|

市场调查报告书

商品编码

1626894

企业防火墙:市场占有率分析、产业趋势与成长预测(2025-2030)Enterprise Firewall - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

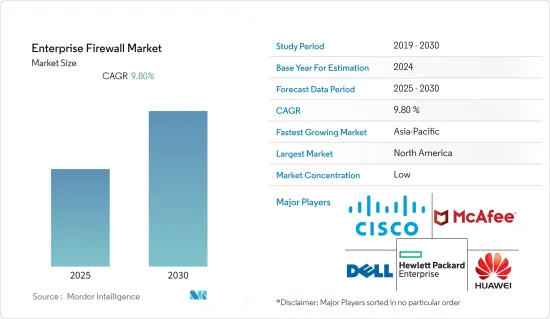

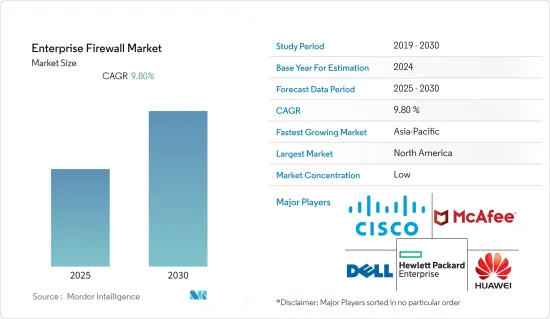

企业防火墙市场预计在预测期间内复合年增长率为 9.8%

主要亮点

- 企业防火墙是网路安全的基本单位。防火墙根据一组预先定义的值检查企业网路中的入境和出站资料封包流,以侦测网路上的恶意活动。

- 不断增加的网路容量、5G 核心、操作技术(OT)、物联网安全专业化以及恶意软体和威胁侦测的发展等长期趋势正在推动防火墙市场的需求。

- 随着云端技术的兴起,防火墙正在安装。这些防火墙提供了捆绑解决方案,可在任何装置上启用防火墙、处理任何流量负载,并确保整个组织遵循相同的策略。

- 成本因素是企业防火墙及其使用者的主要阻碍因素。对组织来说,部署防火墙成本高。成本根据您的组织想要部署的防火墙类型而有所不同。由于安装和维护费用,硬体防火墙的成本比软体防火墙高。

- COVID-19 加速了云端基础设施和服务的采用,企业转向基于云端基础的防火墙和防火墙即服务。疫情期间,不少企业被迫在家工作。这增加了对强大的安全解决方案的需求。

企业防火墙市场趋势

工业4.0实施范围扩大,云端服务将快速成长

- 使用云端运算的人数每天都在增加。这是因为云端运算提供了其他传统运算和资料储存系统无法比拟的灵活的工作环境、轻鬆的资料共用和高效的资料储存。

- 因此,许多公司正在转向云端运算,并将其资料和通讯放在云端。减缓云端运算成长的最大因素之一是安全性问题。

- 尤其是製造业对网路安全的需求不断增加,主要得益于工业4.0政策的快速实施。物联网应用预计也将对企业防火墙系统产生巨大需求。

- 云端技术的兴起导致了防火墙的引入。这些防火墙提供了捆绑解决方案,使防火墙可以在任何设备上使用,处理任何流量负载,并确保整个组织遵循相同的策略。

- 此外,云端运算预计在预测期内将强劲成长。云端基础的软体的日益普及为各行业的企业带来了许多好处,包括能够从任何设备(包括本机应用程式和浏览器)使用软体。云端运算的成长直接推动了企业防火墙市场的成长。如果没有安全层,随着资料外洩的增加,您组织的宝贵资料将面临风险。

北美占最大市场占有率

- 北美地区目前拥有最大的市场占有率,因为该地区的企业继续专注于安全并使用高效能的网路安全解决方案。

- 云端解决方案对于该地区企业防火墙的发展至关重要,因为它们具有成本效益、自动整合、IT 投资低且易于存取。

- 最新的技术创新也促进了企业防火墙市场的发展。这些进步可以使整个过程更加高效,并显着提高众多应用的准确性。北美地区正在见证一系列新产品的推出、合併和收购,以充分利用这一机会。

- 此外,北美地区尤其是美国的网路攻击正在迅速增加。网路攻击处于历史最高水平,这主要是由于该地区行动装置数量的迅速增加。据IBM称,美国资料外洩的平均成本从2021年的905万美元增加到2022年的944万美元。

- 2022 年 11 月,Microsoft Azure 宣布为中小型企业提供 DDoS IP 保护。中小企业 DDoS IP 保护旨在提供企业级 DDoS(分散式阻断服务)保护。这款新产品透过持续监控和自我调整调整来帮助防御 L3/L4 DDoS 攻击,旨在确保您的应用程式始终受到保护。

企业防火墙产业概况

企业防火墙市场与多家国际和本地公司竞争激烈。思科系统公司、瞻博网路公司和帕洛阿尔托网路公司是企业防火墙市场的主要参与者。

2022 年 11 月,全球网路安全服务供应商 Sophos 宣布推出 Sophos Firewall 的新功能,以满足分散式和企业边缘运算复杂而严苛的需求。更新后的防火墙包括更快检查加密流量的性能改进、Internet通讯协定版本6 (IPv6) 的动态流量路由以及软体定义广域网路(SD-WAN) 的改进性能,透过改进的负载平衡和高可用性来提高弹性。

2022 年 3 月,Palo Alto Networks 和 Amazon Web Services (AWS) 共同发布了适用于 AWS 的全新 Palo Alto Networks Cloud NGFW。它是一项託管的下一代防火墙 (NGFW) 服务,旨在更轻鬆地保护 AWS配置并帮助组织在保持安全的同时快速创新。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素

- 安全威胁不断上升

- 市场限制因素

- 一些公司在安全方面的立场落后

第 6 章 技术概览

第七章 市场区隔

- 依部署类型

- 本地

- 云

- 按解决方案

- 硬体

- 软体

- 服务

- 按组织规模

- 中小型组织

- 大型组织

- 按最终用户产业

- 卫生保健

- 製造业

- 政府机构

- 零售业

- 教育

- 金融服务

- 媒体

- 通讯

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第八章 竞争格局

- 公司简介

- Fortinet Inc.

- Palo Alto Networks

- McAfee(Intel Security Group)

- Dell Inc.

- Cisco Systems Inc.

- The Hewlett-Packard Company

- Juniper Networks

- Check Point Software Technologies

- Huawei Technologies Inc.

- Sophos Group plc.

- Netasq SA

- WatchGuard Technologies

- SonicWall Inc.

第九章投资分析

第十章投资分析市场的未来

The Enterprise Firewall Market is expected to register a CAGR of 9.8% during the forecast period.

Key Highlights

- Enterprise firewalls are the basic units of network security. They examine the flow of inbound and outbound data packets in an enterprise network against a set of predefined values to detect any malicious activity in the network.

- The ongoing secular trend of increasing network capacity, specialization for 5G core, operational technology (OT), and IoT security, and the evolution of malware and threat detection are driving demand for the firewall market.

- With the rise of cloud technology, firewalls are now being put in place. These firewalls offer a bundled solution that makes sure a firewall is available on any device, handles any traffic load, and makes sure the same policies are followed across the organization.

- The cost factor is the major restraining factor for enterprise firewalls and their users. Acquiring firewalls can be costly for organizations. The cost varies according to the type of firewall an organization wants to deploy. Hardware firewalls will cost more than software firewalls due to their installation and maintenance charges.

- COVID-19 accelerated the adoption of cloud infrastructure and services, which made businesses shift to cloud-based firewalls and firewall-as-a-service. During the pandemic, many companies had to let people work from home. This increased the need for strong security solutions.

Enterprise Firewall Market Trends

Cloud Services to have High Growth Rate due to enhanced adoption of Industry 4.0

- Every day, the number of people using cloud computing grows. This is because cloud computing offers a flexible work environment, easy data sharing, and efficient data storage, which no other traditional computing or data storage system can match.

- Consequently, numerous companies are heading toward cloud computing, placing their data and communications in the cloud. One of the most significant factors slowing the growth of cloud computing is security concerns.

- The increasing demand for network security, especially in the manufacturing sector, is primarily due to the rapid adoption of Industry 4.0 policies. Also, IoT applications are expected to create a huge demand for enterprise firewall systems.

- With the rise of cloud technology, firewalls are now being put in place. These firewalls offer a bundled solution that makes sure a firewall is available on any device, handles any traffic load, and makes sure the same policies are followed across the organization.

- Furthermore, cloud computing is estimated to grow robustly during the forecast period. The increased adoption of cloud-based software has provided a number of benefits for companies from various industries, including the ability to use software from any device, either through a native app or a browser. The growth of cloud computing is directly driving the growth of the enterprise firewall market, as, without a security layer, the valuable data of organizations is at stake as data breaches are increasing.

North America Occupies the Largest Market Share

- The North American region has the largest market share right now because businesses there care a lot about security and continue to use high-performing network security solutions.

- Cloud solutions are very important to the growth of enterprise firewalls in this region because they are cost-effective, automatically integrate, require little IT investment, and are easy to access.

- The latest technological breakthroughs have also assisted in the advancement of the enterprise firewall market. These advancements can make overall processes more efficient and significantly improve accuracy in numerous applications. There have been a series of new product launches, mergers, and acquisitions in the North American region to take advantage of this opportunity.

- Moreover, cyberattacks in the North American region, especially in the United States, are rising rapidly. They have reached an all-time high, primarily owing to the rapidly increasing number of mobile devices in the region. According to IBM, in the United States, the average cost of a data violation amounted to 9.44 million U.S. dollars in 2022, up from 9.05 million U.S. dollars in 2021.

- In November 2022, Microsoft Azure announced the launch of DDoS IP protection for SMBs. DDoS IP Protection for SMBs is designed to provide enterprise-grade DDoS (distributed denial of service) protection. The new product can help companies defend against L3/L4 DDoS attacks with always-on monitoring and adaptive tuning designed to ensure the application is always protected.

Enterprise Firewall Industry Overview

The enterprise firewall market is highly competitive due to the presence of several international and local players. Cisco Systems, Juniper Networks, Palo Alto Networks, and Cisco Systems are all big names in the enterprise firewall market.

In November 2022, Sophos, a global cybersecurity service provider, announced the launch of new Sophos Firewall capabilities to meet the complex and demanding needs of distributed and enterprise edge computing. The updated firewalls would have better performance that speeds up the inspection of encrypted traffic, dynamic traffic routing for Internet Protocol version 6 (IPv6), more resilience with software-defined wide area network (SD-WAN) load balancing and high-availability improvements, and seamless integration with Microsoft Azure Active Directory.

In March 2022, Palo Alto Networks and Amazon Web Services (AWS) announced that they would be working together to launch the new Palo Alto Networks Cloud NGFW for AWS. This is a managed Next-Generation Firewall (NGFW) service that is meant to make it easier to secure AWS deployments and allow organizations to innovate faster while staying safe.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Security Threats

- 5.2 Market Restraints

- 5.2.1 Laggard Attitude Towards Security by Some Enterprises

6 TECHNOLOGY SNAPSHOT

7 MARKET SEGMENTATION

- 7.1 Type of Deployment

- 7.1.1 On-premise

- 7.1.2 Cloud

- 7.2 Solution

- 7.2.1 Hardware

- 7.2.2 Software

- 7.2.3 Services

- 7.3 Size of the Organization

- 7.3.1 Small and Medium Organizations

- 7.3.2 Large Organizations

- 7.4 End-user Industry

- 7.4.1 Healthcare

- 7.4.2 Manufacturing

- 7.4.3 Government

- 7.4.4 Retail

- 7.4.5 Education

- 7.4.6 Financial Services

- 7.4.7 Media

- 7.4.8 Communications

- 7.4.9 Other End-user Industries

- 7.5 Geography

- 7.5.1 North America

- 7.5.2 Europe

- 7.5.3 Asia-Pacific

- 7.5.4 Latin America

- 7.5.5 Middle East & Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Fortinet Inc.

- 8.1.2 Palo Alto Networks

- 8.1.3 McAfee (Intel Security Group)

- 8.1.4 Dell Inc.

- 8.1.5 Cisco Systems Inc.

- 8.1.6 The Hewlett-Packard Company

- 8.1.7 Juniper Networks

- 8.1.8 Check Point Software Technologies

- 8.1.9 Huawei Technologies Inc.

- 8.1.10 Sophos Group plc.

- 8.1.11 Netasq SA

- 8.1.12 WatchGuard Technologies

- 8.1.13 SonicWall Inc.