|

市场调查报告书

商品编码

1627132

印度的巨量资料技术与服务:市场占有率分析、产业趋势与统计、成长预测(2025-2030)India Big Data Technology & Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

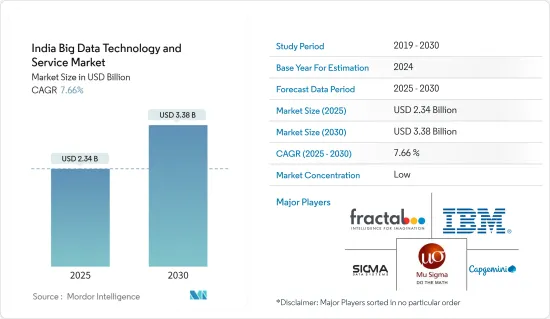

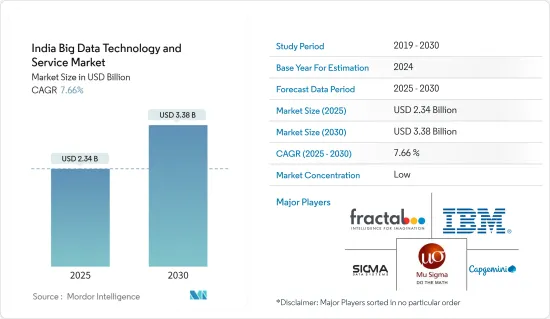

印度巨量资料技术服务市场规模预估至2025年为23.4亿美元,预估至2030年将达33.8亿美元,预测期间(2025-2030年)复合年增长率为7.66%。

印度的巨量资料和人工智慧生态系统正在迅速扩张,过去几年许多大大小小的公司纷纷进入该领域。因此,该国预计将成为世界上最大的巨量资料分析市场之一,为资料科学家提供更好的用例和更大的商机。

主要亮点

- 各种业务流程缺乏适当的人才和资源正在推动分析和其他数位解决方案的采用。这些解决方案在 BFSI、零售和电讯等产业也不断成长。在工业 4.0 时代,资料分析将成为更永续製造流程的关键技能,特别是在人工智慧、机器学习、物联网和自动化方面。

- 例如,据观察,由于缺乏诊断分析能力来识别绩效不佳的触发因素并做出准确的销售额预测,零售业的销售表现不稳定。在这种情况下,製造商没有时间或预算来建立内部资料分析团队。这就是为什么他们转向分析外包来获得可操作的、资料主导的见解。

- 海量资料的产生促使企业寻求对客户细分的洞察,了解每个细分市场的偏好,回应行为变化并提供个人化服务。此外,网路使用量的增加为组织提供了大量的结构化和非结构化资料。这些好处正在推动跨国公司和大型企业分析巨量资料以获得可行的见解。

- 巨量资料分析允许汽车製造部门从多个ERP系统收集资料,并进一步整合供应链中多个职能部门和业务成员的资讯。随着物联网和 M2M通讯的出现,汽车产业正在为工业 4.0 做好准备。感测器、条码阅读器、RFID 和机器人正在成为工业製造现场的常态。

- 印度工业可以更加了解消费者的行为模式并相应地规划生产计画。随着物联网的发展以及电子元件成为汽车不可或缺的一部分,汽车领域也出现了类似的可能性。

- 此外,该地区正在见证加强巨量资料生态系统的投资激增。例如,2022年1月,Fractal Analytics Limited获得私募股权公司TPG Capital Asia 3.6亿美元投资,成为2022年第二家独角兽。继 Mu Sigma 之后,它成为印度纯分析领域的第二家独角兽。此外,Fractal 还收购了微软云端、资料、工程和人工智慧领域的金牌咨询合作伙伴 Neil Analytics,帮助加强其在太平洋西北地区、加拿大和印度的业务。

- 此外,印度国防部将于2022年4月向能够提供人工智慧(AI)、先进影像处理、感测器系统、巨量资料分析、自主无人系统和安全通讯系统等解决方案的新兴企业提供资金。

- 此外,COVID-19 危机为整个行业带来了挑战,软体公司更加关注需求技术并寻找创新方式来服务客户。结果,技术支出有所下降。由于整体 IT 支出大幅下降、对硬体的严重影响以及软体和服务业务的放缓,人工智慧 (AI) 和巨量资料的采用预计将在 2020 年增长。在大流行的早期阶段,印度政府推出了一款免费应用程式「Aarogya Setu」(健康之桥),用于收集可能感染了 COVID-19 的人的行动电话记录、人工智慧和巨量资料,用于识别。

印度巨量资料技术市场趋势

BFSI 细分市场预计将推动市场成长

- 银行拥有大量有关客户收入和支出的资讯。此资讯与特定时间内进入帐户的客户付款和资金相关。透过分析这些资料,金融机构可以确定客户的薪资是否增加或减少,哪些收入来源更稳定,花了多少钱,以及使用哪些管道来完成特定交易,从而可以决定是否这样做。透过分析资料,银行可以评估风险,决定是否发放贷款,并确定客户是否有兴趣获得利润或投资。

- 印度品牌股权基金会(IBEF)称,已有44家外国银行、12家公共部门银行和22家私人银行在印度获得了银行牌照。此外,还有9.6万多家农村合作银行。此外,建立广泛的风险管理系统对于金融公司至关重要。如果风险管理不彻底,收益将受到严重损害。为了在竞争激烈的世界中生存并实现收益最大化,公司必须不断创新新理念。巨量资料分析可以帮助公司立即发现危险,当然也可以保护客户免受潜在的诈骗。

- 据电子和资讯技术部(MeitY)称,2022-2023财年印度数位付款年与前一年同期比较45%。 2022-23 财年数位付款交易额达 1,346.2 亿印度卢比(16.217 亿美元),2023-2024 财年达 1,166 亿印度卢比(14.0451 亿美元)。如此庞大的数位交易预计将推动对巨量资料服务的需求。

- 2022 年 6 月,德里国家银行推出专门的分析来打击诈欺,识别可能暂停付款的压力客户,并透过资料分析帮助金融机构在竞争中保持领先地位。财政部要求各银行选择重要的内部和外部资源,参与新的纵向整合。这将为提高效率提供见解,同时密切监控诈骗和不良债务累积。

通讯和 IT 领域预计将占据主要市场占有率

- 巨量资料技术的成长也得益于区块链、物联网、人工智慧和云端运算等新兴技术。这些技术正在为印度所需的巨量资料服务提供动力。

- 近年来,国内巨量资料服务供应商数量不断增加。 Lymbyc、G Square、TechVantage、BluePiConsulting 和 SIBIA Analytics 只是近年来兴起的几家公司。此外,参与企业数量增加也得益于政府的资料在地化措施。

- 印度目前是全球领先的巨量资料分析市场之一,NASSCOM 的目标是使该国成为前三名之一。 NASSCOM 预测,到 2025 年,印度分析产业的规模将达到 160 亿美元。这意味着它可能占据全球分析市场 32% 的份额。这种情况反映了印度巨量资料分析领域的巨大机会。由于拥有大量技术熟练且讲英语的人口资源库,印度的巨量资料分析行业正在经历高速成长。

- 根据诺基亚《2023 年印度行动宽频指数》报告,2022 年每位用户的平均每月资料消费量为 19.5 GB,而 2021 年为 17 GB,2020 年为 13.5 GB。资料消费量的空前成长产生了资料中心储存和管理这项庞大资源的需求。在 COVID-19主导的全国封锁的背景下,在家工作、线上教育和休閒进一步增加了资料使用。

- 此外,随着多家参与企业的进入,国内通讯业正经历强劲成长。例如,2022 年 7 月,亿万富翁高塔姆·阿达尼 (Gautam Adani) 的集团确认参与收购通讯频谱的竞赛,并表示将利用其建设专用网路来支援从机场到电力到资料中心的业务。

印度巨量资料技术产业概况

印度巨量资料技术和服务市场的竞争格局仍然高度竞争且分散。这主要归功于成熟的 IT 服务产业的存在,该产业能够快速进入资料革命。除了现有的参与企业之外,许多新兴企业和中型公司专门服务各种最终用户的垂直巨量资料需求。近期趋势如下。

2022 年 10 月。凯捷 (Capgemini) 宣布与微软合作,推出世界上第一个云端原生、无伺服器、基于 Azure 的数位双胞胎平台,名为 ReflectIOD。该平台利用Azure套件的增强架构和技术组件来帮助组织转变营运和维护效率,实现智慧产业并推动永续的商业价值。

2024年1月,GenepoweRx宣布推出人工智慧巨量资料分析和药物发现平台。 Upalli K&H 个人化医疗诊所的诊断部门 GenepoweRx 推出了独特的人工智慧 (AI) 平台 GeneConnectRx。个人化医疗的这项突破将使医疗专业人员能够根据每位患者独特的基因组成客製化治疗方案。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

第五章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对工业生态系的影响

第六章市场动态

- 市场驱动因素

- 降低实施成本是驱动因素

- 连接设备数量增加

- 市场限制因素

- 结构性障碍和去中心化製度是限制因素

- 缺乏熟练的专业人员

第七章 市场区隔

- 按类型

- 解决方案

- 服务(託管)

- 按组织规模

- 小型企业

- 大公司

- 按行业分类

- BFSI

- 零售

- 通讯/IT

- 媒体娱乐

- 医疗保健

- 其他的

第八章 竞争格局

- 公司简介

- Mu Sigma Business Solutions Pvt. Ltd.

- IBM Corporation

- Sigma Data Systems

- Capgemini SE

- Fractal Analytics Limited

- SAS Institute Inc.

- WNS(Holdings)Ltd.

- Wipro Ltd.

- TIBCO Software Inc.

- Infosys Ltd.

第九章投资分析

第十章市场机会与未来趋势

The India Big Data Technology & Service Market size is estimated at USD 2.34 billion in 2025, and is expected to reach USD 3.38 billion by 2030, at a CAGR of 7.66% during the forecast period (2025-2030).

In India, there has been a proliferation in the Big Data and AI ecosystem, with numerous large and small players entering in the past few years. Thus, the country is expected to become one of the world's largest Big Data Analytics markets, with better use cases and significant opportunities for data scientists in the future.

Key Highlights

- The shortage of the right talent and resources for various business processes has led to the adoption of analytics and other digital solutions. These solutions are also witnessing growth in industries such as BFSI, Retail, Telecom, and many more. In the Industry 4.0 era, data analytics would be a key skill for more sustainable manufacturing processes, especially concerning artificial intelligence, machine learning, IoT, and automation.

- Retailers, for instance, are observed suffering from unstable sales performance, lacking the capability of diagnostic analytics to identify what triggers poor performance or make accurate sales forecasts. At such a moment, the manufacturer lacks the time and budget to grow an in-house data analytics team. Therefore, they turn to analytics outsourcing to gain actionable and data-driven insight.

- The generation of a huge amount of data has led companies to seek insights such as customer segmentation, understanding the preferences under each segment, staying updated with changes in behavior, and personalization of services. Additionally, due to the rise in internet usage, an enormous amount of structured and unstructured data is available to organizations. Such benefits have led multinational and large companies to analyze their big data for actionable insights.

- Big data analytics allows the automobile manufacturing sector to collect data from multiple ERP systems to further combine information from several functional units of the supply chain and business members. With the emergence of IoT and M2M communication, the automotive industry is positioning itself toward Industry 4.0 ready. Sensors, barcode readers, RFIDs, and robots are becoming standard on the industry's manufacturing floor.

- The Indian industries are more aware of consumer behavior patterns and can plan production based on these. A similar potential has been exposed in the automotive sector, with IoT evolutions and electronics components becoming integral to automobiles.

- Additionally, the region is witnessing an upsurge in investments for enhancing its big data ecosystem. For instance, in January 2022, Fractal Analytics Limited became the second unicorn 2022 with an investment of USD 360 million from TPG Capital Asia, a private equity firm. After Mu Sigma, this is the second firm in India in the pure-play analytics space to get unicorn status. Further, Fractal acquired Neal Analytics, a cloud, data, engineering, and AI Microsoft Gold consulting partner, to help the company strengthen its presence in the Pacific Northwest, Canada, and India.

- Further, in April 2022, the Defence Ministry of India announced that it would fund startups that can provide solutions to Artificial Intelligence (AI), advanced imaging, sensor systems, big data analytics, autonomous unmanned systems, and secured communication systems, among other technologies.

- Further, software companies are intensifying their focus on in-demand technologies and exploring innovative ways to serve their clients even as the COVID-19 crisis created challenges across industries. It led to a reduction in technology spending. The adoption of artificial intelligence (AI) and big data was set to grow through the overall IT spending dropped significantly in 2020, with a severe impact on hardware and a slowdown in the software and services business. In the initial stage of the pandemic, the Government of India launched a free app, the Aarogya Setu, or Bridge to Health, to harvest mobile phone records, artificial intelligence, and big data to help identify individuals potentially exposed to COVID-19.

India Big Data Technology Market Trends

The BFSI Segment is Expected to Drive the Market's Growth

- Banks have extensive information about the earnings and expenses of their customers. This information relates to their payments and the money that entered their accounts over a specific time frame. A financial institution can analyze this data to determine whether a client's salary has increased or decreased, which sources of revenue have been more consistent, how much money was spent, and which channels the client utilized to conduct certain transactions. By analyzing the data, banks can assess risks, decide whether to extend loans, and determine whether a client is more interested in receiving benefits or making investments.

- According to the Indian Brand Equity Foundation (IBEF), 44 foreign banks, 12 public banks, and 22 private banks have banking licenses in India. Moreover, there are over 96,000 rural cooperative banks. Furthermore, developing an extensive risk management system is crucial for financial firms. They will experience a significant loss of revenue if they don't practice thorough risk management. To survive in the competitive world and maximize earnings, businesses must continuously innovate new ideas. Big data analysis aids businesses in detecting dangers instantly and, of course, safeguards customers from potential fraud.

- According to the Ministry of Electronics and IT (MeitY), In India, digital payments rose 45% yearly (YoY) during the fiscal year (FY) 2022-2023. This period saw INR 13,462 crore(USD 1621.7million) digital payment transactions in (FY) 2022-23, and INR 11,660 crore (USD 1404.51 million) in till december 2023 for FY 2023-2024. Such huge digital transactions will drive the demand for big data services.

- In June 2022, Delhi State-run banks were expected to have specialized analytics teams to combat frauds, identify stressed customers who might stop making payments, and assist the lenders in staying ahead of the competition through data analysis. The finance ministry requested that all banks select important internal and external resources to join the new vertical. This would give them insights to enhance efficiency while closely monitoring scams and accumulating bad loans.

The Telecommunication and IT Sector is Expected to Hold a Major Market Share

- The growth of Big Data technologies could also be attributed to emerging technologies, like Blockchain, IoT, AI, and cloud computing. These technologies have provided the push for the necessary big data services in India.

- There has been an increase in the number of big data service providers in the country recently. Lymbyc, G Square, TechVantage, BluePiConsulting, and SIBIA Analytics are a few firms that have come up in recent years. Furthermore, the increase in the number of players was also attributed to the government's data localization policy.

- India is currently among the world's major big data analytics markets, and NASSCOM has set the target of making the country one of the top three. NASSCOM has predicted that the Indian analytics industry is expected to reach USD 16 billion by 2025. This means that it may account for 32% of the analytics market worldwide. This scenario reflects tremendous opportunities for the scope of big data analytics in India. India is witnessing high growth in the big data analytics industry due to its large resource pool of technically skilled, English-speaking population.

- In 2022, according to Nokia's India Mobile Broadband Index 2023 report, the average monthly data consumption per user was 19.5 gigabytes, which was 17 gigabytes in 2021 and 13.5 gigabytes in 2020. The unprecedented growth of data consumption created the need for data centers to store and maintain this vast resource. The data usage increased further due to work from home, online education, and recreation in the backdrop of the COVID-19-led nationwide lockdown.

- Further, the telecom industry in the country is witnessing robust growth due to the entry of several players. For instance, in July 2022, Billionaire Gautam Adani's group confirmed its entry into the race to acquire telecom spectrum, which it said would be used to create a private network to support its businesses from airports to power and data centers.

India Big Data Technology Industry Overview

The competitive landscape of India's Big Data Technology and Services market remains highly competitive and fragmented. This is primarily because of the presence of a well-established IT services industry that has been able to leap into the data revolution quickly. In addition to the established players, a number of startups and mid-sized companies specialize in catering to the Big Data needs of the world across various End-User verticals. Some of the recent developments are as follows:-

In October 2022. Capgemini announced its collaboration with Microsoft to deliver a first-of-its-kind, cloud-native, serverless Azure-based digital twin platform called ReflectIOD. The platform was to leverage the Azure suite's enhanced architecture and technological components to help transform an organization's operations and maintenance efficiency, enabling intelligent industry and driving sustainable business value.

In January 2024, AI big data analytics and drug discovery platform is launched by GenepoweRx. The diagnostic division of Uppaluri K&H Personalized Medicine Clinic, GenepoweRx, has introduced GeneConnectRx, an inventive artifical intelligence (AI) platform. Healthcare professionals will now be able to tailor therapies based on each patient's unique genetic composition due to this groundbreaking advancement in personalized medicine.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

5 MARKET INSIGHT

- 5.1 Market Overview

- 5.2 Industry Value Chain Analysis

- 5.3 Industry Attractiveness - Porter's Five Forces Analysis

- 5.3.1 Bargaining Power of Suppliers

- 5.3.2 Bargaining Power of Buyers

- 5.3.3 Threat of New Entrants

- 5.3.4 Threat of Substitutes

- 5.3.5 Intensity of Competitive Rivalry

- 5.4 Impact of COVID-19 on the Industry Ecosystem

6 MARKET DYNAMICS

- 6.1 Market Drivers

- 6.1.1 Reduction in Cost of Implementation will act as a Driver

- 6.1.2 Increasing Number of Connected Devices

- 6.2 Market Restraints

- 6.2.1 Structural Barriers and Decentralized Systems act as a Restraint

- 6.2.2 Lack of Skilled Professionals

7 MARKET SEGMENTATION

- 7.1 Type

- 7.1.1 Solution

- 7.1.2 Services (Managed)

- 7.2 Organisation Size

- 7.2.1 Small & Medium Enterprise

- 7.2.2 Large Enterprise

- 7.3 End-User Vertical

- 7.3.1 BFSI

- 7.3.2 Retail

- 7.3.3 Telecommunication and IT

- 7.3.4 Media and Entertainment

- 7.3.5 Healthcare

- 7.3.6 Other End-User Industry

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Mu Sigma Business Solutions Pvt. Ltd.

- 8.1.2 IBM Corporation

- 8.1.3 Sigma Data Systems

- 8.1.4 Capgemini SE

- 8.1.5 Fractal Analytics Limited

- 8.1.6 SAS Institute Inc.

- 8.1.7 WNS (Holdings) Ltd.

- 8.1.8 Wipro Ltd.

- 8.1.9 TIBCO Software Inc.

- 8.1.10 Infosys Ltd.