|

市场调查报告书

商品编码

1851501

人体感应器:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Occupancy Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

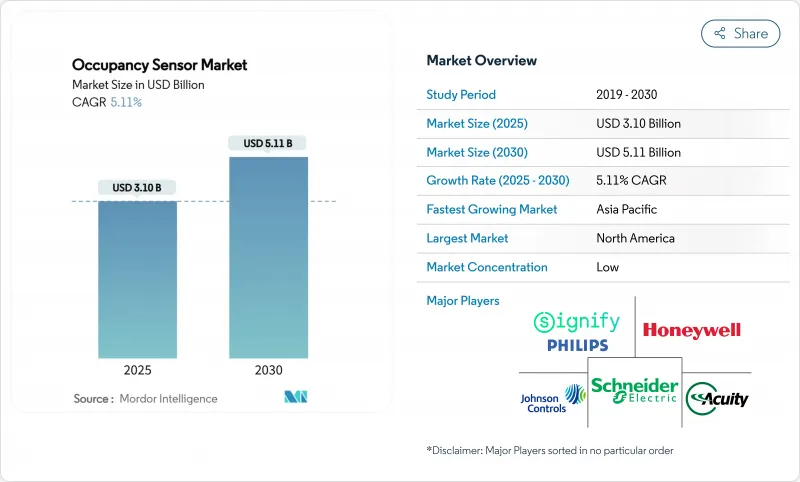

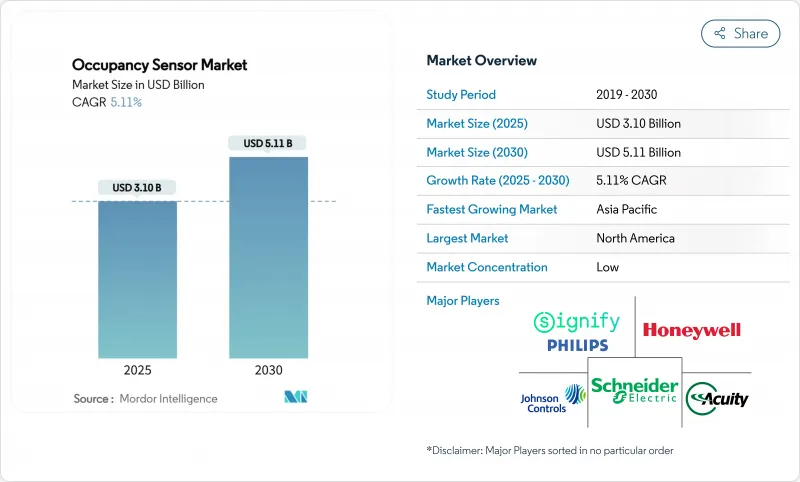

据估计,2025 年人体占用感测器市场规模为 31 亿美元,预计到 2030 年将达到 51.1 亿美元,预测期(2025-2030 年)复合年增长率为 5.11%。

美国和欧盟日益严格的净零排放建筑规范、中国的双碳蓝图以及不断扩大的医疗保健合规计划,正将人员占用检测从一项可有可无的节能措施转变为一项法律要求。企业需求正从试点部署转向系统性部署,将感测器与楼宇管理平台整合。商业房地产所有者现在优先考虑数据分析,以优化空间利用率和暖通空调负荷,而随着智慧家庭的普及,住宅用户采用率也在加速成长。科技融合的趋势显而易见。由于可靠性,有线网路仍占据62%的部署份额,但随着网状通讯协定的成熟,无线节点正以12.4%的复合年增长率快速发展。

全球人体感应器市场趋势与洞察

美国和欧盟的净零能耗建筑标准日益严格,强制要求根据居住者自动关闭能源供应。

加州第24号法规强制要求安装运作感应装置,以便在人员离开后20分钟内关闭插座和通风系统;而2021年国际节能规范则强制要求在密闭空间内安装自动控制装置。欧洲的维修计画旨在2030年改造3500万栋建筑,这些计画与上述法规相呼应,使得合规性而非节能成为主要的实施驱动因素。因此,商业建筑业主选择在施工图中预先整合感测器,而不是在施工完成后加装。这种趋势推动了对整个人体感应器市场更高的基准需求。

中国的双碳蓝图推动智慧照明物联网发展

中国力争在2030年前实现碳排放达峰,并在2060年前实现碳中和,这一目标正推动智慧建筑维修,并朝着基于感测器的自动化方向发展。一项公共部门案例研究显示,透过照明系统进行物联网改造,并利用运动侦测技术,节能超过20%。由于区域差异,软硬体一体化的承包工程方案将比组件销售更具优势,尤其是在预算和技术水平更为均衡的一线城市。

2.4GHz网状网路中的射频拥塞和电池消耗

在无线电环境良好的情况下,承载 192 个节点的 Zigbee 网路可以保持 200 毫秒以下的延迟,但当 Wi-Fi 频道重迭时,封包遗失会急剧上升。频繁的重传会缩短附扣电池的寿命,并增加电池供电设备的维护成本。这使得楼宇业主在部署频率规划工具之前,不愿意将关键负载迁移到无线网路。

细分市场分析

到2024年,有线产品将占全球收入的62%,巩固其在人体感应器市场核心楼宇系统中的领先地位。以乙太网路为基础位寻址网路为新商业建筑的照明和暖通空调控制提供支持,因为设施管理人员优先考虑的是抗干扰能力和便捷的配电方式。无线节点在维修专案中越来越受欢迎,尤其是在导线管空间有限的情况下,无线节点可以减少安装工作量,预计到2030年,网状网路产品的复合年增长率将达到12.4%。混合设计也正在兴起,它透过有线主干网为PoE设备供电,同时在建筑週边部署Thread或Zigbee感测器,从而兼顾可靠性和灵活性。

无线技术的成长将由通讯协定融合驱动。 Matter-over-Thread 技术消除了领先厂商锁定,像 Aqara 这样的厂商已经发布了可在苹果、亚马逊和谷歌生态系统中自动性能验证的人体存在感测器。飞利浦 Hue 展示了软体更新,使灯泡能够兼作动作感测器,预示着一种架构的出现:每个照明设备都成为资料节点。这模糊了连接类别之间的界限,并扩大了照明设备的可寻址范围。

被动红外线技术将在2024年占据50%的市场份额,进一步巩固其在人体感应器市场的成本优势。将被动红外线技术与超音波或毫米波雷达结合,可以侦测到细微的移动或静止的人员。德克萨斯的AWRL6844雷达可将每个节点的成本降低20美元,从而扩大其在高阶设施以外的应用范围。

人工智慧赋能的边缘处理技术透过学习特定场所的居住模式来减少误报。博世感测器技术公司计划在2030年推出100亿个智慧感测器,其中90%将配备片上人工智慧引擎,用于提取原始波形。此类市场发展将提升组件价值,并增强占用感测器市场的平台黏着度。

区域分析

北美将在2024年占据最大的收入份额。由于美国将主导市场需求。加拿大的情况也类似,漫长的供暖季推动了居住者供暖需求的强劲成长。持续进行的维修工程与城市中心高密度的2.4 GHz频谱资源竞争,促使人们采用混合部署模式,将有线骨干网路与Sub-GHz频段的无线网路结合。

欧洲的「建筑翻新浪潮」计画旨在2030年翻新3,500万栋建筑,目前进展强劲。德国、英国和法国已颁布国家建筑规范,纳入了由人员占用触发的照明和通风系统关闭功能。 GDPR合规性将增加成本并减缓人工智慧分析的部署,但提供本地资料处理的平台供应商将有助于缓解这些障碍。无线通讯协定的分散迫使整合商依赖多重通讯协定网关,虽然增加了系统复杂性,但也提高了占用感测器市场的业务收益。

到2030年,亚太地区将维持最快的复合年增长率。中国的双碳政策正在加速智慧建筑的推广,尤其是在一线城市,公共部门计划在安装感测器后可实现20%的节能效果。日本和韩国优先采用结合毫米波和人工智慧的高端解决方案,以优化舒适度。虽然经济实惠的被动红外线感测器节点在印度和东南亚占据主导地位,但班加罗尔和新加坡的商业办公园区正在采用符合全球企业ESG目标的平台架构。这种多样性为人体感应器市场的供应商提供了多种切入点。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 美国收紧净零能耗建筑标准;欧盟强制执行基于居住者的断电措施

- 新冠疫情后办公大楼快速翻维修(北美和欧盟)

- 中国的双碳蓝图推动智慧照明发展

- 物联网主导的空间利用分析和提高销售

- CMS 和 MDR 中的医疗保健床位占用计划

- 多感测器晶片组成本下降,为暖通空调OEM渠道打开了大门。

- 市场限制

- 2.4GHz网状网路中的射频拥塞和电池消耗

- 热点资料中心发生误报事件

- 无线标准碎片化阻碍了欧盟的维修

- 人工智慧人员分析的 GDPR/CCPA 合规成本

- 价值/供应链分析

- 监理展望

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 技术概览

- 投资分析

第五章 市场规模与成长预测

- 透过网路连线

- 有线

- 无线的

- Wi-Fi

- ZigBee

- Z-Wave

- 透过技术

- 被动红外线(PIR)

- 超音波

- 微波

- 双技术/多技术(例如 PIR+毫米波)

- 毫米波/调频连续波雷达

- 按安装类型

- 植入式

- 壁挂式

- 办公桌/一体式家具

- 嵌入式/嵌入式照明灯具

- 按安装类型

- 改装

- 新建工程

- 依建筑类型

- 住宅

- 商业的

- 工业/仓库

- 医疗保健和生活协助

- 政府与教育

- 透过使用

- 照明控制

- 空调和通风

- 安全与监控

- 人口统计和空间利用

- 床位/卫浴占用情形监测

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 北欧国家(瑞典、挪威、丹麦、芬兰)

- 其他欧洲地区

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 亚太其他地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Signify(Philips Lighting)

- Honeywell International Inc.

- Schneider Electric SE

- Johnson Controls International plc

- Legrand SA

- Eaton Corporation plc

- Acuity Brands, Inc.

- Leviton Manufacturing Co., Inc.

- Lutron Electronics Co., Inc.

- Hubbell Incorporated

- Siemens AG(Enlighted)

- Texas Instruments Incorporated

- Panasonic Corporation

- Bosch Sensortec GmbH

- Omron Corporation

- Delta Electronics, Inc.

- RAB Lighting Inc.

- SensorWorx(BEL Products)

- Stanley Black and Decker(STANLEY Security)

- OccupEye Ltd

- Pammvi Group

- General Electric Co.

第七章 市场机会与未来展望

The Occupancy Sensor Market size is estimated at USD 3.10 billion in 2025, and is expected to reach USD 5.11 billion by 2030, at a CAGR of 5.11% during the forecast period (2025-2030).

Stricter net-zero building codes in the United States and European Union, China's dual-carbon roadmap, and expanding healthcare compliance programs are turning occupancy detection from a discretionary energy-savings measure into a legal requirement f-t.com. Corporate demand has shifted from trial deployments to systematic roll-outs that integrate sensors with building management platforms. Commercial property owners now prioritize data analytics that optimize space utilization and HVAC loads, while residential adoption gains pace as smart homes become mainstream. Technology convergence is visible: wired networks still command 62% of deployments for reliability, yet wireless nodes are advancing at a 12.4% CAGR as mesh protocols mature.

Global Occupancy Sensor Market Trends and Insights

Stricter net-zero building codes in U.S./EU mandating occupancy-based shut-off

California's Title 24 now requires occupancy sensing for receptacle and ventilation shut-off within 20 minutes of vacancy, while the 2021 International Energy Conservation Code mandates automatic controls in enclosed spaces. European renovation programs targeting 35 million buildings by 2030 echo these rules, making compliance rather than energy savings the primary adoption trigger. Commercial owners therefore embed sensors in construction documents rather than adding them post-build. This dynamic lifts baseline demand across the occupancy sensor market.

China dual-carbon roadmap boosting smart lighting IoT

China's goal of a 2030 carbon peak and 2060 neutrality propels smart building retrofits that favor sensor-based automation. Case studies in public institutions show energy savings above 20% after IoT lighting overhauls that rely on motion detection. Provincial disparity means turnkey packages that combine hardware and software succeed better than component sales, especially in tier-1 cities where budgets and technical skills align.

RF congestion & battery drain in 2.4 GHz mesh networks

Zigbee networks carrying 192 nodes keep sub-200 ms latency under clean radio conditions, yet packet loss rises sharply when Wi-Fi channels overlap. Frequent retransmits shorten coin-cell lifespan, raising maintenance costs for battery-powered devices. Building owners therefore hesitate to shift critical loads to wireless unless spectrum planning tools are in place.

Other drivers and restraints analyzed in the detailed report include:

- IoT-driven space utilization analytics upselling sensors

- Healthcare bed-occupancy programs under CMS & MDR

- False-positive events in high-heat data centers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The wired category accounted for 62% of global 2024 revenues, confirming its central role in core building systems within the occupancy sensor market. Facility managers value immunity to radio interference and easier power delivery, so Ethernet-based digital addressable networks anchor lighting and HVAC controls in new commercial construction. Retrofit environments with limited conduit space lean toward wireless nodes that reduce installation labor, which explains the 12.4% CAGR forecast for mesh-based products through 2030. Hybrid designs are emerging: a wired backbone feeds PoE luminaires while Thread or Zigbee sensors populate the periphery, balancing reliability and flexibility.

Wireless growth is driven by protocol convergence. Matter-over-Thread eliminates prior vendor lock-in, and vendors like Aqara released presence sensors that self-commission across Apple, Amazon, and Google ecosystems. Philips Hue demonstrated a software update that lets light bulbs double as motion sensors, hinting at an architecture where every luminaire becomes a data node. This blurs the lines between connectivity classes and broadens addressable installations for the

Passive infrared achieved a 50% share in 2024, reinforcing its cost advantage inside the occupancy sensor market. Demand for higher fidelity propels dual-technology modules at a 13.3% CAGR, combining PIR with ultrasonic or mmWave radar to catch minor movements and stationary occupants. Texas Instruments' AWRL6844 radar lowers per-node cost by USD 20, expanding adoption beyond premium installations.

AI-enabled edge processing reduces nuisance alarms by learning site-specific occupancy patterns. Bosch Sensortec targets 10 billion intelligent sensors by 2030, with 90% embedding AI engines that distill raw waveforms on-chip. These developments increase bill-of-material value and reinforce platform stickiness inside the occupancy sensor market.

The Occupancy Sensor Market Report is Segmented by Network Connectivity (Wired, Wireless), Technology (Passive Infrared (PIR), Ultrasonic, Microwave, and More), Mounting Type (Ceiling-Mounted, Wall-Mounted, and More), Installation Type (Retrofit, New Construction), Building Type (Residential, Commercial, Industrial & Warehousing, and More), Application, and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held the largest revenue share in 2024. The United States anchors demand with Title 24 and the 2021 IECC requiring automated shut-off across commercial spaces. Canada follows similar patterns and shows strong interest in occupancy-based heating due to long heating seasons. Ongoing retrofits contend with dense 2.4 GHz spectrum in urban cores, driving hybrid deployments that mix wired backbones and sub-GHz wireless.

Europe registers solid growth under the Renovation Wave program that targets 35 million buildings by 2030. Germany, the United Kingdom, and France institute national building codes that embed occupancy-triggered lighting and ventilation cut-offs. GDPR compliance adds cost and slows AI analytics roll-outs, yet platform vendors that offer on-premise data processing mitigate these barriers. Fragmented wireless protocols force integrators to rely on multiprotocol gateways, elevating system complexity but also boosting services revenue inside the occupancy sensor market.

Asia-Pacific records the fastest CAGR to 2030. China's dual-carbon policy accelerates smart building mandates, especially in tier-1 metros where public-sector projects showcase 20% energy reduction after sensor installations. Japan and South Korea emphasize premium solutions that pair mmWave with AI for comfort optimization. In India and Southeast Asia, cost-efficient PIR nodes dominate, yet commercial office parks in Bengaluru and Singapore adopt platform architectures that align with global corporate ESG goals. This heterogeneity offers multi-tiered entry points for vendors across the occupancy sensor market.

- Signify (Philips Lighting)

- Honeywell International Inc.

- Schneider Electric SE

- Johnson Controls International plc

- Legrand S.A.

- Eaton Corporation plc

- Acuity Brands, Inc.

- Leviton Manufacturing Co., Inc.

- Lutron Electronics Co., Inc.

- Hubbell Incorporated

- Siemens AG (Enlighted)

- Texas Instruments Incorporated

- Panasonic Corporation

- Bosch Sensortec GmbH

- Omron Corporation

- Delta Electronics, Inc.

- RAB Lighting Inc.

- SensorWorx (B.E.L. Products)

- Stanley Black and Decker (STANLEY Security)

- OccupEye Ltd

- Pammvi Group

- General Electric Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stricter Net-Zero Building Codes in U.S./EU Mandating Occupancy-Based Shut-off

- 4.2.2 Rapid Retrofit Wave of Post-COVID Office Stock (NA and EU)

- 4.2.3 China Dual-Carbon Roadmap Boosting Smart Lighting

- 4.2.4 IoT-Driven Space Utilization Analytics Upselling Sensors

- 4.2.5 Healthcare Bed-Occupancy Programs Under CMS and MDR

- 4.2.6 Multi-Sensor Chipset Cost Decline Opening HVAC OEM Channel

- 4.3 Market Restraints

- 4.3.1 RF Congestion and Battery Drain in 2.4 GHz Mesh Networks

- 4.3.2 False-Positive Events in High-Heat Data Centers

- 4.3.3 Fragmented Wireless Standards Hindering EU Retrofits

- 4.3.4 GDPR/CCPA Compliance Cost for AI People Analytics

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Technology Snapshot

- 4.9 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Network Connectivity

- 5.1.1 Wired

- 5.1.2 Wireless

- 5.1.2.1 Wi-Fi

- 5.1.2.2 Zigbee

- 5.1.2.3 Z-Wave

- 5.2 By Technology

- 5.2.1 Passive Infrared (PIR)

- 5.2.2 Ultrasonic

- 5.2.3 Microwave

- 5.2.4 Dual / Multi-Technology (PIR + mmWave, etc.)

- 5.2.5 mmWave / FMCW Radar

- 5.3 By Mounting Type

- 5.3.1 Ceiling-Mounted

- 5.3.2 Wall-Mounted

- 5.3.3 Desk / Furniture-Integrated

- 5.3.4 In-Fixture / Embedded Luminaire

- 5.4 By Installation Type

- 5.4.1 Retrofit

- 5.4.2 New Construction

- 5.5 By Building Type

- 5.5.1 Residential

- 5.5.2 Commercial

- 5.5.3 Industrial and Warehousing

- 5.5.4 Healthcare and Assisted Living

- 5.5.5 Government and Education

- 5.6 By Application

- 5.6.1 Lighting Control

- 5.6.2 HVAC and Ventilation

- 5.6.3 Security and Surveillance

- 5.6.4 People Counting and Space Utilization

- 5.6.5 Bed / Restroom Occupancy Monitoring

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 United Kingdom

- 5.7.3.2 Germany

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Nordics (Sweden, Norway, Denmark, Finland)

- 5.7.3.6 Rest of Europe

- 5.7.4 Middle East

- 5.7.4.1 Saudi Arabia

- 5.7.4.2 UAE

- 5.7.4.3 Turkey

- 5.7.4.4 Rest of Middle East

- 5.7.5 Africa

- 5.7.5.1 South Africa

- 5.7.5.2 Nigeria

- 5.7.5.3 Rest of Africa

- 5.7.6 Asia-Pacific

- 5.7.6.1 China

- 5.7.6.2 Japan

- 5.7.6.3 India

- 5.7.6.4 South Korea

- 5.7.6.5 Australia

- 5.7.6.6 Rest of Asia-Pacific

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Signify (Philips Lighting)

- 6.4.2 Honeywell International Inc.

- 6.4.3 Schneider Electric SE

- 6.4.4 Johnson Controls International plc

- 6.4.5 Legrand S.A.

- 6.4.6 Eaton Corporation plc

- 6.4.7 Acuity Brands, Inc.

- 6.4.8 Leviton Manufacturing Co., Inc.

- 6.4.9 Lutron Electronics Co., Inc.

- 6.4.10 Hubbell Incorporated

- 6.4.11 Siemens AG (Enlighted)

- 6.4.12 Texas Instruments Incorporated

- 6.4.13 Panasonic Corporation

- 6.4.14 Bosch Sensortec GmbH

- 6.4.15 Omron Corporation

- 6.4.16 Delta Electronics, Inc.

- 6.4.17 RAB Lighting Inc.

- 6.4.18 SensorWorx (B.E.L. Products)

- 6.4.19 Stanley Black and Decker (STANLEY Security)

- 6.4.20 OccupEye Ltd

- 6.4.21 Pammvi Group

- 6.4.22 General Electric Co.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment