|

市场调查报告书

商品编码

1627136

美国接近感测器:市场占有率分析、产业趋势、成长预测(2025-2030)United States Proximity Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

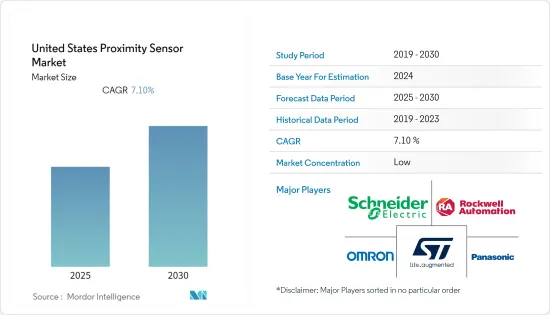

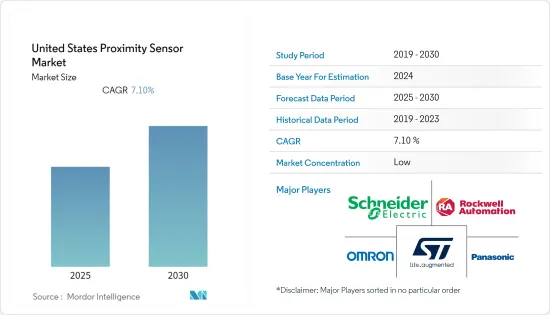

美国接近感测器市场预计在预测期内复合年增长率为 7.1%

主要亮点

- 在美国,由于都市化和人口增长,现代化设施变得更加复杂和多样化。例如,世界银行进行的世界发展指标调查发现,2020年美国都市化程度为82.66%。

- 来自感测器的资讯资料预计将有助于管理各种城市设施,并透过共用资讯有效应对紧急情况和事故。智慧城市车辆需要多个感测器来监测各种现象。这些各种类型的接近感测器不断监控车辆的位置和控制,增加了它们对城市基础设施的需求并推动了接近感测器市场的发展。

- 此外,在科技进步的时代,新型创新的接近感测器飞行时间(ToF)感测器可以在保持社交距离的同时以多种方式保护您的健康。例如,意法半导体于2020年7月推出了基于FlightSense飞行时间技术的高性能接近和测距感测器。这些飞行时间 (ToF) 感测器可协助客户为其日常使用的各种产品开发 3D 感测功能。

- 此外,随着 COVID-19 对各行业的影响越来越大,企业正在透过先进技术追求社交距离。由于大流行,对接近感测器的需求增加了,以提高职场安全性,透过接近检测标籤确保接触者追踪,并确保业务连续性。

- 然而,在不影响品质的情况下设计微型感测器一直是接近感测器市场成长的挑战。

美国接近感测器市场趋势

汽车领域预计将推动市场成长

- 接近感测器广泛应用于汽车应用中,用于检测汽车附近的物体。这些感测器向驾驶员发出警报并提供有关车辆状况的资讯。接近感测器在汽车中的主要应用包括引擎温度、电池充电检查、速度控制、燃油油位等。在某些情况下,这些感测器安装在门和把手上,以便在发生碰撞或警告时侦测物体。

- 此外,停车辅助系统和 ADAS 等自动驾驶技术使用各种感测器,包括温度感测器、动作感测器和光子感测器。这些感测器对于自动驾驶系统至关重要,因为它们产生高效、准确操作所需的资料。

- 由于监管机构和消费者对保护乘员和减少事故死亡人数的安全应用的兴趣,自动监控、警告和控制车辆制动和转向的高级驾驶员辅助系统 (ADAS) 市场正在不断增长。

- 例如,美国要求汽车到2020年必须配备自动紧急煞车(AEB)和前方碰撞警报(FCW)系统。这正在推动汽车接近感测器市场的发展。

- 联网汽车和自动驾驶汽车是汽车产业的重要发展。经济发展,消费者人均所得增加,生活水准提高。由于对豪华舒适车的需求不断增加,对自动驾驶汽车的需求也在增加。配备 AEB、ADAS、FCW 和 PAS 系统的车辆正在推动汽车接近感测器市场的发展。

电感式接近感测器预计将占据主要市场占有率

- 电感式接近感测器是一种经济高效且可靠的解决方案,适用于自动化设备和机械中的大多数应用。不受振动、水、油和灰尘的影响,适合恶劣环境。这些感测器的主要应用包括工具机、农业和物料输送系统。

- 电感式感测器在提高自动化流程的品质和生产率方面发挥关键作用。这些感测器没有移动部件,因此它们的使用寿命不取决于操作週期数。

- 工业和汽车应用中物料输送的增加推动了对电感式接近感测器的需求。接近感测器通常安装在堆高机等物料输送设备 (MHE) 上,并在侦测到实体(人或其他 MHE)时启动讯号。

- 日益增长的工业进步迫使製造业、石油和天然气等行业利用电感式接近感测器实现自动化。例如,在石油和天然气行业,电感式接近感测器为测量海上石油钻井平台的变数提供了耐用且可靠的解决方案。这些感测器可以承受海水等恶劣的海洋条件,海水可能会腐蚀和损坏设备。因此,可以部署感应式接近感测器来安全地测量钻机上管道搬运机和其他移动部件的最终位置,而不会影响性能。

- 然而,这些感测器只能检测金属物体,这限制了它们在不使用金属的其他行业中的功能,这可能会影响美国接近感测器市场的成长。

美国接近感测器产业概况

美国接近感测器市场是一个竞争激烈且分散的市场。着名公司包括意法半导体、欧姆龙公司、霍尼韦尔国际公司和松下公司。这些公司正在利用策略合作计划来提高市场占有率和盈利。在预测期内,竞争和快速的技术进步预计将威胁市场中公司的成长。

- 2020 年 9 月 - 理科光电科技推出 JM-N3/P3 矩形电感式接近感测器,扩大了其产品范围。此感测器的检测距离为2mm+_10%。

- 2020 年 5 月—意法半导体推出了 VL53L3CX,扩展了其 FlightSense ToF 测距感测器的功能,该感测器采用取得专利的直方图演算法,可以更准确地测量到多个物体的距离。与传统红外线感测器不同,VL53L3CX 可测量 2.5cm 至 3m 范围内的物体,且不受目标颜色或反射率的影响。这使得设计人员能够将强大的新功能融入他们的产品中。例如,它可以忽略不需要的背景或前景物体以提供无错误感测,或者它可以报告到感测器视场内的多个目标的准确距离。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 工业自动化的成长

- 对感应感测技术的需求不断增长

- 汽车感测应用的扩展

- 市场挑战

- 感测能力的限制

第六章 市场细分

- 依技术

- 感应式

- 电容式

- 光电式

- 磁力型

- 超音波

- 其他技术

- 按频道类型

- 单通道

- 多通道

- 按最终用户

- 航太/国防

- 车

- 工业自动化

- 家用电子产品

- 饮食

- 製药

- 建造

- 活力

- 其他最终用户

第七章 竞争格局

- 公司简介

- STMicroelectronics

- OMRON Corporation

- Rockwell Automation

- Schneider Electric

- Panasonic Corporation

- Honeywell International Inc.

- SICK AG

- NXP Semiconductors NV

- General Electric

第八章投资分析

第9章 未来展望

The United States Proximity Sensor Market is expected to register a CAGR of 7.1% during the forecast period.

Key Highlights

- In the United States, modern facilities are becoming more complex and diverse with urbanization and population growth. For instance, according to a world development indicators survey conducted by the World Bank, it was found that the degree of urbanization in the United States was 82.66% in 2020.

- The sensor information data would aid in managing various urban facilities and the effective response to emergencies and accidents through information sharing. Intelligent urban vehicles would require multiple sensors to monitor a variety of phenomena. These various types of proximity sensors constantly monitor the position and control of the vehicle, increasing their demand in urban infrastructures and propelling the proximity sensor market forward.

- Moreover, in the era of technological advancement, new innovative proximity sensors - Time of Flight (ToF) sensors - can protect health in various ways while maintaining social distance. For instance, STMicroelectronics introduced high-performance proximity and ranging sensors based on FlightSense Time of Flight technology in July 2020. These Time of Flight (ToF) sensors aid in developing 3D sensing capabilities for a wide range of products used by customers daily.

- Further, with the growing impact of COVID-19 on various industries, businesses are following social distance through advanced technologies. As a result of the pandemic, the demand for proximity sensors has increased as they improve workplace safety and ensure contact tracing through proximity detection tags to ensure business continuity.

- However, designing miniaturized sensors without affecting their quality poses a challenge for the proximity sensor market growth.

US Proximity Sensor Market Trends

The Automotive Segment is Expected to Drive the Market's Growth

- Proximity sensors are widely used in automotive applications to detect objects close to vehicles. These sensors alert the driver and provide information about the vehicle's status. Engine temperature, battery charging check, speed control, fuel level, and other prominent applications of proximity sensors in automobiles include the following. In some cases, these sensors are installed on doors and handle to detect objects in the event of a collision or warning.

- Further, autonomous technologies, such as parking assist systems and ADAS, use a variety of sensors, such as temperature sensors, motion detectors, photon sensors, and so on. These sensors are critical to autonomous systems because they generate the data required for efficient and accurate operation.

- The market for advanced driver-assistance systems (ADAS) that automatically monitor, warn, and control braking and vehicle steering is expected to increase as a result of regulatory and consumer interest in safety applications that protect passengers and reduce accident fatalities.

- For instance, the United States has mandated that vehicles be equipped with autonomous emergency braking (AEB) and forward-collision warning (FCW) systems by 2020. This is propelling the market for automotive proximity sensors.

- Connected and autonomous vehicles are significant developments in the automotive industry. An increase in the per capita income of the consumers as a result of economic developments is elevating their standard of living. The rise, which is also fueling demand for autonomous vehicles, can be attributed to the increase in demand for luxury and comfort vehicles. Vehicles with AEB, ADAS, FCW, and PAS systems are driving the automotive proximity sensor market.

Inductive Proximity Sensor is Expected to Hold a Major Market Share

- The inductive proximity sensors are cost-effective and reliable solutions for most applications in automation equipment and machinery. They are not influenced by vibrations, water, oil, and dust, making them suitable for harsh environments. Some of the prominent applications of these sensors include machine tools, agriculture, and material handling systems.

- Inductive sensors play a crucial role in securing quality and higher productivity from the automated process. As these sensors have no moving parts, their service life is independent of the number of operation cycles.

- The demand for inductive proximity sensors is being driven by increased material handling in industrial and automotive applications. Proximity sensors are typically attached to material handling equipment (MHE) such as forklifts; when an entity (a person or other MHE) is detected, they activate a signal.

- The growing industrial advancement is compelling industries like manufacturing, oil, and gas to utilize inductive proximity sensors for automation. For instance, in the oil and gas industry, inductive proximity sensors provide a durable and dependable solution for measuring variables on offshore oil rigs. These sensors can withstand harsh sea conditions, such as saltwater, which could be corrosive and damaging to equipment. Consequently, deploying inductive proximity sensors can safely measure the ultimate positions of pipe handlers and other moveable components on the rig without performance being influenced by the elements.

- However, these sensors can only detect metal objects, limiting their functionality in other industries that do not use metal, which can affect the growth of the US proximity sensor market.

US Proximity Sensor Industry Overview

The United States Proximity Sensor Market is a fragmented market with intense competition. Some prominent players include STMicroelectronics, OMRON Corporation, Honeywell International Inc., Panasonic Corporation, etc. These companies are leveraging strategic collaborative initiatives to increase their market share and profitability. The competition and rapid technological advancements are expected to threaten the growth of the companies in the said market during the forecast period.

- September 2020 - Riko Optoelectronics Technology Co. Ltd expanded its product range by introducing JM - N3/P3 Rectangular Inductive Proximity Sensor. The sensors have a sensing distance of 2mm+_ 10%.

- May 2020 - STMicroelectronics expanded the capabilities of its FlightSense ToF ranging sensors with the introduction of the VL53L3CX, which features patented histogram algorithms that allow measuring distances to multiple objects while increasing accuracy. Unlike conventional infrared sensors, the VL53L3CX measures objects ranging from 2.5cm to 3m and is unaffected by target color or reflectance. This enables designers to incorporate powerful new features into their products, such as allowing occupancy detectors to provide error-free sensing by ignoring unwanted background or foreground objects or reporting exact distances to multiple targets within the sensor's field of view.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Industrial Automation

- 5.1.2 Increase in the Demand for Inductive Sensing Technology

- 5.1.3 Expansion of Automotive Sensing Applications

- 5.2 Market Challenges

- 5.2.1 Limitations in Sensing Capabilities

6 MARKET SEGMENTATION

- 6.1 Technology

- 6.1.1 Inductive

- 6.1.2 Capacitive

- 6.1.3 Photoelectric

- 6.1.4 Magnetic

- 6.1.5 Ultrasonic

- 6.1.6 Other Technology

- 6.2 Channel Type

- 6.2.1 Single Channel

- 6.2.2 Multi-Channel

- 6.3 End-User

- 6.3.1 Aerospace and Defense

- 6.3.2 Automotive

- 6.3.3 Industrial Automation

- 6.3.4 Consumer Electronics

- 6.3.5 Food & Beverage

- 6.3.6 Pharmaceutical

- 6.3.7 Construction

- 6.3.8 Energy

- 6.3.9 Other End-users

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 STMicroelectronics

- 7.1.2 OMRON Corporation

- 7.1.3 Rockwell Automation

- 7.1.4 Schneider Electric

- 7.1.5 Panasonic Corporation

- 7.1.6 Honeywell International Inc.

- 7.1.7 SICK AG

- 7.1.8 NXP Semiconductors N.V.

- 7.1.9 General Electric