|

市场调查报告书

商品编码

1844542

接近感测器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030)Proximity Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

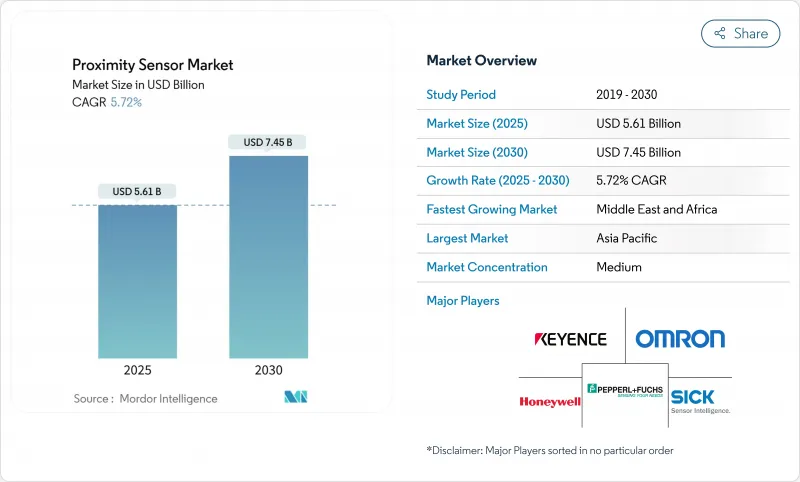

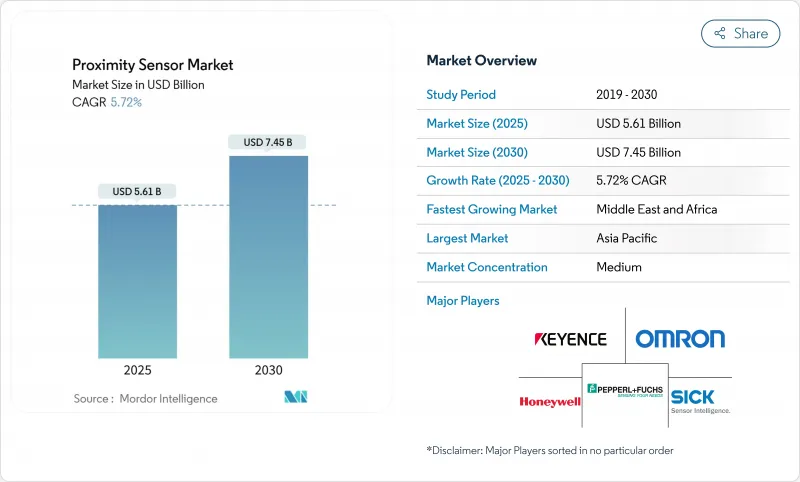

预计 2025 年接近感测器市场价值将达到 56.1 亿美元,到 2030 年将达到 74.5 亿美元,复合年增长率为 5.72%。

2025年,这个价值56.1亿美元的市场将由电动动力传动系统、航太安全法规以及工业4.0改装专案的交汇驱动,这些专案需要精确、稳健且经济高效的感测设备。支援IO-Link的感测器可为边缘控制器提供即时诊断,从而减少工厂停机时间;而汽车原始设备製造商(OEM)则要求设备符合ISO 26262认证标准,促使供应商加快功能安全产品组合的投资。虽然铜线圈价格压力的增加以及大功率电动车逆变器对电磁相容性(EMC)的要求限制了短期利润,但监管转向航空固态感测器,以及混合霍尔效应、MEMS和体声波装置的快速普及,将为接近感测器市场的长期前景带来积极支撑。

全球接近感测器市场趋势和洞察

工业4.0主导亚洲棕地工厂的改装需求

中国、越南和印尼的製造商更倾向于使用支援 IO-Link 的接近感测器升级现有生产线,而不是新建工厂。透过 5G 监控,他们实现了 15-20% 的效率提升和 30% 的成本节省 [gsma.com]。提供嵌入式圆柱形装置、支援 PLC 的引脚排列和云端诊断功能的供应商在改装竞标占据主导地位。与传统控制设备的兼容性可避免买家长时间停机,从而确保接近感测器市场至少在 2028 年之前保持强劲成长。

汽车原始设备製造商需要获得 ISO 26262 认证的非接触式定位

西方汽车计画目前正在指定符合 ASIL C/D 标准的电感线性和旋转感测器,以取代对杂散磁场敏感的霍尔效应元件。 Melexis 推出了双晶粒架构,可在 12 毫米行程内实现 ±0.85% 的精度,并在煞车、踏板和转向模组中内建冗余功能 [melexis.com]。认证成本正在层级构造供应格局,迫使规模较小的公司要么获得 IP 许可,要么退出市场,这进一步巩固了接近感测器市场。

线圈铜成本波动影响欧洲感应炉BOM

铜现货价格已达到三年来的最高点,导致线圈成本上涨高达25%,这进一步挤压了德国和义大利感测器製造商的净利率,而这些製造商先前就已经饱受电费上涨的困扰。大型供应商正在对冲或垂直整合其铜供应,但小型企业则面临季度价格表调整的压力,这削弱了它们的竞争力。

細項分析

到2024年,电感式感测器将占销售额的35%,成为整个接近感测器市场中冲压线和CNC工具机金属侦测的最佳选择。其坚固耐用的铁氧体磁芯线圈能够耐受油污、切屑和振动,是亚太地区工厂改造的理想选择。电容式感测器的复合年增长率高达9.80%,目前正用于检测製药无尘室中的塑胶外壳和液位,而电感式感测器在这些领域往往失效。霍尔效应角度和电容式存在检测技术的混合趋势正在推动供应商转向多物理场ASIC,从而简化安装并减少SKU数量。

电容式正日益普及,因为单一感测器无需机械接触即可覆盖玻璃、树脂和谷物层,从而满足食品安全要求。光电感测器在需要10公尺瞄准的多尘输送机领域仍占据一席之地,而超音波感测器则适用于光学感测器无法应用的化学品罐。磁性xMR感测器在电动车牵引马达领域的市场份额正在不断扩大,这类马达需要毫米级精度才能实现面向现场的控制。总而言之,这些转变使接近感测器市场充满活力且富有弹性。

出于成本效益的考虑,到2024年,固定距离气缸将占出货量的60%。汽车冲压车间全年生产相同的门板,因此固定阈值是首选,以避免意外的重新校准。然而,在电子组装的小批量生产中,配备IO-Link参数化的可调距离型号的复合年增长率将达到8.50%。生产工程师无需更换硬件,只需微调板载韧体,即可缩短转换时间。在过渡到无人值守的工厂中,智慧可调设备会将EQ时间戳和循环计数发送到MES仪表板,从而深化数位双胞胎,并提升接近感测器的市场影响力。

维修团队表示,透过可调式感测器覆盖多个灯具距离,可以抵消高昂的标价并减少备件需求。供应商正在竞相推出LED引导式示教模式和NFC智慧型手机设置,以提高易用性。从长远来看,韧体主导的距离调节预计将成为柔性工厂的预设。

在智慧型手机拾取平台、马达换向和卡扣式品质检查的推动下,0-20mm 感测器将在 2024 年占据接近感测器市场的 45%。它们的固态稳健性优于机械限位开关,从而减少了废品率。然而,仓库自动化、AMR 和托盘穿梭车系统要求在 2 公尺以上的距离内保持视线安全,因此 40mm 及更大尺寸设备的复合年增长率将达到 7.20%。供应商正在推出放大收发器和波束成形光学元件,即使在雾天也能侦测到 4 公尺的距离,与光达和雷达互补,实现 360° 机器人感知。

在物流,远距接近感测器可避免盲点碰撞,且无需牺牲高解析度视觉。超音波光电混合堆迭已进入该领域,将距离和存在性资讯整合到一个SKU中,从而减少高架货架的故障点和布线工作量。

区域分析

受中国工厂数位化补贴、日本机器人出口领先地位以及韩国半导体投资的推动,亚太地区将在2024年保持36%的接近感测器市场份额。将IO-Link感测器改装到棕地线上,可以在不建造新厂房的情况下,在符合区域资本支出限制的前提下提高产量。零件製造商正在将感测器组装安装在智慧型手机丛集附近,以在产品週期紧张的情况下缩短前置作业时间。各国政府正在补贴5G专用网络,支援支撑即时品质迴路的感测器数据主干网。

欧洲仍然是高端买家群体,德国一级供应商要求线控转向应用采用 ASIL-D 电感式编码器,法国航太整合商则指定 ELDEC 感测器用于严苛的涡轮机舱。持续的铜价上涨和高昂的电费推高了欧洲的物料清单 (BOM),导致线圈绕製转移到中欧,并使研发中心更靠近原始设备製造商。欧洲大陆大力推行净零工厂,鼓励采用 IO-Link 诊断技术来消除废料和能源浪费,从而增强了接近感测器市场对先进用例的吸收。

北美市场消费稳定且成熟,主要集中在航太、能源和蓬勃发展的电动车供应链领域。美国电网现代化计划将扩大用于监测断路器位置和阀门状态的接近感测器的市场空间。Schneider Electric7亿美元的资本投资表明,北美市场对整合工厂校准感测器的数位化开关设备和配电盘的需求旺盛。加拿大采矿自动化和墨西哥汽车组装出口正在加深该地区的需求。

中东地区的复合年增长率将达到7.50%,其中沙乌地阿拉伯的石化和公用事业工厂将部署预测性维护套件,每个站点配备数百个IO-Link接近节点。非洲和南美洲虽然仍处于自动化应用的早期阶段,但透过物流和食品加工厂的发展,逐渐普及,为全球接近感测器市场带来长尾成长。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 工业4.0主导亚洲棕地工厂的改装需求

- ISO 26262 认证非接触式定位技术是汽车原始设备製造商 (OEM) 的强制性要求

- 智慧型手机中安装的Mini LED/LED背光源(亚太地区)

- FAA 和 EASA 过渡到固态起落架接近感测器

- 楼宇自动化和智慧基础设施的物联网集成

- 欧洲离散生产线采用 IO-Link

- 市场限制

- 线圈铜成本波动影响欧洲电感BOM

- 高功率电动车逆变器违反 EMC违规(美国)

- 冷凝导致食品光电感测器故障

- ATEX区域认证前置作业时间延迟中东计划

- 价值/供应链分析

- 监理展望(IEC 60947-5-2、ISO 13849)

- 技术展望(晶片级孔、BAW、MEMS混合)

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 投资与资金筹措分析

第五章市场规模及成长预测

- 依技术

- 电感式

- 电容式

- 光电式

- 磁性(霍尔效应和簧片)

- 超音波

- 红外线及其他

- 依产品类型

- 固定距离感测器

- 可变距离感测器

- 按检测范围

- 0-20 mm

- 20-40 mm

- 40毫米或以上

- 依外壳/外形规格

- 圆柱形

- 长方形

- 插槽/频道

- 小型/PCB 安装

- 环形/直通光束

- 依输出类型

- 数字(NPN/PNP)

- 模拟(0-10 V/4-20 mA)

- IO-Link 和其他智慧接口

- 通道布线

- 两线交流/直流

- 3线直流

- 四线互补

- 按最终用户产业

- 航太/国防

- 车

- 工业自动化与机器人

- 家用电器和穿戴设备

- 食品和饮料加工

- 医疗保健和医疗设备

- 建筑自动化和智慧基础设施

- 其他行业(采矿业、农业、海洋业)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Keyence Corporation

- Omron Corporation

- Pepperl+Fuchs GmbH

- Sick AG

- Panasonic Holdings Corp.

- Honeywell International Inc.

- STMicroelectronics NV

- Schneider Electric SE

- Rockwell Automation Inc.

- IFM Electronic GmbH

- Turck Holding GmbH

- Datalogic SpA

- Delta Electronics Inc.

- Autonics Corporation

- Balluff GmbH

- Banner Engineering Corp.

- Texas Instruments Inc.

- Broadcom Inc.

- Littelfuse Inc.

- Baumer Group

- Vishay Intertechnology

- BorgWarner Inc.

- Allegro MicroSystems

- Leuze electronic GmbH

第七章 市场机会与未来展望

The proximity sensors market size is valued at USD 5.61 billion in 2025 and is forecast to grow at a 5.72% CAGR, reaching USD 7.45 billion by 2030.

The 2025 market value of USD 5.61 billion is supported by the intersection of electrified powertrains, aerospace safety directives, and Industry 4.0 retro-fit programs that demand precise, rugged, and cost-efficient detection devices. Growth momentum intensifies as IO-Link-enabled sensors feed real-time diagnostics to edge controllers, trimming factory downtime, while automotive OEM mandates for ISO 26262-certified devices accelerate supplier investments in functional-safety portfolios. Intensifying price pressure on copper coils and the need for electromagnetic compatibility (EMC) in high-power EV inverters temper near-term gains, yet regulatory shifts toward solid-state aviation sensors and the rapid uptake of hybrid Hall-effect, MEMS, and bulk-acoustic-wave devices reinforce a positive long-term outlook for the proximity sensors market.

Global Proximity Sensor Market Trends and Insights

Industry 4.0-led Retro-Fit Demand in Brownfield Asian Factories

Manufacturers across China, Vietnam, and Indonesia prefer upgrading existing lines with IO-Link-ready proximity sensors rather than building new plants, unlocking 15-20% efficiency gains and 30% cost cuts through 5G-enabled monitoring [gsma.com]. Suppliers offering drop-in cylindrical devices with PLC-friendly pinouts yet cloud-ready diagnostics dominate retro-fit tenders. Compatibility with legacy controls shields buyers from lengthy downtime, keeping the proximity sensors market buoyant until at least 2028.

Automotive OEM Mandates for ISO 26262-Certified Contactless Positioning

European and U.S. vehicle programs now specify inductive linear and rotary sensors qualified to ASIL C/D, displacing Hall-effect devices sensitive to stray fields. Dual-die architectures introduced by Melexis achieve +-0.85% accuracy over 12 mm strokes and offer built-in redundancy for brake, pedal, and steering modules [melexis.com]. Certification costs create a two-tier supply landscape, pushing smaller firms to license IP or exit, and further consolidating the proximity sensors market.

Coil-Copper Cost Volatility Impacting Inductive BOM in Europe

Three-year highs in copper spot prices raise coil costs by up to 25%, squeezing margins for German and Italian sensor producers already burdened by elevated electricity tariffs. Larger vendors hedge or vertically integrate copper supply, but smaller firms confront price-list resets quarterly, hampering competitiveness.

Other drivers and restraints analyzed in the detailed report include:

- Mini-LED/µLED Back-Light Integration in Smartphones (APAC)

- FAA & EASA Transition to Solid-State Landing-Gear Proximity Sensors

- EMC Compliance Failures in High-Power EV Inverters (US)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Inductive units delivered 35% of 2024 revenue, validating their status as the de-facto choice for metal detection on press lines and CNC machines embedded across the proximity sensors market. Rugged ferrite-core coils endure oil, chips, and vibration, ideal for retro-fits in APAC factories. Capacitive devices, advancing at 9.80% CAGR, now sense plastic housings and fluid levels in pharmaceutical clean rooms where inductive devices fail. The hybridization trend-combining Hall-effect for angle and capacitive for presence-pushes suppliers toward multi-physics ASICs that simplify installation and reduce SKU count.

Capacitive adoption accelerates because one sensor can cover glass, resin, or grain level without mechanical contact, aligning with food-safety mandates. Photoelectric SKUs retain niches requiring 10 m targeting over dusty conveyors, while ultrasonic variants serve chemical vats impervious to optical methods. Magnetic xMR sensors gain share within EV traction motors needing millidegree precision for field-oriented control. Collectively, these transitions keep the proximity sensors market varied and resilient.

Skewing to cost efficiency, fixed-distance cylinders amassed 60% of 2024 shipments. Automotive stamping plants, running identical door panels year-round, favor fixed thresholds to avoid accidental recalibration. However, short batch runs in electronics assembly spark an 8.50% CAGR for adjustable-distance models equipped with IO-Link parameterization. Production engineers tweak on-board firmware rather than swapping hardware, slashing changeover times. In plants moving toward lights-out operation, smart adjustable devices feed EQ timestamps and cycle counts to MES dashboards, deepening digital twins and elevating the proximity sensors market profile.

Maintenance teams cite reduced spares when one adjustable sensor covers multiple jig distances, offsetting its higher list price. Suppliers compete on LED-guided teach modes and NFC smartphone setup, reinforcing ease of use. Long term, firmware-driven range tuning is expected to become the default in flexible factories.

Smartphone pick-and-place stages, electric-motor commutation, and snap-fit quality checks keep 0-20 mm sensors at 45% of proximity sensors market size in 2024. Their solid-state ruggedness beats mechanical limit switches and reduces false rejects. Yet warehouse automation, AMRs, and pallet-shuttle systems require line-of-sight safety at two-meter plus distances, lifting>40 mm devices at a 7.20% CAGR. Suppliers respond with amplified transceivers and beam-forming optics capable of 4 m detection even in fog, complementing LiDAR and radar for 360° robot perception.

In intralogistics, longer-range proximity avoids blind-spot collisions without the cost of high-resolution vision. Hybrid ultrasonic-photoelectric stacks enter this space, integrating distance and presence into one SKU, reducing points of failure and wiring labor in high-bay racking.

The Proximity Sensors Market Report is Segmented by Technology (Inductive, Capacitive, and More), Product Type (Fixed-Distance, Adjustable-Distance), Sensing Range (0-20mm, 20-40m, M, Greater Than 40mm), Housing (Cylindrical, and More), Output Type (Digital, Analog, IO-Link), Channel Wiring (2-Wire, and More), End-User Industry (Automotive, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained 36% proximity sensors market share in 2024, buoyed by China's factory digitalization grants, Japan's robotics export leadership, and South Korea's semiconductor investments. Retro-fitting brownfield lines with IO-Link sensors boosts output without new buildings, aligning with local CapEx restrictions. Component makers co-locate sensor assembly near smartphone clusters, shrinking lead times amid tight product cycles. Governments subsidize 5G private networks, anchoring sensor data backbones that support real-time quality loops.

Europe remains a premium buyer base. German Tier-1s demand ASIL-D inductive encoders for steer-by-wire, while French aerospace integrators specify ELDEC sensors for harsh turbine bays. Continual copper price waves and high electricity tariffs raise European BOMs, nudging some coil-winding to Central Europe yet retaining R&D centers near OEMs. The continent's push for net-zero factories incentivizes IO-Link diagnostics that trim scrap and energy waste, reinforcing advanced use-case uptake across the proximity sensors market.

North America records steady but mature consumption, concentrated in aerospace, energy, and a burgeoning EV supply chain. U.S. energy grid modernization programs open niches for proximity sensors monitoring breaker position and valve status. Schneider Electric's USD 700 million cap-ex illustrates domestic appetite for digitized switchgear and panelboards that embed factory-calibrated sensors. Canada's mining automation and Mexico's auto assembly exports deepen regional demand.

The Middle East delivers the quickest 7.50% CAGR, with Saudi Arabia's petrochemical and utility plants installing predictive-maintenance suites featuring hundreds of IO-Link proximity nodes per site. Africa and South America, while early in automation adoption, lay groundwork through logistics and food-processing plants, offering long-tail upside to the global proximity sensors market.

- Keyence Corporation

- Omron Corporation

- Pepperl+Fuchs GmbH

- Sick AG

- Panasonic Holdings Corp.

- Honeywell International Inc.

- STMicroelectronics N.V.

- Schneider Electric SE

- Rockwell Automation Inc.

- IFM Electronic GmbH

- Turck Holding GmbH

- Datalogic SpA

- Delta Electronics Inc.

- Autonics Corporation

- Balluff GmbH

- Banner Engineering Corp.

- Texas Instruments Inc.

- Broadcom Inc.

- Littelfuse Inc.

- Baumer Group

- Vishay Intertechnology

- BorgWarner Inc.

- Allegro MicroSystems

- Leuze electronic GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Industry 4.0-led Retro-Fit Demand in Brownfield Asian Factories

- 4.2.2 Automotive OEM Mandates for ISO 26262-Certified Contactless Positioning

- 4.2.3 Mini-LED/LED Back-Light Integration in Smartphones (Asia-Pacific)

- 4.2.4 FAA and EASA Transition to Solid-State Landing-Gear Proximity Sensors

- 4.2.5 Building Automation and Smart Infrastructure IoT Integration

- 4.2.6 IO-Link Adoption in European Discrete Manufacturing Lines

- 4.3 Market Restraints

- 4.3.1 Coil-Copper Cost Volatility Impacting Inductive BOM in Europe

- 4.3.2 EMC Compliance Failures in High-Power EV Inverters (US)

- 4.3.3 Condensation-Driven False Trips in Food-Grade Photoelectric Sensors

- 4.3.4 ATEX-Zone Certification Lead-Times Delaying Middle-East Projects

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook (IEC 60947-5-2, ISO 13849)

- 4.6 Technological Outlook (Chip-level Hall, BAW, MEMS Hybrids)

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment and Funding Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Inductive

- 5.1.2 Capacitive

- 5.1.3 Photoelectric

- 5.1.4 Magnetic (Hall-Effect and Reed)

- 5.1.5 Ultrasonic

- 5.1.6 Infra-Red and Others

- 5.2 By Product Type

- 5.2.1 Fixed-Distance Sensors

- 5.2.2 Adjustable-Distance Sensors

- 5.3 By Sensing Range

- 5.3.1 0 - 20 mm

- 5.3.2 20 - 40 mm

- 5.3.3 Greater than 40 mm

- 5.4 By Housing / Form Factor

- 5.4.1 Cylindrical

- 5.4.2 Rectangular

- 5.4.3 Slot / Channel

- 5.4.4 Miniature / PCB-Mount

- 5.4.5 Ring and Through-Beam

- 5.5 By Output Type

- 5.5.1 Digital (NPN / PNP)

- 5.5.2 Analog (0-10 V / 4-20 mA)

- 5.5.3 IO-Link and Other Smart Interfaces

- 5.6 By Channel Wiring

- 5.6.1 2-Wire AC/DC

- 5.6.2 3-Wire DC

- 5.6.3 4-Wire Complementary

- 5.7 By End-user Industry

- 5.7.1 Aerospace and Defense

- 5.7.2 Automotive

- 5.7.3 Industrial Automation and Robotics

- 5.7.4 Consumer Electronics and Wearables

- 5.7.5 Food and Beverage Processing

- 5.7.6 Healthcare and Medical Devices

- 5.7.7 Building Automation and Smart Infrastructure

- 5.7.8 Other Industries (Mining, Agriculture, Marine)

- 5.8 By Geography

- 5.8.1 North America

- 5.8.1.1 United States

- 5.8.1.2 Canada

- 5.8.1.3 Mexico

- 5.8.2 Europe

- 5.8.2.1 United Kingdom

- 5.8.2.2 Germany

- 5.8.2.3 France

- 5.8.2.4 Italy

- 5.8.2.5 Rest of Europe

- 5.8.3 Asia-Pacific

- 5.8.3.1 China

- 5.8.3.2 Japan

- 5.8.3.3 India

- 5.8.3.4 South Korea

- 5.8.3.5 Rest of Asia-Pacific

- 5.8.4 Middle East

- 5.8.4.1 Israel

- 5.8.4.2 Saudi Arabia

- 5.8.4.3 United Arab Emirates

- 5.8.4.4 Turkey

- 5.8.4.5 Rest of Middle East

- 5.8.5 Africa

- 5.8.5.1 South Africa

- 5.8.5.2 Egypt

- 5.8.5.3 Rest of Africa

- 5.8.6 South America

- 5.8.6.1 Brazil

- 5.8.6.2 Argentina

- 5.8.6.3 Rest of South America

- 5.8.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Keyence Corporation

- 6.4.2 Omron Corporation

- 6.4.3 Pepperl+Fuchs GmbH

- 6.4.4 Sick AG

- 6.4.5 Panasonic Holdings Corp.

- 6.4.6 Honeywell International Inc.

- 6.4.7 STMicroelectronics N.V.

- 6.4.8 Schneider Electric SE

- 6.4.9 Rockwell Automation Inc.

- 6.4.10 IFM Electronic GmbH

- 6.4.11 Turck Holding GmbH

- 6.4.12 Datalogic SpA

- 6.4.13 Delta Electronics Inc.

- 6.4.14 Autonics Corporation

- 6.4.15 Balluff GmbH

- 6.4.16 Banner Engineering Corp.

- 6.4.17 Texas Instruments Inc.

- 6.4.18 Broadcom Inc.

- 6.4.19 Littelfuse Inc.

- 6.4.20 Baumer Group

- 6.4.21 Vishay Intertechnology

- 6.4.22 BorgWarner Inc.

- 6.4.23 Allegro MicroSystems

- 6.4.24 Leuze electronic GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment