|

市场调查报告书

商品编码

1627186

德国塑胶包装:市场占有率分析、产业趋势、成长预测(2025-2030)Germany Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

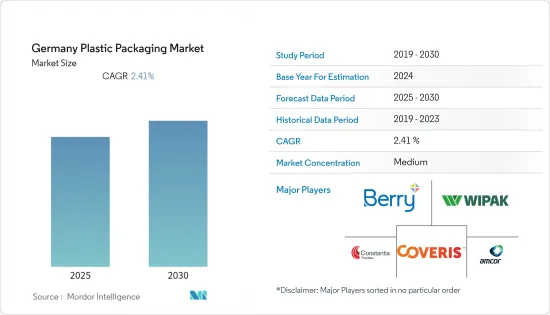

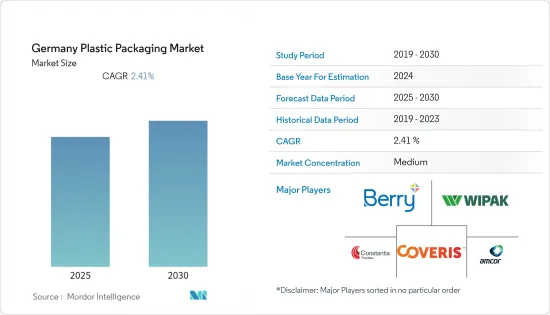

德国塑胶包装市场预计在预测期内复合年增长率为2.41%

主要亮点

- 在德国,由于解决方案供应商和各种最终用户的多项发展,塑胶包装解决方案的采用正在增加。德国製造「典型的消费者对产品的认知为该地区的塑胶包装公司提供了更好的表现场地。德国政府针对德国的塑胶包装行业出台了一些严格的法规。德国包装方法包括包装设计的回收、可回收政府的目标是到去年可再生63% 的塑胶包装,高于 2018 年的 40%。

- 塑胶容器已成为各种最终用户行业的必需品。新的填充技术和耐热包装材料的出现为市场带来了新的可能性和选择。儘管宝特瓶已成为多个领域的标准瓶,但饮料、化妆品、卫生用品和清洁剂主要以聚乙烯 (PE) 瓶销售。

- 此外,多位德国研究人员在捷克共和国的一次会议上召开会议讨论此类问题。水分渗透是影响产品品质的通用问题之一。一种更准确、可重复的方法来确定包装在防潮方面的有效性将使整个行业受益。因此,USP 最近修订了其包装和水分渗透章节(USP 通则容器 - 性能测试),纳入了测量高阻隔和低阻隔药品包装水分渗透的新方法。包装,仅限于“封闭”和“密封”容器。

- 在过去的十年中,公众对塑胶使用有害影响的认识迅速提高。政府所进行的一系列公共宣传活动和措施提高了公众的意识。因此,近年来塑胶包装的消费受到了显着的影响。

- 德国冷冻包装产业的成长预计将对市场产生积极影响。例如,根据欧洲冷冻食品的数据,德国、法国和英国占了欧洲冷冻食品市场50%以上的份额。由于 COVID-19 大流行,政府实施的封锁有助于许多地区冷冻食品的销售,对市场产生了积极影响。大流行后,由于送餐宅配服务的增加,市场出现成长。

德国塑胶包装市场趋势

环保包装和再生塑胶的增加推动市场

- 近年来,德国塑胶包装产业经历了多次变革,监管也日益严格。德国包装方法及其配额主要影响分发包装的包装製造商,这些包装製造商现在需要向中央机构註册。该法案第 21 条还要求包装设计考虑回收、可回收性以及回收和可再生材料的使用。去年,政府的目标是将塑胶包装的回收率从2018年的40%提高到63%。

- 根据欧盟指令,到 2025 年,欧盟一半的塑胶包装必须回收。到2030年,这一比例将上升至55%。德国塑胶包装产业更进一步,目标是到2025年使90%的家用塑胶包装可回收或可重复使用。集中回收可以生产用于新包装的高品质二次原料。

- 这迫使市场供应商进行创新并创建循环解决方案。去年3月,Alpla集团宣布将把德国宝特瓶的回收量增加到每年7.5万吨。在此之前,双方已达成协议,从 FROMM 集团收购回收公司 Texplast,并收购合资企业 PET Recycling Team Wolfen 的所有股份。随着欧洲品牌为日益严格的循环经济法规做准备,PET 回收需求旺盛。欧盟一次性塑胶指令要求到 2029 年,塑胶饮料瓶的回收率达到 90%,从 2025 年起, 宝特瓶的回收塑胶含量至少达到25%,并要求从2030 年起,所有饮料瓶的回收率达到90%。

- 去年二月,可口可乐德国公司更换了一次性宝特瓶的瓶盖,以改善回收。欧盟各地的消费者很快就会看到新的瓶盖,即使在打开后也能牢固地固定在瓶子上。德国可口可乐是首批采用欧盟 2024 年可回收期限的公司之一。整个欧洲正在采取转变,以减少废物并提高回收率。可口可乐也利用新瓶盖的过渡来减少德国各地瓶子的材料使用。改良后的瓶盖每瓶可节省 1.37 克塑胶。这反过来将支持可口可乐在德国的永续发展倡议。

- 此外,塑胶製品产生的收益逐年增加。根据德国联邦统计局预测,到2025年,德国塑胶製品製造业的收益预计将达到约1,043.8亿美元。

饮料预计将占据主要市场占有率

- 果汁、酒精饮料和代餐奶昔等饮料越来越多地采用软质塑胶包装解决方案。各种饮料包装对立式袋和带嘴袋的需求正在增加。

- 然而,饮料品质受到 pH 值、储存温度、压力和污染物存在的影响。其水准的变化可以改变消费量。为了消除氧化的可能性,越来越多的公司开始转向具有阻隔性(热、湿气、细菌)等特性的软包装产品。

- 快速采用轻质包装材料的趋势,以及降低生产、运输和处理成本的趋势,正在推动饮料用软质塑胶包装的发展。此外,以视觉包装趋势为重点的电子商务的兴起正在推动需求。

- 此外,2021年5月,德国联邦议院大多数议员核准了《德国包装方法》修正案。内容是延长去年1月开始实施的PET果汁瓶强制押金规定。这些措施促进了循环经济。

- 此外,该地区对碳酸饮料和矿泉水的需求多年来一直在稳步增长。例如,根据德国统计局的数据,2020年和2021年德国饮料业(包括啤酒、烈酒、葡萄酒、气泡酒、非酒精软性饮料和矿泉水)价值约为212.9亿欧元(232亿欧元),分别为212 亿收益(231 亿美元)。 宝特瓶比其他包装具有优势,因为它们有 200 毫升以上的大尺寸可供选择,并且用途广泛。

德国塑胶包装产业概况

由于德国地区对塑胶包装的需求显着增加,市场适度细分,Amcor、Coveris Holding、Berry Global、Sealed Air Corporation 和 Constantia Flex等主要企业进入市场。市场参与企业正在采取联盟和收购等策略来加强其产品供应并获得可持续的竞争优势。

- 2022 年 5 月:Coveris 在德国纽伦堡举行的欧洲领先包装盛会 FachPack 2022 上宣布了乳製品包装领域的新产品开发,同时在英国成功推出了一系列产品。 Coveris 将在本次活动中提供各种包装材料,从阻隔膜到预製包装、可剥离盖膜到可再剥离盖膜和热成型膜,提供永续性、减重、视觉吸引力和保质期。截止日期保护之类的需求。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 更多采用轻量化包装方法

- 增加环保包装和再生塑料

- 市场问题

- 原料(塑胶树脂)价格上涨

- 政府法规和环境问题

第六章 COVID-19 对市场的影响

第七章 市场区隔

- 按包装类型

- 硬质塑胶包装

- 软质塑胶包装

- 按行业分类

- 食物

- 饮料

- 医疗保健

- 个人护理和家居产品

- 其他的

- 依产品类型

- 瓶罐

- 能

- 小袋

- 托盘/容器

- 薄膜包装

- 其他的

第八章 竞争格局

- 公司简介

- Amcor Plc

- Coveris Holding

- Berry Global

- Constantia Flexibles

- Wipak UK Ltd.

- Sonoco Products Company

- Sealed Air Corporation

- National Flexible

- Tetra Laval

- Silgan Holdings

第九章投资分析

第10章市场的未来

简介目录

Product Code: 50507

The Germany Plastic Packaging Market is expected to register a CAGR of 2.41% during the forecast period.

Key Highlights

- Germany is increasingly adopting plastic packaging solutions, owing to the several developments in the country by the solution providers and different end users. The typical consumer perception of 'Made in Germany' goods provided a better performance space for the plastic packaging companies in the region. The government of Germany introduced several stringent regulations for the plastics packaging industry in Germany. The German Packaging Law requires packaging design for recycling, recyclability, and using recyclable and renewable materials. The government aims to recycle 63% of plastic packaging by the last year, up from 40% in 2018. Such measures are expected to profoundly impact the studied market in the envisaged timeline.

- Plastic containers are becoming essential in various end-user industries. New filling technologies and the emergence of heat-resistant packaging material opened up new possibilities and options in the market. While PET bottles are standard in multiple segments, beverages, cosmetics, sanitary products, and detergents are predominantly sold in polyethylene (PE) bottles.

- Furthermore, various German researchers held a meeting at the Czech Republic conference for such an issue discussion. Moisture permeation is one of the common challenges that can impact product quality. A more accurate and reproducible method to determine how effective the packaging is at keeping moisture out would benefit the industry. Accordingly, USP recently revised the packaging and moisture permeation chapters (USP General Chapter Containers-Performance Testing) to include a new method for determining moisture permeation for high and low-barrier pharmaceutical packaging. USP is also considering changing the USP classification system for the packaging, which is limited so far to 'well-closed,' 'tight,' and 'hermetic' containers.

- Since the past decade, awareness among the population regarding the harmful effects of plastic usage is growing drastically. Many public campaigns and initiatives by governments have resulted in increased awareness among the public. Thus, the consumption of plastic packaging witnessed a significant impact in the past few years.

- The growth of the frozen packaged industry across Germany is expected to impact the market positively. For instance, according to Frozen Food Europe, Germany, France, and the United Kingdom account for more than 50% of the frozen food market in Europe. The government-mandated lockdown due to the COVID-19 pandemic aided frozen food sales in many regions and thus impacted the market positively. After the pandemic, the market grew with increased food delivery services.

Germany Plastic Packaging Market Trends

Increased Eco-Friendly Packaging and Recycled Plastic Driving the Market

- Recent years have brought several changes and more stringent regulations for the plastics packaging industry in Germany. The German Packaging Law and its quotas mainly affect packaging manufacturers that carry packs into circulation, and they now must register with a centralized authority. Paragraph 21 of the law also requires packaging design for recycling, recyclability, and using recyclates and renewable materials. The government aimed to recycle 63% of plastic packaging last year, up from 40% in 2018.

- Under an EU directive, half of all plastic packaging in the EU should be recycled by 2025. It shall rise to 55% by 2030. The German plastic packaging industry is going a step further and set itself the target of making 90% of household plastic packaging recyclable or reusable by 2025. Focused recycling can produce high-quality secondary raw materials for new packaging.

- It compelled market vendors to produce circular solutions along with innovations. In March last year, AlplaGroup announced that it would increase its annual recycling volume in Germany to 75,000 tons of PET bottles. It is after agreeing to acquire recycling company Texplastfrom the FROMM Group and all of its shares in the joint venture PET Recycling Team Wolfen. PET recyclate is in hot demand as European brands prepare for increasingly stringent circular economy regulations. The EU's Single-Use Plastics Directive imposes a 90% collection rate for plastic beverage bottles by 2029 and a minimum of 25% recycled plastic in PET bottles from 2025, rising to 30% from 2030 in all beverage bottles.

- In February last year, Coca-Cola Germany replaced the cap on its single-use PET bottles to improve recycling. Consumers across the EU would soon see new closures that stay securely connected to the bottle after it opens. Coca-Cola in Germany is one of the early adopters of the EU's 2024 recyclability deadline. Across Europe, a transition is underway to reduce trash and enhance recycling collection rates. Coca-Cola is also using the move to the new caps to lower the material amount used in the bottles overall in Germany. The improved closures could save up to 1.37 grams of plastic per bottle. It, in turn, helps Coca-Cola's sustainability initiatives in Germany.

- Further, the revenue generated by plastic products is increasing yearly. According to Statistisches Bundesamt, the projected revenue of the manufacture of plastic products in Germany would amount to approximately USD 104.38 billion by 2025.

Bevarages is Expected to Hold Major Market Share

- Beverages, including fruit juices, alcoholic drinks, and meal replacement shakes, are increasingly embracing flexible plastic packaging solutions. There is an increasing demand for stand-up and spouted pouches for various beverage packaging.

- However, the beverage quality is affected by pH, storage temperature, pressure, and the presence of contaminants. Changes in the levels can alter beverage consumption. Companies are increasingly employing flexible packaging products with properties such as high barrier resistance (heat, moisture, and bacteria) to eliminate possible oxidation.

- The rapidly adopted trend of lightweight packaging material, alongside the inclination towards reducing production, shipment, and handling costs, is driving the flexible plastic packaging of beverages. Furthermore, the demand is driven by the rise of e-commerce focusing on visually appealing packaging trends.

- Further, in May 2021, most parliamentarians in Germany's Bundestag approved changes to the German Packaging Law. It comprised an extension of the mandatory deposit to include PET juice bottles that came into force as of January last year. Such initiatives would promote a circular economy.

- Moreover, the region also witnessed a steady growth in the demand for carbonated soft drinks and mineral water over the years. For instance, according to Statistisches Bundesamt, in 2020 and 2021, the German beverage industry (comprising beer, distilled spirits, wine, sparkling wine, non-alcoholic soft drinks, and mineral water) generated revenues of approximately EUR 21.29 billion (USD 23.20 billion) and EUR 21.2 billion (USD 23.10 billion), respectively. PET bottles provide an advantage over other packaging as they are available in larger sizes from 200 ml, making them versatile.

Germany Plastic Packaging Industry Overview

As the demand for plastic packaging is increasing significantly in the German region, the market is moderately fragmented, with significant players like Amcor, Coveris Holding, Berry Global, Sealed Air Corporation, and Constantia Flexibles, among others. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- May 2022: With many successful product launches in the UK, Coveris launched its new dairy packaging developments to FachPack 2022 in Nuremberg, Germany, one of Europe's leading packaging events. Coveris offers a variety of packaging materials in the event, from barrier films to pre-made packs, peelable to re-closable lidding films, thermoforming films, and many more, to support market needs for sustainability, weight reduction, visual appeal, and shelf-life protection.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Lightweight-packaging Methods

- 5.1.2 Increased eco-friendly packaging and recycled plastic

- 5.2 Market Challenges

- 5.2.1 High Price of Raw Material (Plastic Resin)

- 5.2.2 Government Regulations & Environmental Concerns

6 IMPACT OF COVID-19 ON THE MARKET

7 MARKET SEGEMENTATION

- 7.1 By Packaging Type

- 7.1.1 Rigid Plastic Packaging

- 7.1.2 Flexible Plastic Packaging

- 7.2 By End-User Vertical

- 7.2.1 Food

- 7.2.2 Beverage

- 7.2.3 Healthcare

- 7.2.4 Personal care and Household

- 7.2.5 Other End-User

- 7.3 By Product Type

- 7.3.1 Bottles and Jars

- 7.3.2 Cans

- 7.3.3 Pouches

- 7.3.4 Trays and containers

- 7.3.5 Films & Wraps

- 7.3.6 Other Product Types

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Amcor Plc

- 8.1.2 Coveris Holding

- 8.1.3 Berry Global

- 8.1.4 Constantia Flexibles

- 8.1.5 Wipak UK Ltd.

- 8.1.6 Sonoco Products Company

- 8.1.7 Sealed Air Corporation

- 8.1.8 National Flexible

- 8.1.9 Tetra Laval

- 8.1.10 Silgan Holdings

9 INVESTMENT ANLAYSIS

10 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219