|

市场调查报告书

商品编码

1627137

欧洲软性饮料包装:市场占有率分析、产业趋势、成长预测(2025-2030)Europe Soft Drinks Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

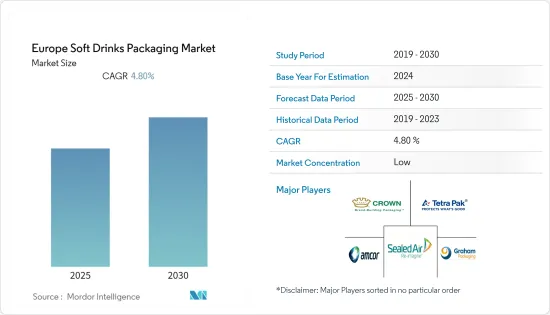

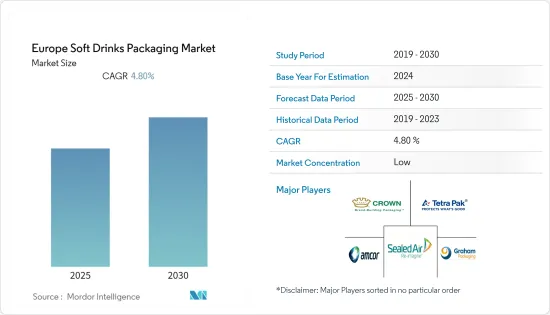

欧洲软性饮料包装市场预计在预测期内复合年增长率为 4.8%

主要亮点

- 欧洲软性饮料的成长继续与国内生产总值的成长和消费者购买力的提高联繫在一起。在最近的调查期间,拉丁美洲的软性饮料消费一直是全球软性饮料品牌所有者和装瓶商的热门话题,因此即饮茶和瓶装水将是关键的机会领域。

- 欧洲地区的碳酸软性饮料 (CSD)消费量很高,但消费者主导的健康趋势可能会损害持续成长。甜菊糖和替代甜味剂为消费者提供了一种享受软性饮料的自然方式,而即饮红茶可能是一种替代选择。

- 软性饮料是仅次于水的第二大消费量饮料,而塑胶是软性饮料包装最常用的材料。人口成长和可支配收入的增加正在增加世界各地对软性饮料产品的需求。包装在软性饮料市场中发挥重要作用。

- 高效的包装解决方案具有易于使用、易于处置和改善使用者体验等优点。这些优势导致软性饮料产业对包装解决方案的需求增加。需求成长的另一个趋势是新的和创新的产品,这有助于製造商区分其产品,同时提高品牌知名度。

- 卡尼的最新研究表明,儘管由于限製而导致消费量减少,但欧洲软性饮料消费量预计将恢復到新冠疫情爆发前的水平。然而,不同国家的消费者偏好有所不同。例如,虽然德国的人均消费量可能会略有下降,但英国消费者未来可能会消费更多的软性饮料。

欧洲软性饮料包装市场趋势

塑胶预计将占据最大的市场占有率

- 塑胶製造起来更节能,而且比替代材料更轻,这使其成为比其他替代材料更有效的软性饮料包装材料。

- 例如,只需 2 磅塑胶即可输送 10 加仑液体 (ig),而需要 3 磅铝、8 磅钢和超过 40 磅玻璃才能输送相同量的液体。

- 在软性饮料领域,由于上班族的忙碌生活,各个品牌都推出了单剂量塑胶袋。因此,即饮饮料的重要性日益增加,进一步推动了市场成长。

- HDPE 是应用最广泛的塑胶包装材料。它用于製造多种类型的瓶子和容器。无色瓶子半透明、耐用且具有阻隔性,使其适合包装保质期较短的产品,例如果汁和能量饮料。

- 显然,随着软性饮料市场的扩大,对果汁、能量饮料、运动饮料等营养产品的需求不断增加,这直接带动了软性饮料包装市场。塑料也非常耐用且易于携带。另外,塑胶是气密的,因此不太可能洩漏或老化。

英国占最大市场占有率

- 由于人口增长和对优质饮料的需求,英国将获得巨大的市场和动力。此外,竞争对手之间的高度敌意和可用性的便利性正在支持市场的成长。

- 近年来,碳酸饮料主导了英国软性饮料市场。 25岁人口的减少可能对该国的销售产生负面影响。主要市场竞争对手不断创新其产品以保持获利和竞争力。

- 例如,百事公司销售的顽固苏打水含有蔗糖和甜菊等甜味剂,并且有多种口味,包括柠檬和柳橙。对洁净标示、无麸质、低热量和低碳水化合物产品的需求不断增长,导致欧洲软性饮料行业低热量即饮碳酸饮料市场的兴起。

- 中上阶层、中产阶级和农村人口的消费模式等社会阶层差异正在推动对包装解决方案的需求。各种软性饮料(包括碳酸饮料、果汁、能量饮料、酒精饮料、即饮饮料、运动饮料、瓶子和水)的包装解决方案的需求在不久的将来将持续增长。强劲的零售市场和不断改善的经济活动将推动欧洲软性饮料包装市场的发展。

- 在英国,塑胶是软性饮料、果汁和水的主要包装材料。塑胶包装的优点是具有化学惰性,不会影响产品的品质、气味或味道。坚固、坚硬且 100% 可回收。

欧洲软性饮料包装产业概况

由于国内外公司众多,软性饮料包装市场高度分散。市场碎片化,企业在价格、产品设计、产品创新等因素上竞争。该市场的一些主要企业包括 Amcor Ltd、Sealed Air Corporation、Tetra Pak International、Graham Packaging Company 和 Crown Holdings Incorporated。

- 2021 年 7 月 - Sealed Air Corporation 投资 3,000 万美元用于全球产能扩张和新设备系统,以满足对自动化包装系统品牌解决方案不断增长的需求。该投资主要用于俄亥俄州 Streetsboro 和 Bedford Heights 以及西维吉尼亚Keyser 工厂的产能扩张、「非接触式」自动化和专有数位印刷技术,预计将于 2021 年完成。我们还将在 APS 位于英国马尔文、菲律宾甲美地和中国青浦的工厂扩大产能并安装新设备。

- 2021 年 11 月 - Amcor 宣布推出与 MGJ 合作开发的广告曝光率技术,该技术使用 CYNK 彩色印刷技术,允许品牌客製闭合件。 Impressions 技术与 Saranex 和锡衬里、Amcor 的 STELVIN 葡萄酒瓶盖以及用于烈酒的 STELCAP 铝製瓶盖相容。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场促进与市场约束因素介绍

- 市场驱动因素

- 可支配所得增加和经济成长

- 对即用饮料的需求不断增长

- 市场限制因素

- 政府对非生物分解产品的严格规定

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按材质

- 塑胶

- 金属

- 玻璃

- 纸板

- 依产品类型

- 瓶子

- 能

- 盒子

- 纸盒

- 按地区

- 欧洲

- 英国

- 瑞典

- 德国

- 法国

- 其他欧洲国家

- 欧洲

第六章 竞争状况

- 公司简介

- Amcor PLC

- Toyo Seikan Group Holdings Ltd

- Graham Packaging Company

- Ball Corporation

- Owens-Illinois Inc.

- Pacific Can China Holdings Limited

- Crown Holdings Incorporated

- CAN-PACK SA

- CKS Packaging Inc.

- Refresco Group NV

- Tetra Pak Inc.

- Ardagh Group SA

第七章 投资分析

第八章 市场机会及未来趋势

The Europe Soft Drinks Packaging Market is expected to register a CAGR of 4.8% during the forecast period.

Key Highlights

- The growth of soft drinks in Europe will remain tied to GDP growth and increasing consumer purchasing power. RTD teas and bottled waters will be key opportunity areas as soft drinks consumption in Latin America have been the global bright spot for soft drinks brand owners and bottlers over the recent review period.

- Although Carbonated Soft Drinks (CSD) consumption is high in European regions, consumer-led health and wellness trends could take their toll on continued growth. Stevia and alternative sweeteners offer a natural way for consumers to enjoy indulgent soft drinks, with RTD tea a possible alternative.

- Soft drinks are the second most-consumed drink after water, with plastic being the most used material for soft drinks packaging. The increasing population and rising disposable income have led to the increasing demand for soft drinks products across the world. Packaging plays an important role in the soft drinks market.

- Efficient packaging solutions offer benefits like ease of use, disposability, and enhanced user experience. These benefits have led to the growth in demand for packaging solutions for the soft drinks segment. The other trend that is augmenting the demand is the new and innovative products, which helps manufacturers enhance their brand visibility while offering product differentiation.

- A new Kearney study finds that soft drink consumption in Europe is expected to return to pre-COVID levels despite declining consumption due to restrictions. However, consumer preferences vary from country to country. For example, per capita consumption in Germany may decline slightly, while consumers in the UK are likely to consume more soft drinks in the future.

Europe Soft Drinks Packaging Market Trends

Plastic is Expected to Hold the Largest Market Share

- Plastics are a more efficient material for soft drinks packaging than other alternatives because plastics are energy efficient to manufacture, and they are also lighter than alternative materials.

- For instance, just two pounds of plastic can deliver 10 gallons of Liquid, i.e., milk, whereas three pounds of aluminum, eight pounds of steel, or over 40 pounds of glass are needed to deliver the same amount of Liquid.

- In the soft drinks segment, the busy life of working people has led to the launch of single-serve plastic sachets by various brands. Thus, this increases the importance of ready-to-consume drinks and further boosts market growth.

- HDPE is the most widely used type of plastic packaging material. It is used to make many types of bottles and containers. Unpigmented bottles are translucent and sturdy, have good barrier properties, and are well suited for packaging products with a shorter shelf life, such as Juices, Energy Drinks.

- With the expanding soft drinks market, it is evident that nutritional product demand, such as Juices, Energy drinks, sports drinks, is increasing, and it is directly driving the soft drinks packaging market. It is also durable, and people can carry them without hassle. Moreover, plastics are airtight, so the chances of leakage and getting stale is unlikely.

United Kingdom to Hold the Largest Market Share

- The United Kingdom is to gain significant market and momentum due to the increase in population and demand for premium drinks. Moreover, high competitive rivalry and easy availability are supporting the growth of the market.

- For the last few years, the Carbonated drinks segment has dominated the United Kingdom soft drinks market. The shrinking base population of age 25 years is likely to affect the sales in the country negatively. The key market players are continuously innovating products to maintain profit and a competitive edge.

- For instance, PepsiCo introduces Stubborn Soda, which contains sweeteners like sugar cane and stevia, and it is available in different flavors such as lemon, orange, etc. The growing demand for clean-label, gluten-free, low-calorie, and low-carb products has led to the elevation of the low-calorie RTD carbonated beverages market in the soft drinks industry of Europe.

- The social class differences like the ones between the upper-middle class, middle class, and the rural population consumption patterns are driving the demand for packaging solutions. The demand for packaging solutions for different soft drinks like Carbonated Drinks, Juices, Energy Drinks, Alcoholic Drinks, RTD Beverages, Sports Drinks, Bottles, Water, and others will continue to witness growth in the near future. The robust retail market and improving economic activity will drive the Europe Soft Drinks Packaging Market.

- In the United Kingdom, plastic is the conventional method for packaging soft drinks, fruit juices, and water. The advantage of plastic packaging is that it is chemically inert and will not affect the quality, odor, or taste of the product. It is strong, rigid, and 100% recyclable.

Europe Soft Drinks Packaging Industry Overview

The Soft Drinks Packaging market is highly fragmented, owing to the presence of many domestic and international players. The market is fragmented, with the players competing in terms of price, product design, product innovation, etc. Some of the major players in the market are Amcor Ltd, Sealed Air Corporation, Tetra Pak International, Graham Packaging Company, Crown Holdings Incorporated, among others.

- July 2021 - Sealed Air Corporation has dedicated more than $30 million in capital to expand global production capacity and invest in new equipment systems to meet the accelerating demand for Automated Packaging Systems brand solutions. The investment is for capacity expansion, "touchless" automation, and proprietary digital printing technologies primarily in facilities in Streetsboro and Bedford Heights, Ohio, and Keyser, West Virginia, and will be completed in 2021. The company will also expand capacity and install new equipment at APS sites in Malvern, UK; Cavite, Philippines; and Qingpu, China.

- November 2021 - Amcor has announced that it will launch Impressions technology that's developed in partnership with MGJ that uses CYNK color printing technology enabling brands to customize closure linders. The Impressions technology is compatible with Saranex and tin liners, as well as Amcor's STELVIN closures for wine and STELCAP aluminum closures for spirits.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Disposable Income and Growing Economies

- 4.3.2 Growing Demand for Ready-to-use Drinks

- 4.4 Market Restraints

- 4.4.1 Stringent Government Regulations Against Non-biodegradable Products

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.2 Metal

- 5.1.3 Glass

- 5.1.4 Paper and Paperboard

- 5.2 By Product Type

- 5.2.1 Bottle

- 5.2.2 Can

- 5.2.3 Boxes

- 5.2.4 Cartons

- 5.3 By Geography

- 5.3.1 Europe

- 5.3.1.1 United Kingdom

- 5.3.1.2 Sweden

- 5.3.1.3 Germany

- 5.3.1.4 France

- 5.3.1.5 Rest of Europe

- 5.3.1 Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amcor PLC

- 6.1.2 Toyo Seikan Group Holdings Ltd

- 6.1.3 Graham Packaging Company

- 6.1.4 Ball Corporation

- 6.1.5 Owens-Illinois Inc.

- 6.1.6 Pacific Can China Holdings Limited

- 6.1.7 Crown Holdings Incorporated

- 6.1.8 CAN-PACK SA

- 6.1.9 CKS Packaging Inc.

- 6.1.10 Refresco Group NV

- 6.1.11 Tetra Pak Inc.

- 6.1.12 Ardagh Group SA