|

市场调查报告书

商品编码

1626882

分散式发电-市场占有率分析、产业趋势/统计、成长预测(2025-2030)Distributed Power Generation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

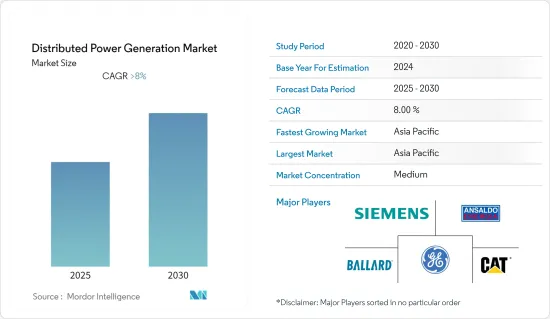

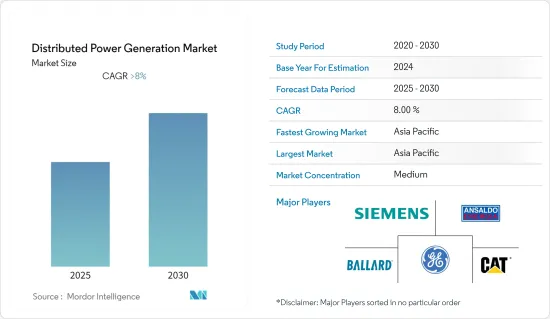

预计分散式发电市场在预测期内将维持8%以上的复合年增长率。

COVID-19 对 2020 年市场产生了负面影响。目前,市场已达到疫情前水准。

主要亮点

- 中期来看,由于可再生能源发电、系统成本降低以及世界各国政府的支持措施,以分散式太阳能发电为中心的可再生能源分散式发电的转变将取得进展。

- 另一方面,由于初始投资较低且不需要发电空间,消费者往往喜欢併网发电而不是离网发电。预计这将阻碍预测期内分散式发电市场的成长。

- 人们对环境问题的认识不断提高、遏制碳排放的国际要求以及一些国家政府引入再生能源来源的有利措施,为我正在做的分散式发电市场提供了机会。

- 亚太地区占最大的市场占有率,中国、印度和东协成员国等国家的能源需求不断增加。中国拥有蓬勃发展的製造业,需要电力运作。因此,该地区正在使用分散式发电来提供不间断的电力。

分散式发电市场趋势

太阳能主导市场

- 预计住宅市场将在预测期内迅速扩张。带有电池储存系统的离网屋顶太阳能发电为住宅家庭提供可靠的二次电力,推动了整个细分市场的产品需求。为了因应电力需求高峰变化而引入大规模储能係统,导致采用超大型屋顶太阳能发电系统,将必要的电力储存在电池中。

- 屋顶太阳能发电系统可以根据您的要求建造。这可以让消费者节省电费。一般家庭的太阳能发电设备称为电錶后端太阳能。分散式太阳能发电系统被称为电錶后端太阳能发电系统,因此消费者无需为其产生的太阳能电力向电力公司付费。

- 根据其位置的不同,在阳光明媚的中午,太阳能电池板只能将总太阳辐射的 15% 到 20% 转化为电能。多晶或结晶面板安装在屋顶、开放空间或墙壁上,正面面向太阳,以产生足够一天的能量。

- 根据国际可再生能源机构(IRENA)统计,2022年太阳能发电容量约为10,46,614兆瓦,与前一年同期比较成长22.4%。这段时期的趋势显示持续成长的趋势。

- 随着太阳能电池板和电池储存价格的下降以及建筑成本的下降,安装带有电池储存系统的分散式太阳能发电并以11kV或33kV传输太阳能变得有吸引力。它可以减少输电线路损耗,提高农村支线的电网弹性,避免输配电损耗,降低发电成本,并降低新发电设备的投资成本。

- 因此,随着太阳能发电技术的介入,较低的发电成本和易于建造的太阳能发电系统有望推动分散式发电市场的发展。

亚太地区主导市场

- 亚太地区占最大的市场占有率,中国、印度和东协成员国等国家的能源需求不断增加。中国拥有广泛的製造业,需要电力来运作。因此,该地区依靠分散式发电来提供不间断电力。

- 可再生能源市场的关键驱动力是政府的大力支持、技术进步和碳排放管理意识。这有利于中国可再生能源产业的快速发展。到2022年终,中国预计将安装分散式发电48GW。我国分散式太阳能发电主要以工商企业为主,采用EMC(合约能源管理)模式建置DSPV电站。由于中国土地价格高昂,安装太阳能屋顶的机会正在增加。

- 在印度,预计2022年太阳能发电装置容量将达到61吉瓦。为了实现100吉瓦太阳能装置容量的目标,太阳能园区计画、VGF计画、CPSU计画、防御计画、运河岸/运河顶部计画、捆绑计画、併网太阳能屋顶计画等许多计画都在规划和实施近年来已出台措施。

- 印度计划在2030年在其电网中新增500GW大规模可再生能源,规划什么样的电网架构将支援这种水准的可再生能源併网至关重要。分散式可再生能源有充分理由成为未来电网的重要组成部分。

- 此外,分散式发电可以为无法扩展电网的各种偏远地区的企业和业主带来显着的好处。

- 亚太地区在扩展分散式能源系统(DES)方面具有巨大潜力,特别是离网和住宅太阳能发电。电网基础设施效率低下、电力供不应求以及分散技术的可扩展性正在推动该地区的部署,特别是在中国和印度。

分散式发电产业概况

分散式发电市场适度细分。市场的主要企业包括(排名不分先后)Ansaldo Energia SpA、Ballard Power Systems Inc.、Caterpillar Inc.、Siemens AG 和 General Electric Company。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:百万美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 科技

- 太阳能

- 柴油发电机

- 天然气发电机

- 微型电网

- 其他的

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 南美洲

- 中东/非洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Ansaldo Energia SpA

- Ballard Power Systems Inc.

- Bloom Energy

- Capstone Turbine Corporation

- Caterpillar Inc.

- Cummins Inc.

- Fuelcell Energy Inc.

- General Electric Co.

- Schneider Electric SE

- Siemens AG

- Sunverge Energy

- Canadian Solar Inc.

第七章 市场机会及未来趋势

简介目录

Product Code: 48339

The Distributed Power Generation Market is expected to register a CAGR of greater than 8% during the forecast period.

COVID-19 negatively impacted the market in 2020. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the increasing shift toward renewable distributed power generation, mainly distributed solar PV installation, owing to declining renewable power generation and system costs, coupled with supportive government policies worldwide.

- On the other hand, consumers tend to prefer grid power over off-grid power owing to the low initial investment and no space requirement to generate electricity. This is expected to hamper the growth of the distributed power generation market over the forecast period.

- Nevertheless, the growing environmental concerns, international mandates to curb carbon emissions, and conducive policies by the governments of several countries to install renewable energy sources provide an opportunity for the distribution power generation market.

- Asia-Pacific holds the largest market share and has witnessed increasing energy demand in countries such as China, India, and ASEAN member states. China has a widespread manufacturing sector, which creates a need for power for operations. Thus, distributed power generation is used in this region to supply uninterrupted power.

Distributed Power Generation Market Trends

Solar PV to Dominate the Market

- The residential segment is expected to expand rapidly over the forecast period. Off-grid rooftop solar PV equipped with an energy battery storage system provides reliable secondary power to residential households, thereby boosting product demand across the segment. The deployment of large-scale storage systems to protect against peak demand power changes has resulted in the adoption of extra-large rooftop solar PV systems to store desired power in batteries.

- Rooftop Solar energy systems can be built, depending on the requirements. It enables consumers to save on their electric utility bills. Solar installations in households are called behind-the-meter solar," since the meter captures how much electricity the consumer is purchasing from a utility. Since distributed solar energy systems are called behind-the-meter, consumers do not pay the utility for the solar power generated.

- According to the location, the solar panels only convert between 15% and 20% of the total solar irradiation at noon on a bright, sunny day into electricity. The polycrystalline or monocrystalline panels are installed on rooftops, open grounds, or walls, with the front facing the sun, to produce sufficient energy in a day.

- As per International Renewable Energy Agency (IRENA) statistics, in 2022, the solar photovoltaic energy capacity was around 10,46,614 MW, up by 22.4% from the previous year. In the period under consideration, figures presented a trend of continuous growth.

- With the downward trend of solar panel and battery storage prices and declining construction costs, establishing distributed PV with a battery storage system and evacuating solar energy at 11 kV or 33 kV is an attractive proposition. It will reduce transmission line losses, increase grid resilience for rural feeders, avoid transmission distribution losses, reduce generation costs, and reduce investment costs in new utility generation capacity.

- Hence, due to technological interventions in solar PV, the declining cost of electricity generation and ease of construction of solar systems are expected to drive the distributed power generation market.

Asia-Pacific to Dominate the Market

- Asia-Pacific holds the largest market share and has witnessed increasing energy demands in countries such as China, India, and ASEAN member states. China has a widespread manufacturing sector, which creates a need for power for operations. Thus, distributed power generation is used in this region to supply uninterrupted power.

- Strong government support, technological progress, and awareness regarding managing carbon emissions are the main drivers for the renewable energy market. This has facilitated the rapid development of China's renewable energy sector. By the end of 2022, China was expected to install 48 GW of distributed generation. China's distributed solar power is dominated by industrial and commercial enterprises, which mainly adopt the EMC (energy management contract) model to build DSPV power plants. The high price of land in China is creating opportunities for deploying solar rooftops.

- In India, the installed capacity of solar was expected to reach 61 GW in 2022. To complete the target of deploying 100 GW of solar installed capacity, a slew of schemes such as solar park schemes, VGF schemes, CPSU schemes, defense schemes, canal bank and canal top schemes, bundling schemes, grid-connected solar rooftop schemes, etc., and policy measures have been introduced in recent years.

- With India planning to add a massive 500 GW of renewable energy to its electric grid by 2030, it is critical to plan what kind of grid architecture will support this level of renewable integration, which is likely unprecedented anywhere else in the world. Distributed renewables present a solid case for being a big part of the future grid.

- Additionally, with various places located in remote parts of the country where grid expansion is not feasible, distributed generation can significantly benefit businesses and owners.

- Asia-Pacific holds vast potential for expanding distributed energy systems (DES), notably off-grid and residential solar. Inefficiencies in the power grid infrastructure, power supply shortages, and the scalability of decentralized technology are driving the deployment in the region, particularly in China and India.

Distributed Power Generation Industry Overview

The distributed power generation market is moderately fragmented. Some key players in this market include (in no particular order) Ansaldo Energia SpA, Ballard Power Systems Inc., Caterpillar Inc., Siemens AG, and General Electric Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD Million, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Solar PV

- 5.1.2 Diesel Gensets

- 5.1.3 Natural Gas Gensets

- 5.1.4 Microgrids

- 5.1.5 Other Technologies

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 South America

- 5.2.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Ansaldo Energia SpA

- 6.3.2 Ballard Power Systems Inc.

- 6.3.3 Bloom Energy

- 6.3.4 Capstone Turbine Corporation

- 6.3.5 Caterpillar Inc.

- 6.3.6 Cummins Inc.

- 6.3.7 Fuelcell Energy Inc.

- 6.3.8 General Electric Co.

- 6.3.9 Schneider Electric SE

- 6.3.10 Siemens AG

- 6.3.11 Sunverge Energy

- 6.3.12 Canadian Solar Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219