|

市场调查报告书

商品编码

1627196

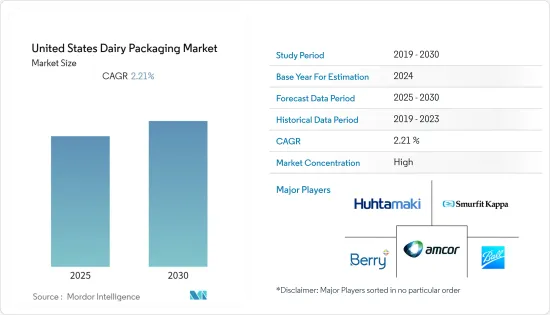

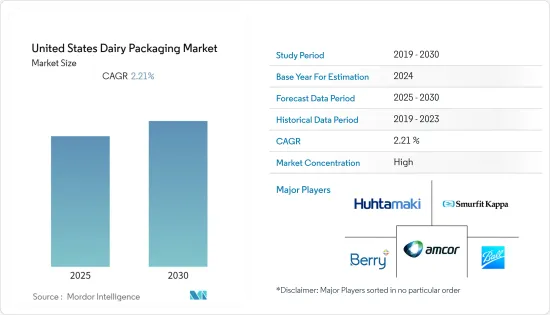

美国乳製品包装:市场占有率分析、产业趋势、产业趋势、成长预测(2025-2030)United States Dairy Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

美国乳製品包装市场预计在预测期内复合年增长率为2.21%

主要亮点

- 包装食品的采用率显着增加,尤其是在年轻人中。此外,由于营养不良引起的健康问题日益增多,对乳製品包装材料的需求也在增加。根据美国农业部经济研究服务处的数据,2021 年有 1,350 万美国家庭(10.2%)面临粮食不安全。此外,随着包装材料在防止污染和杂质方面变得更加重要,国内对产品的需求预计将增加。

- 乳製品易腐烂,必须正确有效地包装以方便储存和运输。由于消费者对小包装的便利性需求不断增加,预计该市场将会成长。由于消费者选择的增加和对新鲜食品的认识的增加、可支配收入的增加和都市化,该国对乳製品包装的需求正在增加。

- 最近的趋势表明,生产商正专注于小批量销售。轻质袋和薄膜通常用于包装起司零食包和饮用优格等产品。包装易于使用和处置。

- 此外,风味乳製品的多样性也成为扩大乳製品包装市场的关键因素。国内食品包装市场的主要趋势包括由于都市化程度的提高、健康意识的提高以及对生鲜食品作为均衡饮食的一部分的需求的增加而导致的各种乳製品的消费。

- 然而,消费者和生产商担心塑胶和其他非生物分解的包装材料的有害后果。因此,公司正在转向环保、生物分解性的包装。此外,预计环境立法将因温室气体排放抑制乳製品的成长。在该国的一些地区,酪农企业的气体排放占总排放的很大一部分。如果相关规则发生变化,酪农生产可能会受到影响。美国EPA(环保署)实施了严格的法规来减少碳气体排放。

- COVID-19 大流行对美国各地的乳製品包装行业产生了负面影响。广泛的封锁限制损害了酪农行业的供应网络,并导致该国许多地区原乳资源的严重浪费。这在短期内影响了包装需求。

- 此外,食品服务业受到严格的监管,减少了对乳製品的需求并影响了乳製品包装行业。受疫情影响,乳製品糖果零食、优格和冰淇淋的需求大幅下降,包装供应链受到限制。由于对疫情潜在经济影响的担忧持续存在,市场预计将逐渐復苏。此外,俄罗斯和乌克兰之间的战争正在影响整个包装生态系统。

美国乳製品包装市场趋势

消费者对蛋白质产品的偏好日益增长

- 由于全国范围内注重健康的顾客和健身设施的增加,市场正在扩大。由于千禧世代对透过均衡饮食改善健康的兴趣日益浓厚,以及蛋白质补充品在这一代人中的流行,预计对乳製品蛋白质补充品的需求将会增加。生活方式的改变可能会增加对补充品的依赖,以满足日常营养需求,从而增加对乳製品蛋白质补充品的需求。

- 消费者对蛋白质产品的需求不断增长,加上各种零售通路提供的包装乳製品,提高了全国范围内对乳製品的接受度,预计将增加并推动市场。

- 作为额外的蛋白质来源,由于定期和适当的补充品使用的好处,蛋白质补充品在所有年龄和性别的消费者中越来越受欢迎。在不同文化中,传统饮食中的清洁蛋白质消费量在现代已显着下降。此外,医学相关人员建议人们在日常饮食中加入蛋白质。这些趋势可能为国内乳製品包装供应商创造更多机会。

- 根据食品洞察调查,到 2021 年,大约 62% 的美国消费者表示他们正在尝试定期摄取蛋白质,但世代之间的差异仍然存在。超过三分之二 (70%) 的婴儿潮世代表示他们积极摄取蛋白质,而千禧世代和 X 世代的比例为 55% 和 58%。蛋白质消费的很大一部分正在推动该国乳製品蛋白质包装产品市场的成长。

塑胶细分市场占据主要市场占有率

- 作为包装材料,塑胶结合了灵活性(从薄膜到刚性应用)、强度、重量轻、稳定性和易于灭菌。例如,塑胶食品包装不会影响食品的风味或品质。事实上,塑胶的阻隔性可确保食品保留其原始风味,同时保护食品免受外部污染。

- 除了提供实用的储存和分配选项外,塑胶包装还特别耐湿、耐热和耐冷。由于采用多层塑胶薄膜,生鲜食品的保存期限很长。塑胶包装可以回收、重新用于能源回收,或三者兼具。根据塑胶的类型,堆肥也是一种选择。

- 储存巴氏杀菌牛奶的理想容器是高密度聚苯乙烯(HDPE) 瓶。另一种用于牛奶包装的塑胶是聚对苯二甲酸乙二醇酯(PET)。染料 PET 可以遮光食品,这也有助于保持风味免受光诱导的脂质氧化的影响。此外,饮用优格产品主要以 HDPE 瓶出售,并以 PE-LD 盖或铝箔层压热封盖封闭。也可使用其他塑胶瓶,例如宝特瓶。

- 此外,乳製品对防篡改和防儿童包装的需求不断增长,使得塑胶包装成为首选。随着消费者不断推动优格、奶油和起司等乳製品的保质期更长,塑胶盖、容器和薄膜的市场正在不断增长,因为它们比传统包装具有更好的阻隔性和保质期。要。乳製品製造商专注于产品个人化,以吸引消费者并满足对各种乳製品的需求,这推动了塑胶包装的使用。

- 此外,根据ITC的数据,2021年美国塑胶进口额约为824.6亿美元,比2020年的约623.4亿美元成长32.27%。各行业对塑胶的大量需求可能是进口增加的原因。乳製品包装主要使用软质塑胶硬质塑胶,并且可能是进口塑料的重要用户。

美国乳製品包装产业概况

由于存在几家拥有重要市场占有率的大公司,美国乳製品包装市场高度整合。创新和永续的包装正在帮助许多公司赢得新合约和开发新市场,从而提高市场占有率。该市场的主要企业包括 Huhtamaki Oyj、Berry Global Group Inc.、Amcor PLC、Ball Corporation 和 Smurfit Kappa Group PLC。

- 2022 年 10 月:Icon 是一种 95%可再生、生物基、纸质的冰淇淋容器和盖子包装解决方案,透过 Huhtamaki 推出的纸製品回收计划,在美国各城市实现回收。消费者可以透过扫描包装上的连结二维码了解更多有关环境永续性的资讯。该公司的水性阻隔涂层和永续森林倡议 (SFI) 认证的纸板为客户提供了环保的选择。冰淇淋容器和盖子与纸盒包装等纸製品一起回收。

- 2022 年 5 月:Berry World Group 与美国速食连锁店 Taco Bell 合作,推出一款新型透明全塑胶杯子,其中含有机械回收的消费后树脂 (PCR)。这款 30 盎司的透明聚丙烯 (PP) 杯旨在推广更循环的永续包装方法,并将于今年晚些时候在美国的几家 Taco Bell 商店进行测试。据 Berry World 称,回收的 HDPE 是由食品级材料製成的,例如回收的奶瓶。塔可钟的原始塑胶杯和盖套件经过改造,可减少垃圾掩埋和焚烧的废弃物暴露量,从而减少碳排放。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 消费者对蛋白质产品的偏好日益增长

- 更多采用内部包装方法

- 更多采用细分包装

- 市场限制因素

- 酪农活动的温室气体排放发展成为法律问题

- 全球乳品包装市场概况

第六章 市场细分

- 依材料类型

- 塑胶

- 纸和纸板

- 玻璃

- 金属

- 依产品类型

- 牛奶

- 起司

- 冷冻产品

- 养殖产品

- 其他产品类型

- 按包装类型

- 瓶子

- 小袋

- 纸箱/盒

- 袋子和包装

- 其他包装类型

第七章 竞争格局

- 公司简介

- Huhtamaki Oyj

- Berry Global Group Inc.

- Amcor Plc

- Ball Corporation

- Smurfit Kappa Group PLC

- Altium Packaging LLC(Loews Corporation)

- Polytainers Inc.

- International Paper Company

- Winpak Ltd

- Sealed Air Corporation

- Tetra Pak International SA

第八章投资分析

第九章 市场机会及未来趋势

The United States Dairy Packaging Market is expected to register a CAGR of 2.21% during the forecast period.

Key Highlights

- Especially among the younger population, packaged food items are being adopted at a significantly greater rate. Additionally, the need for dairy packaging materials has grown due to growing health problems caused by malnutrition. In 2021, 13.5 million US households (10.2%) experienced food insecurity, according to the USDA Economic Research Service. Furthermore, it is expected that the increased significance of packaging materials in preventing contamination and adulteration would boost product demand in the country.

- Dairy products must be properly and effectively packaged since they are perishable to make storage and shipping easier. The market is anticipated to grow as a result of rising consumer demand for small packaging due to its convenience. The need for dairy packaging in the country has increased due to growing consumer choice and awareness of fresh foods, rising disposable income, and urbanization.

- A recent trend indicates that producers are concentrating on selling the items in smaller amounts. Lightweight pouches and films are frequently used in the country for packaging goods like snack packs of cheese and drinkable yogurt. This package is simple to use and dispose of.

- Further, the variety of flavored milk products is a significant factor in expanding the dairy packaging market. Major trends in the dairy food packaging market in the country include rising urbanization, increased health consciousness, and consumption of various dairy products due to increased demand for fresh foods as part of a balanced diet.

- However, consumers and producers are concerned about the harmful consequences of plastics and other non-biodegradable packaging materials. As a result, businesses are switching to environmentally friendly and biodegradable packaging options. Additionally, due to greenhouse-gas emissions, environmental legislation is predicted to impede the growth of dairy products. In some regions of the country, gas emissions from dairy operations make up a sizeable portion of all emissions. Any changes to the rules surrounding them might impact dairy output. Strict rules are being implemented by the United States EPA (Environmental Protection Agency) to reduce carbon gas emissions.

- The COVID-19 pandemic negatively impacted the dairy product packaging industry across the nation. Widespread lockdown limitations have harmed dairy sector supply networks, leading to significant milk resource wastage in many regions of the country. Thus, the demand for packaging in the short term has been impacted.

- Additionally, the food service sector has been subject to strict regulations that have reduced the demand for dairy products, impacting the dairy product packaging sector. As a result of the pandemic, demand for dairy-based sweets, yogurt, and ice cream has dropped significantly, which has restricted supply chains for packaging. The market is anticipated to gradually recover as concerns about the pandemic's potential economic effects persist. Further, the Russia-Ukraine war has had an impact on the overall packaging ecosystem.

US Dairy Packaging Market Trends

Increasing Consumer Preference Toward Protein-based Products

- The market is expanding due to the rising number of health-conscious customers and fitness facilities nationwide. Dairy protein supplements are predicted to increase in demand due to the millennial generation's growing interest in improving health via a balanced diet and the popularity of protein supplements among this generation. Due to changing lifestyles, there will be an increased dependence on supplements to meet daily nutritional needs, which would increase demand for protein supplements derived from dairy.

- Growing demand among consumers for protein-based goods, combined with an expansion in the availability of packaged dairy products through various retailing channels, is predicted to raise the acceptance of dairy-based products countrywide and propel the market.

- As an additional source of protein, protein supplements are becoming more and more popular among customers of all ages and genders due to the advantages of regular, appropriate supplement use. Clean protein consumption in traditional diets across cultures has significantly dropped in the modern era. Moreover, medical practitioners advise people to have some protein in their meals throughout the day. These trends would create more opportunities for the country's dairy packaging vendors.

- According to the Food Insights Survey, in 2021, approximately 62% of American consumers stated that they usually make an effort to eat protein, although generational variations persist. Compared to the Millennials and Generation X's 55% and 58%, over two-thirds of Baby Boomers (70%) said they were willing to eat proteins. The significant share of protein consumption drives the country's dairy-based-protein packaging products market's growth.

Plastic Segment to Hold a Significant Market Share

- Plastics combine flexibility (from film to rigid applications), strength, lightweight, stability, and ease of sterilizing as a packing material. For instance, the flavor and quality of food are unaffected by plastic food packaging. In reality, the barrier qualities of plastics guarantee that food retains its original flavor while protecting it against outside contamination.

- In addition to offering practical storage and distribution choices, plastic packaging is particularly resistant to moisture, heat, and cold. Perishable food has a long shelf life because of multi-laminated plastic films. Plastic packaging can be recycled, repurposed for energy recovery, or all three. Composting is another option for some plastic types.

- The ideal container for keeping pasteurized milk is a high-density polyethylene (HDPE) bottle. Another plastic substance utilized for milk packaging is polyethylene terephthalate (PET). Food is shielded from light by pigmented PET, which also aids in preserving flavor against light-induced lipid oxidation. Further, drinking yogurt products are primarily sold in HDPE bottles closed with PE-LD caps or aluminum foil laminate heat-seal closures. Other plastic bottles, such as PET bottles, can also be utilized.

- Moreover, plastic-based packaging is a desirable option for dairy-based goods due to the increased need for tamper-evident and child-resistant packaging. The market for plastic-based lidding, containers, and films is rising as consumers desire dairy goods like yogurt, cream, and cheese to keep longer on the shelf since these items have better barrier qualities and shelf lives than traditional packaging. Dairy product manufacturers emphasize the personalization of goods to engage consumers and satisfy demands for a wide variety of dairy products, which has prompted the use of packaging made of plastic.

- Further, according to ITC, in 2021, the imports of plastics in the United States were valued at around USD 82.46 billion, a 32.27% rise in the imports from the previous year, 2020, which recorded imports of approximately USD 62.34 billion. The significant demand for plastic across various industries would be responsible for rising imports. Dairy packaging primarily uses flexible and rigid plastic, which would be a considerable utilizer of imported plastics.

US Dairy Packaging Industry Overview

The United States dairy packaging market is highly consolidated owing to the presence of a few major players with significant market shares. With innovative and sustainable packaging, many companies are increasing their market presence by securing new contracts and tapping new markets. Some of the major players in the market are Huhtamaki Oyj, Berry Global Group Inc., Amcor PLC, Ball Corporation, and Smurfit Kappa Group PLC, among others.

- October 2022: Icon, a 95% renewable bio-based, paper-based packaging solution for ice cream containers and lids, was introduced by Huhtamaki to enable recycling in localities across the United States with paper product recycling programs. Consumers may discover more about environmental sustainability by scanning a linked packaging QR code. Incorporating its water-based barrier coating and paperboard that has received Sustainable Forest Initiative (SFI) certification, Huhtamaki claims the launch will provide customers with an environmentally friendly option. The ice cream containers and lids are recycled alongside paper goods like folded carton packing.

- May 2022: Berry Global Group introduced a new transparent, all-plastic cup that contains mechanically recycled post-consumer resin (PCR) in partnership with the American chain of fast-food restaurants Taco Bell. The 30-ounce transparent polypropylene (PP) cup, created to promote a more circular approach to sustainable packaging, will be tested in a few US Taco Bell restaurants later this year. According to Berry Global, food-grade material from recycled milk jugs and other goods has been incorporated into the recovered HDPE. Taco Bell's virgin plastic cup and lid set will be changed, reducing waste exposure to landfill and incineration and lowering its carbon footprint.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porters Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Consumer Preference Toward Protein-based Products

- 5.1.2 Increasing Adoption of In-house Packaging Methods

- 5.1.3 Increasing Adoption of Packages Incorporating Small Portion Size

- 5.2 Market Restraints

- 5.2.1 Greenhouse Gas Emission due to Dairy Activities Leading to Legislative Issues

- 5.3 Global Dairy Packaging Market Overview

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.2 Paper and Paperboard

- 6.1.3 Glass

- 6.1.4 Metal

- 6.2 By Product Type

- 6.2.1 Milk

- 6.2.2 Cheese

- 6.2.3 Frozen Products

- 6.2.4 Cultured Products

- 6.2.5 Other Product Types

- 6.3 By Packaging Type

- 6.3.1 Bottles

- 6.3.2 Pouches

- 6.3.3 Cartons and Boxes

- 6.3.4 Bags and Wraps

- 6.3.5 Other Packaging Types

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Huhtamaki Oyj

- 7.1.2 Berry Global Group Inc.

- 7.1.3 Amcor Plc

- 7.1.4 Ball Corporation

- 7.1.5 Smurfit Kappa Group PLC

- 7.1.6 Altium Packaging LLC (Loews Corporation)

- 7.1.7 Polytainers Inc.

- 7.1.8 International Paper Company

- 7.1.9 Winpak Ltd

- 7.1.10 Sealed Air Corporation

- 7.1.11 Tetra Pak International SA