|

市场调查报告书

商品编码

1627206

义大利的工厂自动化和ICS:市场占有率分析、产业趋势和成长预测(2025-2030)Italy Factory Automation and ICS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

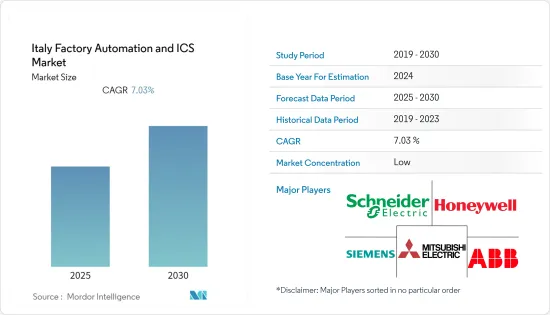

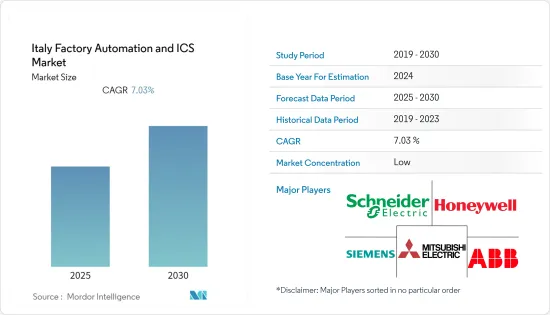

义大利工厂自动化和ICS市场预计在预测期间内复合年增长率为7.03%

主要亮点

- 义大利拥有中小企业(SME),其中大部分属于丛集。这些公司能够抵御来自新兴国家的竞争,因为它们专注于高品质的产品和低廉的人事费用。北方工业化程度很高,主要透过私人公司网络实现。由于大量中小企业的存在,该国正在积极推出倡议,鼓励这些企业采用自动化解决方案,预计将带动该国工厂自动化解决方案的需求。

- 西北地区(米兰-都灵-热那亚)是航太、海军、机械和汽车等大型工业的所在地。义大利中部和东北部地区(以前是农村地区)是许多高工艺和低技术力的所在地,专门从事纺织、服饰、鞋类、家具、皮革製品、珠宝饰品、家具等。

- 此外,该国还确定了新倡议,主要专注于促进工业 4.0 的采用。例如,2020年工业4.0税收优惠。在义大利,从2020年1月1日起,针对资本财投资的新税额扣抵取代了先前的超折旧和超折旧。经济发展部最近提案的改革趋势引入了许多创新,以支持企业的技术和数位转型过程。

- 此外,最近控制器漏洞有所增加,攻击者利用这些漏洞来破坏业务。为了确保ICS网路的安全,需要使用各种通讯协定,这对ICS的实施带来了挑战。此外,操作技术供应商使用自己的 IEC-61131 标准实作来实现可程式逻辑控制器。

义大利工厂自动化与ICS市场趋势

自动化程度显着提高

- 鲜为人知的事实是,义大利处于製造业的前沿。不过,义大利政府计划在2020年引入工业4.0(I4.0),战略指导方针将在一年内实施。该倡议的重点是转变传统製造方法,重点是技能和先进技术,并支持义大利经济的数位化。它还强调了与其他国家合作的未来,这将推动国内工厂自动化。

- 例如,工业自动化和机器人公司柯马推出了其最具创新性的产品,包括MATE外骨骼、传统工业机器人和协作机器人、Agile1500自动驾驶汽车以及e.DO教育机器人。 。柯马此举旨在支持企业取得生产流程和工具,以日益敏锐的方式实现智慧工厂。

- 在过去的几年里,许多汽车製造商已经实现了工厂自动化,我们看到许多公司正在转向一站式自动化解决方案提供商,这些解决方案可以满足他们所有的自动化需求,以提高收益和效率,并引领智慧工厂。

- 此外,将工业控制系统纳入汽车製造工厂使公司能够透过工厂连接产生的资料即时追踪生产力和品质。这可能会让生产线监督和工厂高层鬆一口气。资料分析可以为预测从生产零件的品质到下一次机器故障等结果提供切入点。

- 此外,由于义大利市场为纺织业引入自动化提供了巨大的潜在机会,许多国际参与企业都在寻求扩大在该国的业务。中国领先的缝纫技术供应商杰克缝纫机有限公司收购了义大利牛仔裤自动化公司ViBeMac SPA。

机器人技术将推动市场适度成长

- 工业机器人细分市场包括关节型机器人、直角座标机器人、 SCARA机器人、协作机器人(cobots)、并联机器人、工件拾取机器人等。工业机器人因其更高的精度、灵活性、减少的产品损坏、速度和最终的营运效率而越来越多地被大多数最终用户和应用所采用。

- 智慧生产和自动化市场的快速成长正在推动工业机器人在全球的使用。根据横河电机2020年进行的一项调查,64%的流程工业企业受访者表示,他们预计2030年将完全自动化。

- 此外,89% 的受访者表示,他们的公司目前计划提高组织内部的自主权水平。关于目前的状况,64%的受访者表示他们目前正在实施半自动或自主运作或正在进行检查,67%的受访者预计工厂运作中的大多数决策流程将在2023年之前实施。将实现显着的自动化。

- 工业机器人领域见证了老牌供应商和新兴企业的许多创新努力。其重点是改善工业机器人的机器人感官并帮助它们与周围的世界互动。

- 2021 年 2 月,ABB 在其协作机器人 (cobot) 产品组合中推出了 GoFa 和 SWIFTI 协作机器人系列,列出了更高的承重能力和速度,以补充ABB 的YuMi 和单臂YuMi I am 协作机器人系列。 GoFa 和 SWIFTI 的设计使客户无需依赖内部程式专家。这解放了自动化程度较低的行业。

义大利工厂自动化与ICS产业概况

义大利工厂自动化和 ICS 市场适度整合,有一些大型企业的存在。公司不断投资于策略联盟和产品开发,以占领更多的市场占有率。我们将介绍一些最近的市场趋势。

- 2021 年 5 月-施耐德电机与乐家集团合作加速脱碳。乐家集团是产品设计、生产和商业化领域的世界领导者,这些产品定义了脱碳的新蓝图,在整个集团范围内建立了单一的全球策略。

- 2021 年 5 月 - 罗克韦尔与 Cisco Cyber Vision 合作扩展威胁侦测服务。 CyberVision 描述了工业控制系统的可视化,以建立安全的基础设施。 Cyber Vision 解决方案加入了罗克韦尔的 LifecycleIQ 服务组合。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业魅力-波特的5点

力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 评估 COVID-19 对产业的影响

- 技术简介

第五章市场动态

- 市场驱动因素

- 由于工作人口减少,自动化技术兴起

- 市场问题

- 缺乏熟练劳动力阻碍企业全面实施工厂自动化

第六章 市场细分

- 副产品

- 工业控制系统

- 集散控制系统(DCS)

- PLC(可程式逻辑控制器)

- 监控/资料采集(SCADA)

- 产品生命週期管理 (PLM)

- 人机介面 (HMI)

- 製造执行系统(MES)

- 现场设备

- 感测器和发射器

- 马达

- 安全系统

- 工业机器人

- 工业控制系统

- 按最终用户产业

- 石油和天然气

- 化学/石化

- 电力/公共产业

- 汽车/交通

- 纤维

- 其他的

第七章 竞争格局

- 公司简介

- Schneider Electric SE

- Rockwell Automation Inc.

- Honeywell International Inc.

- Emerson Electric Company

- ABB Limited

- Mitsubishi Electric Corporation

- Siemens AG

- Omron Corporation

- Yokogawa Electric Corporation

- Yasakawa Electric Corporation

- Fanuc Corporation

- Nidec Corporation

- Fuji Electric Co. Ltd

- Seiko Epson Corporation

第八章投资分析

第9章 未来展望

简介目录

Product Code: 51004

The Italy Factory Automation and ICS Market is expected to register a CAGR of 7.03% during the forecast period.

Key Highlights

- Italy has small and medium-sized businesses (SMEs), most of which are grouped in clusters. These enterprises specialize in high-quality products and lower labor costs, which enable them to withstand competition from upcoming economies. The northern part of the country is mainly industrialized with a network of private companies. Due to the presence of many SMEs, the country has been actively starting initiatives to encourage the adoption of automation solutions among these companies, which are anticipated to drive the demand for factory automation solutions in the country.

- The Northwest region (Milan-Turin-Genoa) is home to large industries as aerospace, naval, machinery, and automotive. The Central and Northeast parts of Italy (which were previously rural areas) have become a region with many small businesses of high craftsmanship, coupled with low technology, specialized in textiles, clothing, footwear, furniture, leather products, jewelry, and furniture, among others.

- Furthermore, the country has been witnessing new initiatives that are mainly focused on encouraging the adoption of Industry 4.0. For instance, New Industry 4.0 tax incentives in 2020. Starting from January 1, 2020, in Italy, the new tax credit for capital goods investments replaced the previous super-amortization and hyper-amortization. The recent amendment proposed by the Ministry of Economic Development introduces many innovations to support companies in their technological and digital transformation process.

- Moreover, recent controller vulnerabilities that attackers have exploited to disrupt operations are on the rise. This challenges the implementation of ICS, as to secure ICS networks, there is usage of different communication protocols. Also, operational technology vendors use their own proprietary implementation of the IEC-61131 standard for programmable logic controllers.

Italy Factory Automation and Industrial Control Market Trends

Automation is Observing a Significant Increase

- Italy is not commonly known to be at the forefront of the manufacturing sector. However, the government of Italy introduced Industria 4.0 (I4.0) in 2020 and aimed to include strategic guidelines to be implemented in a year. The initiative is focused on transforming traditional manufacturing methods with a focus on skills and advanced technology and supporting the digitization of the Italian economy. It also emphasizes a future based on collaboration with other countries-this driving factory automation in the country.

- In another instance, Comau, industrial automation, and robotics company, support the Milan Competence Center by providing its most innovative products, like the MATE exoskeleton, traditional industrial robots and collaborative robots, the autonomous driving vehicle Agile1500, and thee.DO educational robot. By doing so, Comau aims to support companies in acquiring production processes and tools, enabling the smart factory in an increasingly incisive manner.

- In the past few years, many automakers have automated their plants, and many companies have been identified as tending toward one-stop automation solution providers who can cater to all of their automation needs to gain better returns and efficiency, driving the smart factory market.

- Moreover, the inculcation of industrial control systems in auto manufacturing plants gives companies the ability to keep real-time track of productivity & quality through the data generated through plant connectivity. It may offer mitigating actions to the line supervisors and plant executives. Data analytics can offer a gateway to predicting various outcomes, from the quality of the part being produced to the next machine breakdown.

- Furthermore, with the Italian market posing high potential opportunities for the adoption of automation in the textile industries, various international players see to expand in the country. Jack Sewing Machine Co., a leading Chinese sewing technology provider, acquired Italian jeans automation company ViBeMac SPA in yet another accomplishment.

Robotics is Propelling the Market With Gradual Growth

- The industrial robotics segment consists of articulated robots, cartesian robots, SCARA robots, collaborative industry robots (cobots), parallel robots, piece picking robots, etc. The adoption of industrial robots has been increasing in most end-users and applications as these robots enhance accuracy, flexibility, reduced product damage, speed, and ultimately the efficiency of operations.

- The rapidly growing market for smart production and automation is propelling the use of industrial robotics across the globe. According to a survey by Yokogawa Electric Corporation in 2020, 64% of respondents from companies in process industries pointed out that they are anticipating fully autonomous operations by 2030.

- Also, 89% of the respondents said their companies currently have plans to increase the level of autonomy in their operations. Regarding the current status, 64% of respondents said they are conducting or are piloting semi-autonomous or autonomous operations, while 67% expect significant automation of most decision-making processes in plant operations by 2023.

- There are a lot of innovation practices done in industrial robotics by start-ups as well as established vendors. The focus is on improving the robotic senses of industrial robots, which helps their interaction with the world around them.

- In February 2021, ABB announced its collaborative robot (cobot) portfolio with the GoFa and SWIFTI cobot families, offering higher payloads and speeds to complement YuMi and Single Arm YuMi in ABB's cobot line-up. GoFa and SWIFTI are designed so that the customers do not need rely on in-house programming specialists. This unlocks industries that have low levels of automation.

Italy Factory Automation and Industrial Control Industry Overview

The Italy factory automation and industrial control market is moderately consolidated, with the presence of a few major companies. The companies are continuously investing in making strategic partnerships and product developments to gain more market share. Some of the recent developments in the market are:

- May 2021 - Schneider Electric partnered with Roca Group to accelerate decarbonization. Roca Group, a world leader in the design, production, and commercialization of products to define a new roadmap toward decarbonization, has been establishing a single, global strategy across the group.

- May 2021- Rockwell partnered with Cisco Cyber Vision to expand its threat detection services. Cyber Vision provides visibility into industrial control systems to build secure infrastructures. Cyber Vision solution will be to Rockwell's LifecycleIQ Services portfolio.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five

Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Assessment of Impact of Covid-19 on the Industry

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Gaining Prominence for Automation Technologies Due to Declining Workforce

- 5.2 Market Challenges

- 5.2.1 Lack of Skilled Workforce Preventing Enterprises from Full-scale Adoption of Factory Automation

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Industrial Control Systems

- 6.1.1.1 Distributed Control System (DCS)

- 6.1.1.2 PLC (Programmable Logic Controller)

- 6.1.1.3 Supervisory Control and Data Acquisition (SCADA)

- 6.1.1.4 Product Lifecycle Management (PLM)

- 6.1.1.5 Human Machine Interface (HMI)

- 6.1.1.6 Manufacturing Execution System (MES)

- 6.1.2 Field Devices

- 6.1.2.1 Sensors and Transmitters

- 6.1.2.2 Electric Motors

- 6.1.2.3 Safety Systems

- 6.1.2.4 Industrial Robotics

- 6.1.1 Industrial Control Systems

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Chemical and Petrochemical

- 6.2.3 Power and Utilities

- 6.2.4 Automotive and Transportation

- 6.2.5 Textile

- 6.2.6 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schneider Electric SE

- 7.1.2 Rockwell Automation Inc.

- 7.1.3 Honeywell International Inc.

- 7.1.4 Emerson Electric Company

- 7.1.5 ABB Limited

- 7.1.6 Mitsubishi Electric Corporation

- 7.1.7 Siemens AG

- 7.1.8 Omron Corporation

- 7.1.9 Yokogawa Electric Corporation

- 7.1.10 Yasakawa Electric Corporation

- 7.1.11 Fanuc Corporation

- 7.1.12 Nidec Corporation

- 7.1.13 Fuji Electric Co. Ltd

- 7.1.14 Seiko Epson Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK

02-2729-4219

+886-2-2729-4219