|

市场调查报告书

商品编码

1626888

北美冷冻食品包装:市场占有率分析、行业趋势和成长预测(2025-2030)North America Frozen Food Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

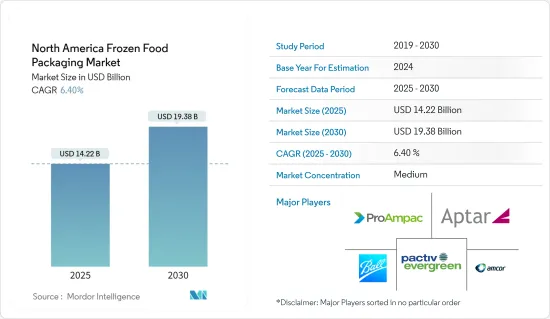

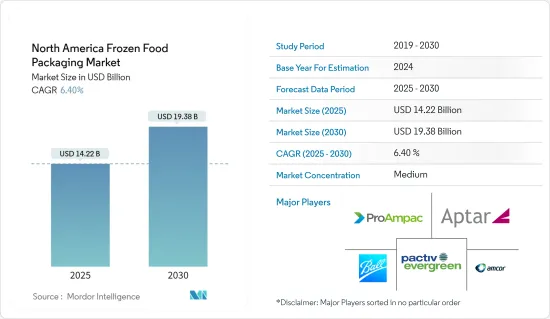

北美冷冻食品包装市场规模预计到 2025 年为 142.2 亿美元,预计到 2030 年将达到 193.8 亿美元,预测期内(2025-2030 年)复合年增长率为 6.4%。

主要亮点

- 消费者对便利性的需求不断增长,推动了冷冻食品销售的成长,因为冷冻食品比传统的家常饭菜需要更少的时间和精力。忙碌的生活方式正在促使消费者转向加工食品,导致对冷冻食品的需求激增。包装冷冻食品的主要类别包括烘焙产品和冷冻加工食品,其中冷冻已调理食品正在成为值得关注的类别。随着消费者对食品品质的期望不断提高,冷藏可以显着延长保质期。

- 随着消费者对冷冻食品越来越感兴趣,对永续包装材料的需求也增加。许多製造商和零售商正在从传统包装过渡到可回收、可重复使用和可堆肥的替代品。对冷冻食品和独立包装物品的需求激增促使包装产业竞相适应。冷冻食品包装的创新正在兴起,其中显着的进步包括适用于微波炉产品的蒸气包装。此外,低温运输技术和提醒用户温度变化的智慧包装的发展预计将满足这些不断变化的需求。

- 杂货购物习惯正在发生巨大变化。越来越多的消费者转向线上平台购买食品,便利性和安全性成为首要考虑因素。为了应对这些不断变化的偏好,零售商正在多样化处理订单的方式。有竞争力的价格、路边取货、宅配、宅配应用程式、远端取货等等。

- 零售商正在努力提高其召回价值和在农村、层级和层级地区的影响力,并加强使其促销计划更具吸引力。这种动态不仅凸显了食品杂货零售业不断变化的格局,也凸显了影响这些地区冷冻食品需求的新兴机会。

北美冷冻食品包装市场趋势

透过零售通路对生鲜肉的需求不断增长

- 随着消费者对用于生肉包装的生物基材料而不是有毒塑胶的需求日益增加,市场前景将在未来几年发生变化。人们对环境问题的认识不断提高,加上严格的政府监管,可能为市场相关人员创造新的商机。这种动态可能会推动这些参与企业在生鲜肉包装领域寻求创新解决方案,从而推动整体市场的成长。

- 这种转变是由于人们认识到富含肉类的蛋白质对健康的好处、生酮饮食等高蛋白饮食的兴起以及对预包装加工肉品的依赖增加而推动的,这对生鲜肉的需求产生了积极的影响。该地区的经济成长预计也将促进肉类消费。

- 近年来,美国肉类产业表现出一致性。美国农业和经济研究部的资料显示,预计 2023 年该国牛肉产量将达到 269.6 亿磅,低于 2022 年的 282.9 亿磅。截至2021年,牛肉在美国生鲜肉零售额中排名第一,当年销售额超过300亿美元。 2022 年,100% 碎肉的零售价格达到每磅 4.8 美元,高于 2020 年的 3.95 美元。同时,主要杂货零售商的牛胸肉平均价格约为每磅 8.84 美元。

- 根据食品工业协会统计,百货公司的肉类销售近年来最稳定,平均家庭渗透率超过98%,每年购买量接近50次。最畅销的生鲜肉是牛肉和鸡肉,最畅销的加工肉品是培根和已烹调午餐肉。

- Progressive Grocer发布的一项研究显示,美国生鲜肉零售额从过去几年的648.8亿美元增加至2022年的866.2亿美元。在预测期内将观察到这一积极趋势,预计将增加该地区对肉类包装的需求。

美国显示出惊人的成长率

- 随着冷冻食品包装需求的飙升,产业参与者正在积极投资于产品创新,刺激了该国市场的成长。蓬勃发展的电子商务进一步增加了对包装解决方案的需求。电子商务不仅增加了购物的便利性,也为各个细分市场的价格带来了下行压力。根据 Business Insider 报告,虽然电子商务正在推动零售成长,但对该地区软包装的影响也将扩大。

- 美国拥有竞争激烈的零售业,以沃尔玛、克罗格和艾伯森等主要企业为主导。沃尔玛来自美国,是全世界最大的零售商。特别是全球前10大零售企业中有5家总部位于美国,可见美国在全球零售业中扮演极为重要的角色。

- 在美国,千禧世代消费者强烈偏好单份、即食食品和饮料,这主要推动了对冷冻食品包装产品的需求。冷冻食品包装设计便携、耐用、轻便,已成为此类产品的热门选择。此外,对加工食品和新鲜休閒食品日益增长的需求预计将进一步推动这一需求。

北美冷冻食品包装产业概况

北美冷冻食品包装市场是一个竞争激烈的市场,有许多强大的参与企业。其中一些主要参与企业目前在市场占有率方面处于市场领先地位。这些拥有大量市场占有率的领先参与企业正专注于扩大海外基本客群。市场上一些主要企业包括 Pactiv Evergreen Inc.、Amcor PLC、ProAmpac LLC、Aptar-Food Protection Inc.、AptarGroup Inc. 和 Ball Corporation Inc.。

- 2024 年 3 月,Amcor 集团与有机优格製造商 Stonyfield Organic 和领先的吸嘴袋包装製造商 Cheer Pack North America 合作。两家公司推出了 YoBaby 冷藏酸奶,这是业界首款全聚乙烯 (PE) 吸嘴袋,从传统的多层结构转向更负责任的设计。此次伙伴关係将三位永续性领导者聚集在一起,共同开创市场优先的解决方案,在保持最佳性能的同时支持永续性。

- 2023 年 10 月,冷冻有机和实践水果市场的知名公司 Nature's Touch 宣布收购 SunOpta Inc. 的冷冻水果业务 Sunrise Growers 的部分资产。此次收购使 Nature's Touch 能够加强其在北美地区以客户为中心的做法,为供应商和零售商带来许多好处,包括获得采用环保且方便包装的一流有机冷冻食品。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业地缘政治情景分析

第五章市场动态

- 市场驱动因素

- 简便食品需求增加

- QSR(快速服务餐厅)越来越受欢迎

- 市场限制因素

- 人们越来越偏好天然食品

- 严格的政府法规

第六章 市场细分

- 按材质

- 玻璃

- 纸

- 金属

- 塑胶

- 其他的

- 透过食物

- 准备好的饭菜

- 水果和蔬菜

- 肉/鸡肉

- 鱼贝类

- 烘焙点心

- 其他的

- 按包装产品

- 包包

- 盒子

- 能

- 纸盒

- 托盘

- 饶舌歌手

- 其他的

- 按国家/地区

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Pactiv Evergreen Inc.

- Amcor PLC

- ProAmpac LLC

- Aptar-Food Protection(AptarGroup Inc.)

- Ball Corporation Inc.

- Sonoco Products Company

- Tetra Pak International

- Genpack LLC

- WestRock Company

- Sealed Air Corporation

- Universal Plastic Bag Manufacturing Co.

第八章投资分析

第9章市场的未来

The North America Frozen Food Packaging Market size is estimated at USD 14.22 billion in 2025, and is expected to reach USD 19.38 billion by 2030, at a CAGR of 6.4% during the forecast period (2025-2030).

Key Highlights

- With frozen items requiring less time and effort than traditional home-cooked meals, the rising consumer demand for convenience is fueling the growth of frozen product sales. Busy lifestyles are pushing consumers toward processed foods, leading to a surge in demand for frozen food. The primary categories of packaged frozen foods include bakery products and frozen processed foods, with frozen ready-to-eat items emerging as a notable category. Colder storage temperatures can significantly extend shelf life, all while consumer expectations for food quality continue to rise.

- As consumers increasingly turn to frozen foods, there is a growing demand for sustainable packaging materials. Numerous manufacturers and retailers are transitioning from traditional packaging to recyclable, reusable, and compostable alternatives. This surge in demand for frozen foods and individually wrapped items has the packaging industry racing to adapt. Innovations in frozen food packaging are on the rise, with notable advancements like steamable packaging for microwavable products. Furthermore, developments in cold-chain technology and smart packaging, like alerting users to temperature changes, are expected to address these evolving needs.

- Grocery shopping habits have undergone a seismic shift. A growing number of consumers are turning to online platforms for their food purchases, prioritizing convenience and safety. In response to these evolving preferences, retailers are diversifying their order fulfillment methods. These include competitive pricing, curbside pickups, home deliveries, food delivery apps, and pickups from remote locations.

- As retailers strive to enhance their recall value and presence in rural, tier I, and tier II regions, they are intensifying efforts to make their promotional programs more enticing. This dynamic not only underscores the evolving landscape of grocery retailing but also highlights the burgeoning opportunities that are shaping the demand for frozen foods in these regions.

North America Frozen Food Packaging Market Trends

Growing Demand for Fresh Meat Through Retail Channels

- As consumers increasingly demand bio-based materials over toxic plastics for fresh meat packaging, the market outlook is set to evolve in the coming years. Heightened environmental concerns, coupled with stringent government regulations, are poised to create fresh opportunities for market players. Such dynamics could propel these players toward innovative solutions in the fresh meat packaging arena, fueling overall market growth.

- This change has positively impacted the demand for fresh meat and poultry through online and offline retail channels owing to reasons, including the recognition of the health advantages of meat-rich protein, the rise of high-protein diets such as the keto diet, and the upswing in reliance on pre-packaged processed meat. Also, the region's economic growth is expected to boost meat consumption.

- The US meat industry has displayed consistency over recent years. Data from the US Department of Agriculture and Economic Research Service indicates that beef production in the country was projected to reach 26.96 billion pounds in 2023, a decrease from 28.29 billion pounds in 2022. As of 2021, beef led the pack in retail sales among fresh meats in the United States, with sales surpassing USD 30 billion that year. In 2022, the retail price for 100% ground beef reached USD 4.8 per pound, a rise from USD 3.95 in 2020. Meanwhile, beef brisket averaged around USD 8.84 per pound at major grocery retailers.

- According to the Food Industry Association, meat sales have been the most consistent in department retail stores during the last few years, with an average household penetration of more than 98% and nearly 50 shopping trips per year. The top sellers in fresh meat are beef and chicken, while bacon and pre-packed lunch meat are the top sellers in processed meats.

- As per the research published by Progressive Grocer, retail sales of fresh meat in the United States increased in the past few years from USD 64.88 billion to USD 86.62 billion in 2022. This positive trend is also anticipated to be witnessed during the forecast period, pushing the demand for meat packaging in the region.

United States to Witness Significant Growth Rate

- As demand for frozen food packaging surges, industry players are heavily investing in product innovation, fueling market growth in the country. The booming e-commerce landscape is further amplifying the need for packaging solutions. E-commerce not only enhances shopping convenience but also exerts downward pressure on prices across various sectors. According to Business Insider, while e-commerce is propelling retail growth, its impact on flexible packaging is poised to expand in the region.

- The United States boasts a fiercely competitive retail industry, largely propelled by dominant players like Walmart, Kroger, and Albertsons. Walmart, hailing from the United States, stands as the world's largest retailer. Notably, five out of the top ten global retail giants are US-based, underscoring the nation's pivotal role in the global retail landscape.

- In the country, millennial consumers, with their strong preference for single-serving and on-the-go food and beverage items, primarily drive the demand for frozen food packaging products. Designed to be portable, durable, and lightweight, frozen food packaging has emerged as a popular choice for such items. Additionally, the rising appetite for both processed and fresh snack foods is poised to further fuel this demand.

North America Frozen Food Packaging Industry Overview

The North American frozen food packaging market is competitive with several influential players. Some of these important players in terms of market share are currently leading the market. These influential players with significant market shares are focused on expanding their customer base abroad. Some of the key players in the market include Pactiv Evergreen Inc., Amcor PLC, ProAmpac LLC, Aptar-Food Protection Inc. (AptarGroup Inc.), and Ball Corporation Inc.

- March 2024: Amcor Group teamed up with Stonyfield Organic, an organic yogurt producer, and Cheer Pack North America, a premier manufacturer of spouted pouch packaging. Together, they unveiled the industry's inaugural all-polyethylene (PE) spouted pouch for YoBaby refrigerated yogurt, moving away from the previous multi-laminate structure to a more responsible design. This partnership united three sustainability leaders, pioneering a market-first solution that champions sustainability while maintaining top-notch performance.

- October 2023: Nature's Touch, a prominent player in the market of frozen organic and conventional fruits, announced the acquisition of specific assets of Sunrise Growers, the frozen fruit operations of SunOpta Inc. Through this acquisition, Nature's Touch will be able to enhance its customer-centric approach throughout North America, resulting in numerous advantages for suppliers and retailers, such as access to top-notch organic frozen food items in eco-friendly and convenient packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Analysis of Geopolitical Scenario on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Convenience Food

- 5.1.2 Increase in Popularity of QSRs (Quick-service Restaurants)

- 5.2 Market Restraints

- 5.2.1 Rising Preference for Natural Food Products

- 5.2.2 Stringent Government Regulations

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Glass

- 6.1.2 Paper

- 6.1.3 Metal

- 6.1.4 Plastic

- 6.1.5 Other Materials

- 6.2 By Food Product

- 6.2.1 Readymade Meals

- 6.2.2 Fruits and Vegetables

- 6.2.3 Meat and Poultry

- 6.2.4 Seafood

- 6.2.5 Baked Goods

- 6.2.6 Other Food Products

- 6.3 By Packaging Product

- 6.3.1 Bags

- 6.3.2 Boxes

- 6.3.3 Cans

- 6.3.4 Cartons

- 6.3.5 Trays

- 6.3.6 Wrappers

- 6.3.7 Other Packaging Products

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Pactiv Evergreen Inc.

- 7.1.2 Amcor PLC

- 7.1.3 ProAmpac LLC

- 7.1.4 Aptar - Food Protection (AptarGroup Inc.)

- 7.1.5 Ball Corporation Inc.

- 7.1.6 Sonoco Products Company

- 7.1.7 Tetra Pak International

- 7.1.8 Genpack LLC

- 7.1.9 WestRock Company

- 7.1.10 Sealed Air Corporation

- 7.1.11 Universal Plastic Bag Manufacturing Co.