|

市场调查报告书

商品编码

1627216

北美触控萤幕控制器:市场占有率分析、产业趋势、成长预测(2025-2030)North America Touch Screen Controllers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

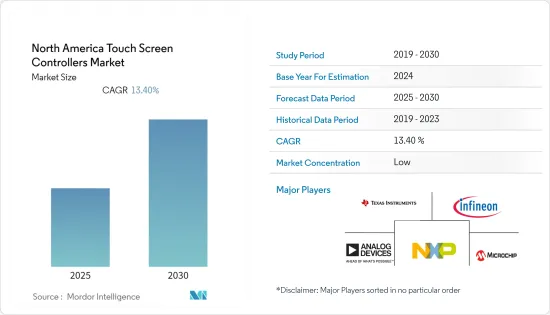

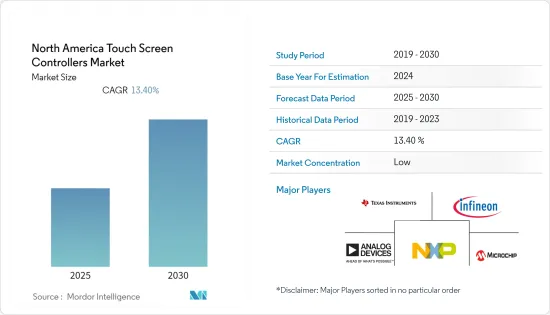

北美触控萤幕控制器市场预计在预测期内复合年增长率为13.4%

主要亮点

- 平板电脑、门锁系统、智慧家电和汽车资讯娱乐系统等电子产品对触控萤幕的需求不断增长,推动了触控萤幕控制器市场的成长。

- 此外,BFSI行业的快速数位化使银行整合了ATM机、用于KYC的生物识别设备、用于线上付款的POS机、用于存摺列印的印表机等,显着促进了市场成长。

- 触控萤幕显示器在全世界的需求量很大。随着供应商推出自己版本的智慧型设备,对触控萤幕的需求正在迅速增加。这种成长正在推动触控萤幕控制器市场,并扩大触控萤幕在各行业的应用。然而,技术复杂性和功耗的增加正在限制市场的成长。

- 由于对智慧型手机、平板电脑、Kindle 等触控设备的需求增加,实施封锁有利于员工在 COVID-19 期间工作,对触控萤幕控制器市场产生了积极影响。此外,疫情爆发造成的供应链中断也影响了全球的生产活动。

北美触控萤幕控制器市场趋势

电容式触控萤幕占据主要市场占有率

- 电容式触控萤幕控制器是一种处理触控指令的设备,尤其适用于电容式触控萤幕。电容式触控萤幕控制器有多种类型,其中最常用的是金属氧化物半导体晶片。

- 这种类型的控制器使用人类触控作为输入,并具有多种优点,包括可靠性、准确性、触控灵敏度和多点触控支援。由于这些优点,电容式控制器在消费性应用中获得了巨大的关注。

- 此外,电容式触控萤幕在能源监控设备、门禁控制器和医疗设备等应用中的日益整合可能会推动未来几年的需求。

- 市场上的供应商也积极注重产品创新,将新产品推向市场,以满足越来越多的客户需求。例如,2022年5月,IDEC公司发布了新款HG2J系列7吋触控萤幕HMI,扩大了其HMI产品线。硬体和软体的进步使得此 HMI 易于在所有类型的工业应用中整合和使用。

家用电子电器领域预计将快速成长

- 消费性电子产品是主要的最终用户领域之一。由于该地区对新技术和创新技术产品的需求不断增长,各种设备现在都配备了触控萤幕,从而增加了对触控萤幕控制器的需求。

- 消费性电子产品的技术进步吸引消费者购买具有最新功能的新产品。因此,人们正在转向基于触控萤幕的产品,进一步促进了市场的成长。

- 2022 年 6 月,东芝电子元件及储存装置公司宣布其欧洲销售和行销子公司 Toshiba Electronics Europe GmbH 将生产电子元件,在欧洲称为 Farnell,在北美称为 Newark,在整个亚太地区称为 Element 14。我们扩大了与全球产品和解决方案经销商派睿电子(Farnell) 的关係。

- 具有内建触控萤幕控制器的家用电器包括智慧型穿戴装置和笔记型电脑。此外,冰箱、洗衣机等产品都配备了智慧技术和触控功能,以提供更好的使用者体验并产生需求。

北美触控萤幕控制器产业概况

北美触控萤幕控制器市场竞争激烈,已有多家公司进入该市场。公司专注于新技术,透过创新和开发适合各种应用的差异化产品来获得相对于其他公司的竞争优势。

- 2021 年 11 月 - Microchip Technology Inc. 推出了一款新产品,可提供广泛的灵活性,以满足汽车应用从 1:1 到 5:1 的独特显示长宽比,并具有防水、快速且高精度的多点触控侦测功能。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 对智慧电子设备的需求增加

- 触控设备在各行业的普及

- 市场挑战/限制

- 技术复杂性和功耗

第六章 市场细分

- 按类型

- 电阻式

- 电容式

- 按最终用户

- 工业的

- 卫生保健

- 家电

- 零售

- 车

- BFSI

- 其他最终用户

- 按国家/地区

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Texas Instruments Incorporated

- Infineon Technologies

- Analog Devices, Inc.

- NXP Semiconductors

- Microchip Technology Incorporated

- Silicon Laboratories

- Integrated Device Technology, Inc.

- Broadcom Inc.

- Semtech Corporation

第八章投资分析

第9章市场的未来

简介目录

Product Code: 51442

The North America Touch Screen Controllers Market is expected to register a CAGR of 13.4% during the forecast period.

Key Highlights

- The growing demand for touch screens in the electronics products such as tablets, door lock systems, smart home appliances, and automobile infotainment systems is propelling the growth of touch screen controllers in the market.

- In addition, the rapid digitalization in the BFSI industry has resulted in the integration of ATM machines, biometric devices for KYC, POS machines for online payments, and printing machines for passbook printing at banks, which is significantly boosting market growth.

- Touch screen displays are in huge demand across the world. The need for touchscreen has been rising exponentially as the vendors launch their own versions of smart devices. This growth is driving the touch screen controller market, with the increasing application of touch screens across industries. However, the technical complexity and more power consumption are straining the market growth.

- The imposition of lockdown during COVID-19, the employees were preferably working from, has positively impacted the touchscreen controller market as the demand increased for touch-enabled devices like smartphones, tablets, kindles, etc. Moreover, the supply chain disruptions caused due to the pandemic outbreak also impacted production activities across the globe.

North America Touch Screen Controllers Market Trends

Capacitive Touch Screens to Account for a Significant Market Share

- A capacitive touch screen controller is a device that processes touch commands and is used specifically in capacitive touch screens. These controllers are available in several types, among which the metal-oxide-semiconductor chip is most used.

- This type of controller uses human touch as input and offers several benefits, such as reliability, accuracy, touch sensitivity, and multi-touch support. Owing to such benefits, capacitive controllers are gaining significant momentum in consumer applications.

- Moreover, the growing integration of capacitive touch screens in applications such as energy monitoring devices, door access controllers, and medical devices will push the demand in the coming years.

- The vendors in the market are also actively focusing on product innovations and are launching new products in the market to cater to a large number of customers. For instance, in May 2022, IDEC Corporation expanded its HMI product line by introducing the new HG2J Series 7" touchscreen HMI. This HMI's hardware and software advancements make it easier to integrate and use for any type of industrial application.

Consumer Electronic Segment is Expected to Grow Rapidly

- Consumer electronics is one of the key segments of the end-user. The rising demand for new and innovative technology products in the region has pushed the demand for touch screens in various devices, thereby driving the demand for touch screen controllers.

- The technological advancement in consumer electronics products attracts consumers to spend on new products with the latest features; hence, people are switching to touchscreen-based products, further augmenting the growth of the market studied.

- In June 2022, Toshiba Electronic Devices & Storage Corporation announced that its European sales and marketing subsidiary, Toshiba Electronics Europe GmbH, has extended its relationship with Farnell, a global distributor of electronic components, products, and solutions known as Farnell in Europe, Newark in North America, and element14 throughout the Asia Pacific.

- Smart wearables and laptops are examples of consumer electronics items with integrated touch screen controllers. In addition, fridges, washing machines, and other products are adopting smart technologies and have come with touch-enabled features to deliver a better user experience and create demand.

North America Touch Screen Controllers Industry Overview

The North American touch screen controller market is highly competitive and consists of several players. The companies are focusing on new technologies to gain a competitive advantage over other players through innovation and are developing differentiated products for various applications.

- November 2021 - Microchip Technology Inc. announced its new maXTouch MXT1296M1T touchscreen controllers that will offer extensive flexibility to satisfy unique display aspect ratios from 1:1 to 5:1 for cars, along with waterproof, fast, and accurate multi-touch detection.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand of Smart Electronic Devices

- 5.1.2 Penetration of Touch Devices Across Different Industry Verticals

- 5.2 Market Challenges/Restraints

- 5.2.1 Technical Complications and Power Consumption

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Resistive

- 6.1.2 Capacitive

- 6.2 By End-user

- 6.2.1 Industrial

- 6.2.2 Healthcare

- 6.2.3 Consumer Electronics

- 6.2.4 Retail

- 6.2.5 Automotive

- 6.2.6 BFSI

- 6.2.7 Other End-users

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Texas Instruments Incorporated

- 7.1.2 Infineon Technologies

- 7.1.3 Analog Devices, Inc.

- 7.1.4 NXP Semiconductors

- 7.1.5 Microchip Technology Incorporated

- 7.1.6 Silicon Laboratories

- 7.1.7 Integrated Device Technology, Inc.

- 7.1.8 Broadcom Inc.

- 7.1.9 Semtech Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219