|

市场调查报告书

商品编码

1627210

法国燃料电池:市场占有率分析、产业趋势与成长预测(2025-2030)France Fuel Cell - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

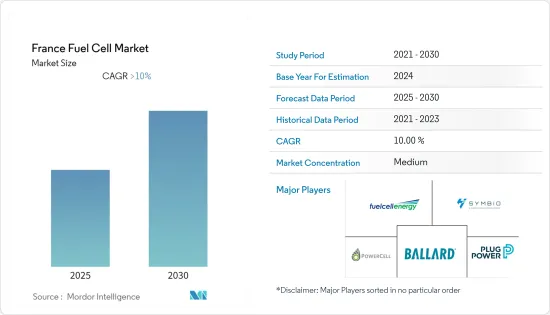

预计法国燃料电池市场在预测期内将维持10%以上的复合年增长率。

2020 年,市场受到 COVID-19 大流行的负面影响。目前市场处于大流行前的水平。

主要亮点

- 从中期来看,加氢站数量的增加和燃料电池电动车(FCEV)需求的增加预计将推动未来市场的成长。

- 另一方面,由于供需缺口,与汽车产量相比,加油站数量较少,预计将阻碍预测期内法国燃料电池市场的成长。

- 欧盟(EU)计划大幅减少交通运输部门的温室气体排放。因此,法国政府正在引入燃料电池(主要是质子交换膜燃料电池)等创新技术来实现这些目标,从而在预测期内为市场创造有利的成长机会。

法国燃料电池市场趋势

增加加氢站

- 法国政府计划以与柴油汽车的能源成本相比具有竞争力的成本(即低于 7 欧元/公斤)全面提供氢气。从长远来看,此类奖励预计将补充法国对燃料电池的需求。

- 2019年底,法国颁布了《出行导向法》,旨在2050年实现陆路交通脱碳,并制定了实现目标的措施。其中一项措施是从 2040 年起逐步停止销售直接排放二氧化碳的车辆。因此,在预测期内,对零排放汽车(例如由 PEM 驱动的燃料电池汽车)的需求预计将会增加。

- 2021年1月,雷诺公司和Plug Power公司推出一家50:50的合资企业,目标是夺取欧洲燃料电池轻型商用车(LCV)30%以上的份额我们签署了一份谅解备忘录,旨在实现此目标。

- 法国政府计划根据其新战略「氢计画」大力投资氢和燃料电池技术。 2021年10月,法国宣布计画在2030年投资300亿欧元用于碳氢化合物技术的测试和研发。政府计划在2023年安装100个加氢站。到 2028 年,这一数字预计将增加到 400 至 1,000 个加氢站。

- 因此,加氢站数量的增加以及将燃料电池技术纳入交通和其他应用的努力等因素预计将在预测期内推动法国燃料电池市场的发展。

运输业主导市场

- 由于区域交通部门的显着增长和石化燃料的高消耗,气候变迁和空气品质差等日益严重的环境问题产生了对清洁能源来源的需求。

- 燃料电池实现零排放,有助于减少温室气体排放。燃料电池主要使用氢气或甲醇,减少经济对石油和天然气的依赖,同时优化能源安全。人们对环境问题和与加氢站相关的基础设施发展的日益关注可能会在预测期内支持汽车燃料电池市场的成长。

- 2021年,交通运输领域占一半以上的市场占有率。我们预计这种主导地位将在未来几年继续下去。法国政府对交通运输领域清洁能源使用的关注可能会产生对燃料电池技术的巨大需求。

- 2021 年,法国交通运输业消耗最多的燃料将是柴油,相当于超过 340 太瓦时的能源。总体而言,不可可再生燃料是该领域最大的能源来源,可再生和电力仅占所用能源约 42 太瓦时。

- 法国的燃料电池市场得到了私人组织和参与该国燃料电池采用和实施的组织的创业投资投资的支持。世界上第一个氢动力快速公车系统(BRT)已在法国南部的波城安装。

- 法国公共交通运营商 Keolis 正在与当地交通运营商合作推出计划,并为 8 辆氢动力 BRT 的运营提供技术支援。

- 2022 年 7 月,巴黎当局宣布计划公开竞标约 47 辆燃料电池公车,并将于 2023 年底年终部署在法国法兰西岛地区。此次采购需要投资约4800万欧元。在 2019 年启动的试点框架中,该地区已部署了 7 辆氢公车。

- 因此,由于技术创新的增加和参与企业参与的增加,交通运输产业预计将主导市场。

法国燃料电池产业概况

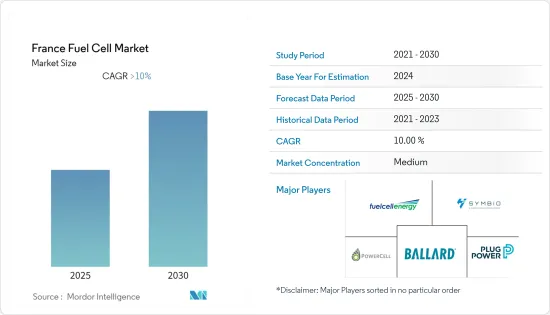

法国燃料电池市场适度细分。市场主要企业包括(排名不分先后)巴拉德动力系统公司、东芝燃料电池动力系统公司、Fuelcell Energy Inc.、Powercell Scotland AB 和 Plug Power Inc.。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2027年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- PESTLE分析

第五章市场区隔

- 应用

- 可携式的

- 固定式

- 运输

- 燃料电池技术

- 固体电解质燃料电池(PEMFC)

- 固体氧化物燃料电池(SOFC)

- 其他燃料电池技术

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Ballard Power System Inc.

- Symbio Fcell SA

- Fuelcell Energy Inc.

- Powercell Sweden AB

- Plug Power Inc.

第七章市场机会与未来趋势

简介目录

Product Code: 51072

The France Fuel Cell Market is expected to register a CAGR of greater than 10% during the forecast period.

The market was negatively impacted by the COVID-19 pandemic in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, increasing hydrogen filling stations and rising demand for fuel cell electric vehicles (FCEVs) are expected to drive the growth of the market in the future.

- On the other hand, less number of refuel stations compared to vehicle production due to the supply-demand gap is expected to hamper the growth of the French fuel cell market during the forecast period.

- The European Union plans to significantly reduce GHG emissions from the transportation sector. As a result, the French government is implementing innovative technologies, such as fuel cells (primarily PEMFC), to meet these objectives, thus creating lucrative growth opportunities for the market during the forecast period.

France Fuel Cell Market Trends

Increasing Hydrogen Filling Stations

- The government is planning to ensure sufficient availability of hydrogen in France at a competitive cost compared to the cost of energy for a diesel vehicle (i.e., less than 7 EUR/kg). Such incentives are expected to supplement the demand for fuel cells in France in the long run.

- In late 2019, France issued the Mobility Orientation Law, which aims to decarbonize land transport by 2050, as well as formulated measures to reach the goal. One of the measures is to phase out the sale of vehicles that directly emit CO2 from 2040. Therefore, the demand for zero-emission vehicles, such as fuel cell vehicles that deploy PEM, is expected to increase during the forecast period.

- Renault SA and Plug Power Inc. signed an MoU in January 2021 to launch a 50-50 joint venture based in France by the end of the first half of 2021, targeting over 30% share of the fuel cell-powered light commercial vehicle (LCV) market in Europe.

- The government of France, under its new strategy Plan Hydrogene, aims to invest heavily in hydrogen and fuel cell technology. In October 2021, France announced its plans to invest EUR 30 billion to test hydrocarbon technologies and for R&D purposes by 2030. The government is planning to install 100 hydrogen filling stations by 2023. By 2028, this number is expected to increase to 400-1,000 hydrogen filling stations.

- Therefore, factors such as increasing hydrogen filling stations and efforts to incorporate fuel cell technology in transportation and other applications are expected to drive the French fuel cell market during the forecast period.

Transportation Sector to Dominate the Market

- The rising environmental issues, such as climate change and low air quality, due to significant growth in the regional transportation sector and high fossil fuel consumption have generated the need for clean energy sources.

- Fuel cells generate zero emissions and contribute to eliminating greenhouse gases. A fuel cell majorly uses hydrogen or methanol, thus reducing economic dependence on oil and gas while optimizing energy security. Rising environmental concerns and growing infrastructure related to hydrogen refueling stations are likely to support the vehicular fuel cell market's growth over the forecast period.

- The transportation sector accounted for more than half of the market share in 2021. It is expected to continue its dominance in the coming years as well. The French government is focusing on clean energy usage in the transportation sector, which may create significant demand for fuel cell technologies.

- In 2021, diesel was the most consumed fuel in the French transportation sector, at over 340 TWh of energy. In general, non-renewable fuels were the largest energy source in the sector, while renewables and electricity only accounted for around 42 TWh of energy used.

- The French fuel cell market is propelled by the venture capital investments by private organizations and those involved in the adoption and implementation of fuel cells in the country. The world's first hydrogen-powered bus rapid transit (BRT) system was deployed in the city of Pau in the south of France.

- Keolis, a French public transport operator, has worked in partnership with local transport operators on the project launch and is providing technical assistance for the operation of eight additional hydrogen-powered BRTs.

- In July 2022, Paris authorities announced their plans to launch tenders for about 47 fuel cell buses with deployment by the end of 2023 in the Ile-de-France region. The procurement requires an investment of about EUR 48 million. Seven hydrogen buses have already been deployed in the region in the framework of a pilot launched in 2019.

- Hence, the transportation sector is expected to dominate the market due to the increasing technological innovations and rising private player involvement.

France Fuel Cell Industry Overview

The French fuel cell market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include Ballard Power System Inc., Toshiba Fuel Cell Power System Corporation, Fuelcell Energy Inc., Powercell Sweden AB, and Plug Power Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Portable

- 5.1.2 Stationary

- 5.1.3 Transport

- 5.2 Fuel Cell Technology

- 5.2.1 Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 5.2.2 Solid Oxide Fuel Cell (SOFC)

- 5.2.3 Other Fuel Cell Technologies

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Ballard Power System Inc.

- 6.3.2 Symbio Fcell SA

- 6.3.3 Fuelcell Energy Inc.

- 6.3.4 Powercell Sweden AB

- 6.3.5 Plug Power Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219