|

市场调查报告书

商品编码

1627219

北美饮料包装:市场占有率分析、产业趋势与成长预测(2025-2030)North America Beverage Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

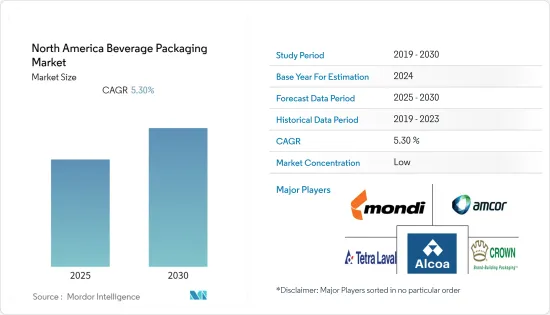

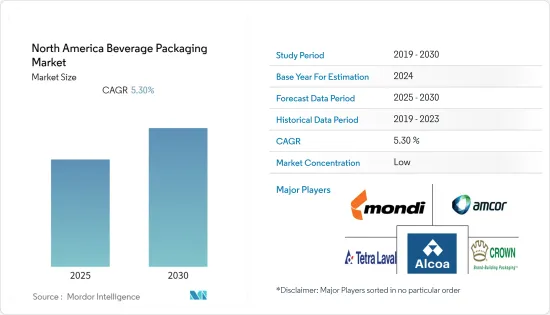

北美饮料包装市场预计在预测期内复合年增长率为 5.3%

主要亮点

- 技术创新、永续性关注和有吸引力的经济效益是过去二十年美国饮料包装显着增长的原因。消费者看待包装和与包装互动的方式正在改变。由于对永续性的日益关注,传统的硬质包装解决方案正在被创新且更永续性的软包装所取代。市场对客户友善包装和增强产品保护的需求不断增长,预计将推动软包装成为可行且具成本效益的替代品。

- 由于碳酸饮料、能量饮料、果汁等的需求不断增长, 宝特瓶和金属罐已成为首选材料。另一方面,具有可回收特性的玻璃面临着製造和回收成本增加的挑战。最近,在饮料包装的永续性趋势方面,人们越来越偏好玻璃。

- 此外,由于塑胶可以降低製造成本、耐用性和物流成本,多年来一直是全球饮料製造商的首选包装选择,因此向永续包装的过渡将有助于这些包装製造商和装瓶公司成为该地区的推动力。

- 例如,宝特瓶承诺到 2030 年将回收尽可能多的宝特瓶。为此,该公司与世界各地的非政府组织合作,协助改善馆藏。此外,截至 2020 年 1 月,雀巢已承诺投入 21 亿美元用于回收塑胶包装的使用。

- 在供应商方面,我们看到金属、玻璃和再生聚酯产能增加,以补充饮料製造商不断增长的需求。例如,截至 2020 年 2 月,波尔公司计划在 2021 年扩大美国金属罐产量。该公司的特种饮料罐将在亚利桑那州和美国东北部开始运营,这符合其先前承诺的到2021年终新增至少80亿罐产能的承诺。

北美饮料包装市场趋势

电子商务可望推动市场占有率

- 电子商务将占据很大的市场份额,因为许多公司尚未针对电子商务进行优化包装,并且在将产品从物流中心运送到消费者手中时过度包装很常见,预计会产生积极影响。由于货物通常被分成单独的包裹进行分发,零售链的这种复杂性会导致进一步的浪费、能源消耗和污染。

- 此外,饮料包装还具有防水、轻质材料和更好的尺寸重量优势等性能特点,使其对该地区的电子商务提供者俱有吸引力。

- 根据《商业内幕》报道,电子商务实际上正在推动零售业的成长,对饮料包装的影响可能会在该地区产生。由于沃尔玛、克罗格和艾伯森等老牌食品零售商的存在,美国零售业竞争激烈,推动了该国市场的成长。

- 此外,总部位于美国的沃尔玛是世界上最大的零售公司和最大的参与者。世界十大零售公司中有五家位于美国,使美国成为主要的零售业。

- 此外,饮料包装产品的需求通常是由该地区的千禧世代客户所推动的。因为他们非常喜欢单份饮料和外带饮料。这些产品通常设计为便携、耐用且轻便,使得软包装成为包装此类产品的热门选择。

酒精饮料占据最大的市场占有率

- 酒精饮料包括葡萄酒、啤酒和烈酒,有瓶子、小桶、纸盒和罐头等包装形式。就酒精饮料而言,随着全球无气泡葡萄酒的消费放缓,我们观察到葡萄酒产业在包装形式方面发生了重大转变。这促使美国酿酒厂创新包装以降低成本并吸引年轻消费者。

- 因此,便携性和便利性已成为葡萄酒包装创新的关键驱动力,Bota Box 和 Black Box 利用了利乐、盒中袋葡萄酒和纸箱等替代包装。硅谷银行《2020年葡萄酒产业状况报告》显示,2019年国产罐装葡萄酒儘管仅占总量的0.5%,但成长了80%。

- 此外,罐装葡萄酒正在增加其他酒精饮料的单份选择的足迹。在这里,375ml 和 500ml 玻璃规格的罐小型化的经济性保持不变。例如,100至200毫升的小瓶装和罐装啤酒占全球整体啤酒量的90%。

- 另一方面,啤酒包装多种多样。包装格式偏好因地区而异,当地法律、法规、偏好、文化和其他驱动因素会影响包装条件。

- 此外,多家包装公司报告称,由于新冠肺炎 (COVID-19) 疫情的爆发和美国各地酒精饮料需求的激增,导致库存短缺。例如,在美国,由于新型冠状病毒感染疾病COVID-19 导致现场关闭,生啤酒的销售停止了。因此,精酿啤酒製造商转而使用 32 盎司的罐装啤酒,这种罐装啤酒可以按需填充和密封,以便在桶装啤酒氧化之前出售。这导致当前手工生产的包装需求增加。在停工的情况下,包装製造商自己也报告说,他们能够在劳动力减少的情况下运营,从而带来了供应主导的挑战。

北美饮料包装产业概况

北美饮料包装市场竞争适中,主要企业很少,新参与企业也很少。公司不断创新并结成策略伙伴关係以维持市场占有率。

- 2021 年 4 月 - Amcor Ltd 宣布对 ePac 软包装进行策略性投资,ePac 是一家用于软包装的高品质短版数位印刷部门。该投资价值 1,000 万美元至 1,500 万美元,包括 ePac Holdings LLC 的少数股权以及一个或多个 ePac专利权场所的融资。

- 2020 年 11 月 - TransContinental 推出 30% 经消费后回收 (PCR) 验证的收缩薄膜「Interglitite」。这种新型包装薄膜在 Sam's 的部分地点有售,包括俄亥俄州、维吉尼亚、马里兰州、西维吉尼亚、印第安纳州、南卡罗来纳州、北卡罗来纳州、阿肯色州、田纳西州、肯塔基州、密西西比州和德拉瓦,并应用于气泡水的印刷包装盒。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 市场范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 主要法规和环境考虑因素

- 产业价值链分析

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 电子商务产业的成长

- 市场限制因素

- 对塑胶的环境问题

第六章 市场细分

- 按材质

- 玻璃

- 塑胶

- 纸板

- 金属

- 依产品类型

- 能

- 瓶子

- 小袋

- 纸盒

- 其他产品类型

- 按用途

- 碳酸饮料/果汁饮料

- 酒精饮料(啤酒、葡萄酒、烈酒)

- 瓶装水

- 牛奶

- 能量和运动饮料

- 其他用途

- 按国家/地区

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Amcor Limited

- Mondi Group

- Tetra Laval International SA

- Crown Holdings, Inc.

- Alcoa Inc.

- Berry Global Inc.

- Saint Gobain SA

- Reynolds Group Holdings Limited

- Rexam PLC

- Owens Illinois Inc.

- Graham Packaging Company

- Westrock Company

- Ball Corporation

第八章市场展望

简介目录

Product Code: 51479

The North America Beverage Packaging Market is expected to register a CAGR of 5.3% during the forecast period.

Key Highlights

- Technological innovation, sustainability trepidations, and attractive economics are the reasons for the remarkable growth of beverage packaging in the last two decades in the United States. The way consumers view and interact with packages is altering. Due to the rising focus on sustainability, traditional rigid packaging solutions are being substituted by innovative, more sustainable, flexible packaging. The growing market demand for customer-friendly packages and heightened product protection is expected to boost flexible packaging as a viable and cost-effective substitute.

- The growing demand for carbonated drinks, energy drinks, and juices, among others, indicates rising PET bottles and metal cans as preferred materials for the same. On the other hand, with its recyclable properties, Glass has been challenged by increased costs of production and recycling. The preference for the same has been growing recently concerning sustainability trends across beverage packaging.

- Moreover, as plastic has been a long-standing and preferred packaging option by global beverage manufacturers, due to the reduced manufacturing, durability, and logistics costs, the transition towards sustainable packaging has driven these packaging manufacturers and bottling companies to pledge and commit usage of newer materials for the same in the region.

- For instance, Coca-Cola shared its commitment towards recycling as many plastic bottles as it uses by 2030. For the same, the company has been partnering with NGOs globally to help improve collection. Then, as of January 2020, Nestle committed USD 2.1 billion towards using recycled plastic packaging.

- On the vendor front, increased capacities across the metal, glass, and rPET have been observed to complement the increasing demand rising from beverage manufacturers. For instance, as of February 2020, Ball Corporation is expected to expand United States Metal Can to increase production by 2021. Its specialty beverage can would commence operations in Arizona and the northeastern US, in line with its previous commitment to add at least 8 billion units of capacity by the end of 2021.

North America Beverage Packaging Market Trends

E-commerce is Expected to Drive the Market Share

- The significant share contributed by e-commerce is expected to positively impact the market as many companies have not yet optimized packaging for e-commerce, and overpacking is common while shipping products from a distribution center to a consumer. Because shipments are usually broken down into individual packages for delivery, this causes additional wastage, energy consumption, and pollution due to the increasing complexity of this retail chain.

- Moreover, Beverage packaging offers performance features, such as waterproof and lightweight materials and better dimensional weight benefits, which are attractive to e-commerce providers in the region.

- As business insider reports, e-commerce is driving retail growth virtually, and its influence on beverage packaging may develop in the region. The retail industry in the US is highly competitive due to established food retailers such as Walmart, Kroger, and Albertsons, thereby driving the growth of the country's market.

- Moreover, based out of the United States, Walmart is the largest global retailer and the largest. Five of the top 10 largest retail companies globally are based out of the United States, making the country the primary retail industry.

- Also, the demand for beverage packaging products is generally driven by millennial customers in the region, as they have an ardent preference for single-serving and on-the-go beverages. These products are generally designed to be portable, durable, and lightweight; flexible packaging stands as a famous option to pack such products.

Alcoholic Beverages Accounts For the Largest Market Share

- The categorization of alcoholic beverages includes wine, beer, spirits, etc., being packaged using formats such as bottles, kegs, cartons, and cans, to name a few. When it comes to Alcoholic beverages, there has been a significant transitioning of the wine industry concerning packaging format has been observed, as the global consumption across still wine has been slowing down. This has led the Unites States-based wineries to drive packaging innovations to cut costs and appeal to younger consumers.

- Therefore, portability and convenience became significant drivers in wine packaging innovation, leading Bota Box and Black Box to leverage alternative packagings, such as tetra packs and bag-in-box wine and cartons. According to the State Of Wine Industry Report 2020 by Silicon Valley Bank, canned wine in the country has recorded an 80% growth in 2019, despite the 0.5% as an overall share.

- Moreover, Cans have been observed increasing footprints across other alcoholic single-serve options. Here, the economies of smaller sizes remain the same for cans for 375- and 500-milliliter glass formats. For instance, small-sized bottles and cans, such as 100-200 milliliters, hold 90% of beer volume globally.

- Beer's packaging, on the other hand, is highly diverse. The format packaging type preference has been driven by different regions where local laws, regulations, tastes, culture, and other drivers influence the packaging landscape.

- Further, with the COVID-19 outbreak and an upsurge in demand for alcoholic beverages across the United States, multiple packagers have reported running on low stocks. For instance, the draft beer sales stopped flowing in the United States due to on-premise shutdowns caused by efforts in the wake of novel coronavirus disease COVID-19. Therefore, allied craft brewers turned to 32 oz. Cans filled and sealed on demand to sell out leftover beer in kegs before oxidization. This has led to an increased demand for packaging towards current production in hand. Amidst the lockdown scenarios, packaging manufacturers have themselves reported operability with a reduced workforce, creating a supply-driven challenge.

North America Beverage Packaging Industry Overview

The North America Beverage Packaging Market is moderately competitive with few dominant and few new entrants. The companies keep on innovating and entering into strategic partnerships to retain their market share.

- April 2021 - Amcor Ltd is pleased to announce a strategic investment in ePac Flexible Packaging, a high-quality, short-run length digital printing segment for flexible packaging. The investment will range between USD 10 to USD 15 million, including a minority ownership interest in ePac Holdings LLC and funding for one or more ePac franchise sites.

- November 2020 - Transcontinental Inc. launched the Intergritite, a 30% post-consumer recycled (PCR) collation shrink film. The new packaging film is applicable for Sparkling Water printed case wrap appearing on select Sam's and BJ's Club Store shelves in countries like Ohio, Virginia, Maryland, West Virginia, Indiana, South Carolina, North Carolina, Arkansas, Tennessee, Kentucky, Mississippi, and Delaware.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Market

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Competitive Rivalry within the Industry

- 4.3 Key Regulations and Environmental considerations

- 4.4 Industry Value Chain Analysis

- 4.5 Impact of Covid-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing e-commerce industry

- 5.2 Market Restraints

- 5.2.1 Environmental concerns against plastic

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Glass

- 6.1.2 Plastic

- 6.1.3 Paperboard

- 6.1.4 Metal

- 6.2 By Product Type

- 6.2.1 Cans

- 6.2.2 Bottles

- 6.2.3 Pouches

- 6.2.4 Cartons

- 6.2.5 Other Product Types

- 6.3 By Application Type

- 6.3.1 Carbonated Soft Drinks & Fruit Beverages

- 6.3.2 Alcoholic (Beer, Wine & Distilled Spirits)

- 6.3.3 Bottled Water

- 6.3.4 Milk

- 6.3.5 Energy & Sport Drinks

- 6.3.6 Other Applications

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Limited

- 7.1.2 Mondi Group

- 7.1.3 Tetra Laval International S.A.

- 7.1.4 Crown Holdings, Inc.

- 7.1.5 Alcoa Inc.

- 7.1.6 Berry Global Inc.

- 7.1.7 Saint Gobain S.A.

- 7.1.8 Reynolds Group Holdings Limited

- 7.1.9 Rexam PLC

- 7.1.10 Owens Illinois Inc.

- 7.1.11 Graham Packaging Company

- 7.1.12 Westrock Company

- 7.1.13 Ball Corporation

8 MARKET OUTLOOK

02-2729-4219

+886-2-2729-4219