|

市场调查报告书

商品编码

1627174

东南亚黏合剂和密封剂:市场占有率分析、产业趋势、成长预测(2025-2030)Southeast Asia Adhesives And Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

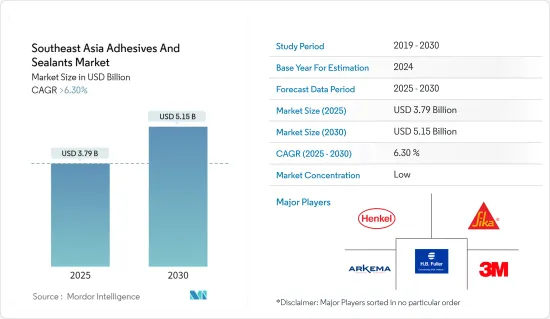

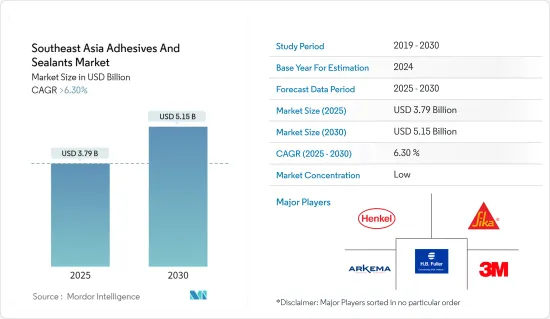

东南亚黏合剂和密封剂市场规模预计到2025年为37.9亿美元,预计到2030年将达到51.5亿美元,预测期内(2025-2030年)复合年增长率为6.3%。

由于 COVID-19,东南亚黏合剂和密封剂市场面临挫折。全球封锁和严格的政府监管导致生产基地大规模关闭。然而,市场于 2021 年復苏,预计未来几年将显着成长。

主要亮点

- 从短期来看,建筑业不断增长的需求和包装行业不断增长的采用是推动所研究市场需求的关键因素。

- 然而,黏合剂和密封剂严格的挥发性有机化合物排放法规预计将阻碍市场成长。

- 生物基黏合剂的创新和发展以及复合材料黏合的转变预计将在所研究的市场中创造新的机会。

- 预计印尼将主导市场并在预测期内实现最高成长。

东南亚黏合剂和密封剂市场趋势

建筑业成长迅速

- 由于其独特的性能和物理特性,黏合剂和密封剂在建筑行业中发挥着至关重要的作用,使其成为市场的关键最终用户部分。

- 黏合剂和密封剂的关键性能包括强内聚力、黏合力和弹性,以及高内聚力和柔韧性。它还具有高弹性模量,抗热膨胀,并能承受紫外线、腐蚀、盐水、雨水和其他风化条件等环境挑战。

- 常见应用包括暖通空调系统、混凝土建筑、接缝水泥、弹性地板材料、屋顶和固定窗框。

- 在东南亚,印尼、菲律宾、马来西亚、越南和泰国等国家的建设活动不断增加,增加了对黏合剂和密封剂的需求。

- 在政府的大力支持下,马来西亚的建筑业正迅速现代化和扩张。根据马来西亚工业发展金融公司(MIDF)的数据,该产业已连续第六个季度实现成长。

- 2023 年最后一个季度,赛城资料中心开始建设,这是位于马来西亚雪兰莪州赛城的一座 17,000平方公尺的七层资料中心。赛城资料中心由 1,830 个机柜组成,容量为 12MW。施工预计将于 2025 年第二季完成,从而增加所研究市场的需求。

- 据预算和管理部称,2023年菲律宾政府将在基础设施和资本支出上支出12,046亿披索(约220亿美元),与前一年同期比较增加19%。

- 根据建设局的资料,2023 年新加坡的建筑合约预计价值在 270 亿新元(约 206 亿美元)至 320 亿新元(约 244 亿美元)之间。公共部门计划预计将占这一需求的 60% 左右,住宅和发展委员会 (HDB) 正在大力开展公共住宅建设。此外,随着水处理厂和教育设施等计划的激增,新加坡对黏合剂和密封剂的需求预计将增加。

- 政府倡议以及许多正在进行和计划中的基础设施计划可能会影响预测期内东南亚对黏合剂和密封剂的需求。例如,在泰国普吉岛,作为卡图芭东高速公路计划一部分的卡图芭东隧道计划将建造一条1.85公里的隧道。建设总成本为146.7亿泰铢(约4.3亿美元),预计2027年完工。

- 作为旅游中心,泰国大力投资购物中心和豪华酒店。芭堤雅马奎斯万豪酒店拥有 900 多间客房,是一个备受瞩目的计划,计划于 2024 年开业。这两栋建筑的开发项目还包括拥有 398 间客房的 JW 万豪酒店和芭堤雅海滩水疗度假村。万豪计划在 2027 年之前在曼谷和芭堤雅推出三个品牌下的四家新酒店,加入其在泰国现有 45 家酒店和度假村的投资组合。

- 根据越南统计局资料,2023年,越南建筑业将为GDP贡献超过640.72兆越南盾(约300亿美元),为国家贡献总额约1.2兆越南盾(约4亿美元)占GDP的6.27%。

- 鑑于这些动态,上述因素可能会影响未来几年黏合剂和密封剂的需求轨迹。

印尼主导市场

- 印尼在黏合剂和密封剂消费方面领先东南亚。这一增长的主要驱动因素包括建设活动的增加、电子产品生产的蓬勃发展以及鞋类、皮革和医疗领域需求的不断增长。

- 在鞋类和皮革行业,黏合剂和密封剂对于将材料黏合在一起、确保耐用性并提高产品性能至关重要。随着印尼鞋类和皮革工业的扩张,对黏合剂和密封剂的需求也不断增长。

- 印尼统计局资料显示,2023年皮革鞋类製造业GDP达约49.24兆印度卢比(约30亿美元),比前一年成长2%。这一增长证实了印尼作为全球製造业强国的崛起。

- 在医疗领域,黏合剂和密封剂对于将材料黏合在一起、确保耐用性并增强医疗设备的功能至关重要。随着医疗产业的成长,预计未来几年对黏合剂和密封剂的需求将会增加。

- 过去一年,印尼透过重大国内和国际投资加强了卫生部门。 2023 年第 17 号卫生法废除了强制性卫生支出,并引入基于绩效的预算(PBBS)以鼓励有针对性的支出。该法律还提供了六大支柱的医疗保健转型大纲,强调了政府加强印尼医疗保健服务的承诺。

- 根据印尼卫生署预计,2023年印尼医疗设备出口额将达到约33.4亿美元,与前一年同期比较成长22%,进一步拉动医疗产业成长,支持受访者市场成长。

- 东南亚最大的建筑市场印尼正在加大政府在基础设施和都市化的支出,以满足住宅和商业设施需求的激增,从而导致对黏合剂和密封剂的需求增加。

- 建筑业对印尼的国内生产毛额至关重要。财政部将从2024年预算中向公共工程和住宅部拨款35兆印尼币(约20亿美元)资金,用于增加公务员的基础设施和住宅。西爪哇茂物占地 95 公顷的 Sequoia Hills Sentul住宅开发计划将于 2023 年第四季开始施工,预计 2027 年完工。

- 印尼在 2024 年预算中累计40.6 兆印度卢比(27 亿美元)用于开发新首都。政府相关人员报告说,总统府和几栋住宅大楼正在迅速动工,预计 2024 年竣工。建筑投资的激增将推动对黏合剂和密封剂的需求。

- 在汽车领域,黏合剂和密封剂对于黏合材料、确保耐用性和提高车辆性能至关重要。随着汽车生产和销售的扩大,黏合剂和密封剂的成长预计在预测期内上升。

- 根据OICA(国际汽车构造组织)的资料,2023年印尼汽车产量为139万辆,低于2022年的147万辆。然而,汽车销量成长13%,2023年达到101万辆。

- 经过强劲復苏后,印尼汽车市场不仅在2023年实现反弹,也超过了疫情前的数字。然而,根据 GAIKINDO 的数据,2024 年 1 月出现了挫折,汽车总体销量从 2023 年的 94,087 辆下降了 26% 至 69,619 辆。乘用车下降20%至56,007辆,商用车下降43%至13,612辆。儘管如此,GAIKINDO 预计 2024 年汽车销量将达到约 110 万辆。

- 在电子领域,黏合剂和密封剂对于黏合材料、确保耐用性和提高设备性能至关重要。随着电子产业的发展,对这些黏合剂和密封剂的需求也在成长。

- 根据印尼电子产品生产商协会(Gabel)的资料,电子产品的国内销售通常每年增长约11%。 Gabel也预测电子产业将显着成长,预计2024年将成长5%至10%。

- 鑑于各行业的这些趋势,印尼对黏合剂和密封剂的需求预计在未来几年将增长。

东南亚黏合剂和密封剂产业概况

东南亚的黏合剂和密封剂市场较为分散。主要参与企业(排名不分先后)包括 3M、Arkema、Sika AG、HB Fuller、Henkel AG & Co. KGaA。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 建筑业需求不断增长

- 包装产业的采用率提高

- 其他司机

- 抑制因素

- 关于VOC排放的严格环境法规

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(以金额为准的市场规模)

- 黏合技术

- 水性的

- 丙烯酸纤维

- 乙烯醋酸乙烯酯(EVA)乳液

- 聚氨酯分散体和CR(氯丁橡胶)胶乳

- 聚醋酸乙烯酯(PVA)乳液

- 其他水性胶黏剂

- 溶剂型

- 苯乙烯-丁二烯橡胶(SBR)

- 苯乙烯-丁二烯橡胶(SBR)

- 聚丙烯酸酯 (PA)

- 其他溶剂型胶黏剂

- 反应性

- 环氧树脂

- 改性亚克力

- 硅胶

- 聚氨酯

- 厌氧的

- 氰基丙烯酸酯

- 其他反应型黏合剂

- 热熔胶

- 乙烯醋酸乙烯酯

- 苯乙烯嵌段共聚物

- 热塑性聚氨酯

- 其他热熔胶

- 其他的

- 水性的

- 密封胶产品类型

- 硅胶

- 聚氨酯

- 丙烯酸纤维

- 聚醋酸乙烯酯

- 其他的

- 最终用户产业

- 建筑/施工

- 纸/纸板包装

- 运输

- 木工/细木工

- 鞋类/皮革

- 医疗保健

- 电力/电子

- 其他的

- 地区

- 印尼

- 马来西亚

- 菲律宾

- 新加坡

- 泰国

- 越南

- 其他东南亚地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- ADB Sealant Co., Ltd

- Arkema Group

- Ashland

- Avery Dennison Corporation

- Beardow Adams

- Dow

- DuPont

- Dymax Corporation

- Franklin International

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- ITW Performance Polymers(Illinois Tool Works Inc.)

- Jowat AG

- Mapei Inc.

- MUNZING Corporation

- Pidilite Industries Ltd.

- Sika AG

- Tesa SE(A Beiersdorf Company)

- Wacker Chemie AG

第七章 市场机会及未来趋势

- 生物基胶黏剂的创新与发展

- 重点转向粘合复合材料

- 其他机会

The Southeast Asia Adhesives And Sealants Market size is estimated at USD 3.79 billion in 2025, and is expected to reach USD 5.15 billion by 2030, at a CAGR of greater than 6.3% during the forecast period (2025-2030).

The Southeast Asia adhesives and sealants market faced setbacks due to COVID-19. Global lockdowns and stringent government regulations led to widespread shutdowns of production hubs. However, the market rebounded in 2021 and is projected to see significant growth in the upcoming years.

Key Highlights

- Over the short term, growing demand from the construction sector and increasing adoption in the packaging industry are the major factors driving the demand for the market studied.

- However, stringent VOC emissions regulations related to adhesives and sealants are expected to hinder the market's growth.

- Nevertheless, the innovation and development of bio-based adhesives and shifting focus toward adhesive bonding for composite materials is expected to create new opportunities for the market studied.

- Indonesia is expected to dominate the market and witness the highest growth during the forecast period.

Southeast Asia Adhesives and Sealants Market Trends

Building and Construction Segment to Witness Fastest Growth

- Adhesives and sealants, due to their unique characteristics and physical properties, play a pivotal role in the building and construction industry, establishing it as the leading end-user segment in the market.

- Key properties of adhesives and sealants encompass strong cohesion, adhesion, and elasticity, coupled with high cohesive strength and flexibility. They also exhibit a high elastic modulus, resist thermal expansion, and withstand environmental challenges such as UV light, corrosion, saltwater, rain, and other weathering conditions.

- Common applications span across HVAC systems, concrete work, joint cementing, resilient flooring, roofing, and fixed window frames.

- In Southeast Asia, rising construction activities in nations like Indonesia, the Philippines, Malaysia, Vietnam, and Thailand are propelling the demand for adhesives and sealants.

- Malaysia's construction sector, buoyed by substantial government backing, is rapidly modernizing and expanding. As per Malaysian Industrial Development Finance Berhad (MIDF), the sector has seen six consecutive growth periods.

- In the last quarter of 2023, construction commenced on a 17,000 m2, seven-story data center called the Cyberjaya Data Centre in Cyberjaya, Selangor, Malaysia. The Cyberjaya Data Centre comprises 1,830 cabinets with a capacity of 12 MW. Construction is projected to be completed by the second quarter of 2025, thus increasing the demand for the market studied.

- According to the Department of Budget and Management, the Philippines government spent PHP 1204.6 billion (~USD 22 billion) on infrastructure and capital outlays in 2023, marking a 19% rise from the prior year, thus increasing the demand for the market studied.

- As per the data from the Building and Construction Authority, Singapore's construction contracts are projected to be valued between SGD 27 billion (~USD 20.6 billion) and SGD 32 billion (~USD 24.4 billion) in 2023. Public sector projects are anticipated to make up about 60% of this demand, driven by a robust pipeline of public housing initiatives from the Housing Development Board (HDB). Additionally, with a surge in projects like water treatment plants and educational facilities, the demand for adhesives and sealants in Singapore is set to rise.

- Government initiatives and numerous ongoing and planned infrastructure projects are set to influence the demand for adhesives and sealants in Southeast Asia during the forecast period. For instance, In Phuket, Thailand, the Kathu-Patong Tunnel Project, part of the Kathu-Patong Expressway Project, is set to construct a 1.85-kilometer tunnel. With an estimated cost of THB 14.67 billion (~USD 0.43 billion), completion is anticipated by 2027.

- Thailand, a major tourist hub, is seeing significant investments in malls, luxury hotels, and more. The Pattaya Marriott Marquis Hotel, boasting over 900 guest rooms, is the standout project, aiming for a 2024 launch. This dual-property development also features a 398-room JW Marriott and the Pattaya Beach Resort & Spa. By 2027, Marriott plans to introduce four new hotels across its three brands in Bangkok and Pattaya, adding to its existing portfolio of 45 hotels and resorts in Thailand, nine of which are in collaboration with Asset World Corporation.

- As per the data from General Statistics Office of Vietnam, in 2023, Vietnam's construction sector contributed over VND 640.72 trillion (~USD 0.03 trillion) to the GDP, representing 6.27% of the nation's total GDP, which was approximately VND 10.2 thousand trillion (~USD 0.0004 trillion).

- Given these dynamics, the aforementioned factors are poised to shape the demand trajectory for adhesives and sealants in the coming years.

Indonesia to Dominate the Market

- Indonesia leads Southeast Asia in the consumption of adhesives and sealants. Key drivers for this growth include rising construction activities, booming electronics production, and heightened demand in the footwear, leather, and healthcare sectors.

- In the footwear and leather industry, adhesives and sealants are essential for bonding materials, ensuring durability, and enhancing product performance. As Indonesia's footwear and leather sector expands, so does the demand for these adhesives and sealants.

- Data from Statistics Indonesia reveals that in 2023, the GDP from leather and footwear manufacturing reached approximately IDR 49.24 trillion (~USD 0.0030 trillion), marking a 2% increase from the previous year. This growth underscores Indonesia's emergence as a global manufacturing powerhouse.

- In the healthcare sector, adhesives and sealants are vital for bonding materials, ensuring durability, and enhancing the functionality of medical devices. With the healthcare sector's growth, the demand for adhesives and sealants is set to rise in the coming years.

- Over the past year, Indonesia has bolstered its healthcare sector through significant investments, both domestic and foreign. The 2023 Health Law (Law No.17 of 2023 on Health) eliminated mandatory health spending, introducing a performance-based budgeting system (PBBS) to promote targeted spending. This law also outlines a six-pillar healthcare transformation, highlighting the government's commitment to enhancing Indonesia's healthcare services.

- According to the Ministry of Health (Indonesia), in 2023, Indonesia's medical equipment exports reached approximately USD 3.34 billion, a 22% increase from the previous year, further fueling the healthcare sector's growth, therby supporting the growth of the market studied.

- As Southeast Asia's largest construction market, Indonesia is ramping up government spending on infrastructure and urbanization to meet the bosltering demand for residential and commercial properties, subsequently increasing the need for adhesives and sealants.

- The construction sector is vital to Indonesia's GDP. The Ministry of Finance has allocated an IDR 35 trillion (~USD 0.002 trillion) fund from the 2024 budget to the Public Works and Housing Ministry, aiming to boost infrastructure and housing for civil servants. In Q4 2023, construction began on the Sequoia Hills Sentul Residential Development project, a 95-hectare endeavor in Bogor, West Java, set for completion in 2027, aiming to elevate regional living standards.

- In its 2024 budget, Indonesia has set aside IDR 40.6 trillion (USD 2.7 billion) for its new capital city development. Government officials report rapid advancements, with the presidential office and several residential blocks on track for a 2024 completion. This surge in construction investment is poised to elevate the demand for adhesives and sealants.

- In the automotive sector, adhesives and sealants are crucial for bonding materials, ensuring durability, and enhancing vehicle performance. With the country's expanding vehicle production and sales, growth for adhesives and sealants is anticipated to rise during the forecast period.

- Data from the Organisation Internationale des Constructeurs d'Automobiles (OICA) indicates that Indonesia produced 1.39 million automobiles in 2023, down from 1.47 million in 2022. However, vehicle sales saw a 13% uptick, reaching 1.01 million units in 2023.

- After a strong recovery, Indonesia's vehicle market not only bounced back by 2023 but also exceeded pre-pandemic figures. Yet, January 2024 brought a setback, with GAIKINDO noting a 26% decline in overall vehicle sales, dropping to 69,619 units from 94,087 in 2023. Passenger vehicle sales dipped 20% to 56,007 units, while commercial vehicles saw a sharper 43% drop to 13,612 units. Despite this, GAIKINDO anticipates car sales will reach around 1.1 million units in 2024.

- In the electronics sector, adhesives and sealants are vital for bonding materials, ensuring durability, and enhancing device performance. As the electronics sector grows, so does the demand for these adhesives and sealants.

- Data from the Indonesian Electronics Producers Association (Gabel) indicates that domestic sales of electronic products typically see an annual increase of about 11%. Gabel also projects significant growth for the electronics industry, estimating a rise between 5% and 10% in 2024.

- Given these trends across various industries, the demand for adhesives and sealants in Indonesia is poised for growth in the coming years.

Southeast Asia Adhesives and Sealants Industry Overview

The Southeast Asia's adhesives and sealants market is fragmented in nature. The major players (not in any particular order) include 3M, Arkema, Sika AG, H.B. Fuller, and Henkel AG & Co. KGaA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from Construction Sector

- 4.1.2 Increasing Adoption in Packaging Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations Regarding VOC Emissions

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Adhesive Technology

- 5.1.1 Water Borne

- 5.1.1.1 Acrylic

- 5.1.1.2 Ethylene Vinyl Acetate (EVA) Emulsion

- 5.1.1.3 Polyurethane Dispersion and CR (Chloroprene Rubber) Latex

- 5.1.1.4 Polyvinyl Acetate (PVA) Emulsion

- 5.1.1.5 Other Water-borne Adhesives

- 5.1.2 Solvent-borne

- 5.1.2.1 Styrene-Butadiene Rubber (SBR)

- 5.1.2.2 Styrene-Butadiene Rubber (SBR)

- 5.1.2.3 Poly Acrylate (PA)

- 5.1.2.4 Other Solvent-borne Adhesives

- 5.1.3 Reactive

- 5.1.3.1 Epoxy

- 5.1.3.2 Modified Acrylic

- 5.1.3.3 Silicone

- 5.1.3.4 Polyurethane

- 5.1.3.5 Anaerobic

- 5.1.3.6 Cyanoacrylate

- 5.1.3.7 Other Reactive Adhesives

- 5.1.4 Hot Melt

- 5.1.4.1 Ethylene Vinyl Acetate

- 5.1.4.2 Styrenic Block Copolymers

- 5.1.4.3 Thermoplastic Polyurethane

- 5.1.4.4 Other Hot Melt Adhesives

- 5.1.5 Other Technologies

- 5.1.1 Water Borne

- 5.2 Sealant Product Type

- 5.2.1 Silicone

- 5.2.2 Polyurethane

- 5.2.3 Acrylic

- 5.2.4 Polyvinyl Acetate

- 5.2.5 Other Product Types

- 5.3 End-user Industry

- 5.3.1 Building and Construction

- 5.3.2 Paper, Board, and Packaging

- 5.3.3 Transportation

- 5.3.4 Woodworking and Joinery

- 5.3.5 Footwear and Leather

- 5.3.6 Healthcare

- 5.3.7 Electrical and Electronics

- 5.3.8 Other End-user Industries

- 5.4 Geography

- 5.4.1 Indonesia

- 5.4.2 Malaysia

- 5.4.3 Philippines

- 5.4.4 Singapore

- 5.4.5 Thailand

- 5.4.6 Vietnam

- 5.4.7 Rest of Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 ADB Sealant Co., Ltd

- 6.4.3 Arkema Group

- 6.4.4 Ashland

- 6.4.5 Avery Dennison Corporation

- 6.4.6 Beardow Adams

- 6.4.7 Dow

- 6.4.8 DuPont

- 6.4.9 Dymax Corporation

- 6.4.10 Franklin International

- 6.4.11 H.B. Fuller Company

- 6.4.12 Henkel AG & Co. KGaA

- 6.4.13 Huntsman International LLC

- 6.4.14 ITW Performance Polymers (Illinois Tool Works Inc.)

- 6.4.15 Jowat AG

- 6.4.16 Mapei Inc.

- 6.4.17 MUNZING Corporation

- 6.4.18 Pidilite Industries Ltd.

- 6.4.19 Sika AG

- 6.4.20 Tesa SE (A Beiersdorf Company)

- 6.4.21 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation and Development of Bio-based Adhesives

- 7.2 Shifting Focus Toward Adhesive Bonding for Composite Materials

- 7.3 Other Opportunities