|

市场调查报告书

商品编码

1627138

北美玻璃瓶/容器:市场占有率分析、行业趋势和成长预测(2025-2030)North America Glass Bottles/Containers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

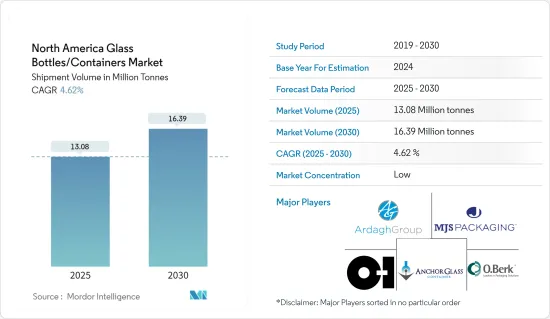

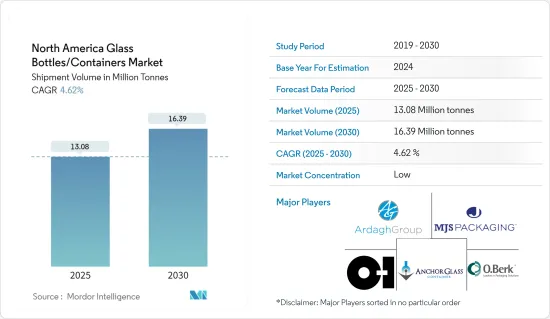

北美玻璃瓶/容器市场规模(以出货量为准)预计将从2025年的1308万吨扩大到2030年的1639万吨,预测期间(2025-2030年)复合年增长率为4.62%。

主要亮点

- 在食品和饮料、化妆品和药品等领域消费增加的推动下,北美玻璃瓶/容器市场正在成长。随着消费者越来越重视安全和健康的包装,玻璃正在进入不同的类别。这种趋势在饮料领域尤其明显,奢侈品和工艺饮料通常采用玻璃瓶包装。

- 此外,压花、成型和艺术精加工方面的最尖端科技增强了玻璃包装的吸引力。这些创新不仅可以实现更大的客製化和品牌化,而且还使玻璃容器成为希望使其包装脱颖而出的公司的可行选择。该行业对轻质玻璃技术的关注,解决了运输成本问题和环境影响,进一步推动了市场扩张。

- 在美国,酒精饮料的消费量激增,对包装的需求不断增加,尤其是玻璃瓶。这种需求反映了酒精饮料种类的扩大和消费者对优质包装的偏好。玻璃瓶之所以受到青睐,不仅是因为其可回收性和奢华感,还因为它们能够保持饮料的品质和风味。精酿啤酒的趋势和手工烈酒的出现激发了人们对优质玻璃包装的渴望。

- 2023 年全国药物滥用与健康调查 (NSDUH) 的资料显示,2.187 亿美国成年人(其中 84.9% 为 18 岁及以上)饮酒。如此庞大的消费群确保了饮料领域对多样化包装解决方案的稳定需求。由于其多功能性和吸引力,玻璃瓶仍然是主流,製造商正在不断创新,以跟上生产商和消费者不断变化的偏好。

- Glass Global报告称,北美各行业玻璃瓶/容器产量为8,389,233吨,年产能为9,321,370吨。这凸显了该地区在玻璃包装领域的强大影响力。强劲的生产能力和产量显示了强大的基础设施以及食品和饮料、药品和化妆品等行业的强劲需求。

- 此外,根据国际贸易中心的资料,美国出口了约 141,143 吨玻璃包装。这不仅代表了玻璃包装领域的新兴机会,也凸显了国际对北美玻璃产品的需求。大量国内生产和大量出口的结合凸显了北美玻璃包装产业的实力和成长轨迹。

- 随着玻璃瓶/容器被各个领域所采用,回收已成为该地区的重点关注点。食品饮料、药品和化妆品等行业越来越多地使用玻璃瓶/容器,产生大量玻璃废弃物。高效回收对于废弃物管理、最大限度地减少环境影响和促进永续性至关重要。随着政府法规倾向于永续包装,製造商越来越多地转向玻璃解决方案。这些动态正在推动北美玻璃包装市场的成长。

北美玻璃瓶/容器市场趋势

酒精饮料领域预计将显着成长

- 酒精饮料製造商正在推出玻璃瓶装的新产品,此举预计将对市场产生正面影响。透过采用玻璃包装,这些製造商旨在提高其产品的吸引力,重塑消费者的观念,并利用与玻璃相关的奢华形象。玻璃瓶不仅能更有效地保存产品的味道和质量,还能提高可回收性和奢华感。许多消费者将玻璃包装等同于卓越的饮料品质,通常证明高价是合理的。

- 此外,玻璃可以实现独特且富有创意的瓶子设计,使品牌能够在商店脱颖而出。

- 向玻璃包装的转变与消费者对永续和环保选择不断增长的需求产生了共鸣。

- 例如,2024年9月,帝亚吉欧公司旗下尊尼获加推出限量版“Blue Label Ultra”,展示了专为苏格兰威士忌量身定制的全球最轻的700ml玻璃瓶。这种开创性的包装标誌着可持续威士忌装瓶的重大飞跃。

- 北美的啤酒包装行业深受不断发展的文化趋势、人口增长、都市化以及年轻人中啤酒受欢迎程度激增的影响。区域啤酒分销网络的持续投资和扩张可能会维持这些趋势并重振玻璃瓶/容器市场。

- 2024年3月至2024年5月,美国瓶装和罐装啤酒产量在1,041万桶至1,247万桶之间波动,支撑了美国对包装啤酒的需求。市场受到啤酒消费量, 2023 年美国啤酒产量和进口量将减少 5%,精酿啤酒生产商产量将减少 1%。

- 产量和进口量的下降可能是由于消费者偏好、经济因素或监管变化的变化。然而,啤酒消费量的增加表明该行业尚未开发的成长和创新潜力,这可能是受到新啤酒品种、行销力度的加大和消费行为变化的刺激。

- 在北美,越来越多的消费者正在采用永续的生活方式,而遏制塑胶废弃物的努力尤其受欢迎。此举支持葡萄酒和烈酒市场向玻璃瓶的转变。许多消费者认为玻璃瓶比塑胶瓶更环保且是优质产品。这种认可引起了具有环保意识的消费者的共鸣,他们往往愿意为永续包装支付溢价。此外,即将出台的旨在限制塑胶使用的政府法规可能会进一步增加酒精饮料领域对玻璃瓶的需求。

美国预计将占据主要市场占有率

- 美国是世界上最大的包装市场之一,有许多主要企业为食品和饮料、个人护理和药品等多种行业生产玻璃瓶和容器。该国的经济成长以及消费者在食品、饮料、药品和个人保健产品方面支出的增加正在推动对玻璃瓶和包装解决方案的需求。

- 人们对永续和可回收包装选择的日益偏好进一步推动了这一趋势,玻璃因其环保特性而受到青睐。以啤酒和烈酒为主的精酿饮料行业的成长也促进了特种玻璃包装需求的增加。由于社会老化和医疗保健的进步,製药业的扩张也增加了对满足严格安全和储存标准的高品质玻璃容器的需求。

- 美国拥有强大的经济、完善的商业移民体系、多元化的消费基础、创新主导的文化和亲商政策,为商业投资提供了良好的环境。这些因素使美国成为对寻求扩张或建立新业务的企业家和公司有吸引力的目的地。强大的基础设施、先进的技术领域和获得资本的机会使其对各行业的公司更具吸引力。

- 电子商务平台的发展和消费行为的演变为线上零售商创造了巨大的机会。由于网路普及率、行动装置使用和购物习惯改变等因素,数位市场正在迅速扩张。这些趋势为包括玻璃包装在内的各种行业带来了潜在机会。

- 随着消费者的环保意识越来越强并寻求可持续的解决方案,玻璃包装製造商可以利用对可回收和可重复使用容器的需求。此外,利基市场对奢侈品和手工产品日益增长的偏好往往与玻璃包装的品质和美学吸引力相匹配,为玻璃包装行业提供了进一步的成长潜力。

- 在美国,千禧世代和X世代正在推动葡萄酒消费的成长。这些消费者群体对葡萄酒的偏好正在提高,这正在影响市场趋势和产品供应。他们不断变化的偏好和购买习惯正在对葡萄酒行业的方向产生重大影响。 2023年美国葡萄酒零售总额将达约1,063亿美元。这一重要数字反映了美国葡萄酒市场的强劲本质和持续扩张。销售成长显示消费增加以及可能转向优质或更高价格的葡萄酒产品。

- 这一趋势显示葡萄酒包装对高品质玻璃瓶的需求不断增加。随着消费者的眼光越来越挑剔,他们更加重视葡萄酒产品的整体呈现和品质。玻璃瓶,尤其是那些品质好的玻璃瓶,在保存葡萄酒的完整性和增加其价值方面发挥着重要作用。包装产业,尤其是玻璃製造商,将受益于此趋势,因为酿酒厂力求满足消费者对优质包装解决方案的期望。

北美玻璃瓶/容器产业概况

北美玻璃瓶/容器市场细分,许多全球和地区公司争夺市场占有率。该领域的主要企业包括 OI Glass, Inc.、Ardagh Group SA、MJS Packaging 和 Anchor Glass Container Corporation。这些和其他市场参与企业促成了多元化和竞争的格局。

随着市场的发展,技术创新对于维持和扩大永续竞争优势至关重要。公司投资研发以改进产品、增强製造流程并回应不断变化的消费者需求。这种对创新的关注正在推动轻质玻璃製造的进步、改进的回收技术以及开发用于增强产品保护的专用涂层。

对永续性和环境的日益关注也是玻璃瓶/容器市场的关键驱动因素。许多公司正在采用环保方法,并将玻璃的可回收性作为主要卖点。这一趋势将持续塑造竞争格局并影响市场动态。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 容器玻璃进出口资料

- 容器玻璃市场PESTEL分析

- 包装玻璃行业标准及法规

- 容器和包装用玻璃的原料分析和材料考虑

- 容器和包装玻璃的永续性趋势

- 北美的容器玻璃熔炉和位置

第五章市场动态

- 市场驱动因素

- 食品和饮料产业不断扩大的需求

- 永续性和可回收性措施推动了最终用户对玻璃包装的需求

- 市场限制因素

- 玻璃製造造成的高碳足迹

- 营运和物流问题

- 贸易情景-玻璃瓶/容器产业进出口范式的历史与现况分析

第六章 市场细分

- 按最终用户产业

- 饮料

- 酒精饮料(按细分市场定性分析)

- 啤酒/苹果酒

- 葡萄酒/烈酒

- 其他酒精饮料

- 非酒精类(按细分市场定性分析)

- 碳酸饮料

- 牛奶

- 水/其他非酒精饮料

- 食物

- 化妆品

- 药品

- 其他行业

- 饮料

- 按国家/地区

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- OI Glass, Inc

- Ardagh Group SA

- Gerresheimer AG

- Arksansas Glass Container Corporation

- MJS Packaging

- O.Berk Company, LLC

- Kaufman Container Company

- Burch Bottle & Packaging, Inc.

- Anchor Glass Container Corporation

- West Coast Container Inc.

- PGP Glass Private Limited

第八章 供应北美玻璃瓶/容器厂的主要窑炉製造商分析

第九章 市场未来展望

The North America Glass Bottles/Containers Market size in terms of shipment volume is expected to grow from 13.08 million tonnes in 2025 to 16.39 million tonnes by 2030, at a CAGR of 4.62% during the forecast period (2025-2030).

Key Highlights

- Driven by rising consumption in sectors like food and beverage, cosmetics, and pharmaceuticals, the North American container glass market is on an upward trajectory. As consumers increasingly prioritize safe and healthy packaging, glass has found its way into diverse categories. This is especially pronounced in the beverage sector, where premium products and craft beverages often come in glass bottles.

- Moreover, cutting-edge technologies in embossing, shaping, and artistic finishes are elevating the allure of glass packaging. Such innovations not only offer enhanced customization and branding but also make glass containers a go-to choice for companies aiming for standout packaging. The industry's push towards lightweight glass technologies addresses transportation cost concerns and environmental implications, further fueling market expansion.

- In the U.S., a surge in alcoholic beverage consumption is driving a robust demand for packaging, especially glass bottles. This demand mirrors the expanding range of alcoholic offerings and a consumer tilt towards premium packaging. Glass bottles are preferred not just for their recyclability and premium look, but also for their prowess in preserving beverage quality and taste. The craft beer trend and the emergence of artisanal spirits have amplified the appetite for top-tier glass packaging.

- Data from the 2023 National Survey on Drug Use and Health (NSDUH) reveals that 218.7 million U.S. adults (84.9% of those 18 and older) have consumed alcohol at some point. Such a significant consumer base ensures a steady demand for varied packaging solutions in the beverage sector. Glass bottles, with their versatility and appeal, remain dominant, and manufacturers are innovating to cater to the changing preferences of both producers and consumers.

- Glass Global reports that North America produced 8,389,233 tonnes of glass bottles and containers across sectors, with an annual capacity of 9,321,370 tonnes. This underscores the region's formidable presence in the glass packaging arena. The robust production capacity and volume signal not just a strong infrastructure but also a thriving demand, spanning industries like food and beverage, pharmaceuticals, and cosmetics.

- Additionally, data from the International Trade Centre highlights the U.S. exported around 141,143 tonnes of glass packaging. This not only points to a burgeoning opportunity in the glass packaging realm but also underscores the international demand for North American glass products, likely attributed to their quality and the region's manufacturing prowess. The blend of substantial domestic production and significant export figures accentuates the North American glass packaging industry's strength and growth trajectory.

- As container glass finds increasing adoption across sectors in the region, recycling has emerged as a critical focus. Industries like food and beverage, pharmaceuticals, and cosmetics are generating substantial glass waste due to their heightened use of container glass. Efficient recycling is vital for waste management, minimizing environmental impact, and championing sustainability. With government regulations leaning towards sustainable packaging, manufacturers are increasingly turning to glass solutions. Collectively, these dynamics are propelling the growth of North America's glass packaging market.

North America Glass Bottles/Containers Market Trends

Alcoholic Beverage Segment is Expected to Witness Significant Growth

- Alcohol manufacturers are rolling out new versions of their products in glass bottles, a move anticipated to positively influence the market. By adopting glass packaging, these manufacturers aim to boost product appeal and reshape consumer perceptions, capitalizing on the premium image associated with glass. Glass bottles not only preserve the product's taste and quality more effectively but also offer heightened recyclability and an upscale feel. Many consumers equate glass packaging with superior beverage quality, often justifying a premium price tag.

- Moreover, glass facilitates unique and creative bottle designs, allowing brands to differentiate themselves on store shelves.

- This pivot to glass packaging resonates with the rising consumer demand for sustainable and eco-friendly options, given that glass is entirely recyclable and boasts multiple reuse capabilities.

- For example, in September 2024, Diageo-owned Johnnie Walker unveiled a limited edition Blue Label Ultra, showcasing the world's lightest 700ml glass bottle tailored for Scotch whisky. This pioneering packaging marks a notable leap in sustainable whisky bottling.

- The North American beer packaging sector is largely influenced by evolving cultural trends, a growing population, urbanization, and a surge in beer's popularity among younger demographics. Continued investments and a broadening beer distribution network across regions are likely to uphold these trends, potentially invigorating the market for glass bottles and containers.

- From March to May 2024, U.S. beer production in bottles and cans fluctuated between 10.41 million and 12.47 million barrels, underscoring the nation's demand for packaged beer. Even though the U.S. witnessed a 5% dip in beer production and imports in 2023, and craft brewer volume sales fell by 1%, the market remains buoyed by a rising beer consumption trend.

- The dip in production and imports could stem from shifts in consumer preferences, economic factors, or regulatory changes. Yet, the uptick in beer consumption hints at untapped growth and innovation avenues in the industry, possibly spurred by new beer varieties, intensified marketing, or evolving consumer behaviors.

- In North America, a growing segment of consumers is embracing sustainable lifestyles, notably in their efforts to curb plastic waste. This movement is propelling the wine and spirits market's shift towards glass bottles. Many consumers view glass bottles as more eco-friendly than their plastic counterparts and associate them with premium product quality. This perception resonates with environmentally-conscious consumers, often willing to pay a premium for sustainable packaging. Furthermore, looming government regulations aimed at curbing plastic usage could further amplify the demand for glass bottles in the alcoholic beverage sector.

United States is Expected to Account for Major Market Share

- The United States represents one of the world's largest packaging markets, featuring numerous key players producing glass bottles and containers for various industries, including food and beverage, personal care, and pharmaceuticals. The country's economic growth and rising consumer expenditure on food, drinks, pharmaceuticals, and personal care products drive the demand for glass bottle and container packaging solutions.

- This trend is further supported by the increasing preference for sustainable and recyclable packaging options, with glass being favored due to its eco-friendly properties. The growing craft beverage industry, particularly in beer and spirits, has also contributed to the increased demand for specialized glass packaging. The pharmaceutical sector's expansion, driven by an aging population and advancements in healthcare, has also bolstered the need for high-quality glass containers that meet stringent safety and preservation standards.

- The United States offers a favorable environment for business ventures due to its strong economy, comprehensive business immigration system, diverse consumer base, innovation-driven culture, and business-friendly policies. These factors make the USA an attractive destination for entrepreneurs and companies looking to expand or establish new operations. The country's robust infrastructure, advanced technology sector, and access to capital further enhance its appeal for businesses across various industries.

- The growth of e-commerce platforms and evolving consumer behaviors present significant opportunities for online retailers. The digital marketplace has experienced rapid expansion, driven by increased internet penetration, mobile device usage, and changing shopping habits. This shift has created a fertile ground for businesses to reach a wider audience and implement innovative sales strategies.These trends create potential opportunities for various industries, including glass packaging.

- As consumers become more environmentally conscious and seek sustainable solutions, glass packaging manufacturers can capitalize on the demand for recyclable and reusable containers. Additionally, the growing preference for premium and artisanal products in niche markets often aligns well with the perceived quality and aesthetic appeal of glass packaging, presenting further growth prospects for the industry.

- In the United States, Millennial and Gen X consumers have been driving the growth in wine consumption. These demographic groups have shown an increasing preference for wine, influencing market trends and product offerings. Their evolving tastes and purchasing habits have significantly impacted the wine industry's direction. The total retail value of wine sales in the US reached approximately USD 106.3 billion in 2023. This substantial figure reflects the robust nature of the American wine market and its continued expansion. The sales value growth indicates increased consumption and a potential shift towards premium or higher-priced wine products.

- This trend indicates an increasing demand for high-quality glass bottles in wine packaging. As consumers become more discerning, there is a growing emphasis on the overall presentation and quality of wine products. Glass bottles, particularly those of superior quality, play a crucial role in preserving the wine's integrity and enhancing its perceived value. The packaging industry, especially glass manufacturers, will likely benefit from this trend as wineries seek to meet consumer expectations for premium packaging solutions.

North America Glass Bottles/Containers Industry Overview

The North America container glass market is fragmented, with numerous global and regional players competing for market share. Key companies in this space include O-I Glass, Inc., Ardagh Group S.A., MJS Packaging, and Anchor Glass Container Corporation. These firms and other market participants contribute to a diverse and competitive landscape.

As the market evolves, innovation has become crucial in maintaining and growing sustainable competitive advantage. Companies invest in research and development to improve product offerings, enhance manufacturing processes, and meet changing consumer demands. This focus on innovation drives advancements in lightweight glass production, improved recycling techniques, and the development of specialized coatings for enhanced product protection.

The increasing emphasis on sustainability and environmental concerns has also become a significant driver in the glass bottles and containers market. Many companies are adopting eco-friendly practices and promoting the recyclability of glass as a key selling point. This trend will likely continue shaping the competitive landscape and influencing market dynamics in the coming years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Export-Import Data of Container Glass

- 4.3 PESTEL Analysis of Container Glass Market

- 4.4 Industry Standard and Regulation For Container Glass Use For Packaging

- 4.5 Raw Material Analysis and Material Consideration For Packaging

- 4.6 Sustainability Trends For Glass Packaging

- 4.7 Container Glass Furnace and Location in North American Region

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand from Food and Beverage Industry

- 5.1.2 Sustainability and Recyclability Initiatives Are Expanding End-Users Demand For Glass Packaging

- 5.2 Market Restraints

- 5.2.1 High Carbon Footprint due to Glass Manufacturing

- 5.2.2 Operation and Logistical Concerns

- 5.3 Trade Scenario - Analysis of the Historical and Current Export-Import Paradigm For Container Glass Industry

6 MARKET SEGMENTATION

- 6.1 By End-user Vertical

- 6.1.1 Bevarages

- 6.1.1.1 Alcoholic (Qualitative Analysis For Segment Analysis)

- 6.1.1.1.1 Beer and Cider

- 6.1.1.1.2 Wine and Spirits

- 6.1.1.1.3 Other Alcoholic Beverages

- 6.1.1.2 Non-alcoholic (Qualitative Analysis For Segment Analysis)

- 6.1.1.2.1 Carbonated Soft Drinks

- 6.1.1.2.2 Milk

- 6.1.1.2.3 Water and Other Non-alcoholic Beverages

- 6.1.2 Food

- 6.1.3 Cosmetics

- 6.1.4 Pharmaceutical

- 6.1.5 Other End-user Verticals

- 6.1.1 Bevarages

- 6.2 By Country

- 6.2.1 United States

- 6.2.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 O-I Glass, Inc

- 7.1.2 Ardagh Group S.A.

- 7.1.3 Gerresheimer AG

- 7.1.4 Arksansas Glass Container Corporation

- 7.1.5 MJS Packaging

- 7.1.6 O.Berk Company, L.L.C.

- 7.1.7 Kaufman Container Company

- 7.1.8 Burch Bottle & Packaging, Inc.

- 7.1.9 Anchor Glass Container Corporation

- 7.1.10 West Coast Container Inc.

- 7.1.11 PGP Glass Private Limited