|

市场调查报告书

商品编码

1686572

电容式接近感测器:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Capacitive Proximity Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

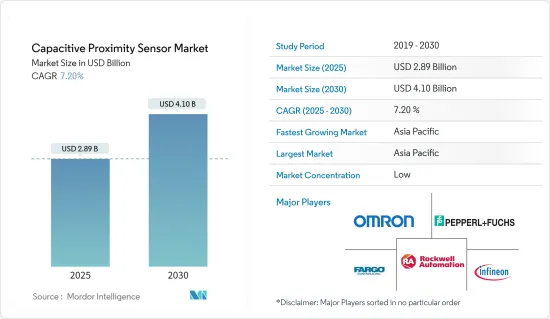

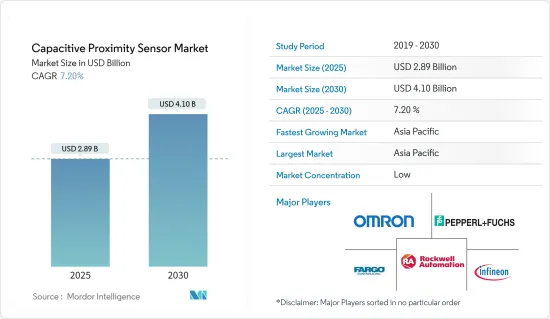

电容式接近感测器市场规模预计在 2025 年为 28.9 亿美元,预计到 2030 年将达到 41 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.2%。

电容式接近感测器是一种用于检测金属和非金属目标的感测装置。它们还可以探测机械限位开关无法探测到的光或小物体。它利用电容的介电原理在感测器表面附近创建一个感应场,形成一个检测区。这些感测器透过记录感测器读取的电容变化来工作。

主要亮点

- 电容会随被侦测物体的大小和距离而变化。典型的电容式接近感测器类似于具有两个平行板的电容器,可以检测两个板的电容。该感测器由高频振盪器和放大器组成。当物体接近感测器的感应面时,环路的电容会变化,引起高频振盪器振盪。放大器将振盪、停止状态转换成电讯号,再将电讯号转换为二进位开关讯号。

- 电容式接近感测器具有较宽的灵敏度频宽,并且可以透过非金属墙壁检测物体。它们也因其较长的使用寿命而闻名,这使得它们在各种应用中都值得信赖。这些感测器灵敏度高,可以准确检测到最小的偏转,适用于运动、位移、化学成分、电场、压力、加速度、液位和流体成分等各种应用。

- 製造设施和生产工厂的成长是电容式接近感测器市场的主要驱动因素。这些感测器可以简化和减少生产功能中的时间消耗,同时提高可靠性、准确性并降低工作组的参与度。

- 此外,虽然电容式接近感测器具有许多优点,但它们的感测能力也存在一些局限性,可能会阻碍其发展。电容式接近感测器对材料的介电特性很敏感。虽然它可以检测多种材料,包括金属、液体和塑料,但它很难检测介电常数低或电导率高的材料。

电容式接近感测器的市场趋势

消费性电子产品将迎来巨大成长

- 电容式触控技术正在使用感测器取代更广泛的家用电子电器中的按钮和薄膜开关,从智慧型手机和平板电脑到笔记型电脑和其他类似设备。

- 电容式触控感应器利用静电场来感应场中非常微小的变化,将表面区域转换为多个感应机会。此外,这种感测器可以检测和量化导电或具有不同于空气的介电体的东西,从而促进非机械的接收刺激的方法。

- 该技术同样适用于按钮、滑桿、开关、垫片板、触控萤幕和接近感测器,使设计师能够将智慧型手机设计提升到更高的水平。因此,行动装置具有多种可透过电容式触控感应实现的智慧功能。

- 电容式触控感应允许使用者创建特殊的手势介面,让他们可以用一隻手操作行动电话,并用拇指控制各种功能。例如,行动电话方面的简单四段电容式滑桿感应器可实现向上滑动、向下滑动、向上轻拂、向下轻拂、点击、双击和长按等功能。

- 这些功能可用于所有智慧型手机应用程序,以便在萤幕之间浏览、在文件中上下滚动以及选择或取消选择图示。这样的单手介面增强了行动电话的便利性和简洁性,提高了使用者体验。爱立信预计,到2023年全球智慧型手机行动网路用户数量将达到67.18亿,将进一步推动市场成长。

亚太地区占很大份额

- 由于中国、日本、印度、韩国和台湾等多个国家广泛采用工业机器人,预计亚太地区将在预测期内达到最高成长率。

- 由于汽车和半导体製造业的大规模采用,中国在机器人应用感测器的区域采用率方面占据主导地位。电容式接近感测器用于机器人避免碰撞并安全且有效率地执行任务。此外,这些感测器还用于在组装和其他製造过程中精确定位和引导零件。

- 增加政府援助以改善先进製造业可能会对市场成长率产生正面影响。中国政府推出了一项名为「中国製造2025」的国家主导产业政策,旨在使中国在全球高科技製造业中占据优势。

- 到2025年,中国机器人产业年均营业利润成长率达到20%以上。该五年计画的目标是拓展机器人应用的广度和深度,并持续增加全国机器人的数量。

- 其也旨在培育更稳定、更强大的供应链,并推动产业标准化。由于机器人涉及各种类型的感测器,例如触摸、接近检测等,该领域的成长将推动市场成长率。

电容式接近接近感测器产业概况

电容式接近感测器市场已经进行了细分和研究,目的是透过扩大特定应用的产品供应、加强分销管道和影响力、以及增加产品客製化来获得竞争优势。主要企业包括罗克韦尔自动化公司、欧姆龙公司、英飞凌科技股份公司、Fargo Controls 公司和 Pepperl+Fuchs GmbH。

- 2023 年 10 月-Automation Direct 已将 Balluff BCS 系列电容式接近感测器纳入其广泛的物体侦测感测器系列中。这些感测器具有多种样式,包括 12-30 毫米管状、50 毫米圆形和小矩形体,提供高达 30 毫米的感应距离。此外,这些进步有望扩大市场潜力。

- 2023 年 9 月 - ROHM 宣布开发 RPR-0720,这是一款紧凑型 2.0mm x 1.0mm接近感测器,专为需要连接/分离和接近检测的应用而设计。这款新型紧凑型 VCSEL接近感测器将为无线耳机和穿戴式装置的小型化和电池容量的提升做出重大贡献。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 新冠肺炎疫情及其他宏观经济因素对市场的影响

第五章 市场动态

- 市场驱动因素

- 非接触式感测技术的需求不断增加

- 市场限制

- 感测能力的局限性

第六章 市场细分

- 按类型

- 触摸感应器

- 动作感测器

- 位置感测器

- 其他类型

- 按最终用户产业

- 卫生保健

- 製造业

- 车

- 消费性电子产品

- 饮食

- 金属与矿业

- 航太和国防

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Rockwell Automation Inc.

- Omron Corporation

- Infineon Technologies AG

- Fargo Controls Inc.

- Pepperl+Fuchs GmbH

- STMicroelectronics NV

- Hans Turck GmbH & Co. KG

- TMSS France(YAGEO Corporation)

- Microchip Technology Inc.

- Sick AG

- Eaton Corporation

第八章 市场机会与未来趋势

The Capacitive Proximity Sensor Market size is estimated at USD 2.89 billion in 2025, and is expected to reach USD 4.10 billion by 2030, at a CAGR of 7.2% during the forecast period (2025-2030).

A capacitive proximity sensor is a sensing device designed to detect metallic and non-metallic targets. It may detect lightweight or small objects that mechanical limit switches cannot see. They use dielectric principles of capacitance to establish a sensing field near the sensor's face, creating a detecting zone. These sensors operate by recording a change in the capacitance read by the sensor.

Key Highlights

- The amount of capacitance varies depending on the size and distance of the sensing object. An ordinary capacitive proximity sensor is similar to a capacitor with two parallel plates, where the capacity of the two plates is detected. The sensor consists of a high-frequency oscillator and an amplifier. When an object approaches the sensor's detection surface, the capacitance of the loop varies, causing the high-frequency oscillator to vibrate. Amplifiers transform the oscillation and stop states into electrical signals, which are then turned into binary switching signals.

- Capacitive proximity sensors have a wide sensitivity band, enabling them to detect objects through non-metallic walls. They are known for their long operational lifespan, making them reliable for various applications. These sensors are highly sensitive and can accurately detect very small deflections, making them suitable for various applications like motion, displacement, chemical composition, electric field, pressure, acceleration, fluid level, and fluid composition.

- The growth in manufacturing facilities and production plants is a major driver for the capacitive proximity sensors market. These sensors can simplify and decrease the time consumption in production functions while enhancing the dependability, accuracy, and involvement of a low task force.

- Moreover, while capacitive proximity sensors offer numerous advantages, they have some limitations in sensing capabilities that can hinder their growth. Capacitive proximity sensors are sensitive to the dielectric properties of materials. While they can detect a wide range of materials, including metals, liquids, and plastics, they struggle with certain materials that have low dielectric constants or are highly conductive.

Capacitive Proximity Sensors Market Trends

Consumer Electronics to Witness Major Growth

- In capacitive touch technologies, sensors have replaced buttons and membrane switches across a larger range of consumer electronic devices, from smartphones and tablets to laptops and other similar electronic devices.

- Capacitance-based touch sensors convert a surface area into several sensing opportunities by utilizing an electrostatic field and sensing very small changes in the capacitive field. Moreover, sensors like these can detect and quantify anything conductive or have a different dielectric than air, facilitating non-mechanical methods of receiving stimuli.

- This technology lends itself equally well to buttons, sliders, switches, touch pads, touch screens, and proximity sensors, enabling designers to take smartphone design to much higher levels. As a result, there are a variety of intelligent features that can be implemented using capacitive touch sensing in mobile devices.

- With capacitive sensing, creating a special gesture interface allows users to operate phones with a single hand and control various functions using their thumb. For instance, a simple four-segment capacitive slider sensor on the side of the phone enables such features as swipe up, swipe down, flick up, flick down, single tab, double tab, long press, etc.

- These features may be used with all smartphone applications to browse between screens, scroll a document up and down, or select or deselect an icon. Such a single-handed interface can increase the phone's convenience and simplicity, thus enhancing the user experience. According to Ericsson, by 2023, 6.718 billion smartphone mobile network subscriptions will be adopted across the globe, which would further boost the market's growth.

Asia-Pacific to Hold Major Share

- Asia-Pacific is anticipated to record the highest growth rate during the forecast period, with the noteworthy installation of industrial robots in several countries, including China, Japan, India, South Korea, and Taiwan.

- China is dominating the regional adoption rate of sensors for robotic applications due to the massive deployment in the country's dominating automotive and semiconductor manufacturing industries. Capacitive proximity sensors are used in robots to avoid collisions and perform tasks safely and efficiently. Moreover, these sensors are used to accurately position and guide parts during assembly or other manufacturing processes.

- The growing government aid in improving the advanced manufacturing sector will positively impact the market growth rate. The government of China launched "Made in China 2025", a state-led industrial policy that seeks to make China dominant in global high-tech manufacturing.

- By 2025, the country aims to exceed its average annual operating income growth rate by 20% in the robotics industry. The five-year plan set out objectives to expand the breadth and depth of robotic applications to continue to increase the number of robots in the country.

- It also aims to promote a more stable and robust supply chain and better standardize the industry. As robotics involve various types of sensors in touch, proximity detection, and so on, the sector's growth is set to boost the market growth rate.

Capacitive Proximity Sensors Industry Overview

The capacitive proximity sensor market is fragmented and studied, and the company intends to achieve a competitive edge by expanding its product offerings to specific applications, strengthening its distribution channels and presence, and offering greater customization of its products. Some significant players include Rockwell Automation Inc., Omron Corporation, Infineon Technologies AG., Fargo Controls Inc., and Pepperl + Fuchs GmbH, among others.

- October 2023 - AutomationDirect incorporated Balluff BCS series capacitive proximity sensors into their extensive collection of object detection sensors. These sensors are offered in various styles, such as 12-30 mm tubular, 50 mm round, and small rectangular bodies, and they provide sensing distances of up to 30mm. These advancements are also projected to amplify the market's potential.

- September 2023 - ROHM disclosed the development of a compact 2.0 mm X 1.0 mm proximity sensor, known as the RPR-0720, specifically designed for applications that necessitate attachment/detachment and proximity detection. This novel compact VCSEL proximity sensor significantly contributes to wireless earbuds and wearable devices' enhanced miniaturization and battery capacity.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Demand for Non-contact Sensing Technology

- 5.2 Market Restraints

- 5.2.1 Limitations in Sensing Capabilities

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Touch Sensors

- 6.1.2 Motion Sensors

- 6.1.3 Position Sensors

- 6.1.4 Other Types

- 6.2 By End-user Industry

- 6.2.1 Healthcare

- 6.2.2 Manufacturing

- 6.2.3 Automotive

- 6.2.4 Consumer Electronics

- 6.2.5 Food and Beverage

- 6.2.6 Metals and Mining

- 6.2.7 Aerospace and Defense

- 6.2.8 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Rockwell Automation Inc.

- 7.1.2 Omron Corporation

- 7.1.3 Infineon Technologies AG

- 7.1.4 Fargo Controls Inc.

- 7.1.5 Pepperl + Fuchs GmbH

- 7.1.6 STMicroelectronics NV

- 7.1.7 Hans Turck GmbH & Co. KG

- 7.1.8 TMSS France (YAGEO Corporation)

- 7.1.9 Microchip Technology Inc.

- 7.1.10 Sick AG

- 7.1.11 Eaton Corporation