|

市场调查报告书

商品编码

1627129

欧洲压力感测器 -市场占有率分析、行业趋势/统计、成长预测 (2025-2030)Europe Pressure Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

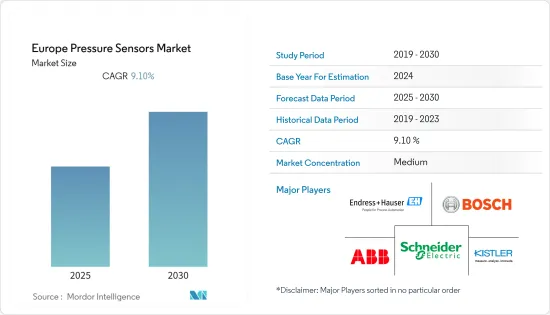

欧洲压力感测器市场预计在预测期内复合年增长率为 9.1%

主要亮点

- 支持成长的关键因素是对研究和研发中心的投资增加、政府计划的扩大以及有利于汽车和 IT医疗设备市场的倡议。

- 该地区新治疗方法、医疗设备和通讯协定的开发速度很快,是欧洲医疗设备和设备产业成长的主要动力。政府在医疗保健方面的支出预计将进一步发展该地区的压力感测器市场。

- 该地区的汽车工业也在以健康的速度成长,其中德国处于领先地位。由于欧洲电动车产量不断增加以及联网汽车概念的兴起,该地区的压力感测器市场预计将显着增长。

- COVID-19 大流行对该行业产生了负面影响。在疫情爆发的最初几个月,由于缺乏资金和对行业绩效的重新评估,大多数主要行业都关闭了,几个扩建计划被推迟。

欧洲压力感测器市场趋势

汽车工业显着成长

- 由于压力感测器在汽车和汽车工业中的多种应用,以应用类型来看,汽车产业占据了最大的市场占有率。无论应用是在引擎、轮胎或乘客舱中,合适的汽车压力感知器都可以提供经济高效的可靠性和较长的使用寿命。

- 德国和瑞典等许多欧洲国家正在提高汽车安全标准。因此,预计欧洲将成为预测期内汽车煞车压力感知器成长最快的市场。

- 如今,专用越野和越野车辆都配备了创新的轮胎压力控制系统。例如,在梅赛德斯 G63 AMG 6X6 上,驾驶可以独立改变前轴和后轴的轮胎压力。

- 在预测期内,由于高端车辆中安装的预测性维护功能数量不断增加,HVAC 应用对压力感测器的需求预计将大幅增加。

德国市场占有率最高

- 促进新兴市场研究和创新的政府计画也促进了该地区压力感测器市场的发展。例如,德国政府到2020年将研究公司数量增加到2万家,创新公司数量增加到14万家。

- 德国是世界上最大的褐煤生产国。欧洲的发电业也正在快速发展。欧洲发电产业对压力感测器的需求预计将显着增加,因为压力感测器代表发电厂的可观利润。

- 由于该国製造业强大,自动化的范围很大,因此,越来越多的公司正在采用机器人解决方案来自动化流程。根据IFR统计,2020年,德国是全球第五大机器人市场,欧洲第一大机器人市场。与前一年相比,2020年全国机器人出货量成长8.78%至2.23万台,主要由汽车产业需求拉动。新兴国家的这些发展预计将进一步增加对操作室内和室外机器人设备的压力感测器的需求。

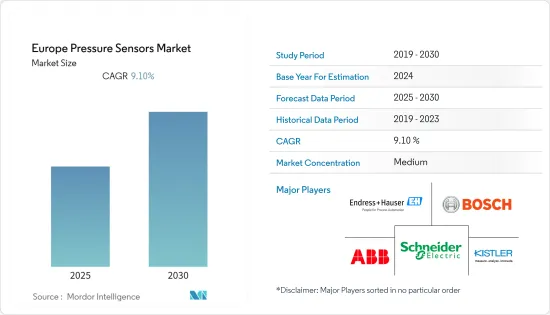

欧洲压力感测器产业概况

欧洲压力感测器市场适度细分,由多家大型企业组成。从市场占有率来看,目前只有少数大公司占据市场主导地位。然而,凭藉创新和永续的包装,许多 Nikolak 公司正在透过赢得新契约和开拓新市场来扩大其市场份额。

- 2021 年 9 月 - Arduino Pro 和 Bosch Sensortec 合作开发小型感测器板。 Nicla Sense ME 是 Arduino 最小的板,采用博世最新一代感测器技术,以最小的外形规格实现边缘感测和智慧。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 评估 COVID-19 对产业的影响

- 市场驱动因素

- 汽车、医疗等终端用户产业的成长

- MEMS 和 NEMS 系统在工业中的采用率不断提高

- 市场限制因素

- 与感测产品相关的高成本

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按用途

- 汽车(轮胎压力、煞车油压力、燃料箱蒸气压、燃油喷射和CDRi、歧管绝对压力等)

- 医疗(CPAP、人工呼吸器、吸入器、血压监测等)

- 消费性电子产品

- 工业的

- 航太/国防

- 饮食

- 空调

- 按国家/地区

- 英国

- 德国

- 法国

- 欧洲其他地区

第六章 竞争状况

- 公司简介

- ABB Ltd

- All Sensors Corporation

- Bosch Sensortec GmbH

- Endress+Hauser AG

- GMS Instruments BV

- Honeywell International Inc.

- Invensys Ltd

- Kistler Group

- Rockwell Automation Inc.

- Rosemount Inc.(Emerson Electric Company)

- Sensata Technologies Inc.

- Siemens AG

- Yokogawa Corporation

第七章 投资分析

第八章市场的未来

简介目录

Product Code: 49743

The Europe Pressure Sensors Market is expected to register a CAGR of 9.1% during the forecast period.

Key Highlights

- The major factors supporting the growth are increasing investments in research and innovation centers and growing government programs and policies favoring the automotive, and IT healthcare equipment and devices markets.

- The high rate of development of new treatment methods, medical equipment, and protocols in the region is boosting the European healthcare equipment and devices industry to grow significantly. The increasing government expenditure on healthcare is further estimated to develop a market for pressure sensors in the region.

- The automotive industry is also growing at a healthy rate in the region; Germany is leading the race. With increasing electric vehicle production and increasing connected vehicles concept in Europe, the market for pressure sensors in the region is expected to witness significant growth.

- The covid-19 pandemic had an adverse effect on the industry. Most of the leading industries were shut down during the early months of the pandemic, and several expansion projects were postponed due to a lack of capital and re-evaluation of industry performance.

Europe Pressure Sensors Market Trends

Automotive Industry to Show Significant Growth

- The automotive sector accounted for the largest market share by application type, owing to several applications of pressure sensors in automobiles and the automotive industry. The appropriate automotive pressure sensor can deliver cost-effective reliability and long operational life, whether the application is in the engine, tire, or passenger compartment.

- Many European countries such as Germany, Sweden are increasing their automotive safety standards. As a result, Europe is estimated to be the fastest-growing market for pressure sensors for automotive breaking applications over the forecast period.

- In recent times, exclusive off-road and cross-country cars are installing innovative tire pressure control systems. For example, the Mercedes G63 AMG 6X6 enables the driver to vary the tire pressure of both the front and rear axles separately.

- Over the forecast period, increasing predictive maintenance capabilities provided in high-end cars are expected to create considerable demand for pressure sensors in HVAC applications.

Germany to Hold the Highest Market Share

- Growing government programs promoting research and innovation is also helping advancement in the pressure sensor market to develop in the region. For instance, the German government increased the number of research companies to 20,000 and innovative companies to 140,000 by the year 2020.

- Germany is the world's largest producer of lignite. The power generation industry is also evolving rapidly in Europe. As the pressure sensor implies substantial benefits in power plants, hence the demand for a pressure sensor in Europe's power generation industry is expected to be boosted significantly.

- Owing to the prominence of manufacturing in the country, the scope of automation is significant, and with it, enterprises are increasingly adopting robotic solutions to automate processes. According to IFR, in 2020, Germany was the fifth-largest robot market in the world and number one in Europe. Compared to the previous year, the country's robot shipment increased by 8.78% in 2020 and stood at 22300 units, mainly driven by the demand from the automotive industry. Such developments in the country are expected to drive further the demand for pressure sensors to operate both indoor and outdoor robotics installations.

Europe Pressure Sensors Industry Overview

The European Pressure Sensor market is moderately fragmented and consists of several major players. In terms of market share, few of the major players currently dominate the market. However, with innovative and sustainable packaging, many Nicolacompanies are increasing their market presence by securing new contracts and tapping new markets.

- September 2021 - Arduino Pro and Bosch Sensortec partnered to develop a small sensor board. The Nicla Sense ME is Arduino's smallest board to date and uses the latest generation Bosch sensors technology on the smallest form factor yet for sensing and intelligence at the edge.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Assessment of Impact of COVID-19 on the Industry

- 4.3 Market Drivers

- 4.3.1 Growth Of End-user Verticals, such as Automotive and Healthcare

- 4.3.2 Increasing Adoption of MEMS and NEMS Systems in the Industry

- 4.4 Market Restraints

- 4.4.1 High Costs Associated with Sensing Products

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Automotive (Tire Pressure, Break Fluid Pressure, Vapor Pressure in Fuel Tank, Fuel Injection and CDRi, and Manifold Absolute Pressure among others)

- 5.1.2 Medical (Continuous Positive Airway Pressure (CPAP), Ventilators and Inhalers, and Blood Pressure Monitoring, Among Others)

- 5.1.3 Consumer Electronics

- 5.1.4 Industrial

- 5.1.5 Aerospace and Defence

- 5.1.6 Food and Beverage

- 5.1.7 HVAC

- 5.2 By Country

- 5.2.1 United Kingdom

- 5.2.2 Germany

- 5.2.3 France

- 5.2.4 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ABB Ltd

- 6.1.2 All Sensors Corporation

- 6.1.3 Bosch Sensortec GmbH

- 6.1.4 Endress+Hauser AG

- 6.1.5 GMS Instruments BV

- 6.1.6 Honeywell International Inc.

- 6.1.7 Invensys Ltd

- 6.1.8 Kistler Group

- 6.1.9 Rockwell Automation Inc.

- 6.1.10 Rosemount Inc. (Emerson Electric Company)

- 6.1.11 Sensata Technologies Inc.

- 6.1.12 Siemens AG

- 6.1.13 Yokogawa Corporation

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219