|

市场调查报告书

商品编码

1844547

无线占用感测器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Wireless Occupancy Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

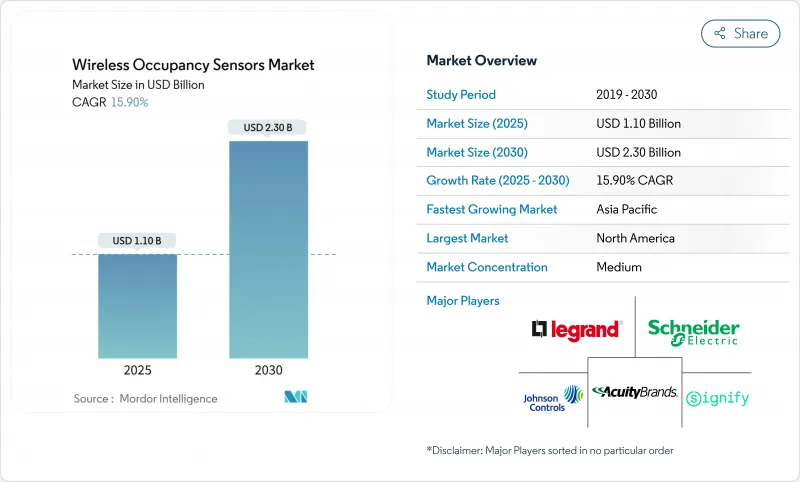

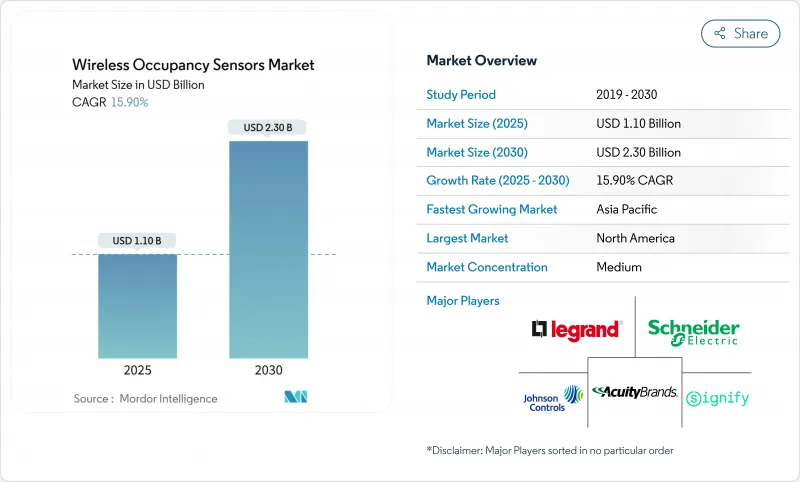

无线占用感测器市场规模预计在 2025 年达到 11 亿美元,到 2030 年达到 23 亿美元,复合年增长率为 15.9%。

智慧建筑平台投资激增、能源效率法规不断加强以及无电池能量收集设计的快速发展是这一势头背后的关键驱动力。供应商正在整合人工智慧感测器融合演算法,以减少误报并提高侦测精度,而建筑业主也对运动感测器、太阳能和热能收集器带来的维护减少表示讚赏。北美地区受益于 ASHRAE 90.1-2019 和加州第 24 条法规的要求,而亚太地区则受益于中国的智慧建筑指令和日本的节能物联网计画。这些因素的融合正在催生一系列强劲的维修和绿地计画,以支持无线占用感测器市场在未来十年保持两位数的成长轨迹。

全球无线占用感测器市场趋势与洞察

严格的能源效率要求

欧盟《建筑能源效率指令》和加州第24号法案等能源法规强制要求安装自动照明和暖通空调系统,这为无线占用感测器市场解决方案的长期需求提供了支撑。纽约市第88号地方法规增加了对违规的经济处罚,进一步巩固了监管力度,使其不再局限于简单的投资回报计算。製造商在欧盟每五年、在美国部分州每三年可以进行一次升级,这将鼓励持续的研发投资。这些法规也鼓励对先前认为自动化并非必需的中小型建筑维修。这些措施将加速计划建设,使复合年增长率预测增加3.2个百分点。

智慧建筑和物联网的快速应用

思科 Spaces 和施耐德电气 EcoStruxure 等智慧楼宇平台整合即时运作数据,实现暖通空调、照明和维护的自动化,将感测器从独立设备转变为为企业分析提供数据的数据节点。 Thread 和 Matter通讯协定让蓝牙、Zigbee 和 Wi-Fi 装置无需专有网关即可共存,从而消除了互通性难题。 Aqara 等供应商正在推出双 PIR 和毫米波感测器,这些感测器可轻鬆连接 Apple Home、Alexa 和 Google 生态系统,从而扩大其覆盖范围。这种网路效应将推动采用曲线的加快,尤其是在亚太地区的新商业建筑中。因此,智慧楼宇的采用将成为推动无线居住感测器市场 4.1 个百分点复合年增长率的最大因素。

错误触发和校准问题

传统的PIR感测器会误读空调气流和温度变化,导致居住者时灯亮,从而抵消节能效果。超音波飞行时间感测器可以改善这些环境下的检测效果,但需要安装人员微调灵敏度,增加了人事费用。双技术融合虽然减少了误报,但零件数量和电池消耗都增加了一倍。高阶毫米波雷达价格昂贵,并且需要许多电工不熟悉的熟练设置。在基于人工智慧的自动校准标准成熟之前,这些技术摩擦将使无线占用感测器市场的复合年增长率降低2.1个百分点。

細項分析

预计到2024年,被动红外线感测器将维持46%的市场份额,凭藉其低成本和成熟度,成为无线占位感测器市场的销售支柱。随着用户在开放式空调办公室中追求更高的精度,融合被动红外线和超音波讯号的双技术设备预计将实现20.5%的复合年增长率。接下来是提供温度稳定声学运动侦测的超音波感测器。毫米波雷达正吸引医疗保健、机场和高阶办公室的买家,这些领域的关键照明和暖通空调决策需要亚秒级的存在确认。电脑视觉和声学是利基市场,在零售分析中,它们对客流统计的准确性越来越有吸引力。

供应商的蓝图越来越多地纳入人工智慧融合引擎,这些引擎可以学习环境模式并减少误报,从而提高无线占用感测器市场的可靠性。 Aqara 的 FP300 结合了双 PIR、毫米波、温度、湿度和照度感测功能,将指令资料输入 Matter 网路。此类平台采用无线更新,可在演算法演进过程中保护您的投资。虽然 BOM 成本上升,但减少回调带来的生命週期节省证明了其溢价的合理性,并为更大规模的企业部署奠定了基础。

照明控制受益于数十年来在商业建筑中以规范主导,在2024年保持了59%的收入领先优势。然而,暖通空调和通风市场预计将以19%的复合年增长率成长,因为运转率数据对于合理调整气流以满足疫情后的室内空气品质标准至关重要。安防和监控系统可实现跨预算协同效应,因为感测器可用于触发警报并照亮疏散路线。空间利用率分析提供了最大的价值,其先进的计数功能可实现高端房地产的租金最佳化。

Honeywell的「Forge Sustainability+」专案展示瞭如何透过根据入住率调整的暖通空调系统 (HVAC) 在保持舒适度的同时,将风扇能耗降低 40%,从而在与能源合约挂钩的无线入住率感测器市场规模中释放新的投资回报率槓桿。供应商正在整合云端仪表板,并将数据收益的获利能力提升至硬体利润之外。资产追踪覆盖层使用相同的基础设施,为设施管理人员提供了一个多服务平台,无需额外资本净利率即可扩展总营运成本 (TAM)。

区域分析

到2024年,北美将以35%的收入份额领先。 ASHRAE 90.1-2019和Title 24规范将强制要求几乎所有商业计划都必须安装感测器。美国在毫米波雷达研发方面处于领先地位,Novelda等公司提供能够追踪病房微小运动的超宽频检测器。加拿大正在推动LEED驱动的维修,而墨西哥正在进行工厂扩建。无线占用感测器市场将继续受益于联邦节能设备升级的税收优惠政策。

亚太地区是成长最快的地区,预计复合年增长率将达到17.8%,这得益于中国的智慧城市蓝图和日本的零能耗建筑目标推动感测器的普及。印度的「百城智慧城市」计画和5G的广泛部署为在商业塔上安装基于低功耗蓝牙的设备创造了肥沃的土壤。韩国正利用其电子製造能力缩短前置作业时间并降低系统价格,推动当地教育和医疗保健产业的应用。充足的本地零件供应使该地区免受全球晶片短缺的影响,从而增强了无线占用感测器市场的成长轨迹。

欧洲正受益于《建筑能效指令》,该指令透过定期绩效审核来促进持续的维修週期。德国正在探索与工业自动化的协同效应,英国则将碳减排资金用于公共部门的维修补贴。法国正在探索与智慧电网进行建筑数据交换,并对建筑的需量反应进行补偿,使感测器成为一项收益资产,而非合规成本。 GDPR 正在推动买家采用边缘处理解决方案,并青睐拥有设备内建分析功能的供应商。这些因素共同确立了无线感测器作为欧洲脱碳蓝图的基础要素的地位。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 严格的能源效率要求

- 智慧建筑和物联网的快速应用

- 无电池能源采集感应器

- 透过混合工作进行空间分析的需求

- ESG 相关的基于入住率的暖通空调合约

- 支援 AI 的毫米波融合,实现零延迟侦测

- 市场限制

- 错误触发和校准问题

- 资料隐私和网路安全问题

- 密集物联网部署中的射频拥塞

- 电池处置合规成本

- 价值/供应链分析

- 监管状况

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模及成长预测

- 依技术

- 被动红外线(PIR)

- 超音波

- 双重技术(PIR +超音波)

- 微波/毫米波雷达

- 其他技术

- 按用途

- 照明控制

- 空调和通风

- 安全与监控

- 空间使用分析

- 其他用途

- 依建筑类型

- 住房

- 商业

- 工业

- 公共设施

- 透过网路连线

- Zigbee

- Bluetooth/BLE

- Wi-Fi

- EnOcean(能源采集)

- LoRa和其他LPWAN

- 按最终用户产业

- 智慧建筑

- 医疗机构

- 製造业

- 航太/国防

- 家用电器和智慧家居

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Legrand SA

- Schneider Electric SE

- Acuity Brands Inc.

- Eaton Corporation plc

- Leviton Manufacturing Co. Inc.

- Johnson Controls International plc

- Signify NV

- Lutron Electronics Co. Inc.

- Honeywell International Inc.

- General Electric Co.

- Hubbell Incorporated

- ABB Ltd.

- Siemens AG

- Texas Instruments Inc.

- Crestron Electronics Inc.

- Enlighted Inc.(Siemens)

- RAB Lighting Inc.

- Autani LLC

- PointGrab Ltd.

- Delta Electronics Inc.

第七章 市场机会与未来展望

The wireless occupancy sensors market size reached USD 1.1 billion in 2025 and is forecast to climb to USD 2.3 billion by 2030, advancing at a 15.9% CAGR.

Surging investment in smart-building platforms, tightening energy-efficiency regulations, and rapid advances in battery-free energy-harvesting designs are the primary engines behind this momentum. Vendors are embedding AI-enabled sensor-fusion algorithms that cut false triggers and raise detection accuracy, while building owners value the reduced maintenance that kinetic, solar, and thermal harvesters provide. Competition is intensifying as lighting majors buy specialist sensor makers to gain data-interoperability advantages, and regional growth profiles mirror regulatory rigor-North America benefits from ASHRAE 90.1-2019 and California Title 24 requirements, whereas Asia-Pacific leverages China's intelligent-building mandate and Japan's energy-efficient IoT programs. These converging factors are creating a robust pipeline of retrofit and greenfield projects that will keep the wireless occupancy sensors market on a double-digit growth path through the decade.

Global Wireless Occupancy Sensors Market Trends and Insights

Stringent Energy-Efficiency Mandates

Energy codes such as the European Union's Energy Performance of Buildings Directive and California Title 24 require automatic lighting and HVAC controls, anchoring long-term demand for wireless occupancy sensors market solutions. New York City's Local Law 88 adds financial penalties for non-compliance, cementing a regulatory pull that transcends simple payback calculations. Manufacturers see predictable upgrade cycles every five years in the EU and every three years in several U.S. states, which encourages sustained R&D spending. The mandates also catalyze retrofits in small and midsize buildings that previously viewed automation as discretionary. Collectively, these measures add 3.2 percentage points to the forecast CAGR by accelerating project pipelines.

Rapid Smart-Building & IoT Adoption

Smart-building platforms such as Cisco Spaces and Schneider Electric EcoStruxure integrate real-time occupancy data to automate HVAC, lighting, and maintenance, transforming sensors from single-function devices into data nodes that feed enterprise analytics. Thread and Matter protocols now remove interoperability headaches, letting Bluetooth, Zigbee, and Wi-Fi devices coexist without proprietary gateways. Vendors like Aqara ship dual PIR and mmWave sensors that join Apple Home, Alexa, and Google ecosystems out of the box, widening consumer reach. These network effects drive faster adoption curves, particularly in Asia-Pacific's new commercial builds. As a result, smart-building penetration will deliver the highest driver uplift at 4.1 percentage points to the wireless occupancy sensors market CAGR.

False Triggering & Calibration Issues

Conventional PIR sensors misread HVAC drafts and temperature swings, causing lights to turn on without occupants and eroding energy-savings claims. Ultrasonic Time-of-Flight devices improve detection in such environments, but installers must fine-tune sensitivity, boosting labor costs. Dual-tech fusion reduces false positives yet doubles component count and battery drain. Premium mmWave radar remains costly and needs skilled setup unfamiliar to many electricians. Until AI-assisted auto-calibration standards mature, these technical frictions subtract 2.1 percentage points from the wireless occupancy sensors market CAGR.

Other drivers and restraints analyzed in the detailed report include:

- Battery-Free Energy-Harvesting Sensors

- Hybrid-Work Demand for Space Analytics

- Data-Privacy & Cybersecurity Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passive Infrared maintained 46% share in 2024 thanks to low cost and maturity, positioning it as the volume anchor of the wireless occupancy sensors market. Dual-Tech devices that blend PIR and ultrasonic signals are projected to post a 20.5% CAGR as users demand higher precision in air-conditioned open offices. Ultrasonic standalone sensors hold the runner-up slot where stable temperatures favor sound-based motion detection. mmWave radar attracts healthcare, airport, and premium office buyers that need sub-second presence confirmation for critical lighting and HVAC decisions. Computer-vision and acoustic variants remain niche yet gain attention for people-counting accuracy in retail analytics.

Vendor roadmaps increasingly bundle AI fusion engines that learn environmental patterns to slash false positives, improving confidence in the wireless occupancy sensors market. Aqara's FP300 combines dual PIR, mmWave, temperature, humidity, and illuminance sensing to feed command data into Matter networks. Such platforms use over-the-air updates, protecting investment as algorithms evolve. While BOM costs rise, lifecycle savings from reduced callbacks justify the premium, setting the stage for larger enterprise rollouts.

Lighting Control retained 59% revenue dominance in 2024, benefiting from decades of code-driven deployment in commercial fit-outs. Yet HVAC & Ventilation is forecast to expand at a 19% CAGR, as occupancy data proves essential for right-sizing airflow to post-pandemic indoor-air-quality standards. Security & Surveillance uses sensors for alarm arming and egress path lighting, offering cross-budget synergies. The highest value accrues to Space-Utilization Analytics, where advanced counting functions enable rent optimization in premium real estate.

Honeywell's Forge Sustainability+ illustrates how occupancy-tuned HVAC can reduce fan energy by 40% while maintaining comfort, unlocking new ROI levers for the wireless occupancy sensors market size tied to energy contracts. Vendors package cloud dashboards that monetize data subscriptions beyond hardware margins. Asset-tracking overlays use the same infrastructure, giving facility managers a multi-service platform that widens TAM without extra capex.

The Wireless Occupancy Sensors Market Report is Segmented by Technology (Passive Infrared, Ultrasonic, Dual Tech, and More), Application (Lighting Control, HVAC & Ventilation, Security & Surveillance, and More), Building Type (Residential, Commercial, Industrial, and More), Network Connectivity (Zigbee, Bluetooth/BLE, and More), End-User Industry, and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with a 35% revenue share in 2024, powered by ASHRAE 90.1-2019 and Title 24 codes that mandate sensors in virtually all commercial projects. The United States spearheads mmWave radar R&D, with firms such as Novelda delivering ultra-wideband detectors capable of micro-motion tracking for patient-room applications Novelda. Canada's LEED-centric retrofit drive and Mexico's factory expansion sustain regional volume despite occasional trade policy uncertainties. The wireless occupancy sensors market continues to benefit from federal tax incentives for energy-efficient equipment upgrades.

Asia-Pacific is the fastest-growing territory, projected to post a 17.8% CAGR as China's smart-city blueprint and Japan's Zero-Energy-Building targets boost sensor penetration. India's 100-Smart-Cities Mission and widespread 5G rollout create fertile ground for BLE-based installations in commercial towers. South Korea leverages its electronics manufacturing capacity to shorten lead times and reduce system prices, driving adoption in local education and healthcare sectors. Abundant local component supply shields the region from global chip shortages, reinforcing the wireless occupancy sensors market growth trajectory.

Europe benefits from the Energy Performance of Buildings Directive, which enforces periodic performance audits that spur continuous retrofit cycles. Germany excels in industrial automation synergies, while the United Kingdom channels carbon-reduction funds into public-sector retrofit grants. France explores smart-grid-to-building data exchanges that pay buildings for demand-response, making sensors revenue-generating assets instead of compliance costs. GDPR steers buyers toward edge-processed solutions, favoring vendors with on-device analytics. Together, these factors embed wireless sensors as a foundational element of Europe's decarbonization roadmap.

- Legrand SA

- Schneider Electric SE

- Acuity Brands Inc.

- Eaton Corporation plc

- Leviton Manufacturing Co. Inc.

- Johnson Controls International plc

- Signify N.V.

- Lutron Electronics Co. Inc.

- Honeywell International Inc.

- General Electric Co.

- Hubbell Incorporated

- ABB Ltd.

- Siemens AG

- Texas Instruments Inc.

- Crestron Electronics Inc.

- Enlighted Inc. (Siemens)

- RAB Lighting Inc.

- Autani LLC

- PointGrab Ltd.

- Delta Electronics Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent energy-efficiency mandates

- 4.2.2 Rapid smart-building and IoT adoption

- 4.2.3 Battery-free energy-harvesting sensors

- 4.2.4 Hybrid-work demand for space analytics

- 4.2.5 ESG-linked occupancy-based HVAC contracts

- 4.2.6 AI-enabled mmWave fusion for zero-latency detection

- 4.3 Market Restraints

- 4.3.1 False triggering and calibration issues

- 4.3.2 Data-privacy and cybersecurity concerns

- 4.3.3 RF congestion in dense IoT deployments

- 4.3.4 Battery-disposal compliance costs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Passive Infrared (PIR)

- 5.1.2 Ultrasonic

- 5.1.3 Dual Tech (PIR + Ultrasonic)

- 5.1.4 Microwave / mmWave Radar

- 5.1.5 Other Technologies

- 5.2 By Application

- 5.2.1 Lighting Control

- 5.2.2 HVAC and Ventilation

- 5.2.3 Security and Surveillance

- 5.2.4 Space-Utilization Analytics

- 5.2.5 Other Applications

- 5.3 By Building Type

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

- 5.3.4 Public and Institutional

- 5.4 By Network Connectivity

- 5.4.1 Zigbee

- 5.4.2 Bluetooth / BLE

- 5.4.3 Wi-Fi

- 5.4.4 EnOcean (Energy-Harvesting)

- 5.4.5 LoRa and Other LPWAN

- 5.5 By End-User Industry

- 5.5.1 Smart Buildings

- 5.5.2 Healthcare Facilities

- 5.5.3 Manufacturing

- 5.5.4 Aerospace and Defense

- 5.5.5 Consumer Electronics and Smart Home

- 5.5.6 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 Middle East

- 5.6.4.1 Israel

- 5.6.4.2 Saudi Arabia

- 5.6.4.3 United Arab Emirates

- 5.6.4.4 Turkey

- 5.6.4.5 Rest of Middle East

- 5.6.5 Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Egypt

- 5.6.5.3 Rest of Africa

- 5.6.6 South America

- 5.6.6.1 Brazil

- 5.6.6.2 Argentina

- 5.6.6.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Legrand SA

- 6.4.2 Schneider Electric SE

- 6.4.3 Acuity Brands Inc.

- 6.4.4 Eaton Corporation plc

- 6.4.5 Leviton Manufacturing Co. Inc.

- 6.4.6 Johnson Controls International plc

- 6.4.7 Signify N.V.

- 6.4.8 Lutron Electronics Co. Inc.

- 6.4.9 Honeywell International Inc.

- 6.4.10 General Electric Co.

- 6.4.11 Hubbell Incorporated

- 6.4.12 ABB Ltd.

- 6.4.13 Siemens AG

- 6.4.14 Texas Instruments Inc.

- 6.4.15 Crestron Electronics Inc.

- 6.4.16 Enlighted Inc. (Siemens)

- 6.4.17 RAB Lighting Inc.

- 6.4.18 Autani LLC

- 6.4.19 PointGrab Ltd.

- 6.4.20 Delta Electronics Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment