|

市场调查报告书

商品编码

1626881

欧洲触控萤幕控制器:市场占有率分析、产业趋势、成长预测(2025-2030)Europe Touch Screen Controllers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

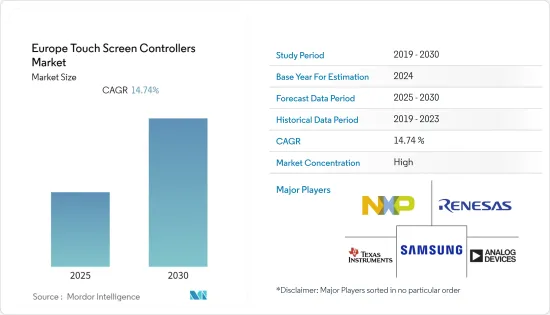

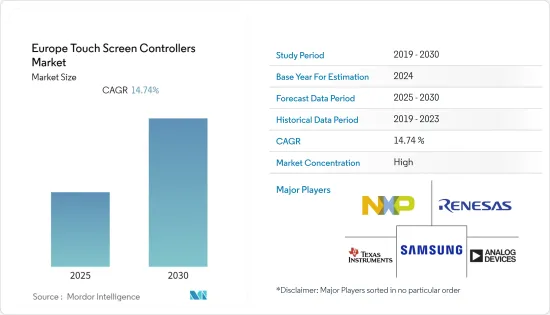

欧洲触控萤幕控制器市场预计在预测期内复合年增长率为14.74%

主要亮点

- 电容式触控萤幕使用电容式感应,因此不像电阻萤幕那样使用柔性聚氨酯片,而是在结构上安装一层安全玻璃来密封它。这使我们能够为消费者提供更耐用的设计。这一特性使它们比电阻控制器更具优势。

- 手势姿态辨识技术的进步使得滑动、捏合缩放、滑动(或轻拂)、扭转和按住(或长按)等操作成为可能,从而刺激了市场扩张。此外,汽车产业对触控萤幕控制器市场也有重大影响。

- 电容式触控萤幕使用两层 ITO(氧化铟锡),或在某些情况下使用棋盘状图案感测器。因此,只需要一张纸来覆盖液晶显示屏,从而获得更清晰的萤幕。

- 除了增加触控萤幕出货量之外,电容式触控萤幕预计将在汽车应用中取代电阻式技术。汽车製造商正在将触控萤幕融入各种应用中,包括中控台显示器、导航系统、无线电人机介面 (HMI)、车窗开关、无钥匙进入和后座娱乐系统。

欧洲触控萤幕控制器市场趋势

电容式触控萤幕占据主要市场占有率

- 电容式触控萤幕由两层玻璃组成,玻璃上涂有 ITO(氧化铟锡)等导体。电容式触控萤幕控制器使用电容式。电阻式触控萤幕使用柔性聚氨酯片,而电容式触控萤幕则在结构顶部用一层安全玻璃密封。这为消费者提供了耐用的设计。

- 与电阻式触控萤幕不同,电容式触控萤幕不依赖手指压力。电容式触控萤幕不依赖手指压力,而是对任何带电荷的物体(例如人体皮肤)做出反应。由于该技术依赖导电源的电气干扰,因此电容式触控萤幕是电气隔离的,并且不适用于大多数手套。这些萤幕主要用于大多数消费性产品,例如平板电脑、笔记型电脑和智慧型手机。

- 这些触控萤幕支援多点触控控制,并且需要较少的体力来记录触控。与电阻式触控萤幕相比,它的使用寿命更长,适合高阶面板控制器和行动电话。

- 由于社会与消费性电子产品中各种系统之间的资讯交流不断增加,人机介面技术正经历模式转移。因此,电容式触控萤幕控制器被用来实现室内照明控制和空调等人机介面(HMI)应用,并且需求正在迅速成长。

预计家用电子领域将占据主要份额

- 消费性电子领域是市场上最重要和最具影响力的类别之一。由于该领域对新产品和创新产品的需求不断增加,各种产品都采用触控萤幕。

- 行动电话、穿戴式装置、平板装置、笔记型电脑和个人电脑是大规模采用触控功能的消费性电子产品的例子。洗衣机、冷冻库、影印机等设备现在也配备了触控介面,以提供更好的使用者体验,创造差异化需求。

- 可支配收入的增加促使消费者选择具有有吸引力的设计和丰富的功能的产品。智慧连网型家电越来越受到英国消费者的欢迎。鑑于对此类设备的需求不断增长,欧洲市场对触控萤幕控制器的需求在该国的预测期内可能会增加。

欧洲触控萤幕控制器产业概况

欧洲触控萤幕控制器市场竞争激烈,由多家大型厂商组成。从市场占有率来看,目前该市场由少数大公司主导。竞争公司之间的竞争主要由恩智浦半导体、德州仪器、意法半导体、Microchip Technology Inc.和Integrated Device Technology Inc.等大公司的存在主导。公司努力透过技术创新、为各种应用开发差异化产品来获得相对于其他公司的竞争优势。

- 2022 年 1 月:OmniVision 发布适用于智慧型手机的全高清 144Hz 触控和显示驱动程式。该产品可实现 1080 像素的全高清 (FHD) 分辨率,显示影格速率高达 144Hz,触控报告率是 LCD 显示器和触控解决方案显示影格速率的两倍。

- 2021年4月,TLC Europe推出RP503SXE0冰箱,在AI x IoT策略下提供连网智慧家庭解决方案。 RP503SXE0 的前面板上设计有数位显示屏,并采用雾面不銹钢表面和耐用且美观的涂层。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 智慧型设备增加

- 增加在各个最终用户产业的使用

- 市场限制因素

- 与技术相关的复杂性

第六章 市场细分

- 按类型

- 电阻膜式

- 电容式

- 按最终用户

- 工业的

- 卫生保健

- 家电

- 零售

- 车

- BFSI

- 其他最终用户

- 按国家/地区

- 英国

- 德国

- 法国

- 西班牙

- 其他欧洲国家

第七章 竞争格局

- 公司简介

- NXP Semiconductors

- Renesas Electronics Corporation

- Samsung Electronics Co. Ltd

- Texas Instruments Incorporated

- Analog Devices Inc.

- STMicroelectronics

- MELFAS Co. Ltd

- Synaptics Incorporated

- Semtech Corporation

- Microchip Technology Inc.

第八章投资分析

第九章 市场机会及未来趋势

The Europe Touch Screen Controllers Market is expected to register a CAGR of 14.74% during the forecast period.

Key Highlights

- Since capacitive touchscreen control uses an electro-capacitive detection method, a layer of safety glass is mounted over the structure to seal it instead of using a flexible sheet of polyurethane for a resistive screen. This provides a more durable design to consumers. This property has made them prominent over resistive controllers.

- Technological advances in gesture recognition have spurred market expansion by enabling motions such as slide, pinch-to-zoom, swipe (or flick), twist, and press-and-hold (or long-press). Furthermore, the automobile industry has substantially influenced the touch screen controller market.

- A capacitive touchscreen uses two layers of ITO (indium tin oxide) or, in some cases, uses a patterned sensor similar to a checkerboard. Hence, only one full sheet covering the LCD is possible, providing a clearer screen.

- In addition to an increase in shipped touchscreen units, the projected capacitive touchscreens replace resistive technology in automotive applications. Automotive manufacturers are incorporating touchscreens into various applications, such as center stack displays, navigation systems, radio human-machine interfaces (HMIs), car window switches, keyless entry, and rear-seat entertainment systems.

Europe Touch Screen Controllers Market Trends

Capacitive Touch Screens to Account for a Significant Market Share

- Capacitive touchscreen consists of two spaced layers of glass, which are coated with conductors like indium tin oxide (ITO). A capacitive touchscreen controller uses an electro capacitive method of detection; a layer of safety glass is placed on top of the structure to seal it, as against using a flexible sheet of polyurethane for a resistive touchscreen. This provides consumers with a durable design.

- Unlike resistive touchscreens, capacitive touchscreens do not rely on finger pressure. Instead, these work with anything that holds an electrical charge, including human skin. As the technology relies upon electrical interference from a conductive source, capacitive touchscreens do not work via most gloves as they are electrically insulating. These screens are mainly used in most consumer products, such as tablets, laptops, and smartphones.

- These touchscreens accept multi-touch controls and require less physical force to register a touch. They are longer-lived compared to resistive touch screens, thus, making them suitable for high-grade panel controllers or mobile phones.

- Human-machine interface technologies have witnessed a paradigm shift, owing to the increasing information interchange between social and various systems in appliances. This has resulted in a surge in demand for capacitive touch screen controllers, as they are deployed for the implementation of human-machine interface (HMI) applications, such as indoor illumination control, Air conditioning, etc.

The Consumer Electronics Segment is Expected to Hold the Major Share

- The consumer electronics segment is one of the market's most essential and influential categories. A variety of products has adopted touch screens due to the segment's increased demand for new and innovative products.

- Mobile phones, wearables, tablets, laptops, and PCs are a few examples of consumer electronics items that have incorporated touch capabilities on a larger scale. Washing machines, freezers, copiers, and other devices have recently been outfitted with touch-enabled interfaces to provide a better user experience and create distinguishable demand.

- Due to the increase in disposable income, consumers are opting for products with appealing designs and extensive features. Smart and connected consumer electronics are becoming ever more prominent among UK consumers. With such growing demand for these devices, the demand for touchscreen controllers in the European market is likely to increase over the forecast period in the country.

Europe Touch Screen Controllers Industry Overview

The European touch screen controllers market is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. Competitive rivalry in the industry is governed by the presence of major players, such as NXP Semiconductors, Texas Instruments Incorporated, STMicroelectronics, Microchip Technology Inc., Integrated Device Technology Inc., etc. The companies are struggling to achieve a competitive advantage over other players through innovation and are developing differentiated products for various applications.

- January 2022: Omnivision launched a full high definition 144 Hz Touch and Display Driver for smartphones. This product enables 1080 pixel full high definition (FHD) resolution, up to 144 Hz display frame rate with the touch report rate doubling the display frame rate in LCD display and touch solutions.

- April 2021: TLC Europe launched the RP503SXE0 refrigerator to provide interconnected smart home solutions under its AI x IoT strategy. RP503SXE0 is designed with a digital display on the front panel and is made of a matt stainless-steel finish, a resistant and aesthetic coating.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in the Number of Smart Devices

- 5.1.2 Increasing Usage Across Various End-user Industries

- 5.2 Market Restraints

- 5.2.1 Complexities Associated with the Technology

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Resistive

- 6.1.2 Capacitive

- 6.2 By End User

- 6.2.1 Industrial

- 6.2.2 Healthcare

- 6.2.3 Consumer Electronics

- 6.2.4 Retail

- 6.2.5 Automotive

- 6.2.6 BFSI

- 6.2.7 Other End Users

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Spain

- 6.3.5 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 NXP Semiconductors

- 7.1.2 Renesas Electronics Corporation

- 7.1.3 Samsung Electronics Co. Ltd

- 7.1.4 Texas Instruments Incorporated

- 7.1.5 Analog Devices Inc.

- 7.1.6 STMicroelectronics

- 7.1.7 MELFAS Co. Ltd

- 7.1.8 Synaptics Incorporated

- 7.1.9 Semtech Corporation

- 7.1.10 Microchip Technology Inc.