|

市场调查报告书

商品编码

1687061

神经型态晶片:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Neuromorphic Chip - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

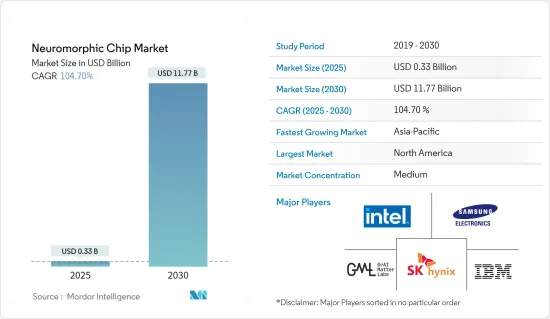

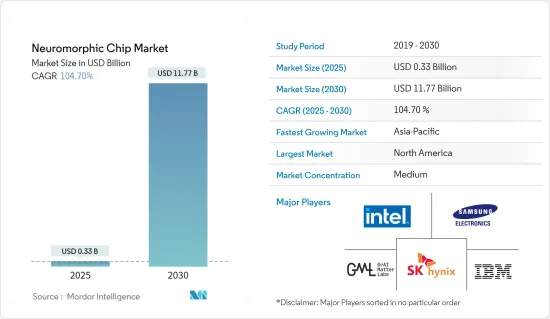

预计神经型态晶片市场规模在 2025 年将达到 3.3 亿美元,到 2030 年将达到 117.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 104.7%。

生物识别和语音辨识的使用日益增多,推动了智慧型手机对神经形态晶片的需求。这些晶片用于处理云端的语音资料并将其发送回行动电话。此外,由于人工智慧 (AI) 需要更多的运算能力,低能耗神经形态运算可以显着推动目前在云端运行的应用程式未来直接在智慧型手机上运行,而不会显着消耗智慧型手机电池。

神经形态是一种受大脑启发的特定 ASIC,可实现尖峰神经网路 (SNN)。平均而言,它们由能够达到数十瓦大规模并行大脑处理能力的物体提供动力。记忆体和处理单元是单一抽象(记忆体内运算)。

这意味着在复杂环境中具有动态和自可程式设计行为的优势。神经型态硬体并非采用传统的位元精度计算,而是利用大脑的高度机率特性,从而形成简单、可靠、稳健且资料高效的机率计算模型。神经形态硬体可以说比精确计算更适合认知应用。

未来十年,神经形态计算可能会改变广泛的科学和非科学应用的性质和能力。这包括越来越需要强大处理能力和功能的行动应用程式。

神经型态晶片的设计遵循对生物神经系统部分建模的目标。目的是复製计算功能,特别是有效解决认知和感知任务的能力。为了实现这一点,需要建立一个在神经元和突触连接数量方面足够复杂的网路模型。大脑及其学习和适应特定问题的能力仍然是基础神经科学研究的主题。

神经形态计算设备可能只使用很少的电量,导致能源需求显着增加,使硬体攻击更容易识别。这种增长可能透过侧通道监控显现出来。神经形态设备的设计者可能会使用大脑的功能作为蓝图,利用 3D 奈米结构、生医材料、氧化还原忆阻器、磁性神经网路交叉阵列和其他技术来建构运算系统。

新冠疫情对医疗保健业务市场产生了正面影响。 IBM、惠普和高通等多家市场领导已将神经形态运算解决方案推广至全球多家医院和诊所。他们的技术的计算能力可以缓解典型医院生态系统中的各种困难。疫情推动了资本设备产业的发展,对下一代电子产品的需求强劲。

神经型态晶片市场趋势

消费性电子领域占较大市场占有率

消费性电子产业已经认识到神经形态运算是实现这些目标的有前途的工具,可以实现高效能运算和超低功耗。例如,Alexa 和 Siri 等人工智慧服务依靠云端运算和互联网来解释和回应口头命令和问题。神经形态晶片有可能使各种感测器和设备无需网路连接就能智慧运作。

智慧型手机有望成为神经形态运算引入的催化剂。某些操作(例如生物识别)非常耗电且资料密集。例如,透过语音辨识,语音资料在云端处理,然后发送回行动电话。

穿戴式装置是一项快速发展的技术,它将对个人医疗保健、经济和社会产生深远的影响。随着宽频和分散式网路中感测器的激增,功耗、处理速度和系统适应性对于智慧穿戴式装置的未来至关重要。此外,人工智慧领域正在进一步增强智慧穿戴感测系统的潜力。新兴的高效能係统和智慧应用需要更大的复杂性,并需要能够准确代表物理物件的感觉单元。

IBM 的 TrueNorth 等专用神经形态装置正在为穿戴式装置实现影像辨识和自然语言处理等高级功能。在紧急情况下,神经形态穿戴装置可以通知相关人员、监测生命征象、辨识异常并快速做出反应。

人们对神经型态工程的兴趣日益浓厚,显示硬体脉衝神经网路被认为是一项重要的未来技术,在边缘运算和穿戴式装置等重要应用方面具有巨大潜力。

预测期内,北美将占据主要份额

北美有英特尔公司、IBM公司等主要供应商。由于政府倡议、投资活动和其他活动等因素,该地区的神经形态晶片市场正在成长。

例如,2023年9月,美国国家科学基金会宣布了24项研究和教育计划,总额达4560万美元,其中包括来自2022年《晶片与科学法案》的资助,旨在促进新半导体倡议的快速进步、製造和劳动力发展。 NSF 未来半导体 (FuSe) 计划是公私合营,与三星、爱立信、IBM 和英特尔四家公司合作资助倡议。

同时,加拿大政府对人工智慧技术的关注也有望在未来几年为神经形态运算创造成长空间。例如,2023年6月,加拿大政府提出新的《人工智慧和资料法案》(AIDA),以提案人工智慧带来的潜在风险,建立对加拿大人工智慧产业的信任,并保护加拿大人免受各种伤害。 AIDA 将确保加拿大成为世界上最负责任和最值得信赖的人工智慧的发源地。

多个研究计划正在寻求合作以推进神经型态技术。例如,2023年6月,洛斯阿拉莫斯国家实验室宣布开发出一种新型介面忆阻装置。结果表明,它们可用于构建下一代神经形态计算的人工突触。

此外,各国国防支出的增加也可望推动北美对神经形态运算的需求。

神经形态晶片产业概况

神经形态晶片市场包括大型半导体供应商、架构开发新兴企业以及具有强大产生收入能力的大学。市场正在整合,供应商越来越多地投入研发和合作活动来获取和商业化技术力,使市场竞争更加激烈。

儘管神经型态晶片尚处于开发早期阶段,但市场参与企业的专利申请活动已引起各大半导体公司、研发中心和大学的兴趣,未来竞争对手之间的竞争可能会更加激烈。

2023 年 6 月,BrainChip Holdings Ltd. 和 Lorser Industries Inc. 宣布将利用 BrainChip 的 Akida 技术为软体定义无线电 (SDR) 装置提供神经形态运算解决方案。此次伙伴关係将利用 Lorser 在 SDR 设计和製造方面的专业知识以及 BrainChip 的尖端神经型态技术,实现创新、智慧的解决方案,使 SDR 设备更具适应性、可靠性和扩充性。

2024 年 4 月,晶片製造商英特尔宣布已建成世界上最大的神经型态系统“Hala Point”,以促进更永续的人工智慧 (AI)。这个大型神经形态系统首先在桑迪亚国家实验室实施,将利用英特尔的 Loihi 2 CPU 支援未来受大脑启发的人工智慧研究,并解决当前人工智慧的有效性和永续性问题。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力模型

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- 神经型态晶片的新使用案例

- COVID-19 市场影响评估

第五章 市场洞察

- 市场驱动因素

- 对基于人工智慧的微晶片的需求不断增长

- 新趋势:神经可塑性概念与电子学的融合

- 市场挑战

- 硬体设计对精确度和复杂性的需求

第六章 全球深度学习市场分析

- 当前市场状况

- 全球深度学习市场细分

- 按类型

- CPU

- GPU

- FPGA

- ASIC

- SoC加速器

- 按类型

- 涵盖深度学习软体和服务业的最新趋势

- 投资场景

- 主要硬体供应商列表

- 市场潜力

第七章市场区隔

- 按最终用户产业

- 金融服务及网路安全

- 汽车(ADAS/自动驾驶汽车)

- 产业(物联网生态系统、监控、机器人)

- 消费性电子产品

- 其他终端用户产业(医疗、航太、国防等)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第八章竞争格局

- 公司简介

- Intel Corporation

- SK Hynix Inc.

- IBM Corporation

- Samsung Electronics Co. Ltd

- GrAI Matter Labs

- Nepes Corporation

- General Vision Inc.

- Gyrfalcon Technology Inc.

- BrainChip Holdings Ltd

- Vicarious FPC Inc.

- SynSense AG

第九章投资分析

第十章:市场的未来

The Neuromorphic Chip Market size is estimated at USD 0.33 billion in 2025, and is expected to reach USD 11.77 billion by 2030, at a CAGR of 104.7% during the forecast period (2025-2030).

The increasing use of biometrics and in-speech recognition drives the demand for neuromorphic chips in smartphones. These chips are used to process audio data in the cloud and then return it to the phone. In addition, Artificial Intelligence (AI) requires more computing power, but low-energy neuromorphic computing could significantly push applications that run presently in the cloud to run directly in the smartphone in the future without substantially draining the phone battery.

Neuromorphic is a specific brain-inspired ASIC that implements the Spiked Neural Networks (SNNs). On average, it has an object that can reach a massively parallel brain processing ability in tens of watts. The memory and the processing units are in single abstraction (in-memory computing).

This leads to the advantage of dynamic, self-programmable behavior in complex environments. Instead of traditional bit-precise computing, neuromorphic hardware leads to the probabilistic models of simple, reliable, robust, and data-efficient computing as the brain's highly stochastic nature. Neuromorphic hardware certainly suits more cognitive applications than precise computing.

During the next decade, neuromorphic computing will transform the nature and functionalities of a wide range of scientific and non-scientific applications. Some of them include mobile applications that are increasingly demanding powerful processing capacities and abilities.

The design of neuromorphic chips follows the goal of modeling parts of the biological nervous system. The aim is to reproduce its computational functionality, especially its ability to efficiently solve cognitive and perceptual tasks. Achieving this requires modeling networks of sufficient complexity regarding the number of neurons and synaptic connections. The brain and its ability to learn and adapt to specific problems are still subject to basic neuroscientific research.

The telltale spike in energy demand resulting from neuromorphic computing devices using potentially very small quantities of electricity makes hardware attacks much easier to identify. This increase would be visible through side-channel monitoring. Neuromorphic device designers may use brain functionality as a blueprint to create computing systems that use 3D nanostructures, biomaterials, redox memristors, magnetic neural network crossbar arrays, and other technologies.

The COVID-19 pandemic had a favorable influence on the medical business market. Several market leaders, including IBM, Hewlett Packard, and Qualcomm, pushed their neuromorphic computing solutions into several hospitals and clinics worldwide. Their technologies' computational skills were able to reduce various difficulties inside a normal hospital ecosystem. The pandemic kept the capital equipment sector humming with a strong demand for next-generation electronics.

Neuromorphic Chip Market Trends

Consumer Electronics Segment Holds Significant Market Share

The consumer electronics industry identifies neuromorphic computing as a promising tool for enabling high-performance computing and ultra-low power consumption to achieve these goals. For instance, AI services like Alexa and Siri rely on cloud computing and the internet to parse and respond to spoken commands and questions. Neuromorphic chips have the potential to allow several varieties of sensors and devices to perform intelligently without requiring an internet connection.

Smartphones are expected to be the trigger for the introduction of neuromorphic computing. Several operations, such as biometrics, are power-hungry and data-intensive. For instance, in speech recognition, audio data is processed in the cloud and then returned to the phone.

Wearable devices are a fast-growing technology with a considerable impact on personal healthcare for both the economy and society. Due to widespread sensors in pervasive and distributed networks, power consumption, processing speed, and system adaptation are vital in the future of smart wearable devices. Additionally, the field of artificial intelligence further boosts the possibility of smart wearable sensory systems. The emerging high-performance systems and intelligent applications need more complexity and demand sensory units to describe the physical object accurately.

Advanced functions like image identification and natural language processing are becoming possible for wearables due to dedicated neuromorphic devices like IBM's TrueNorth. In an emergency, neuromorphic wearables can notify medical personnel, monitor vital signs, identify abnormalities, and respond promptly.

The increasing interest in neuromorphic engineering shows that hardware-spiking neural networks are considered a critical future technology with high potential in crucial applications, such as edge computing and wearable devices.

North America to Hold Major Share over the Forecast Period

North America is home to some of the major market vendors, such as Intel Corporation and IBM Corporation. The market for neuromorphic chips is growing in the region due to factors such as government initiatives, investment activities, and others.

For instance, in September 2023, In order to facilitate quick advancements in novel semiconductor technologies and manufacturing as well as workforce development, the US National Science Foundation announced 24 research and education initiatives totaling USD 45.6 million, including financing from the "CHIPS and Science Act of 2022". The NSF Future of Semiconductors (FuSe) program funds the initiatives in conjunction with four companies, Samsung, Ericsson, IBM, and Intel, through a public-private collaboration.

On the other hand, the government of Canada is focusing on artificial intelligence technology, which is also expected to create a scope for growth in neuromorphic computing over the coming years. For instance, in June 2023, the government of Canada proposed a new Artificial Intelligence and Data Act (AIDA) to address the potential risks of AI, build trust in Canada's AI industry, and protect Canadians from a range of harms. AIDA will ensure that Canada is home to the world's most responsible and trusted AI.

Several research projects are attracting collaborations for advancements in neuromorphic technology. For instance, in June 2023, Los Alamos National Laboratory announced the development of the new interface-type memristive device, which their results suggest can be used to build artificial synapses for next-generation neuromorphic computing.

The increasing defense expenditure of various countries is also expected to drive the demand for neuromorphic computing in North America.

Neuromorphic Chip Industry Overview

The neuromorphic chip market has large-scale semiconductor vendors that command significant revenue generation capabilities, architecture-development start-ups, and universities. The market is consolidated, and vendors are increasingly spending on R&D and collaboration activities to gain technological capabilities and commercialize the market, making the market less competitive.

Despite neuromorphic chips being at an early stage of development, the patent filing activity by players in the market is gaining interest across key semiconductor companies, R&D centers, and universities, and competitive rivalry is poised to increase in the future.

In June 2023, BrainChip Holdings Ltd and Lorser Industries Inc. announced that they would use BrainChip's Akida technology to deliver neuromorphic computing solutions for software-defined radio (SDR) devices. The partnership will leverage Lorser's expertise in SDR design and manufacturing and BrainChip's cutting-edge neuromorphic technology to create innovative, intelligent solutions that enhance SDR devices' adaptability, reliability, and scale.

In April 2024, Chip maker Intel announced that to facilitate more sustainable artificial intelligence (AI), it has constructed the largest neuromorphic system in the world, known as "Hala Point." This massive neuromorphic system, which was first implemented at Sandia National Laboratories, makes use of Intel's "Loihi 2" CPU, supports research into future brain-inspired artificial intelligence, and addresses issues with the effectiveness and sustainability of current AI.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Emerging Use Cases for Neuromorphic Chips

- 4.5 Assessment of the Impact of COVID-19 on the Market

5 MARKET INSIGHTS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Artificial Intelligence-based Microchips

- 5.1.2 Emerging Trend of Combining the Concept of Neuroplasticity with Electronics

- 5.2 Market Challenges

- 5.2.1 Need for High Level of Precision and Complexity in Hardware Design

6 GLOBAL DEEP LEARNING MARKET ANALYSIS

- 6.1 Current market scenario

- 6.2 Global Deep Learning Market Segmentation

- 6.2.1 By Type

- 6.2.1.1 CPU

- 6.2.1.2 GPU

- 6.2.1.3 FPGA

- 6.2.1.4 ASIC

- 6.2.1.5 SoC Accelerators

- 6.2.1 By Type

- 6.3 Coverage on the Current Trends in the Deep Learning Software and Service industry

- 6.4 Investment Scenario

- 6.5 List of Major Hardware Vendors

- 6.6 Future of the Market

7 MARKET SEGMENTATION

- 7.1 By End-User Industry

- 7.1.1 Financial Services and Cybersecurity

- 7.1.2 Automotive (ADAS/Autonomous Vehicles)

- 7.1.3 Industrial (IoT Ecosystem, Surveillance, and Robotics)

- 7.1.4 Consumer Electronics

- 7.1.5 Other End-user Industries (Medical, Space, Defense, Etc.)

- 7.2 By Geography

- 7.2.1 North America

- 7.2.2 Europe

- 7.2.3 Asia Pacific

- 7.2.4 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Intel Corporation

- 8.1.2 SK Hynix Inc.

- 8.1.3 IBM Corporation

- 8.1.4 Samsung Electronics Co. Ltd

- 8.1.5 GrAI Matter Labs

- 8.1.6 Nepes Corporation

- 8.1.7 General Vision Inc.

- 8.1.8 Gyrfalcon Technology Inc.

- 8.1.9 BrainChip Holdings Ltd

- 8.1.10 Vicarious FPC Inc.

- 8.1.11 SynSense AG