|

市场调查报告书

商品编码

1627176

中东和非洲占用感测器:市场占有率分析、行业趋势和成长预测(2025-2030)MEA Occupancy Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

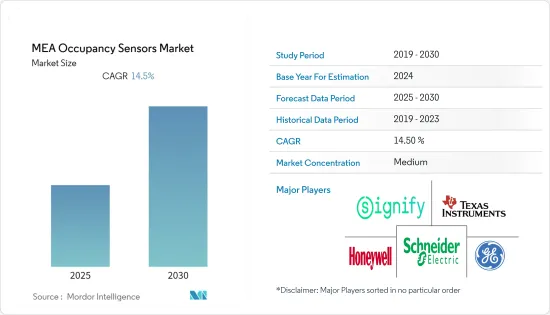

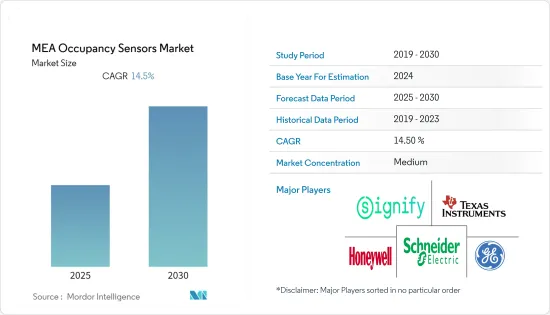

中东和非洲占用感测器市场预计在预测期内复合年增长率为 14.5%

主要亮点

- 占用感测器使用各种技术(例如被动红外线、超音波和双技术)来指示空间中是否存在居住者。被动红外线感测器需要感测器和居住者之间存在视线。

- 此外,为了减少能源浪费,大多数能源法规都要求以某种方式根据时间表或占用情况在不使用时自动关闭灯光。占用感测器是一种照明控制设备,可以关闭无人区域的灯光,透过消除能源浪费来降低能源成本。此外,该地区的各个供应商都安装了超音波感测器,透过向周围区域发射超音波并测量他们返回的速度来检测人员的存在。

- 人们对使用被动红外线和超音波技术来检测居住者存在的双技术感测器也越来越感兴趣,只有当两种技术都检测到居住者存在时才会启动灯光。这种配置实际上消除了错误照明的可能性,而且由于需要一种或另一种技术来保持灯亮,所以错误熄灭的可能性也大大降低。

- 占用感测器主要用于侦测占用者的运动,而不是侦测占用者的存在或其他更重要的特征,例如计数、位置、追踪或身分。此外,新技术正在迅速扩展,以检测更有价值的居住特征。

中东和非洲占用感测器市场趋势

预计住宅将出现显着成长

- 智慧建筑技术的引入现在为设施管理人员提供了强大的工具来获取有关空间运转率的准确信息,而不是依赖估计和近似值。运转率感测器还收集本地空间使用的资料,并帮助优化空间管理决策。

- 此外,从传统照明控制系统切换到智慧照明控制系统可以实现无线甚至非接触式照明控制,并具有运转率感应、时间安排和语音控制功能。这为照明控制专家提供了为家庭提供灵活解决方案的新机会。

- 此外,光电红外线 (PIR) 感测器是检测建筑物内居住者存在的当前标准。智慧恆温器使用感测器根据居住的居住情况控製暖气和冷气。一个重要的问题是这些 PIR 感测器只能侦测正在移动的人。

- 此外,居住感测器和智慧插座参考设计将帮助家庭自动化设备製造商和开发商加快上市时间,同时降低系统成本和复杂性。这些新的承包参考设计可协助开发人员最终产品。

南非市场预计将显着成长

- 适用于各种应用并提供用户友好且可靠服务的技术先进的占用感测器的出现正在增加对安全门禁系统的需求。此外,IT公司、企业和资料中心等各种商业设施正在实施存取控制系统,以记录员工何时进出,以防止人员和资料外洩。

- 对节能设备的需求不断增长预计将推动该国的发展。占用感测器在降低能耗方面发挥重要作用。这是透过感测器根据运作条件关闭设备和其他设备来实现的。这些感测器有助于减少光污染,可用于室内和室外空间。

- 由于被动红外线成本低、对节能设备的需求以及低功耗要求,预计该国对被动红外线的需求将持续。它具有多种应用,包括照明、光谱仪、气体和火灾侦测系统。被动红外线感测器的主要优点是精确的运动侦测、可靠的触发和成本效益。例如,自动贩卖机设计人员现在将 PIR 感测器整合到他们的产品中,这样只有当有人站在装置前面或在面板前挥手时,显示器才会亮起。

- 泛非私部门贸易和投资委员会 (PAFTRAC) 表示,对 46 个非洲国家执行长的最新调查显示,非洲执行长对他们的公司在未来 12 至 18 个月内实现成长充满信心。大多数受访者也对产业的经济前景充满信心。此外,87%的受访者认为非洲大陆自由贸易协定(AfCFTA)将增加非洲内部贸易。预计这将为占用感测器市场创造成长机会。

中东和非洲占用感测器产业概况

中东和非洲占用感测器市场本质上竞争适度。产品探索、研发、联盟和收购是该地区公司保持竞争力的关键成长策略。

- 2021 年 7 月 - 私募股权公司 Arcline Investment Management 宣布购买 Dwyer Instruments 的多数股权。该公司是一家为製程自动化、暖通空调和建筑自动化市场设计和製造感测器和仪器解决方案的供应商。该公司拥有 93 项有效且正在申请的专利以及超过 40,000 个可配置 SKU 的广泛产品组合,几乎可以满足客户所需的任何应用。

- 2020 年 3 月 - Signify 宣布推出全新飞利浦物联网感测器套件,可透过 Interact 办公室互联照明系统和环境监控 API 收集和传输资料。此感测器包可监控占用情况、占用人数、温度(房间和办公桌水平)、噪音水平、阳光水平、相对湿度,并且相容于蓝牙,用于室内定位和导航。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 节能设备的需求不断增长

- 低成本和高能效对被动红外线的需求

- 市场挑战

- 与无线网路系统相关的交换器故障和不一致问题

第六章 市场细分

- 依网路类型

- 有线

- 无线的

- 依技术

- 超音波

- 被动红外线

- 微波

- 按用途

- 照明控制

- 空调

- 安全和监视

- 依建筑类型

- 住宅

- 商业设施

- 按国家/地区

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲

第七章 竞争格局

- 公司简介

- Schneider Electric SE

- Eaton Corp PLC

- Signify Holding BV

- Honeywell Inc

- Dwyer Instruments Inc

- Johnson Controls Inc

- General Electric Co

- Legrand SA

- Analog Devices Inc

- Texas Instruments Inc

第八章投资分析

第9章 市场的未来

简介目录

Product Code: 50232

The MEA Occupancy Sensors Market is expected to register a CAGR of 14.5% during the forecast period.

Key Highlights

- Occupancy sensors indicate the presence or absence of occupants in a space using various technologies such as passive infrared, ultrasonic, and dual-technology. Passive-infrared sensors necessitate a line of sight between the sensor and the space's occupants.

- Further, to reduce energy waste, most energy codes require some method of automatically turning off lights when they are not in use, either on a schedule or based on occupancy. Occupancy sensors are lighting controls that turn off lights in unoccupied areas, lowering energy costs by reducing energy waste. Also, various vendors in the region are introducing Ultrasonic sensors to detect the presence of people by emitting ultrasonic sound waves into the environment and measuring the speed with which they return.

- Also, there is an increasing focus on Dual-technology sensors that use both passive infrared and ultrasonic technologies to detect the presence of occupants and activate the lights only when both technologies detect the presence of occupants. This configuration virtually eliminates the possibility of false-on problems, and requiring either technology to keep the lights on significantly reduces the possibility of false-off problems.

- Occupancy sensors have primarily been used to detect motion rather than the presence or other more essential occupancy features, including count, location, track, and identity. Also, New technology is expanding rapidly to detect higher-value features of occupancy.

MEA Occupancy Sensors Market Trends

Residential is Expected to Witness Significant Growth

- With the introduction of smart building technologies, facility managers now have access to robust tools to access accurate information about space occupancy rather than relying on estimates and approximations and occupancy sensors aiding in collecting data about space usage and optimizing space management decisions in the region.

- Also, switch from a traditional lighting control system to a smart lighting control system, which allows for wireless and even touchless lighting control through occupancy sensing, time scheduling, and voice control. All of this has opened up new opportunities for professional lighting control companies, which provide flexible solutions to homes.

- Further, Photoelectric infrared (PIR) sensors are the current standard for detecting occupancy presence in buildings. Smart thermostats use sensors to control heating and cooling based on occupancy. One significant issue is that these PIR sensors only detect individuals moving.

- Additionally, occupancy sensor and smart outlet reference designs help home automation device makers and developers accelerate time to market while lowering system cost and complexity. Developers can quickly advance from design concept to final product by leveraging these new, turnkey reference designs, including pre-certified wireless technology, open-source hardware design files, industry-standard software stacks, and proven test setups manufacturing methods.

South Africa is Expected to Witness Significant Growth in the Market

- The initiation of technically sophisticated occupancy sensors for various applications fuels security and access systems demand by providing a user-friendly and reliable service. Aside from that, various commercial establishments such as IT companies, enterprises, data centers are implementing access control systems to protect personnel and data breaches, to record employee's entry and exit timings.

- The rising demand for energy-efficient devices is expected to drive the country. Occupancy sensors play a vital role in reducing energy consumption. This is achieved through the sensors, which shut down devices and other equipment based on occupancy. These sensors help reduce light pollution and can be used for indoor and outdoor spaces.

- The demand for passive infrared is expected to continue in the country due to the low cost, demand for energy-efficient devices, and less power requirement. It has a range of applications, such as lighting, spectrometers, gas, and fire detection systems. Some of the significant benefits of passive infrared sensors are accurate movement detection, reliable triggering, and cost-efficiency. Vending machine designers, for instance, are now incorporating PIR sensors into their products so that their displays only light up when someone is standing in front of the unit or maybe waving their hand in front of a panel, which saves on operating costs.

- According to PAFTRAC, the Pan-African Private Sector Trade and Investment Committee, a new study of African CEOs from 46 nations indicated that CEOs in Africa are certain that firms would grow over the next 12-18 months. The majority of respondents are also confident about the industry's economic prospects. Furthermore, 87% of respondents believe that the African Continental Free Commerce Agreement will increase intra-African trade (AfCFTA). This is expected to create growth opportunities for the occupancy sensor market.

MEA Occupancy Sensors Industry Overview

The Middle East and Africa Occupancy Sensors Market is moderately competitive in nature. Product launches, high expense on research and development, partnerships, and acquisitions are the prime growth strategies adopted by the companies in the region to sustain the intense competition.

- July 2021 - Arcline Investment Management, a private equity firm, announced purchasing a majority stake in Dwyer Instruments. The company is a provider in designing and manufacturing sensor and instrumentation solutions for the process automation, HVAC, and building automation markets. The company has 93 active and pending patents and an extensive suite of over 40,000 configurable SKUs, allowing it to service nearly all customer-required applications.

- March 2020 - Signify introduced new Philips IoT sensor packages that gather and deliver data via the Interact Office connected lighting system and environmental monitoring APIs. The sensor bundles can observe occupancy, the total of people in the room, temperature (at the room and desk level), noise levels, daylight levels, relative humidity, and are Bluetooth enabled, allowing for indoor positioning and navigation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising demand for energy-efficient devices

- 5.1.2 Demand for Passive Infrared Due to Low Cost and High Energy Efficiency

- 5.2 Market Challenges

- 5.2.1 False Triggering of Switch and Inconsistency Issues Associated with Wireless Network Systems

6 MARKET SEGMENTATION

- 6.1 By Network Type

- 6.1.1 Wired

- 6.1.2 Wireless

- 6.2 By Technology

- 6.2.1 Ultrasonic

- 6.2.2 Passive Infrared

- 6.2.3 Microwave

- 6.3 By Application

- 6.3.1 Lighting Control

- 6.3.2 HVAC

- 6.3.3 Security and Surveillance

- 6.4 By Building Type

- 6.4.1 Residential

- 6.4.2 Commercial

- 6.5 By Country

- 6.5.1 Saudi Arabia

- 6.5.2 United Arab Emirates

- 6.5.3 South Africa

- 6.5.4 Rest of Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schneider Electric SE

- 7.1.2 Eaton Corp PLC

- 7.1.3 Signify Holding BV

- 7.1.4 Honeywell Inc

- 7.1.5 Dwyer Instruments Inc

- 7.1.6 Johnson Controls Inc

- 7.1.7 General Electric Co

- 7.1.8 Legrand SA

- 7.1.9 Analog Devices Inc

- 7.1.10 Texas Instruments Inc

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219