intuitive way to indicate a user's interest in taking action, and connecting devices easily and intuitively. Hence, an increase in NFC solutions usage is penetrating the retail market, driving the market significantly.

- Companies like Paytm made headlines last year as it declared its plans for a USD 2.2 billion IPO. The country's highest-valued startup at USD 16 billion, the Noida-based fintech first known as One97 Communications originally started as a significant provider of digital phone payments. Still, it grew to cover insurance sales, ticket booking, and other digital financial services. PhonePe and Paytm were more commonly used than credit or debit cards for online shopping in India.

- According to the website (Boku), Google Pay, PhonePe, and Paytm are expected to grow by hundreds of millions of users in India by the end of 2025. Hence, with the rise in the number of users of mobile wallets, the market for IoT in the retail sector is expected to witness significant growth opportunities throughout the forecast period.

North America to Hold Largest Share

- The advent of e-commerce technologies and the incorporation of the best in-store experience have been the major factors responsible for the paradigm shift in US retailing. Retailers are prioritizing their spending toward omnichannel retailing by moving from purely online stores to brick-and-mortar stores and vice-versa.

- In addition, with an increasing number of consumers embracing the smart home environment in the United States, the expansion of IoT is on the rise across the region. As a result, retailers are aiming to develop their solutions around home assistants. The success of Alexa and Google Home are clear indicators of the trend. Also, deploying IoT to track inventory using sensors and RFID tags enables real-time management and streamlining of the entire flow. Amazon's warehouses in the United States have smart shelves, which help the retailer monitor and track inventory items, reducing human errors while reordering items and eliminating overstocking products in warehouses.

- The significant growth of internet shopping can be attributed to higher transaction values and increased order frequency owing to convenience. The retail Industry in America is divided into brick-and-mortar retailers boasting of successful online strategies and surviving the competition with Amazon. Moreover, the Internet of Things is also being widely used by retailers to provide a personalized experience to their customers. For example, Walmart uses IoT in its United States warehouses to gain insights about popular products on social media.

- Companies like Walmart, Target, and Best Buy have also found the right mix of products and services, like selling groceries, to keep shoppers coming into their stores. While Amazon remains the leader in e-commerce, these players are using their physical stores to fulfill online orders, simultaneously increasing their digital promotions.

- In December last year, Amazon planned to bring a TikTok-like shopping experience to its app. The company declared the launch of Inspire, a new short-form video and photo feed that enables consumers to explore ideas and products and shop from content created by brands, influencers, and other customers. The feature is primarily designed to draw consumers' attention away from apps like TikTok, where brands can directly market to consumers, significantly driving sales on Amazon.com instead.

IoT in Retail Industry Overview

The internet of things in the retail market needs to be more cohesive. An increasing number of consumers embracing the smart home environment, temperature sensors deployment in warehouses, and the advent of e-commerce technologies provide lucrative opportunities in the internet of things in the retail market. Overall, the competitive rivalry among existing competitors is high. Product innovation and expansion are penetrating the industry growth effectively.

- January 2023 - EY declared the introduction launch of a retail solution that builds on the Microsoft Cloud to help achieve seamless consumer shopping experiences. The EY organization introduced a new EY Retail Intelligence solution that primarily uses the Microsoft Cloud and Cloud for Retail to offer consumers a direct and seamless shopping experience.

- December 2022 - KORE, a global leader in the Internet of Things (IoT) Solutions and worldwide IoT Connectivity-as-a-Service (IoT CaaS), declared that it had established a go-to-market alliance with Google Cloud to bring IoT capabilities to global businesses. This multi-year alliance would help enterprises create robust IoT solutions that leverage Google Cloud infrastructure and abilities, as well as KORE's IoT Solutions. In addition, the coalition would transform the IoT industry by expanding new paths to market for industries such as Fleet/Logistics, Industrial IoT, Connected Health, retail/communications service providers, and many more.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions? and Market Definition?

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis?

- 4.4 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing IoT Applications Among Retailers Such As Predictive Equipment Maintenance , Connected Consumer and Smart Store

- 5.1.2 Rising Need for a Competitive Business Model to Sustain Competition

- 5.1.2.1 Competition

- 5.2 Market Challenges

- 5.2.1 Security Concerns and Interoperability Issues

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Service

- 6.1.3.1 Managed

- 6.1.3.2 Professional

- 6.2 Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Italy

- 6.2.2.5 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 Japan

- 6.2.3.4 Korea

- 6.2.3.5 Rest of Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East & Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon Web Services Inc.

- 7.1.2 AT&T Inc.

- 7.1.3 Ayla Networks Inc.

- 7.1.4 Bosch Software Innovations GmbH

- 7.1.5 Cisco Systems Inc.

- 7.1.6 Fujitsu Ltd

- 7.1.7 General Electric

- 7.1.8 Google Inc.

- 7.1.9 Hewlett Packard Enterprise

- 7.1.10 Hitachi Ltd

- 7.1.11 Huawei Technologies Co. Ltd

- 7.1.12 IBM Corporation

- 7.1.13 Intel Corporation

- 7.1.14 Microsoft Corporation

- 7.1.15 Oracle Corporation

- 7.1.16 SAP SE

- 7.1.17 Siemens AG

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219