|

市场调查报告书

商品编码

1628711

红外线/热感成像系统:市场占有率分析、产业趋势、成长预测(2025-2030)IR And Thermal Imaging Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

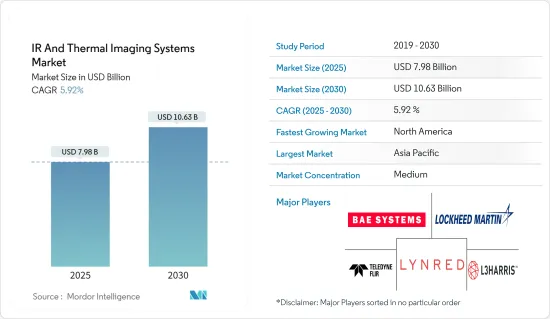

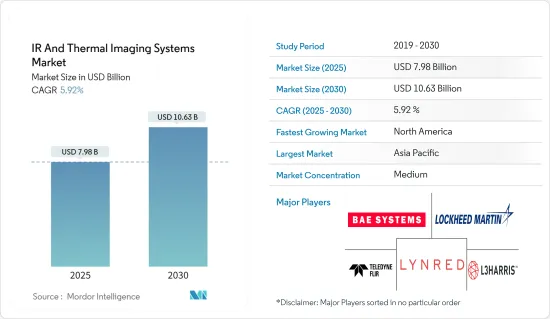

红外线和热感成像系统市场规模预计到 2025 年为 79.8 亿美元,预计到 2030 年将达到 106.3 亿美元,预测期内(2025-2030 年)复合年增长率为 5.92%。

即使在完全黑暗和困难而清晰的条件下,红外线和热感成像技术也能侦测物体和个人。与其他方法不同,热成像即使在没有环境光的环境中也能运作。热感与近红外线照明一样,可以穿透烟、雾、霾等障碍物。

主要亮点

- 由于军事和国防应用的使用增加,全球对红外线 (IR) 和热感成像系统的需求不断增长。世界各地的军队都依赖热热感仪来增强情境察觉、监视、目标捕获和夜视能力。

- 军事和国防研究与开发项目优先考虑红外线 (IR) 波长,因为大部分监视和目标捕获都发生在夜间。军方主要在夜视镜、飞弹导引系统和机载前视红外线 (FLIR) 扫描仪中使用红外线技术。军事和国防部门对红外线成像技术的需求不断增长,进一步加速了市场的成长。

- 经济实惠的解决方案的出现对全球热感市场产生了重大影响。过去,工业和军事领域使用的高端、昂贵设备是主流,但随着感测器技术的进步、大规模生产和小型化降低了成本,情况已经完全改变。这些进步使得红外线成像被应用于多种行业,包括消费性电子、医疗保健和公共。

- 技术进步提高了热感的效率、便利性和多功能性,促进了热感广泛采用。更高解析度的感测器、改进的影像处理能力和更小的设备等技术创新正在提高各行业的准确性和易用性。这些进步使得更好的热检测、更详细的影像处理以及将热摄影机整合到更小、更便携的设备中成为可能。

- 热感热感像仪和系统是高度专业化的技术,必须由专业人员安装、操作和维护。缺乏合格的人员来执行系统校准和维护等日常支援任务会导致营运效率低下。缺乏及时支援可能会降低热热感仪的准确性和可靠性,并影响其性能。

红外线/热感成像系统市场趋势

工业应用占很大份额

- 在工业领域,红外线和热感成像越来越多地用于维护、检查和监控设备和流程。在製造、能源和建设产业,热感成像可以检测过热、能量损失和设备故障等问题,从而防止昂贵的维修和停机。这些趋势大大增加了对热感用于预测性维护和品管的需求。

- 据联合国欧洲经济委员会称,到2023年,阿尔巴尼亚的建筑业占GDP的比例将成为欧洲最大。英国建设业占GDP的6.2%,与德国相当。

- 推动工业领域扩张的主要因素之一是热感和红外线技术在预测性维护中的使用。热感成像经常用于在机械和设备发生故障之前发现热点、漏水和电气问题。预测性维护使企业能够减少规划停机时间并节省昂贵的维修费用。

- 热感成像系统在工业品管和製程监控应用中变得越来越重要。製造业使用红外线和热感成像来监控温度敏感过程、识别缺陷并确保产品的一致性。这对于需要精确温度控制的领域尤其重要,例如金属和聚合物加工以及电子产品製造。

- 红外线和热感成像在工业领域的另一个重要应用是能源审核。公司越来越多地使用红外线和热感成像进行建筑能源审核。这些审核有助于识别能源损失的领域,例如绝缘不良、漏水和低效率的暖气系统。这项运动是由对永续性和能源效率的日益关注所推动的,特别是在水泥、钢铁和化学生产等重工业领域。

亚太地区录得强劲成长

- InfiRay、Hikmicro等中国企业在数量导向策略的推动下持续成长,在工业和消费市场的影响力不断增强。中国的热感成像产业占据了全球热感成像器出货量的很大一部分,实现了一个重要的里程碑。不同行业对这项技术的需求不断增长,预计将增加其在该地区的市场影响。

- 红外线和热感成像系统在工业应用中越来越受欢迎。投资的增加和生产率的提高预计将推动该地区产业部门对该技术的需求。世界经济论坛的数据显示,中国正加大力度增强製造能力,2024年前7个月製造业技术改造投资成长10.9%。

- 技术进步催生了微测辐射热计,预计在预测期内将大幅成长。受全球疫情影响,日本交通、製造业、公共安全等各领域对热感的需求不断增加。例如,包括日本在内的亚太地区的机场正在使用热感来监控旅客。预计如此显着的渗透率将推动该地区的市场成长。

- 机场两个国内航站楼的安检门前均安装了热感,航空公司工作人员正在对其进行评估。为了缓解新冠肺炎 (COVID-19) 从首都地区的传播,日本于週五开始要求在多个机场对乘坐国内航班出发的所有乘客进行体温检查。热成像技术在该地区交通运输领域的广泛采用预计将提振市场未来性。

红外线/热感成像系统市场竞争格局

红外线和热感成像系统市场是一个半独立市场,拥有许多区域和全球参与者。 Teledyne FLIR LLC、L3Harris Technologies Inc.、Lynred、Lockheed Martin 和 BAE Systems PLC 等公司正在寻求透过产品创新来增加市场占有率。

竞争程度取决于影响市场的各种因素,包括品牌形象、强而有力的竞争策略和透明度。由于市场买家寻求更有效的解决方案来优化其流程,因此所研究市场的创新带来的可持续竞争优势很高。

由于研发投入大、合约期限长、品牌形像等原因,退出障碍较高,企业难以轻易退出市场。产品差异化、併购和策略联盟等竞争策略导致了所研究市场的激烈竞争。

该市场由老字型大小企业组成,这些公司为改进其产品技术进行了大量投资。供应商包括 Teledyne FLIR LLC、L-3 Communications 和 BAE Systems。例如,2023年10月,Skydio发布了配备客製化Teledyne FLIR Boson+热感相机模组的X10无人机。透过此次合作,公共和关键基础设施检查领域的专业飞行员现在可以轻鬆使用非製冷热感成像技术。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素

- 低成本解决方案

- 将应用扩展到产业之外

- 对环境影响低

- 市场挑战

- 缺乏定期的支援和服务

第六章 市场细分

- 按解决方案

- 硬体

- 软体

- 服务

- 按用途

- 工业的

- 安全

- 研究与开发

- 建筑业

- 海洋

- 运输

- 执法

- 其他用途

- 按外形规格

- 手持式成像设备和系统

- 固定式(旋转式/非旋转式)

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 亚洲

- 中国

- 日本

- 印度

- 澳洲/纽西兰

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 北美洲

第七章 竞争格局

- 公司简介

- Teledyne FLIR LLC

- L3Harris Technologies Inc.

- Lynred

- Lockheed Martin

- BAE Systems PLC

- Leonardo DRS

- Elbit Systems Ltd

- RTX Corporation

- Sofradir Group

- Thermoteknix Systems Ltd

第八章投资分析

第九章 市场机会及未来趋势

The IR And Thermal Imaging Systems Market size is estimated at USD 7.98 billion in 2025, and is expected to reach USD 10.63 billion by 2030, at a CAGR of 5.92% during the forecast period (2025-2030).

Infrared and thermal imaging technology enables users to detect objects or individuals in complete darkness and in difficult and distinct conditions. Unlike other methods, thermal imaging works in environments without any ambient light. Like near-infrared illumination, thermal imaging can penetrate obscurants like smoke, fog, and haze.

Key Highlights

- The global demand for infrared (IR) and thermal imaging is growing due to the increased use of these technologies in military and defense applications. Armed forces worldwide rely on IR and thermal imaging for enhanced situational awareness, surveillance, target acquisition, and night-vision capabilities.

- Military and defense R&D programs prioritize infrared (IR) wavelengths, given that many surveillance and targeting operations occur at night. The military primarily uses infrared technology in night vision goggles, missile guidance systems, and aerial forward-looking infrared (FLIR) scanners. The rising demand for IR imaging technology in the military and defense sectors is further accelerating the growth of the market.

- The emergence of affordable solutions had a considerable impact on the global market for infrared and thermal imaging systems. Previously dominated by high-end, costly equipment mostly utilized in the industrial and military sectors, the landscape changed because of cost reductions brought about by advances in sensor technology, mass production, and miniaturization. Due to these advancements, thermal imaging is used in several industries, including consumer electronics, healthcare, and public safety.

- Technological advancements are promoting the adoption of IR and thermal imaging systems by enhancing their efficiency, accessibility, and versatility. Innovations such as higher-resolution sensors, improved image processing capabilities, and the miniaturization of devices have increased their accuracy and usability across various industries. These advancements enable better heat detection, more detailed imaging, and the integration of thermal cameras into smaller and more portable devices.

- Thermal imaging and infrared systems are extremely specialized technologies that need to be installed, operated, and maintained by professionals. Operational inefficiencies are caused by a shortage of qualified personnel to perform routine support tasks, such as system calibration and maintenance. The accuracy and dependability of thermal imaging systems might deteriorate in the absence of prompt support, which can impact their performance.

IR & Thermal Imaging Systems Market Trends

Industrial Applications Hold Major Share

- Industrial sectors are increasingly utilizing thermal imaging to maintain, inspect, and monitor equipment and processes. In manufacturing, energy, and construction industries, thermal cameras detect issues like overheating, energy loss, and equipment malfunctions, preventing costly repairs and downtime. This trend drives significant demand for thermal imaging systems in predictive maintenance and quality control as companies aim to enhance efficiency and safety while reducing operational risks.

- According to UNECE, in 2023, Albania had the biggest construction industry relative to its GDP in Europe. The construction industry in the United Kingdom accounted for 6.2% of its GDP, which is equal to Germany's.

- One of the main factors fueling the expansion of the industrial segment is the use of thermal imaging and infrared technologies in predictive maintenance. Thermal cameras are frequently utilized to find hotspots, leaks, and electrical problems in machinery and equipment before they cause failure. By being proactive, companies may cut down on scheduled downtime and save money on expensive repairs.

- Thermal imaging systems are becoming more crucial in industrial quality control and process monitoring applications. Manufacturers use these systems to monitor temperature-sensitive processes, identify flaws, and guarantee product uniformity. This is especially important in sectors where exact temperature control is essential, like the processing of metals and polymers and the creation of electronic products.

- Another significant use of infrared and thermal imaging devices in the industrial sector is energy auditing. Businesses are using thermal cameras more often to do energy audits in their buildings. These audits help detect areas of energy loss, such as inadequate insulation, leaks, and inefficient heating systems. Growing concerns about sustainability and energy efficiency, especially in heavy industries like cement, steel, and chemical production, are the driving force behind this movement.

Asia-Pacific to Register Major Growth

- Several Chinese firms, such as InfiRay and Hikmicro, have continued to experience growth, propelled by strategies emphasizing volume, resulting in their expanding influence in both industrial and consumer markets. The thermal imaging sector in China has achieved a noteworthy milestone, capturing a substantial portion of global thermal imager shipments. The rising demand for this technology across diverse industries is anticipated to enhance the region's market presence.

- IR and Thermal Imaging systems are significantly gaining popularity across industrial applications. The growing investments and increasing productivity are expected to increase the demand for this technology across the region's industrial sector. According to the World Economic Forum, China is intensifying its initiatives to enhance its manufacturing capabilities, as evidenced by a 10.9% increase in investments aimed at technological transformation within the manufacturing sector during the first seven months of 2024, maintaining a trend of double-digit growth.

- Technological advancements have created microbolometers, which are anticipated to offer numerous growth prospects throughout the forecast period. The pandemic increased the demand for thermal imaging solutions in multiple sectors, such as transportation, manufacturing, and public safety in Japan. For example, airports in the Asia-Pacific region, including Japan, are utilizing thermal cameras to monitor travelers. This considerable uptake is projected to propel market growth in the region.

- Thermal imaging cameras have been positioned prior to the security gates in both domestic terminals of the airport, where airline personnel are performing the assessments. As part of efforts to mitigate the transmission of Covid-19 from the capital, Japan initiated mandatory temperature screenings on Friday for all passengers departing on domestic flights at multiple airports. The extensive implementation of thermal imaging technology within the region's transportation sector is anticipated to enhance the market's prospects.

IR & Thermal Imaging Systems Market Competitive Landscape

The IR and thermal imaging systems market is semiconsolidated, with many regional and global players. The players, such as Teledyne FLIR LLC, L3Harris Technologies Inc., Lynred, Lockheed Martin, and BAE Systems PLC, are attempting to increase their market share through product innovation.

The degree of competition depends on various factors affecting the market, such as brand identity, powerful competitive strategy, and degree of transparency. The sustainable competitive advantage through innovation in the market studied is high, as the buyers in the market look for more efficient solutions to optimize the process.

Barriers to exit are high due to significant research and development investments, long-term contracts, and brand identity, making it difficult for firms to leave the market easily. Competitive strategies such as product differentiation, M&A, and strategic collaboration make competition fierce in the market studied.

The market consists of long-standing established players who have made significant investments to improve product technology. Some of the vendors include Teledyne FLIR LLC, L-3 Communications, BAE Systems, and others. For instance, in October 2023, Skydio released its X10 UAV, which features a customized Teledyne FLIR Boson+ thermal camera module. As a result of the collaboration, professional public safety and critical infrastructure inspection pilots can now easily access uncooled thermal imaging technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Low Cost Solutions

- 5.1.2 Increasing Usage Across Industries

- 5.1.3 Low Impact on the Environment

- 5.2 Market Challenges

- 5.2.1 Lack of Regular Support and Services

6 MARKET SEGMENTATION

- 6.1 By Solutions

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Applications

- 6.2.1 Industrial

- 6.2.2 Security

- 6.2.3 Research and Development

- 6.2.4 Construction Industry

- 6.2.5 Maritime

- 6.2.6 Transportation

- 6.2.7 Law Enforcement Agencies

- 6.2.8 Other Applications

- 6.3 By Form Factor

- 6.3.1 Handheld Imaging Devices and Systems

- 6.3.2 Fixed Mounted (Rotary and Non-Rotary)

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.5.1 Brazil

- 6.4.5.2 Mexico

- 6.4.5.3 Argentina

- 6.4.6 Middle East and Africa

- 6.4.6.1 Saudi Arabia

- 6.4.6.2 United Arab Emirates

- 6.4.6.3 South Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Teledyne FLIR LLC

- 7.1.2 L3Harris Technologies Inc.

- 7.1.3 Lynred

- 7.1.4 Lockheed Martin

- 7.1.5 BAE Systems PLC

- 7.1.6 Leonardo DRS

- 7.1.7 Elbit Systems Ltd

- 7.1.8 RTX Corporation

- 7.1.9 Sofradir Group

- 7.1.10 Thermoteknix Systems Ltd