|

市场调查报告书

商品编码

1627097

拉丁美洲的神经型态晶片:市场占有率分析、行业趋势和成长预测(2025-2030)LA Neuromorphic Chip - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

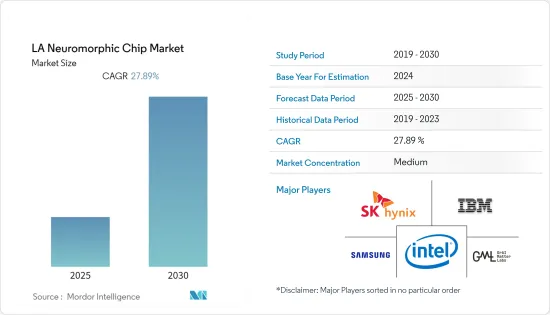

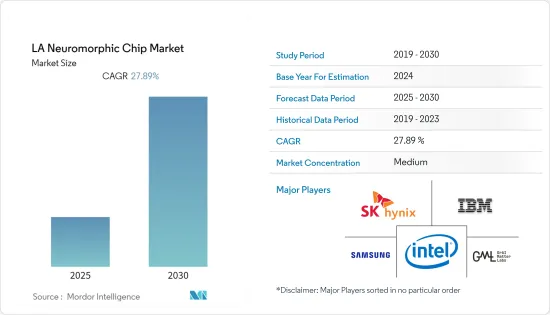

拉丁美洲神经型态晶片市场预计在预测期内复合年增长率为27.89%

主要亮点

- 神经型态是一种受大脑启发的 ASIC,它实现了尖峰神经网路 (SNN)。平均数十瓦即可实现大规模平行大脑处理能力。记忆体和处理单元是一个单一的抽象(记忆体内运算)。这带来了在复杂环境下动态和自可程式设计行为的优势。

- BrainChip Holdings Ltd. 等公司已经建立了多个伙伴关係关係,利用神经型态晶片来遏制 COVID-19 的传播。 2021 年 5 月,BrainChip Holdings Ltd 与精密免疫学公司 Biotome Pty Ltd 合作开发了一种快速、准确的 COVID-19 抗体测试。两家公司将探索 Akida 神经处理器如何提高抗体测试中资讯的准确性和质量,而 Biotome 将透过在护理点提供先进的人工智慧功能来推进开发。

- 神经型态晶片可以设计为数位晶片、类比晶片或两者的混合晶片。与数位晶片相比,类比晶片更类似于神经网路的生物特性。在模拟架构中,使用较少的电晶体来模拟神经元的微分方程。因此,理论上它比数位神经型态晶片消耗更少的能量。此外,处理可以扩展到超出分配的时隙。此功能允许比即时更快地执行处理。然而,模拟架构噪音更大且精度较低。

- 另一方面,数位晶片比类比晶片具有更高的精度。其数位结构增强了片上程式设计。这种灵活性使得人工智慧研究人员能够以比 GPU 更低的功耗准确地实现各种演算法。混合晶片试图将类比晶片的低能耗与数位晶片的高精度结合。

- 神经型态架构解决了冯诺依曼架构中常见的挑战,例如高功耗、低速度和其他效率瓶颈。与二元编码中具有突然高低差异的传统冯诺依曼架构不同,神经型态晶片以尖峰讯号的形式提供连续的类比转换。神经型态架构将储存和处理融为一体,消除了CPU和记忆体之间的汇流排瓶颈。

拉丁美洲神经型态晶片市场趋势

汽车产业是采用神经型态晶片快速发展的产业

- 汽车产业是神经型态晶片成长最快的产业之一。所有高端汽车製造商都在大力投资,以在其车辆中实现 5 级自治,预计这将导致对人工智慧驱动的神经型态晶片的巨大需求。

- 自动驾驶市场需要不断改进人工智慧演算法,以低功耗实现高吞吐量。神经型态晶片非常适合分类任务,可用于自动驾驶的多种场景。与静态深度学习解决方案相比,即使在自动驾驶汽车等嘈杂的环境中,它也更有效率。

- 据英特尔称,自动驾驶汽车在行驶近一个半小时内估计可以产生 4 Terabyte的资料量,相当于普通人一天在汽车上花费的时间。自动驾驶汽车面临着有效管理这些行程中产生的所有资料的重大挑战。

- 为现代自动驾驶汽车提供动力的电脑实际上是微型超级电脑。 NVIDIA 等公司的目标是在 2022 年实现 5 级自治,以 750W 的功率提供 200 TOPS(每秒万亿次操作)。然而,每小时花费 750W 的处理能力将对电动车的续航里程产生显着影响。

- ADAS(进阶驾驶辅助系统)应用包括神经型态晶片各种车载应用中的影像学习和辨识功能。这与乘用车中的巡航控制和智慧速度辅助系统等传统 ADAS 功能的工作原理类似。可以透过识别道路上显示的交通资讯(例如行人穿越道、学区和道路差异)来控制车辆速度。

对基于人工智慧的微晶片的需求不断增长推动市场成长

- 由于对人工智慧的需求不断增长以及消费者对较小产品的偏好导致对 IC 小型化的需求,拉丁美洲神经型态晶片市场正在经历高速成长。随着智慧技术的出现,智慧感测器被应用于汽车、电子和医疗等许多最终用户产业。

- 目前可用于人工智慧应用的半导体是CPU和人工智慧加速器。由于 CPU 的运算处理能力有限,人工智慧加速器正在引领市场。可用的人工智慧加速器包括 GPU、专用积体电路 (ASIC) 和 FPGA(现场可程式闸阵列)。 GPU拥有许多平行处理核心,这使得它们在处理AI训练和推理方面具有巨大优势。然而,GPU由于功耗较高,无法相容于未来的应用。

- 另一方面,新兴的 FPGA 的能源效率比 GPU 高 10 倍,但效能较低。对于能源效率是重中之重的应用,FPGA 可以作为替代解决方案。在AI加速器中,ASIC效能最好,功耗更低,效率更高。然而,设计具有独特功能的 ASIC 非常昂贵且无法重新配置。因此,当特定人工智慧应用的市场适合设计投资时,应该使用 ASIC。

- 与人工智慧加速器相比,神经型态晶片在并行性、能源效率和性能方面可能是更好的选择。神经型态晶片可以即时处理人工智慧推理和训练。此外,还可以透过神经型态晶片进行边缘训练。但学习方法的准确性仍有待提升。

拉丁美洲神经型态晶片产业概况

由于神经型态晶片市场非常小众,且处于市场发展的早期阶段,市场上只有BrainChip Holdings Ltd、英特尔公司和SynSense AG等少数公司。主要企业透过协作、市场开发、产品创新和研发活动等各种市场开发策略,在这个一体化的市场场景中蓬勃发展。因此,市场集中度适中。

- 2020 年 3 月 - SolidRun 和 Gyrfalcon 开发了首款边缘优化 AI 推理伺服器 Janux GS31,支援主要的神经网路框架。最多可安装128颗Gyrfalcon Lightspeeur SPR2803 AI加速晶片,以提高最复杂的视讯AI模型的推理性能。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- 神经型态晶片的新使用案例

- COVID-19 市场影响分析

第五章市场洞察

- 市场驱动因素

- 对基于人工智慧的微晶片的需求不断增加

- 新趋势是神经可塑性和电子学概念的融合

- 市场挑战

- 硬体设计对高精度和复杂性的需求

第六章 拉丁美洲神经型态晶片市场

- 按最终用户产业

- 金融服务及网路安全

- 车

- 工业的

- 家用电子产品

- 其他最终用户产业

第七章 竞争格局

- 公司简介

- Intel Corporation

- SK Hynix Inc.

- IBM Corporation

- Samsung Electronics Co. Ltd

- GrAI Matter Labs

- Nepes Corporation

- General Vision Inc.

- Gyrfalcon Technology Inc.

- BrainChip Holdings Ltd

- Vicarious FPC Inc.

- SynSense AG

第八章投资分析

第9章市场的未来

The LA Neuromorphic Chip Market is expected to register a CAGR of 27.89% during the forecast period.

Key Highlights

- Neuromorphic is a specific brain-inspired ASIC that implements the Spiked Neural Networks (SNNs). It has an object to reach the massively parallel brain processing ability in tens of watts on average. The memory and the processing units are in single abstraction (in-memory computing). This leads to the advantage of dynamic, self-programmable behavior in complex environments.

- Companies, such as BrainChip Holdings Ltd, are forming multiple partnership activities to utilize neuromorphic chips in curbing the spread of COVID-19. In May 2021, BrainChip Holdings Ltd partnered with precision immunology company Biotome Pty Ltd to develop a fast, accurate COVID-19 antibody test. The companies will explore how the Akida neural processor could improve the accuracy and information quality of the antibody tests while Biotome is developing by providing advanced AI capacity at the point of care.

- Neuromorphic chips can be designed digitally, analog, or in a mixed way. Analog chips resemble the characteristics of the biological properties of neural networks better than digital ones. In the analog architecture, few transistors are used for emulating the differential equations of neurons. Therefore, theoretically, they consume lesser energy than digital neuromorphic chips. Besides, they can extend the processing beyond its allocated time slot. Thanks to this feature, the speed can be accelerated to process faster than in real-time. However, the analog architecture leads to higher noise, which lowers the precision.

- Digital ones, on the other hand, are more precise compared to analog chips. Their digital structure enhances on-chip programming. This flexibility allows artificial intelligent researchers to accurately implement various kinds of an algorithm with low-energy consumption compared to GPUs. Mixed chips try to combine the advantages of analog chips, i.e., lesser energy consumption, and the benefits of digital ones, i.e., precision.

- Neuromorphic architectures address challenges, such as high-power consumption, low speed, and other efficiency-related bottlenecks prevalent in the von Neumann architecture. Unlike the traditional von Neumann architecture with sudden highs and lows in binary encoding, neuromorphic chips provide a continuous analog transition in the form of spiking signals. Neuromorphic architectures integrate storage and processing, getting rid of the bus bottleneck connecting the CPU and memory.

Latin America Neuromorphic Chip Market Trends

Automotive is the Fastest Growing Industry to Adapt Neuromorphic Chip

- The automotive industry is one of the fastest-growing industries for neuromorphic chips. All the premium car manufacturers are investing heavily to achieve Level 5 of Vehicle Autonomy, which in turn, is anticipated to generate huge demand for AI-powered neuromorphic chips.

- The autonomous driving market requires constant improvement in AI algorithms for high throughput with low power requirements. Neuromorphic chips are ideal for classification tasks and could be utilized for several scenarios in autonomous driving. Compared with static deep learning solutions, they are also more efficient in a noisy environment, such as self-driving vehicles.

- According to Intel, four terabytes is the estimated amount of data that an autonomous car may generate through almost an hour and a half of driving or the amount of time a general person spends in their car each day. Autonomous vehicles face a significant challenge in efficiently managing all the data generated during these trips.

- The computers running the latest self-driving cars are effectively small supercomputers. The companies, such as Nvidia, aim to achieve Level 5 autonomous driving in 2022, delivering 200TOPS (trillions of operations per second) using 750W of power. However, spending 750W an hour on processing is poised to have a noticeable impact on the driving range of electric vehicles.

- ADAS (Advanced Driver Assistance System) applications include image learning and recognition functions among various automotive applications of neuromorphic chips. It works like conventional ADAS functions, such as cruise control or intelligent speed, assist system in passenger cars. It can control vehicle speed by recognizing the traffic information marked on roads, such as crosswalks, school zone, road-bump, etc.

Increasing Demand for Artificial Intelligence-based Microchips drive the market growth

- The Latin American neuromorphic chip market is experiencing high growth due to increasing demand for artificial intelligence and consumer preference towards small-sized products leading to the requirement of miniaturization of ICs. With the advent of smart technologies, smart sensors are being used in many end-user industries like automotive, electronics, and medical.

- Currently available semiconductors for AI applications are CPUs and AI accelerators. The AI accelerators are leading the market because of the computing limitations of CPUs. Available AI accelerators are GPUs, Application-Specific Integrated Circuits (ASICs), and Field-Programmable Gate Arrays (FPGAs). GPUs have many parallel processing cores, which give them a significant advantage for processing AI training and inference. However, they do have a high-power consumption cost which is not sustainable for future applications.

- On the other hand, emerging FPGAs can have ten times more power efficiency than GPUs but have lower performance. In applications where energy efficiency is the top priority, FPGAs can be the alternative solution. Among AI Accelerators, ASICs show the best performance, lesser power consumption, and efficiency. However, designing unique functioning ASIC is highly costly and is not reconfigurable. Therefore, ASICs should be used when the market of specific AI applications is adequate for the design investment.

- Compared to AI Accelerators, neuromorphic chips are poised to be the prominent option concerning parallelism, energy efficiency, and performance. They can handle both AI inference and training in real-time. Moreover, edge training is possible through neuromorphic chips. However, learning methodologies should be improved their accuracy.

Latin America Neuromorphic Chip Industry Overview

As the market for neuromorphic chips is very niche and in the initial phase of development, the market has a presence of a few players, such as BrainChip Holdings Ltd, Intel Corporation, SynSense AG, etc. Top players are growing intensely in this consolidated market scenario through various market development strategies, such as collaboration, market expansion, product innovation, and R&D activities. Hence the market concentration is medium.

- March 2020 - SolidRun and Gyrfalcon developed First Edge Optimized AI Inference Server Janux GS31 that supports leading neural network frameworks. It can be configured with up to 128 Gyrfalcon Lightspeeur SPR2803 AI acceleration chips for improved inference performance for most complex video AI models.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Emerging Use Cases for Neuromorphic Chips

- 4.5 Analysis of the Impact of COVID-19 on the Market

5 MARKET INSIGHTS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Artificial Intelligence-based Microchips

- 5.1.2 Emerging Trend of Combining the Concept of Neuroplasticity with Electronics

- 5.2 Market Challenges

- 5.2.1 Need for High Level of Precision and Complexity in Hardware Design

6 LATIN AMERICA NEUROMORPHIC CHIP MARKET

- 6.1 End User Industry

- 6.1.1 Financial Services and Cybersecurity

- 6.1.2 Automotive

- 6.1.3 Industrial

- 6.1.4 Consumer Electronics

- 6.1.5 Other End User Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intel Corporation

- 7.1.2 SK Hynix Inc.

- 7.1.3 IBM Corporation

- 7.1.4 Samsung Electronics Co. Ltd

- 7.1.5 GrAI Matter Labs

- 7.1.6 Nepes Corporation

- 7.1.7 General Vision Inc.

- 7.1.8 Gyrfalcon Technology Inc.

- 7.1.9 BrainChip Holdings Ltd

- 7.1.10 Vicarious FPC Inc.

- 7.1.11 SynSense AG